About 2 months ago I wrote about My Net Fone. By way of history, I had sold my shares at about $1.50 earlier in the year, but the fall in the share price to below $1.20 prompted me to write a short article, in which I concluded (conservatively) that the company would earn about 6c per share. Having thus justified my decision not to buy shares at $1.20, I carefully avoided considering whether affirmation bias might have swayed me (after all, I had decided the shares were over valued at just $1.50). Further evidence that I have a way to go developing my investing temperament.

My Net Fone subsequently reported, exceeding my expectations by about 10%. I should make an academic point here: I use actual earnings per shares (diluted) whereas My Net Fone uses completely accepted and legal (but in my view misleading) accounting to suggest that their earnings per share is closer to 7 cents. They use the average weighted number of shares: I use the sum of the actual number of shares and the 65c options that will inevitably be converted into shares. Options are a great way of making per share statistics look a lot better than they really are, but that’s a rant for another day. Either way, my earnings per share figure is just above 6.6 cents. At the current price of $1.35, My Net Fone trades on a trailing yield of just over 2.5% fully franked.

Based on the profit for 2013, and the full year contribution from the acquisitions, I think that earnings per share of about 9c is more likely than not, per the table below. One possible flaw in this theory is if they did so much better in 2013 than I expected because they managed to squeeze efficiencies out of the acquisitions more quickly than expected; and as a result there will be few gains next year.

Cashflow in FY 2013 was $6 million. It's worth noting that, this year, cashflow was a fair bit higher than profit, and this is only partially accounted for by depreciation of about $600,000. However, it can be reasonably assumed that if profit were to be within striking distance of the estimate above, cashflow would be at least $6 million again in 2014 year. My worst case scenario valuation of My Net Fone is a no-growth-beyond 2014 scenario. In that case, I get a value of about $1.

However, I think that My Net Fone will continue to grow. When I made my prior assessment of MNF, I assumed no organic growth. Now, either the acquisitions have integrated seamlessly, or that was my error. The indication is that the company is still growing organically, and with their Tasmanian government contract making a full contribution in FY2014, I think growing cashflow is more than likely. Here's how I value My Net Fone, in the "most likely" scenario.

As you can see, My Net Fone is currently selling below my indicative buy price of $1.38, looking at an 8 year span. Given how fast changing the telco industry is, the 8 year model is a bit ridiculous: MNF will almost certainly continue to acquire or be acquired before 2020! However, I think this gives a reasonable indication of the company today.

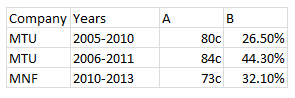

The final reason why I like My Net Fone is that it is achieving impressive returns on investment. In the table below, column A is the amount generated per $1 of capital investment, and column B is the ongoing increase in cashflow as a percentage of capital expenditure. I've compared MNF with relative giant M2 Telecommunications (ASX: MTU) because both companies operate in the same industry, and MNF is following a similar growth strategy to the one M2 pursued in the past. Take note though; they are different businesses with different product offerings.

As you will see My Net Fone has achieved lower, but comparable return on investment to what MTU did during its early growth phase. This is important because it reflects the ability for My Net Fone to grow and to continue to pay dividends (because it earns a good return on cash invested). However, please note that the table above is comparing apples with oranges: and share issues essentially distort those figures. I have, however, used the same methodology for each company. If you show a man a healthy apple, it will help him identify a healthy orange: healthy fruit have common characteristics.

This is not advice. The author owns shares in My Net Fone directly and in a managed fund.

Looking for ethical companies with good prospects? Sign up to the Free Newsletter to hear about it when I find them!

Lots of details here. Again good strong look behind the headline figures.

I take exception on one point. the use of the average weighted number of shares is not anly "acceptable", but the more sound approach. This is illustrated if one takes an extreme example. Say a company has 1M shares, and in the last month of their reporting period they issue another 2500,000 shares. To divide the years profit by 1.5M to get an eps would be misleading in the least.

Generally, MNF has been somewhat volatile since they became earnings profitable in 2010. I must say has a stong positive feeling about MNF. No the only thing to be considered, but to be noted.

Thanks Damien for pointing this out to readers. You are correct.

My only justification for my attitude towards calculating EPS is that I want to penalise a company in my analysis for issuing shares at too low a price to institutional investors. I am perhaps biased against dilution.

Good analysis - thank you!

LinkI like the fact they develop proprietary products, and have their own network (Symbio). Acquisitions appear to be strategic (except perhaps GoTalk) and well controlled. As I see it, the main risk is the potential dilution should shares be used as a component of future acquisitions.

Thanks for pointing that out Peter. That is a risk, and I notice that they are asking pre-approval to dilute by up to 25% rather than 15%. Their willingness to issue shares suggests they are either overpaying, or think their shares are overvalued. Personally I don't see why they can't just stop paying a dividend if they need cash. While that may cause some to sell, it would be a temporary thing and you would end up with a more solid shareholder base.

Link