I recently shared "2 Rules To Avoid The Hype Trap" with Ethical Equities Supporters. Following those rules requires that investors can establish revenue growth, free cash flow and profit from the primary documents. It is always important to take these numbers from the accounts themselves, because companies will often highlight misleading adjusted numbers in their presentations, not the statutory numbers.

How To Calculate True Free Cashflow

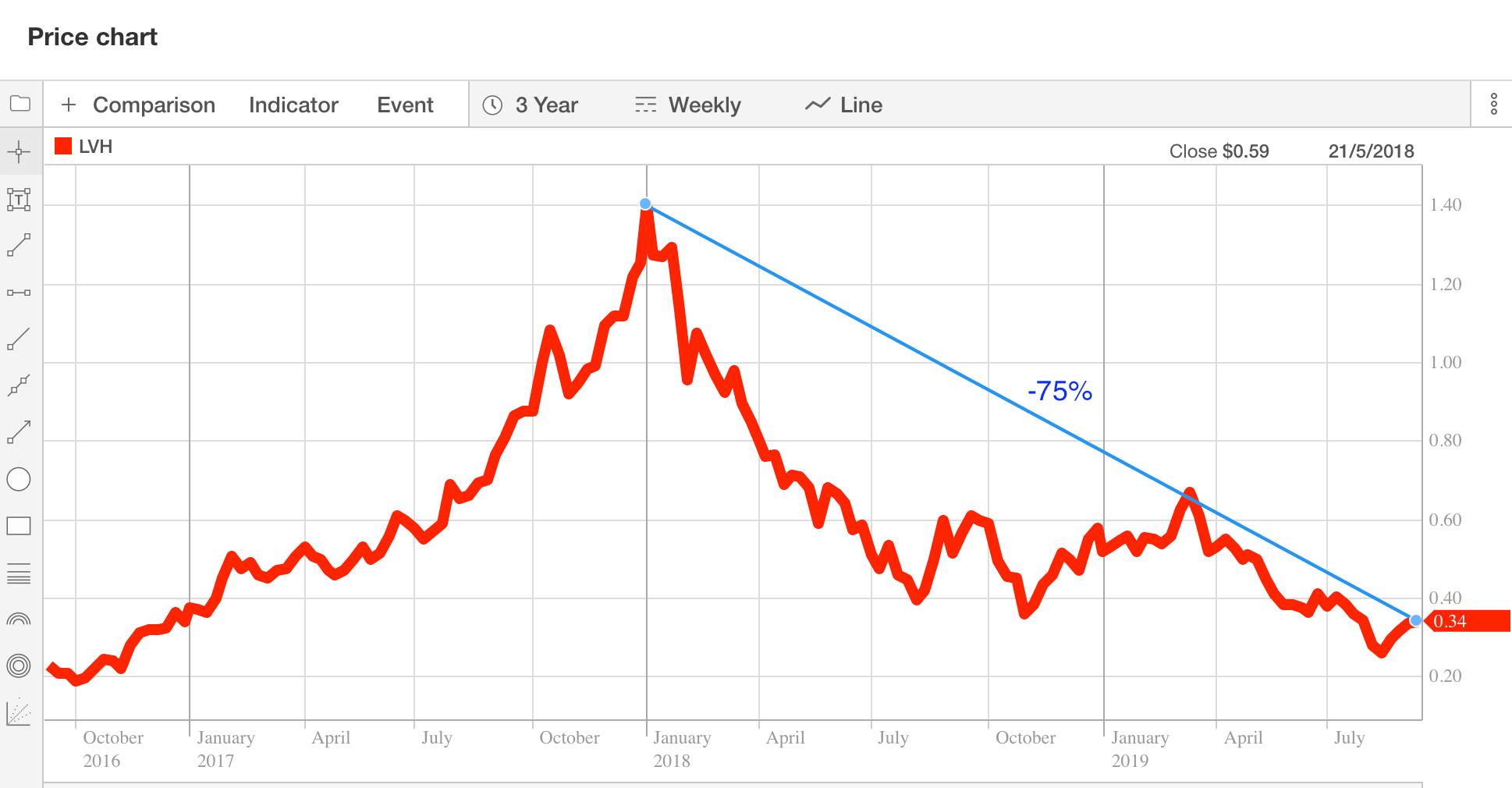

Free cash flow = operating cash flow minus investing cashflow. You can get this information from the cashflow statement in a company's annual report. Let's look at Livehire (ASX:LVH) as an example. Below is their cashflow statement from page 31 in their annual report.

Livehire's free cash flow for FY 2019 is -$9,877,307 -$1,259,530 = $-11,136,837 (the blue boxes). Since that is a negative number, we can surmise that the company has free cash outflow (or negative free cash flow) of about $11.1 million. That means that the company used up $11.1 million in its operations over FY 2019.

Now that is the "pure" or "true" free cash flow number. However, we may wish to make adjustments that would reflect free cash flow without certain benefits or costs that we might consider to be one-off or unsustainable. I've highlighted some such values with the pink arrows. You could also adjust for big changes in the receivables and payables (check the balance sheet for that) or share based payments to employees (check the profit and loss statement for that). Knowing when to make this adjustments can be important for valuation, and can be complex and subjective, but it doesn't matter much for the purpose of this exercise.

How To Calculate Operating Revenue Growth And Ascertain Statutory Continuing Profit

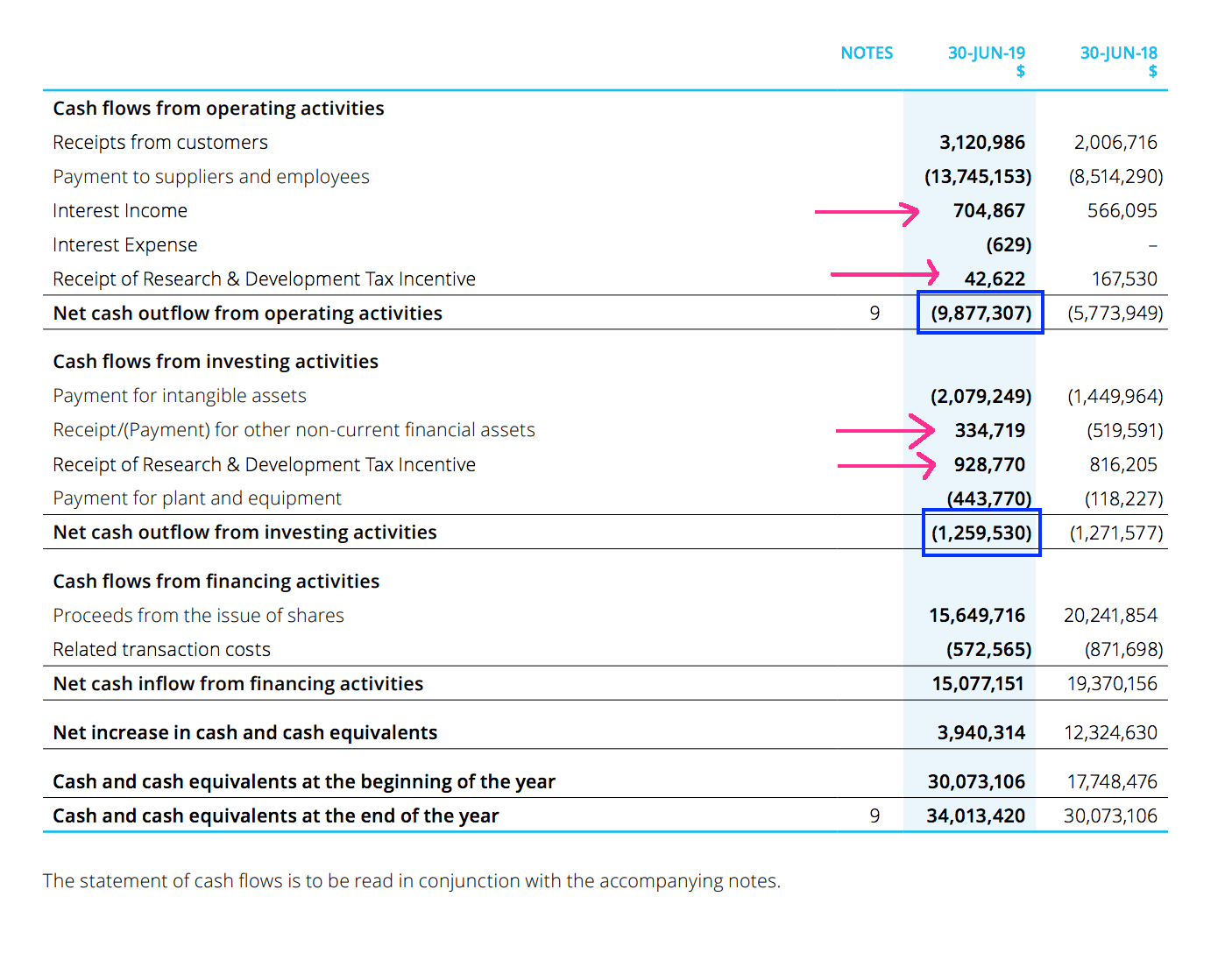

The next step is too look at how much it grew revenue in the same year that it spent $11.1 million. For that, we'll look at the income statement, below, from page 28 of the annual report.

Calculate the operating revenue growth by subtracting last year's revenue from this year's revenue (top blue boxes). In this case, that is: $2,622,814 - $1,650,517 = $972,297. We can then use that revenue growth of $972,297 to calculate a percentage growth rate by dividing the growth amount by last year's revenue, like this: $972,297 divided by $1,650,517 = 0.589086328707914 = 59%. Of course, a revenue growth rate of 59% is neither good nor bad on its own, since it depends on all the context (such as whether it was off a low base, and how much the company spent to get that result).

Finally, it's also important to identify the true profit from the profit and loss statement statement (the bottom blue box). We can see Livehire has a loss of over $13 million.

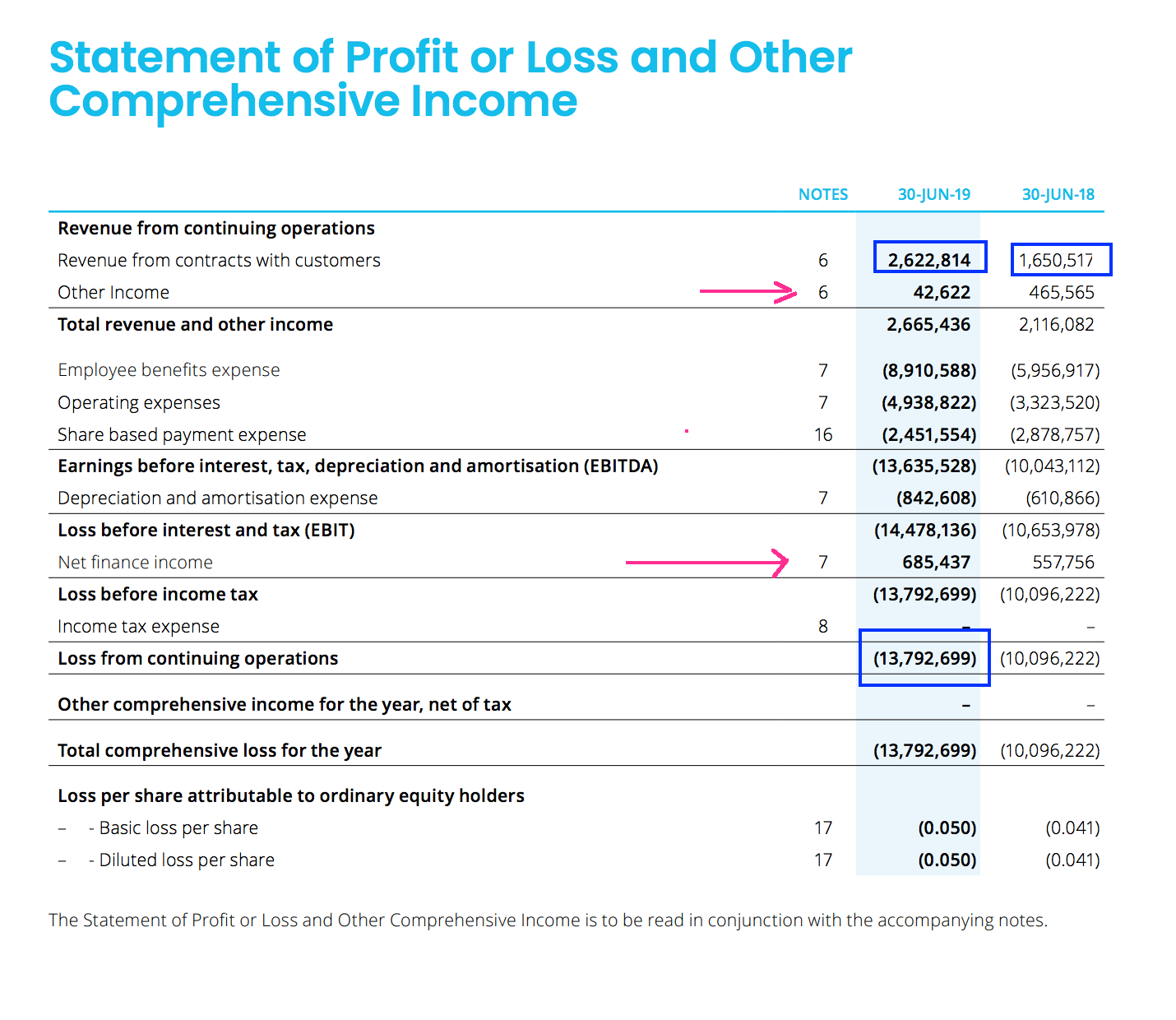

2 Rules To Avoid The Hype Trap

On the ASX, there are plenty of companies that exist for years, and continuously raise capital. Their businesses are never really going to take off, but they usually have some glossy presentations, a great story about some amazing technology, cannabis-related business model, or mining tenement. Many (but not all) of these stocks (which can eventually fall 90% or more) can be avoided if you follow the two rules below. If you've had less than three years investing experience, or still consider yourself a beginner, then I recommend applying these rules to the vast majority of your portfolio.

Rule 1: Generally only ever buy stocks with positive free cash flow, profit, and growing revenue.

Rule 2: If you break rule one, only do it if the company had at least $10 million in revenue in the trailing financial year.

If I had applied these rules to my investing I would have avoided only a few of my winners, so I don't believe the price of restricting oneself in this way is very high.

Disclosure: the author does not own shares in Livehire (ASX:LVH).

For occasional exclusive content, join the FREE Ethical Equities Newsletter.

This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.

If, somehow, you are not already using Sharesight, please consider signing up for a free trial on this link, and we will get a small contribution if you do decide to use the service (which in turn should save you money with your accountant, or time if you do your own tax.)