An Ethical Equities Supporter has requested I do more case studies of investments I've made in the past, which I think is good for learning, so here is the first one.

The Process

I came across Pro Medicus because I have two beliefs about the long term future.

- Software is eating the world

- Healthcare is the best defensive industry

So I was looking for companies that were working in software and healthcare.

I also look for:

- Insider buying

- High Insider ownership

- Profit and dividends.

Pro Medicus in 2013

Made $5 million in profit, market cap of <$50 million.

However, on an underlying basis, only made about $1 million in profit.

The big profit was because it sold its part of its Amira business (which it bought in 2009), for a multi-million dollar profit.

It sold the software, but it kept the team of software developers that built the software -- they were now working on software for the visualisation of large radiology files: Visage 7.

https://www.youtube.com/watch?v=idCQOUHv7Q4

Pro Medicus in 2014

In October 2013, PME made its first sale of Visage 7, worth $4 million.

Then, in April 2014 it announced a 6 year deal worth $20 million. This was the inflection point.

In July I bought shares. In August it reported profit of $1.5 million (ie, an improvement on the year before, backing out Amira proceeds). It had a market cap of about $90 m, plus over $20 million in the bank.

If you adjust for the cash, it was trading on EV to Earnings of about 46 times -- so it was definitely not cheap on the past metrics. It announced another deal in November, worth $8m. CEO said gross margins on these deals would be around 80%.

Importantly, both founders were involved in the business, and insiders were buying shares in the business, despite already controlling over 60% of the shares.

The CEO was willing to take time to explain the business to a little-young-nobody like me. My research indicated that both founders sourced some of their energy for life and work activities, from pride and passion. This is important because if majority owners are motivated only by money then they will not share the spoils of success fairly with minority shareholders.

Looking to the numbers; forward gross margins of around $25m had been won in the space of 1 year of launching Visage 7, while the company's entire enterprise value was around $100m.

It was clear if the company kept winning Visage contracts then it was extremely cheap. While I did of course perform a discounted cash flow valuation, the undervaluation this was extremely obvious, given the material gross profit uplift caused by each new contract, and the fact that the company was profitable already. The only it needed to do to be very undervalued, was to keep winning Visage contracts. The key question was whether it would. Given that it was well publicised the entire healthcare industry was moving towards deconstructed picture archiving and communication systems, there was a technological tailwind driving adoption. Thus, further wins seemed likely.

The Journey Since Then

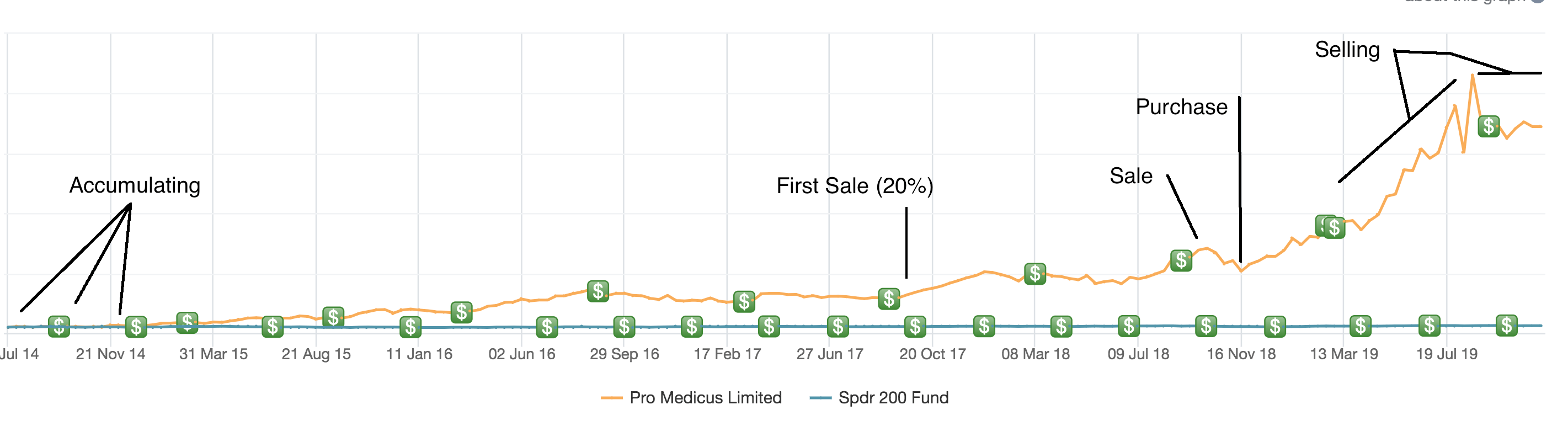

As the company continued to win contracts and grow revenue, the market begun pricing in further wins. Whereas in late 2013 the price arguably reflected announced wins, rather than future wins, by 2019 the price arguably reflects many future wins, including both Visage and the Vendor Neutral Archive product. In this way, the market has become more optimistic and is now willing to pay a higher multiple of (much increased) earnings. You can see in the chart how I've traded the stock over the years. I still hold despite seeing it as too richly valued -- see here for my lament on why.

For occasional exclusive content, join the FREE Ethical Equities Newsletter.

Disclosure: The author owns shares in Pro Medicus.

This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.

If, somehow, you are not already using Sharesight, please consider signing up for a free trial on this link, and we will get a small contribution if you do decide to use the service (which in turn should save you money with your accountant, or time if you do your own tax.)

"The Ethical Equities website contains general financial advice and information only. That means the advice and information does not take into account your objectives, financial situation or needs. Because of that, you should consider if the information is appropriate to you and your needs, before acting on it. In addition, you should obtain and read the product disclosure statement (PDS) of the financial product before making a decision to acquire the financial product. We cannot guarantee the accuracy of the information on this website, including financial, taxation and legal information. Remember, past performance is not a reliable indicator of future performance."