Pro Medicus (ASX:PME) Posts Record Results In FY 2019

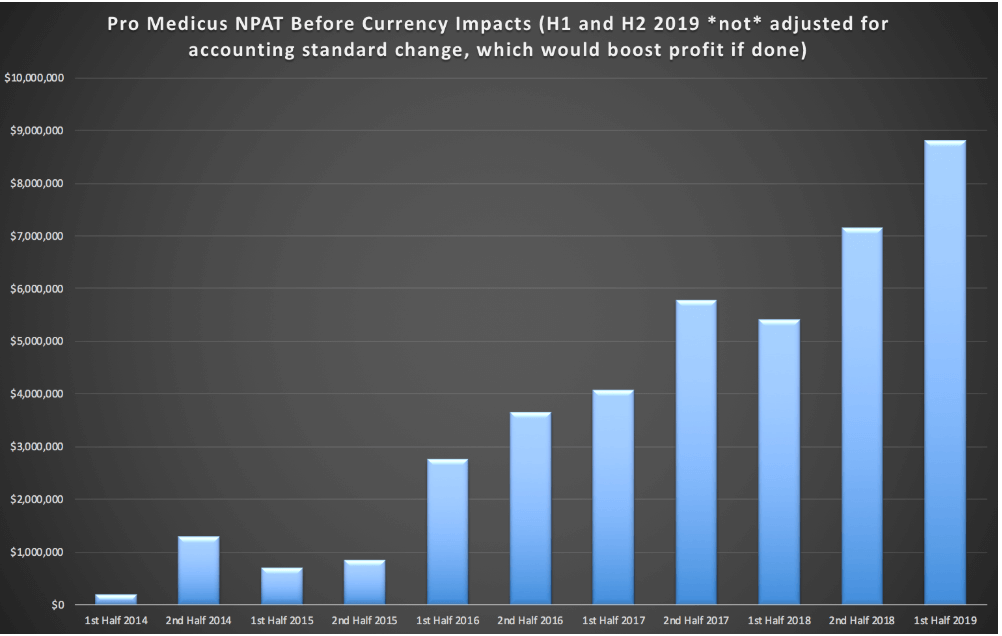

Yesterday radiology imaging company Pro Medicus (ASX:PME) reported revenue of $50.1 million for the full year, along with profit of $19.1 million, an increase of over 91% on last year. When I reported on the half year results, I noted that it would be hard for the company to grow half on half, since last half was such a strong half. I also expressed my hesitancy about the share price. It turns out I was too conservative, as the stock has gained well over 100% in the intervening period, to close above $30.50 on the day of the results.

The business seems to be doing very well indeed. As you can see below, the company grew profits strongly, half-on-half, in the end. Some of that growth coming from existing customers using the image viewer more. Many clients have signed transaction-based contracts, which mean Pro Medicus benefits if they view more images. However, the company also benefited from on-boarding new clients and receiving the first full year contribution from others.

The Australian business, which is primarily a radiology information system (RIS), showed good growth, largely because it now serves two of the biggest radiology companies, in iMed and Healius Ltd (ASX:HLS), along with other customers. The company had to invest for many years to win this dominant position, but it now enjoys natural growth as its clients themselves are growing.

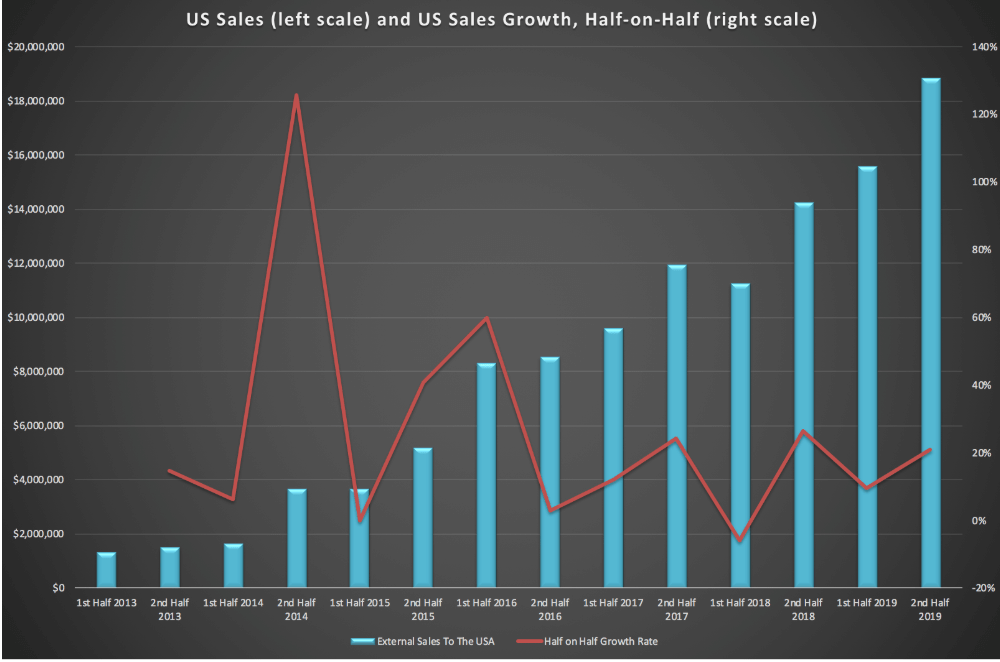

It was the US business that stole the show, with the viewer product (Visage 7) accounting for the vast majority of the revenue. You can see below how revenue from the US is tracking.

Turning to free cash flow, the company did very well indeed, converting 90% of profit to free cash flow, which came in at about $17.1 million. That lead to net cash of just over $32 million. That puts the company on an enterprise value to free cash flow (EV/FCF) ratio of around 175; an eye-wateringly expensive price! The good news, at least, is that as the company continues to grow, free cash flow should remain strong (or even get stronger) relative to net profit, as accounting changes mean that some payments received up-front will be recognised over the period of the contract on a flat line basis. There will of course be some volatility in cash flows related to capital sales.

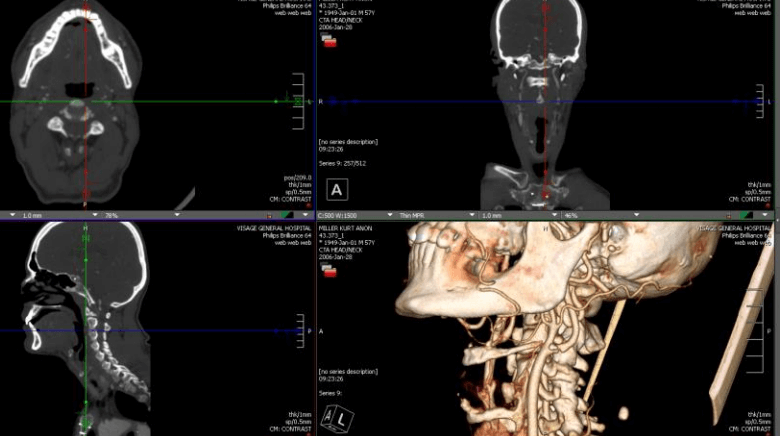

While there is no doubt that the stock is not cheap, any more, it also seems clear that the company is of very high quality. For example, it still has minimal salespeople but has only ever lost 4 tenders for its Visage 7 product. This year, it did increase staff numbers, but its investments were in R&D and implementation. This expenditure helps delight customers, if not win them. Over time radiologists who have used Visage become advocates for it when they move to an institution that does not have Visage. Therefore, in my view, the best kind of marketing is continual investment in the product. This focus is evidenced by the fact the company has around 40 software engineers out of a total staff of about 75 globally.

Following on from our sociological examination of the Pro Medicus share price, it seems clear the company is getting a lot more attention now, with several questions from analysts indicating that they were relatively new to the stock. In my view, this process of discovery is a large part of why the share price is so high at the moment.

Longer term, it was pleasing to learn more about the twofold potential for artificial intelligence algorithms on the Visage viewer platform. As the company develops AI applications, it can roll out those improvements with the next update. Some technology will be made available to all users.

However, the company is also encouraging other organisations and people to develop their own diagnostic algorithms for radiology, and make those technologies available for radiologists for a price through the Visage 7 platform. Pro Medicus would take a cut. If the company ever achieves this, it will have profoundly improved the business because it would have positioned itself to profit from the capital (monetary and intellectual) of third parties. This path would result in better outcomes for patients (based on past documented experience of the impact of Visage), and also potential savings for radiologist employers. In the US, radiologists are paid a lot, so anything that improves their workflow is very beneficial. For me, a key milestone in the next few years will be when the company first manages to sell a third party product (an algorithm, essentially) over the Visage 7 platform.

On the call, one analyst elicited some interesting insight into the radiology market over in the USA. According to the CEO, requests for tender amongst radiology groups is in “deep freeze” because there has been so much consolidation in that market. When a radiology group is looking to either buy another, or sell itself to another, it is not an attractive time to change move to a deconstructed PACS system with Visage. Once consolidation dies down in this sector, Pro Medicus should see a pick up in the pipeline selling to these kinds of clients. Longer term, consolidation is a tailwind for Pro Medicus, as the company specialises in large radiology and hospital groups. The reason for this is that their product is expensive, and the product is designed to optimise ROI for large groups; and these are the contracts Pro Medicus tenders for.

Valuation

Notably, one of the difficulties for modelling how Pro Medicus might justify its current $3 billion market cap is that at present the company is focussed on the larger, more attractive end of the radiology market. However, they already are making quite a splash in this end of the market, and it’s not clear how much further they can grow before it simply gets harder to continue to increase market share. From memory, they already have 5 of the top 20 hospital groups. I think they can go to 10, or even 15; but would that be enough to justify the current price?

That is not guaranteed.

One bright spot, however, is that the company’s vendor neutral archiving is continuing to appeal. The CEO said that one day he thinks it could be worth 30%-40% of the imaging business, which would be a significant contribution. At present, it seems there is some potential for them to cross sell the VNA product to customers who already use their viewer, and going forward, it seems more likely they will manage to sell some combined offerings. We’ll need to see growth in the VNA business if the company is to fulfil its potential.

I stand by my recent comment that the aggressive buying of Pro Medicus shares at around $33 by passive index funds is frothy-mouthed accumulation. However, I also think those people who have been short selling the company, many of them since much lower prices, are cruising for a continued bruising. Time is their enemy, because even though the valuation is frothy as it comes, the company continues to improve in quality over time.

I have upgraded my valuation on the back of these results. I think the company is now worth at least $1.5 billion (or a share price of around $15) which has me at a much more conservative valuation than most. Having said that, the main argument for it being worth buying at $3 billion is to understand the company through a gorilla game framework.

If Pro Medicus to become the gorilla in its niche it will need to achieve the following:

- Maintain its technology advantage through continual improvements to its Visage and VNA technology (Within its control).

- Sell other people’s algorithms over its platform to assist with diagnosis in both radiology and other medical sciences (Partly within its control).

- Continue to be able to find clientele who are willing to spend money to make money. Pro Medicus provides strong ROI to its clients, but some (for example, public health organisations) cannot make that ROI because internal process mandate they go for the cheapest option, even when it will leave them worse off in the long term. (Not really within its control).

If Pro Medicus does end up dominating algorithmic radiological diagnosis, in the long term, then I suggest that in fact it will be considered to have been cheap at current prices. While I do not necessarily think the risk versus reward is brilliant at current prices, I maintain Pro Medicus as my largest single shareholding, due to this long term potential. Of course, I do not expect a smooth run, and I will take profits as and when I deem appropriate.

Finally, it’s worth noting that the founders have previously said they would sell 3 million shares each but have only sold 1 million each so far, so we may see a further sell-down after these results. It is very positive that the founders remain committed to the business and I believe that the retention of the team at Pro Medicus (at multiple levels, not just top management) is the most important thing for me to track. It’s truly rare to see a group of people doing such good work and the longer that is sustained, the better for everyone.

Disclosure: Claude Walker owns shares in Pro Medicus at the time of publication, and will not sell for at least two days.

Post Script: Claude's subsequent coverage of Promedicus can be found on A Rich Life

For occasional exclusive content, and the freshest content, join the FREE Ethical Equities Newsletter.

This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.