I've been a bit busy lately, but I wanted to record my notes on Azure Healthcare Ltd (ASX: AZV). Over the weekend I had a discussion about Azure with Motley Fool analyst Mike King, who noted that the half yearly results looked interesting. I believe the results reduce the risk of the investment (which is somewhat speculative), and I bought shares in the company on open yesterday at 27c and 27.5c. The purchase was funded by selling my remaining shares in Cryosite (ASX: CTE) at 46c, and selling 10% of my Global Health (ASX: GLH) shares at 70c, so it will be interesting to compare the investment to those two options in the future.

I almost added Azure Healthcare the Hypothetical Ethical Share Portfolio at 28 cents per share, but I decided not to because the company lacks sufficient recurring revenue, and is therefore vulnerable to health care cuts. Here are my thoughts on Azure Healthcare extracted (and edited) from my discussion with Mike. I definitely welcome feedback, as usual!

I have made multiple attempts to buy shares in Azure, but my order at 23c was expired when the company dropped to those levels in recent days. Words scarcely described the frustration I feel about this fact: possibly another investing foible I need to rub my nose in. Pie Funds was selling at around 24c - 25c. I was trying to get shares at less than Pie was selling at, but that didn't work out for me.

My thesis for buying is predicated on the company transitioning successfully from the sub-optimal hardware business to a business that has higher margin software sales. It's (network) software as far as I can gather, not software as a service; hospitals are the client. The Sedco acquisition was good judgement in my opinion, as they took out a competitor.

The most significant information I take from the half yearly is that management's stated plan to morph their business now appears to be evident in the accounts.

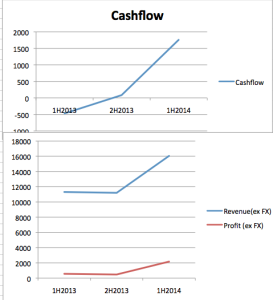

Excluding foreign exchange impacts, Revenue is up 43% from 2H 2013 and Profit is up 357%, even better than the prior corresponding period (pcp) comparisons. I'm using the preceding period, not the pcp, because I don't think that the business is notably cyclical. Either way, the results are similar if you compare to the pcp. These headline figures signify high operating leverage, only a good thing if revenues keep going up. The question is whether the increase in revenue is because of sales of the Austco Tacera Nurse Call System, or if it is because of hardware sales.

The company reports that "consolidated revenues from ordinary activities increased by 41.9% to $16.046 million compared to the previous corresponding period, reflecting increased demand for our new generation Tacera products." Tacera is an IP solution where all system components are fully IP configurable and have their own unique address for best in class supervision and system management, so it is mostly about the software.

Prior to this result there was execution risk for the Azure Healthcare story, and the company was priced as if it was going to succeed in its plans. To justify buying at 26c, I need the company to at a minimum repeat its 1st half performance in the second half, and subsequently to record growth of 20% on average over 2015 and 2016.

Question to you: can the company achieve this? I'm not sure, but they are off to a good start. This thesis would probably be broken is cashflow is significantly down next half.

Thee charts show the cashflow, revenue and net profit for the last three halves. Sources: HY 2014 Report, FY 2013 Report.

Thee charts show the cashflow, revenue and net profit for the last three halves. Sources: HY 2014 Report, FY 2013 Report.Usually, I'm very skeptical of a company being able to repeat outsized growth without a wide business moat. However, high margin software companies are capable of such growth, especially in their early days. If you believe such growth is possible, then I would call Azure a buy at 26c - 30c based on the discounted value of future free cash flow. In my models I have allowed growth of only 5% p.a. from 2017 - 2020, which should be easily achievable for the company; it's the next couple of years that will make or break the thesis.

The Author owns shares in Azure Healthcare. Nothing on this website is advice, ever. This post is for entertainment (and for my own reference!)

Recipients of the Free Newsletter will receive more thorough research on Azure Healthcare in the future. Sign up to access the hidden research.

I agree that this could be the start of a new business plan. However, do the high PE justify purchasing at these levels? Also interesting as to why PIE sold out if the growth looks promising. I hold shares purchased some years ago, so wondering if I should continue to hold.

LinkHi Al,

LinkPie had a fairly large holding, so needed to sell out into volume (even then, they took a while). According to their last mention of AZV, they still hold, just no longer are substantial holders. I can't give you advice about what to do.

I hold, but Azure is less than 5% of my portfolio.

What were your original reasons for buying?

I bought when at the original float - then TSV. It hit a high of 90c and there was euphoria about the telecommunications business they were investing in. However, they overpaid for various business, especially for the goodwill. No surprise to see that as the market cooled and business spending dropped that the revenue fell substantially. The business then reshaped and I remained on the register because I liked the story of the nursecall focus and the ageing population/improved medical care opportunities. I've watched the recovery from 3c in Oct 2011 to about 31c today... just not sure if we current price has too much froth in it??

LinkI would say that it is not the best bargain, close to fully priced at 31c. I'm keeping it in my portfolio for now.

Link