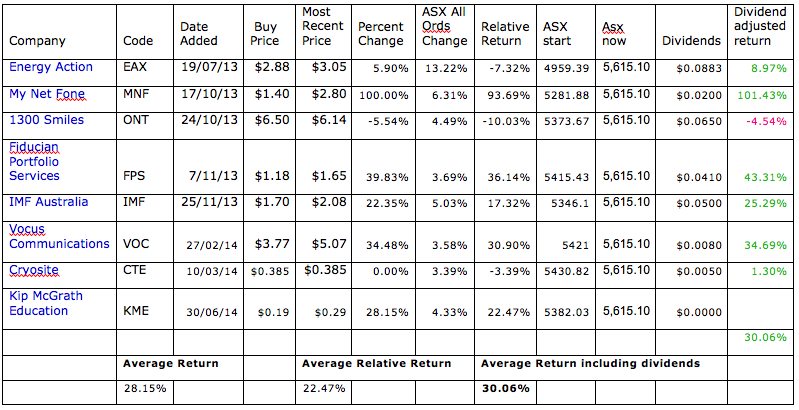

*Edit: The graphic below is wrong (luckily the real returns are higher). I had left out a cell. Please see comments.

As you can see, I added Kip McGrath to the Portfolio at 19c and called it in real time with a "hypothetical order" in the comments. This data correct at market close on 30/7/2014. I note strong performances from MNF, VOC, IMF and KME have all made the scorecard look a lot better since last update. Swings and roundabouts...

Nothing on this website is advice, ever. I hold positions in all of the companies mentioned above, namely, Cryosite Limited ASX:CTE, Energy Action, ASX:EAX, Fiducian Portfolio Services Limited, ASX:FPS, Vocus Communications Limited, ASX:VOC, 1300 Smiles Limited, ASX:ONT, My Net Fone Limited, ASX:MNF, Bentham IMF Limited, ASX:IMF and Kip McGrath Education Centres Limited, ASX:KME.

Newsletter subscribers get (monthly-ish) emails when I write my best content, that's just the way it is.

The Hypothetical Ethical Share Portfolio

So I just noticed that the "including dividends" return is incorrect because I chopped the data for Kip McGrath Education (see bottom right corner).

LinkLuckily, the real returns are better than the ones in the graphic above. The correct figures are:

Average Return: 31.21%

Average Relative Return: 25.7%

Average Return including dividends: 32.89%

You can see the correct spreadsheet here:

http://ethicalequities.com.au/wp-content/uploads/2014/09/The-real-correct-score-for-August-2014.png