Why We Hold Advance Nanotek Ltd (ASX:ANO): “The Zincularity”

Date published: 16 September

Author: Matt Brazier

Advance Nanotek Ltd (ASX:ANO) divides opinion. The bulls say it is a hyper growth stock that is comfortably worth its $260 million price tag. The bears say the company is run unprofessionally and the market valuation is too high given FY 2019 normalised NPAT was *only* a couple of million. I have been a shareholder in Advance Nanotek on and off for a number of years and currently own stock. Here’s why I am firmly in the bull camp.

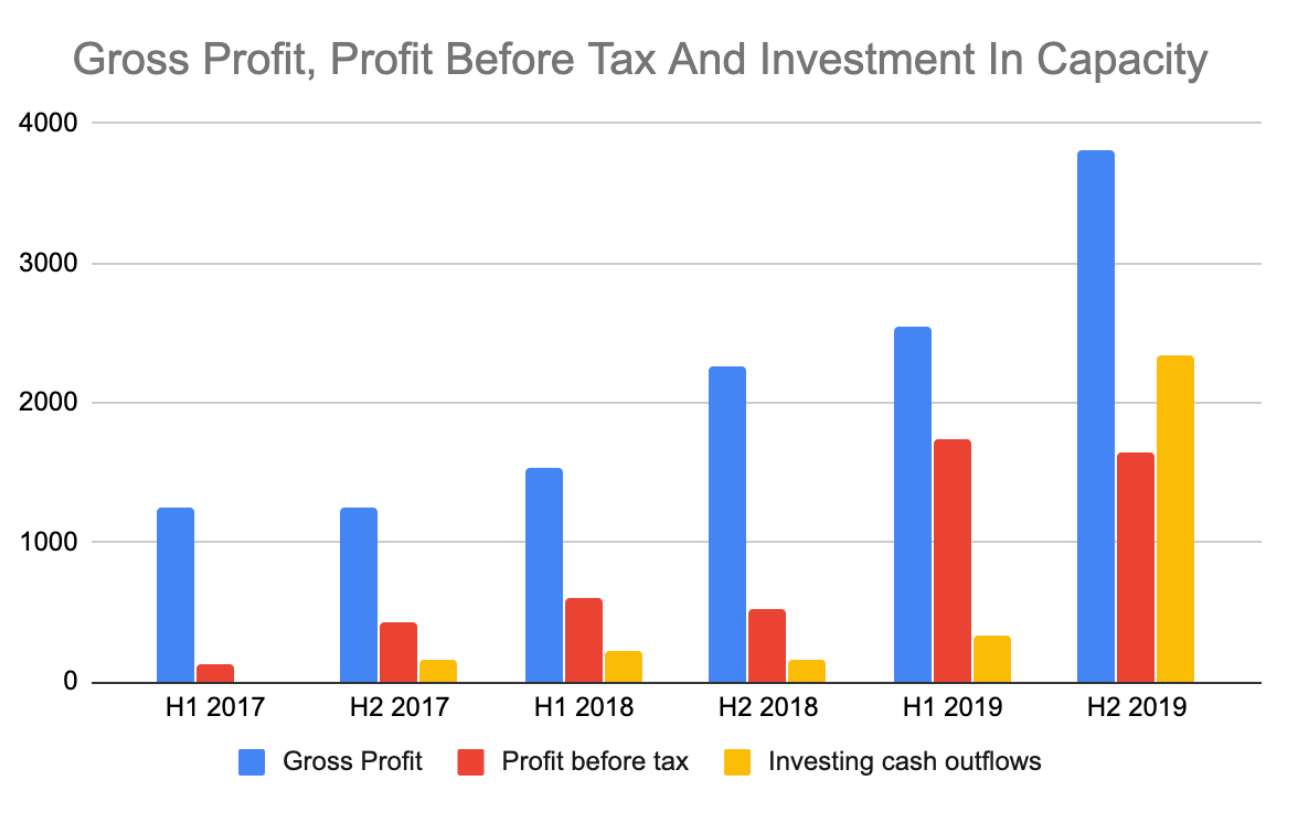

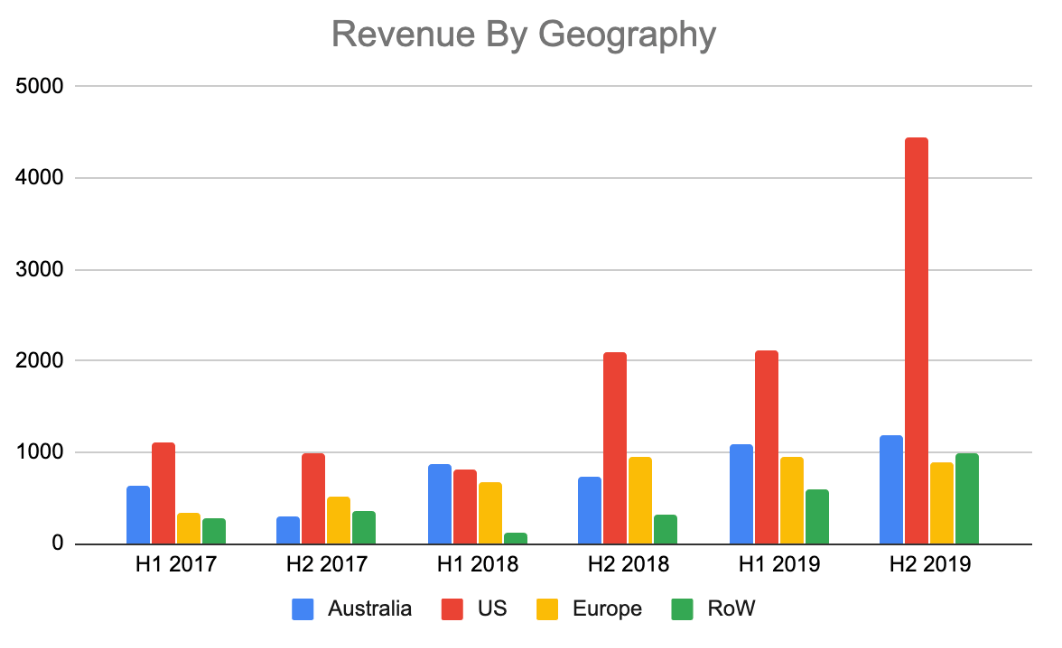

Firstly, I’m impressed by the dramatic improvement in financial performance since current CEO Geoff Acton joined the board in March 2016, shown below.

Note that profit is first half weighted because of higher corporate costs in the second half. I think this is because items such as director bonuses and related party transactions are finalised prior to the full year results and hence do not appear in the half year figures. In addition, R&D tax income can fall into either the first or second half of the year and in FY 2019 it was included in the half year result.

The directors also behave admirably when it comes to other shareholders. Directors’ fees were a mere $0.1 million in FY 2019 and the only capital raise undertaken in recent times was via an entitlement offer ensuring all existing shareholders had an equal opportunity to participate. Offsetting this are various related party costs which rose from $0.2 million in FY 2018 to $0.4 million in FY 2019 including cyber security services for $50,000. I’m not saying that there is anything untoward going on here, but related party transactions do require additional faith from shareholders.

I agree with the bears that market communication is suboptimal, but think this is the consequence of Advance Nanotek’s extremely lean corporate structure. Total overheads including depreciation and employee expenses were $3.7 million in FY2019. I would prefer it if management was always consistent when giving guidance and that it did not reference stock market forums in market releases, but not at the expense of higher admin costs.

The company recently had to undergo the ignominy of explaining the qualified audit opinion accompanying its accounts for FY 2019 following a request by the ASX. The auditors were unable to identify all of the inventory stated in the accounts. The directors say they have subsequently found almost all of the missing stock, but the auditors could not verify this claim as they were not present. Again, I think this is a consequence of a *possibly* overstretched admin department in a business undergoing rapid growth. The fact that chairman Lev Mizikovsky recently purchased more than $0.4 million worth of shares on market indicates that he believes the qualified opinion is nothing to worry about.

Overall, my opinion of the board is very positive despite a few foibles.

What It Does

The company makes two products, Alusion and Zinclear. Alusion is an aluminium oxide powder used in cosmetics that is sold solely to pharmaceutical giant Merck. Around a decade ago, Merck paid a license fee for exclusivity that is coming up for renewal in the next couple of years. Sales of Alusion have risen since the current board took control, but remain relatively low at a couple of million dollars per year.

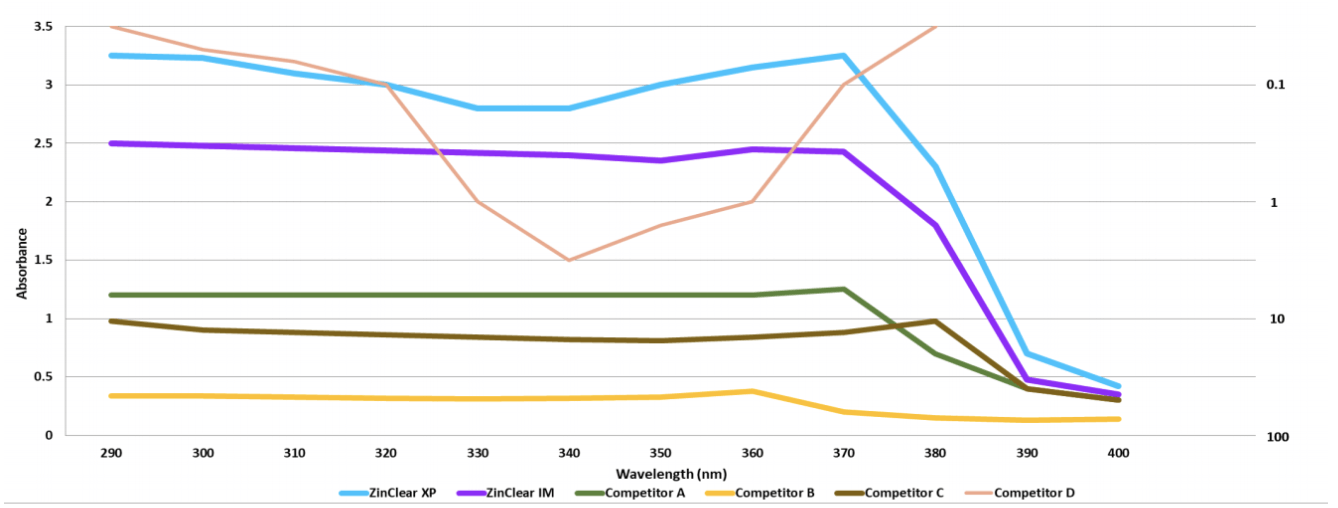

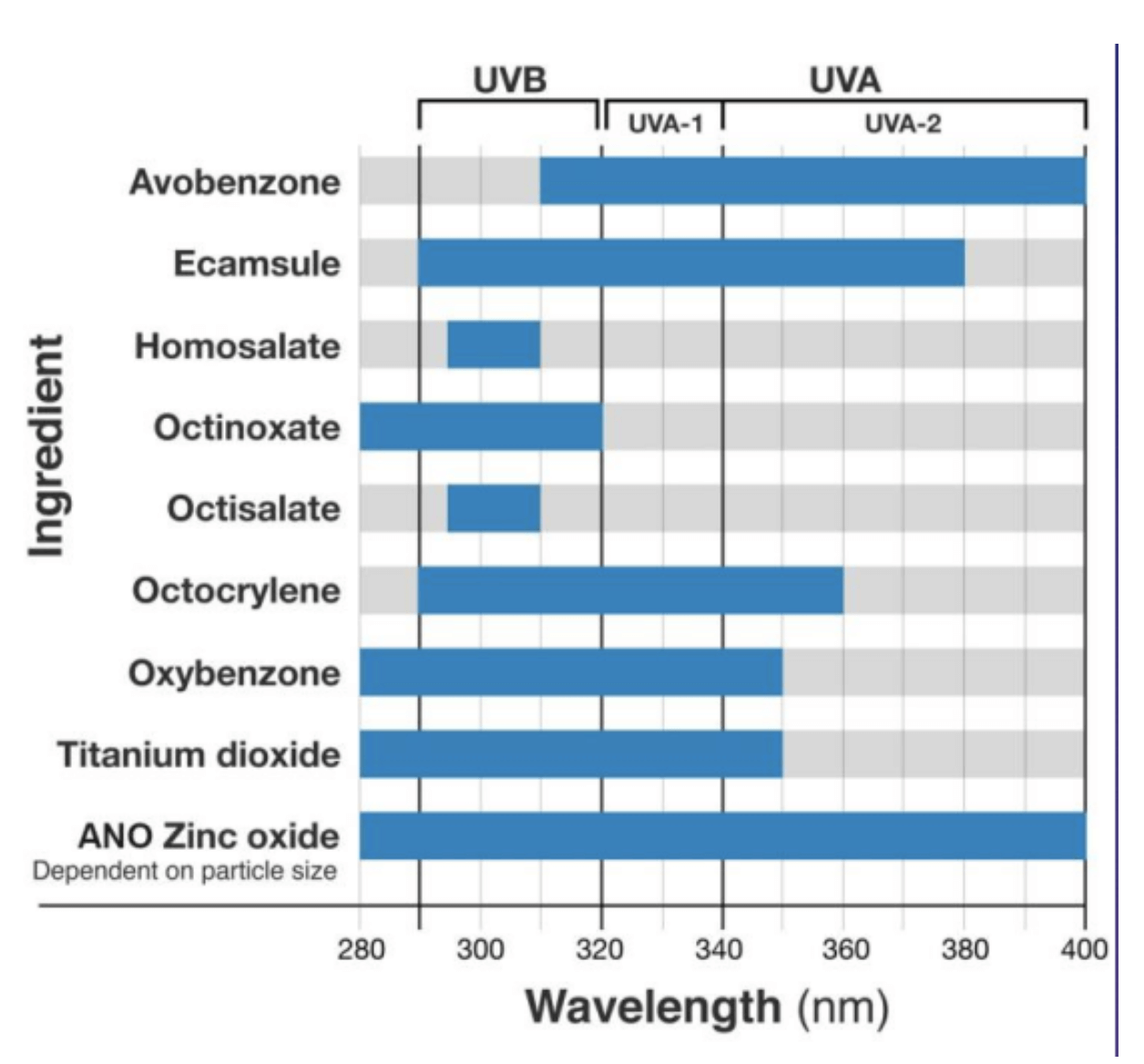

Zinclear is a product family of powders and dispersions of zinc oxide used as a photoprotective ingredient in sunscreens. Advance Nanotek uses patent protected processes to achieve high performance and transparency in its zinc oxide formulations. According to the chart below, Zinclear offers both better absorbance and broader coverage of UV rays compared to competing products. Admittedly, this chart is sourced from a company presentation so may not be the most objective evidence.

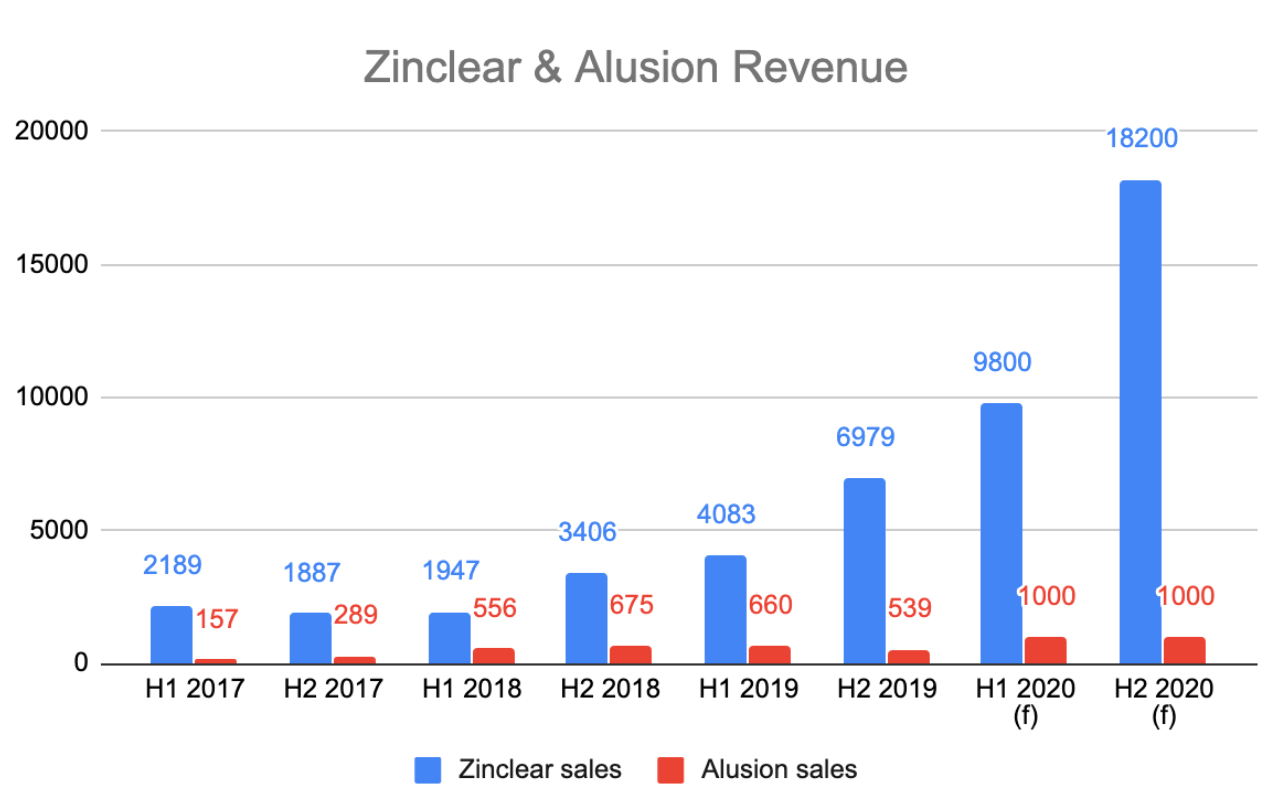

The FY 2020 Zinclear forecasts in the chart below are as per management guidance for the full year and are split by half according to my best guess.

The gargantuan growth profile above explains why the company invested heavily in both inventory and plant and equipment in FY 2019, and hence why free cash flow was so weak at negative $2.4 million. With just $0.4 million in the bank at 30 June, perhaps the company will need to raise additional capital, but if so this could be seen as a good thing because it means that demand for Zinclear exceeds Advance Nanotek’s ability to self reinvest its profits. It is not as if the company makes low returns either, since return on equity was 40% in FY 2019 (based on profit before tax and opening equity plus the $1.8 million capital raise completed during the year).

Zinclear sales are improving for a couple of reasons besides its superior properties. Firstly, Advance Nanotek reduced prices in January 2019 to win market share. Clearly, there is a risk that rivals follow suit and drop prices, but their ability to do so depends on their respective cost structures. Competitor Everzinc *actually* increased prices at the same time as the Zinclear cut. We know that Advance Nanotek has very low head office costs and in my opinion it is reasonable to assume the same frugality applies to the rest of the organisation. If Advance Nanotek is the lowest cost supplier then it need not fear price competition too much.

Similarly sized US competitor Nanophase made a US$2 million loss on US$14 million revenue in 2018, compared to $3.4 million profit before tax and $12.3 million revenue for ANO in FY 2019. Nanophase sells zinc oxide product Z-cote to BASF on an exclusive basis, which then resells it for between US$37.50 and US$55.00 per kg. I estimate that Zinclear sells for about $38 Aussie per kg based on order volumes contained in the latest Advance Nanotek investor presentation. Data from two versions of Z-cote is included in the UV absorbance chart above (Competitor A and Competitor B) and as you can see they both perform significantly worse than Zinclear.

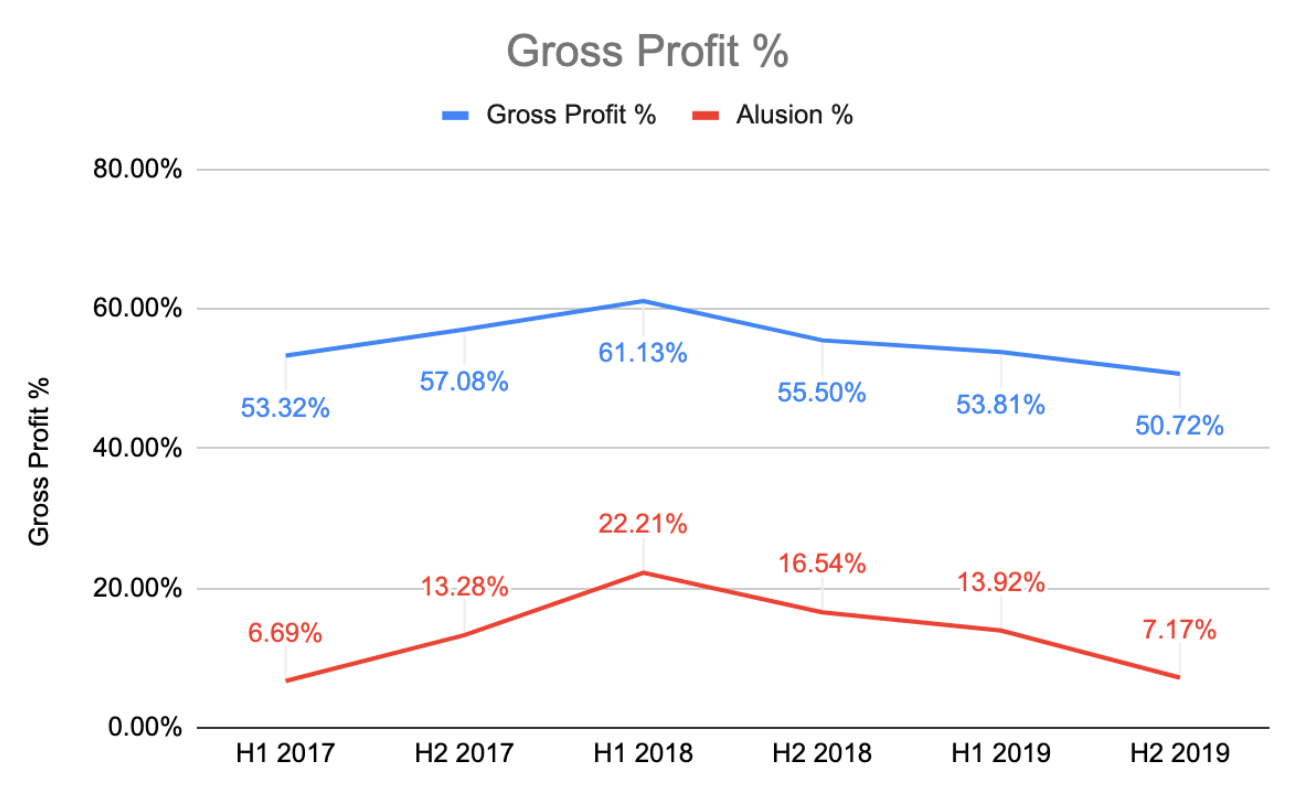

Gross profit, shown below, is based solely on raw materials and consumables and does not include any employee or other costs. Part of the deterioration in gross profit % in recent years appears to be related to Alusion becoming a much smaller percentage of total sales as well as the price cut at the start of the year.

Another main driver of Zinclear’s rise is changing consumer trends towards ethical products. In this case there is evidence that chemical filters found in most sun creams damage coral reefs. Hawaii has banned use of some chemical sunscreens and other tourist hotspots are following suit. Zinc oxide and titanium dioxide are the only two non-chemical alternatives and as you can see from the chart below (also courtesy of an Advance Nanotek presentation), zinc oxide is the only one which protects against UVA rays. This point is critical as according to skincancer.org “UVA radiation is proven to contribute to the development of skin cancer.”

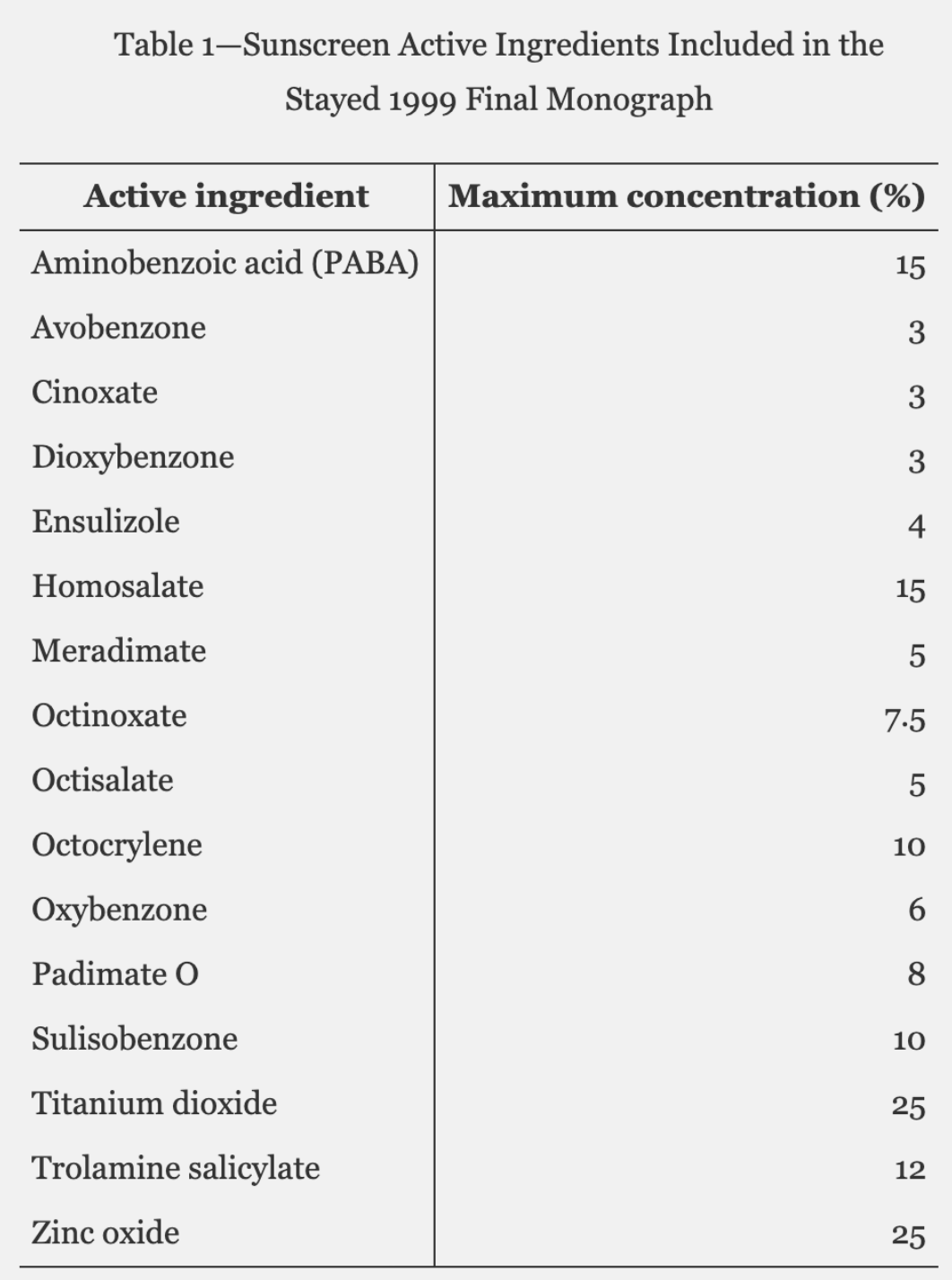

In addition, the FDA has proposed a new rule to be enacted in November 2019 which requires manufacturers to submit data demonstrating the safety and efficacy of all chemical ingredients. Without this additional evidence the FDA would consider only zinc oxide and titanium oxide generally recognized as safe and effective (GRASE). From the proposal:

“Because the public record does not currently contain sufficient data to support positive GRASE determinations for cinoxate, dioxybenzone, ensulizole, homosalate, meradimate, octinoxate, octisalate, octocrylene, padimate O, sulisobenzone, oxybenzone, or avobenzone, we are proposing that these ingredients are Category III.” (Category III means cannot be determined if safe and effective.)

At the same time the governing body is tightening up requirements for UVA protection:

“To address these concerns, we are making a number of proposals designed to couple a greater magnitude of UVA protection to increases in SPF values. We are proposing to require that all sunscreen products with SPF values of 15 and above satisfy broad spectrum requirements.”

Based on FDA estimates, between 6% and 26% of sunscreen consumed in 2016 was classified as SPF 15 or greater, but would not satisfy the broad spectrum requirements under the new rule.

It is no wonder that brands are rapidly adopting zinc oxide given the issues facing chemical ingredients described above. The underlying current of public opinion towards zero-harm consumption suggests that the zinc oxide sunscreen market will get much bigger regardless of whether chemical ingredients are banned by the FDA.

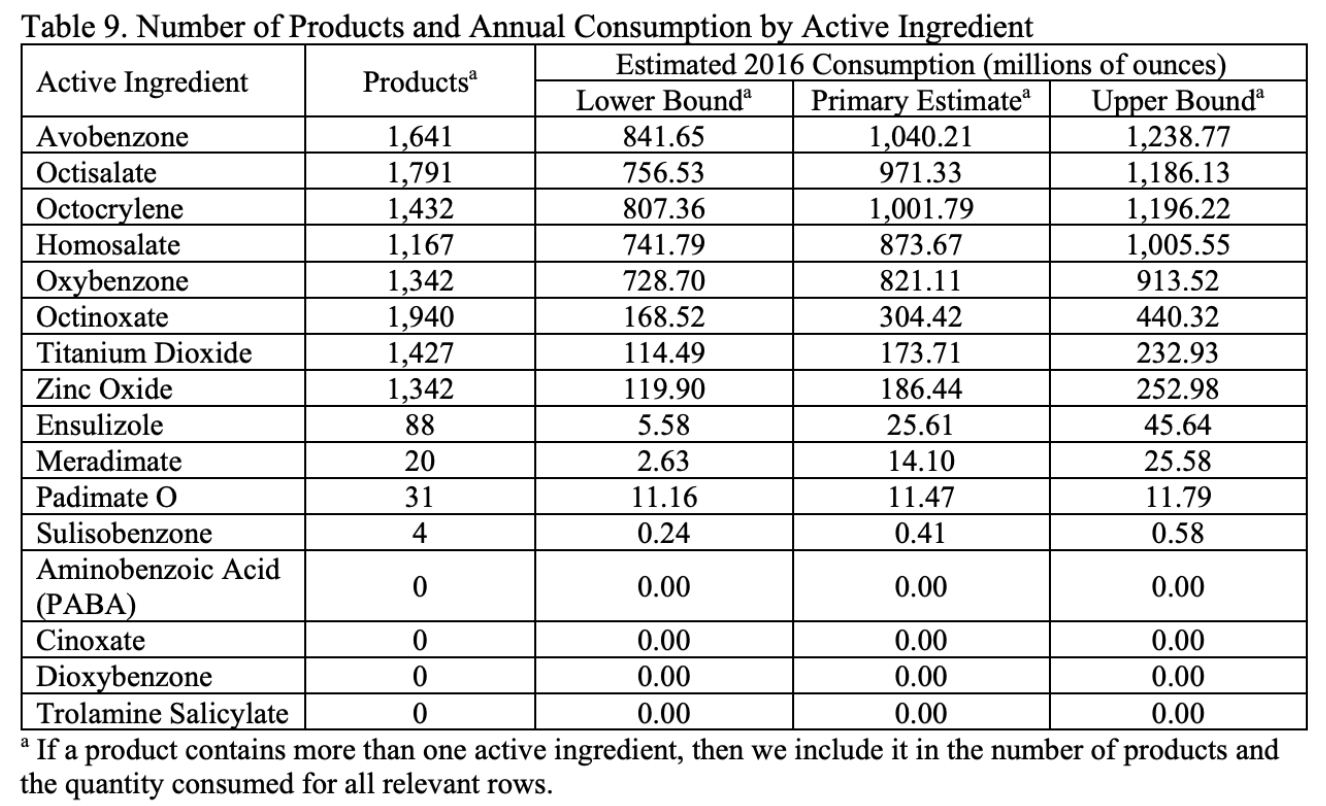

According to the FDA, “consumption of sunscreen products in 2016 ranged from about 1,080 million ounces to 1,743 million ounces” broken down by active ingredients in the table below.

By these statistics, zinc oxide was present in between 7% and 23% of all the sunscreen used in the US in 2016. In many cases zinc oxide would accompany chemical filters in these products and so be present in a lower concentration than would be necessary to be effective as the sole active ingredient. Indeed, without the presence of other agents, sunscreen requires a concentration of at least 15% zinc oxide to provide adequate protection, with a maximum proportion of 25% permitted.

Research by Euromonitor analyst Maria Coronado shows that the global sunscreen ingredient market was 44,000 tonnes in 2016, growing at 4% per year. She reckons that the US accounts for the largest share of any region at around a third of the total market, but that Europe and Asia are growing much faster. Minerals (zinc oxide and titanium oxide) currently represent 9% and 11% of all ingredients in the US and Europe respectively. If these findings are accurate, there is a large opportunity for Advance Nanotek in light of the shift away from chemical filters. The company has provisional plans to increase production capacity to 3,600 tonnes by the end of FY 2020 to “ensure manufacturing capacity is at least double the current sales order intake.” Meanwhile, management has forecast sales orders of more than 1,000 tonnes for FY 2020, which we think is slightly more than 2% of today’s global sunscreen ingredients market.

In summary, my estimation is that Advance Nanotech has a top notch management team and is selling a superior quality, low cost and patent protected product into a rapidly growing market. I also think that as was the case in FY 2019, should management achieve its forecast 150% sales growth in FY 2020 then this would translate into more than 150% growth in profit before tax, with lower gross margins more than offset by relatively fixed overheads. I am forecasting earnings of $10 million in FY 2020, which equates to a price-to-earnings multiple (P/E) of 28 based on the share price at the time of writing ($4.70). Even if my forecast proves too aggressive for this year, I am confident that Advance Nanotek will continue growing at high rates for the foreseeable future because of the factors discussed within this article. I believe the shares to be decent value today, albeit towards the higher end of the risk spectrum, and would consider them an outright buy at less $4 (a P/E of 23 based on my earnings forecast).

There are a couple of friends who have assisted me in researching this stock - you know who you are so thanks for your help.

Disclosure: Matt Brazier and Claude Walker both own shares in Advance Nanotek at the time of publication, and will not sell for at least two days.

For those for whom it is appropriate and affordable, we are still selling Pro Ethical Equities Supporter Subscriptions only.

This content is part of the hidden content emailed to members of the he FREE Ethical Equities Newsletter.

This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.

If, somehow, you are not already using Sharesight, please consider signing up for a free trial on this link, and we will get a small contribution if you do decide to use the service (which in turn should save you money with your accountant, or time if you do your own tax.)