Xref Team

An Under The Radar HR Software Stock Gaining Traction

Author: Matt Brazier

Date Published: 13/1/2019

Xref (ASX:XF1) is led by founders and major shareholders Lee-Martin Seymour and Tim Griffiths who formed the company in Sydney in 2010. It reverse listed into the shell of King Solomon Mines Limited (ASX:KSO) for 20 cents per share in February 2016 and has so far raised $27 million of capital, mainly at or above 60 cents per share (versus the current share price of 48 cents).

The company provides cloud-based employment reference checking software to organisations in 192 countries including more than a third of the ASX 50. Xref provides many benefits to recruiters compared to the traditional approach to reference checking of making a phone call. These include:

- Speed - it takes 15 seconds to request a reference check using Xref and on average references are completed within 24 hours. Completed references are automatically stored in a usable format whereas the content of a phone call needs to be separately written down and stored which takes extra time and information can be lost.

- Standardisation - Xref prevents discrimination by ensuring the reference process is standardised and enables objective comparisons of candidates. It provides better quality and more complete information compared to a phone call.

- Flexibility - Referees are able to complete references outside of office hours and the candidate is able to track the process, putting the onus on them to chase the referee rather than the recruiter.

- Security - Xref is ISO 27001 certified and is built to the highest security standards ensuring sensitive reference data is stored safely. The software has the ability to detect fraud by analysing the digital footprint of candidate and referees.

These claims are supported by numerous testimonials found on Xref’s website and by four other clients who I contacted independently and all provided highly positive feedback (including one who is planning to significantly expand its use). I have also demoed the

software and found the process of conducting a reference check to be seamless. Xref’s client retention (based on sales volumes) of 94% across all time also seemingly speaks volumes.

However, another two organisations which I contacted that are listed as clients in the company’s ASX releases said they did not use the software. One even said that they had never heard of Xref. When I queried management about this client, I was told that the company in question does not make many hires and used the software for a one-off project a couple of years ago. They said that the other organisation is still a client and offered to put me in touch with their contact. I declined the offer and assumed I must have spoken to the wrong person.

Too simple?

Xref is a niche solution that addresses one aspect of the recruitment process. Many large organisations use applicant tracking systems (ATS) such as Oracle Taleo and Workday to manage the entire process. Xref integrates with a growing number of these platforms and sees them as partners but perhaps they also represent a competitive threat. For example, is it possible that their larger and better resourced partners could build their own referencing software or acquire a competitor?

CEO Lee-Martin Seymour says he does not see this as a significant risk. Firstly, the ATS providers have broad offerings whereas Xref is focussed on its niche. It is unlikely that an ATS could build a product that matches up to Xref. Lee quoted an example of where a global data company built a competing product which was later decommissioned because of its inferior quality.

Furthermore, the major platforms cannot effectively provide a perfect end-to-end recruitment solution for every customer because the requirements are too diverse. This is why there is a trend towards application marketplaces and integrations between individual software products enabling organisations to build bespoke solutions.

I previously thought that Xref’s software was relatively simple and therefore easy to copy. Essentially, the employer requests references from the candidate, the candidate fills in the details of the referees and then the referees write the references which are sent to the employer. However, whilst Xref is simple from the user’s point of view (which is as it should be), there is lots happening behind the scenes.

Firstly, the platform is highly secure which is important because of the sensitive nature of reference data and increasing data protection regulation. In September, the company achieved ISO 27001 accreditation following a two year process providing a barrier to entry for would-be competitors. Lee cited an example where a customer returned to Xref because a competitor suffered a data breach. He says Xref was ready for the introduction of GDPR regulation in Europe (considered among the toughest data security regulation globally) months in advance and that the Xref software goes well above the GDPR requirements.

Another aspect of Xref that would be hard to replicate is the fraud detection capability which uses algorithms to detect fake references. It can tell from IP addresses and other elements of referee and candidate digital signatures if a reference is likely to be real.

Xref also has algorithms which objectively measure reference sentiment based on the language used.

A new product to be sold separately called People Search allows clients to mine their historical reference data to identify potential candidates. Larger clients collect hundreds of thousands of references over time and People Search could help them reduce recruitment spend.

The accumulation of large amounts of sensitive data by major clients also provides a minor competitive strength. It might be painful for these customers to change providers given the need to migrate this data should they wish to retain it. An alternative solution may not generate consistent reference data making comparisons between candidates difficult. Despite this, I would say the Xref is not a software application that is deeply ingrained into an organisation’s workflows and so switching costs are not particularly high.

An easy sell

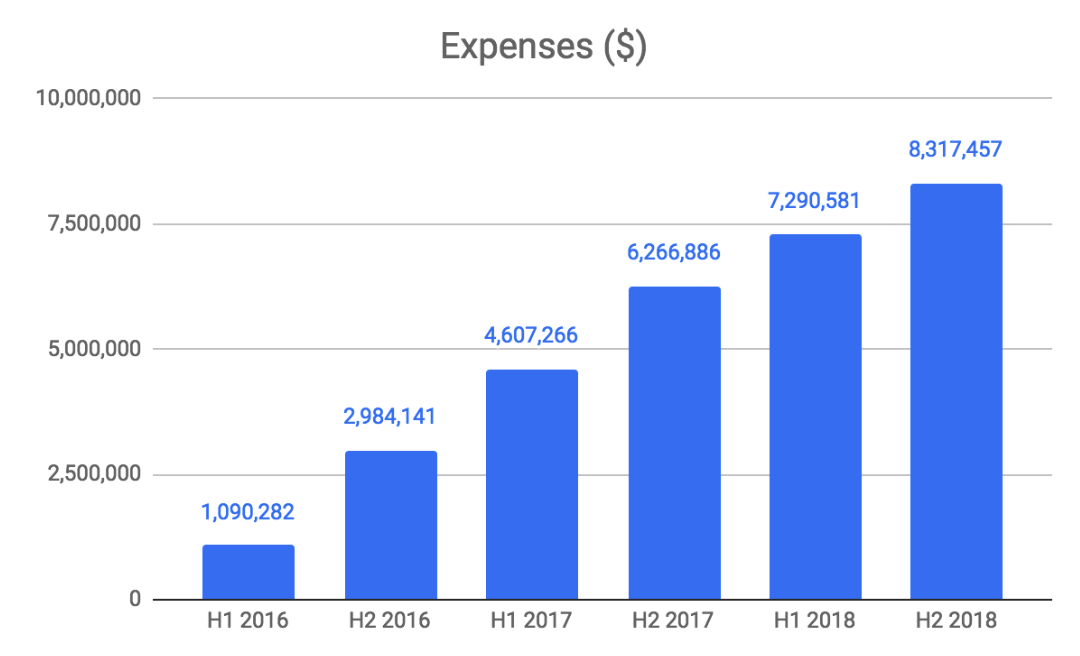

Xref was cash flow positive prior to listing and has since invested heavily in developing the software (including building integrations with third party solutions) and expanding overseas. I believe this money has been well spent given the business is now growing cost effectively on multiple fronts.

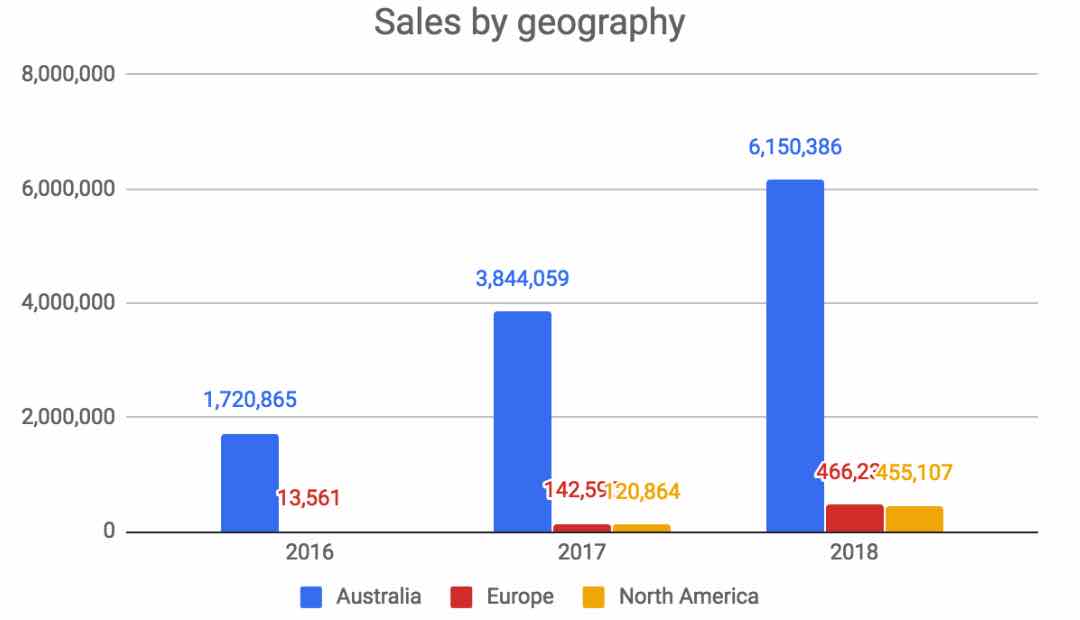

The company has gone from a single office in Australia with no overseas staff at the time of listing to four global offices covering Europe, North America and Australasia and 13 overseas staff. This small physical presence is augmented by a combined 10,000 support staff of its 13 technology partners, all added since listing. The platform was previously only available in English and now supports 12 languages.

24% of revenue came from channel partners in 2018 and this percentage is likely to grow over time. Xref does not lose any margin on channel sales and so although each client won this way is typically smaller, they are very profitable.

Meanwhile its sales team can focus on high value business. Xref employs sales people with recruitment experience who can relate to potential clients and often bring valuable contacts into the business.

Another key driver of sales is through existing clients using Xref since many candidates and referees work in HR but are not currently paying users.

Xref does not disclose customer retention on a regular basis but has provided ad-hoc figures over the last couple of years. These have consistently been above 90% (recorded since inception rather than per year). Lee says the reason for not focusing on client retention as a metric is because the revenue cycle is irregular. For example, a client may use lots of credits over a short period of time due to a major expansion and then hold off hiring for a period. There are also some clients such as the NBN and The Gold Coast Commonwealth Games that have temporary hiring requirements which can distort retention numbers.

This is fine, but I still think some sort of client retention metric should be provided because it is important for understanding the health of the business. I am also unsure how the retention figures that are quoted have been calculated. The company says they are based on volumes, but given many customers increase usage over time it may be that these clients are offsetting others that are lost.

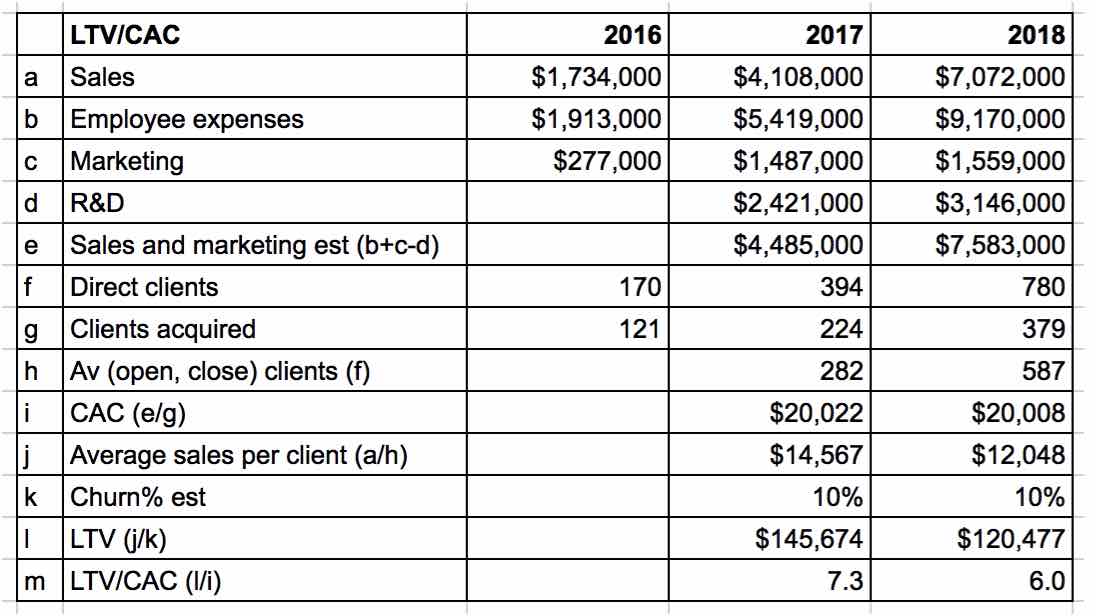

Sales and marketing spend is generating excellent returns. I calculated (above) that in 2018 each newly acquired customer is likely to pay for its cost of acquisition six times over the coming years. I assume a churn rate of 10% (which is conservative compared to the retention figures quoted by the company), that all employee expenses except for those related to R&D are for sales and marketing personnel (even though some are clearly admin staff) and no uplift in average sales per client over time (Xref has demonstrated increasing client adoption over time).

Valuation and the road to profitability

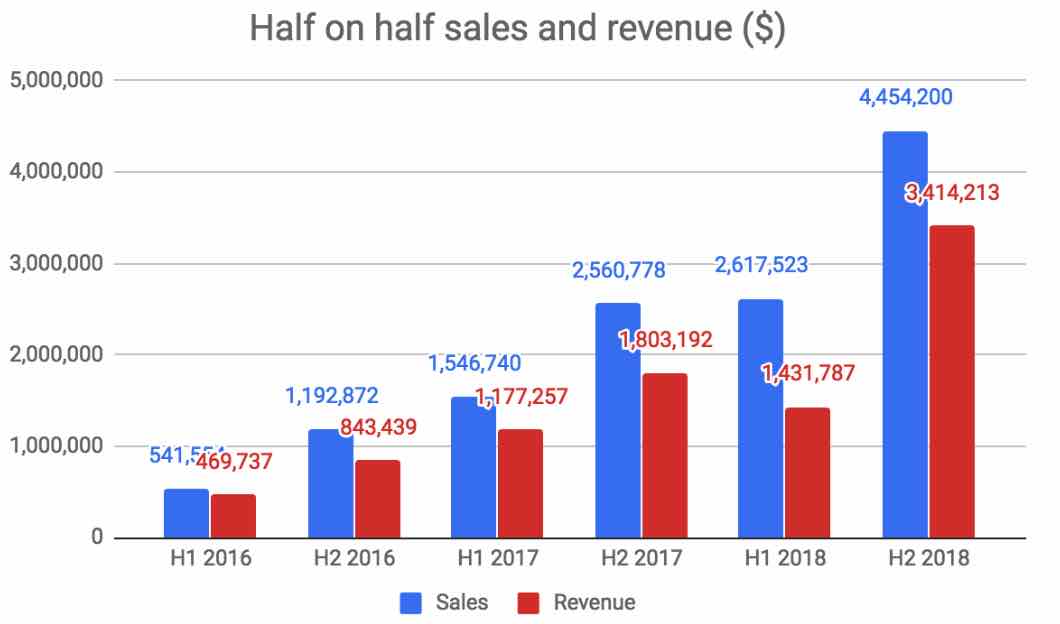

Xref generates revenue through the sale of credits to clients. Each credit can be used to provide reference checks for a single applicant. Clients periodically top up their credits and then steadily use them. This means that there is a lag between when Xref records a sale of a credit, when the cash is received for that sale and when the credit is used and converted to revenue.

The price of credits has gone up over time. When Xref first listed the price of a credit was $35. It was later raised to $50 and is now $75, although volume discounts are available. $75 may seem like a lot, but the time saved from using the software is worth significantly more. The total cost of hiring someone can run into the tens of thousands of dollars and so Xref’s pricing is reasonable by comparison.

Xref has a market capitalisation of $78.5 million plus 16.7 million performance rights which are convertible into ordinary shares if the company records $2.5 million in EBITDA in a six month period prior to February 2021. I think there is a reasonable chance of this happening given the growth trajectory and flattening cost profile (cash costs are forecast at $3.65 million for the upcoming quarter). In any case, I believe Xref is fully funded to profitability given it has $12.2 million in cash and cash is received in advance of revenue.

Assuming the performance rights are converted and including 2 million in the money options, the market cap becomes $87.5 million. There are also 15 million options with exercise prices between 58.5 cents and 70 cents.

This may seem like a lot to pay for a loss making company that generated $3 million of revenue last year but revenue is growing at 100% year on year, gross margins are close to 100% and the global market opportunity is in the billions of dollars. If the company can continue adding a few million dollars of high margin revenue per year then over time it will comfortably outgrow its current valuation.

On average, a new client uses Xref for for around a third of hires in year one, growing to almost 90% by year four (it is possible for clients to reference more candidates than hires it ultimately makes). Xref’s current client base collectively hires 679,000 employees per year so Xref will generate $30 million in annualised revenue in four years time assuming a continuation of historical adoption trends. This assumes no further growth in clients but around 100 clients are being added each quarter. Costs are currently around $17 million per year and so Xref’s market capitalisation looks reasonable when viewed in this light, because it seems likely that the company can become profitable in the next few years.

Management interests

In March 2018 founders Lee and Tim sold 9.8 million shares each at 60 cents per share and now hold 61.8 million shares or a 37.7% of the company between them. The performance rights described above accrue solely to Lee and Tim and they have already received 16.7 million shares each since Xref listed after achieving predetermined revenue and share price goals.

One way of looking at this is that management have awarded themselves millions of dollars worth of shares for hitting modest targets. Another way to view it is that they simply structured the reverse listing so that their equity was preserved during the first few capital raisings. Either way, the sale of almost $6 million worth of shares by each of the founders so early in the company’s life certainly leaves a sour taste in the mouth.

Ultimately, I think it appropriate that management retains a major shareholding and should be well rewarded if the company prospers (as it has done to date), but there are limits. I would be concerned if employee share incentives continue to be as generous and dilutive to existing shareholders in future.

During my discussions with management I found them to be open and enthusiastic, actively encouraging me to speak to clients which demonstrates their confidence in the value proposition of Xref. Overall, I am cautiously optimistic and look forward to following the progress of this exciting HR tech company.

Note from Claude: I own a small holding in Xref, and I will accumulate more shares if it tracks towards profitability, but I will sell my shares if it looks like management is too profligate with spending. My biggest concern with this company is that they fall in to the "Catapult trap" and think that because they are a tech company they can keep increasing losses and not worry about a profit. I'm expecting breakeven by FY 2020 at the latest, if they don't achieve that then revenue growth would have to be particularly impressive. I had hoped to get this out when the stock was under 45c but I think it's attractive at 50c (lowest offer currently $0.485). My average buy price for my (very small) holding is $0.4625.

For early access to content like this, join the Ethical Equities Newsletter.

Disclosure: The author Matt Brazier does not own shares in Xref at the time of publication, 13/01/2019. Claude Walker edited this piece and does own Xref shares -- he commits not to buy or sell within two days of publishing this article. This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.