Published: Monday, October 29, 2018

Elixinol Global (ASX:EXL): An ASX Cannabis Stock Well Worth Watching

Our preferred position in the Australian listed cannabis sector – for reasons that should quickly be apparent, is Elixinol Global (ASX: EXL). It arrived fashionably late to the ASX party, listing in January this year at $1.00 and trading up to as high as $2.15 in late September - immediately prior to a $40M capital raising (at $1.85) which brought the share price back to ~$1.90 and then the global growth stock sell-off which has seen the stock down to $1.65 as of Friday.

EXL comprises three separate operating businesses, each with a different growth trajectory and market potential:

- A US-based manufacturer and distributor of hemp-based nutraceutical, dietary supplement and skincare products;

- An Australian-based manufacturer and marketer of hemp food and (more recently) cosmetic products; and

- An early stage Australian entity preparing to focus on the cultivation, manufacture and distribution of medicinal cannabis products (all subject to necessary approvals which have not yet been received).

The first two business units above have been trading for a while and generate meaningful revenue, and the third is a new entity seeking to operate in the Australian medicinal cannabis sector (once the necessary accreditation has been obtained).

Company background

Elixinol US – over the counter (“OTC”) CBD-based nutraceutical products

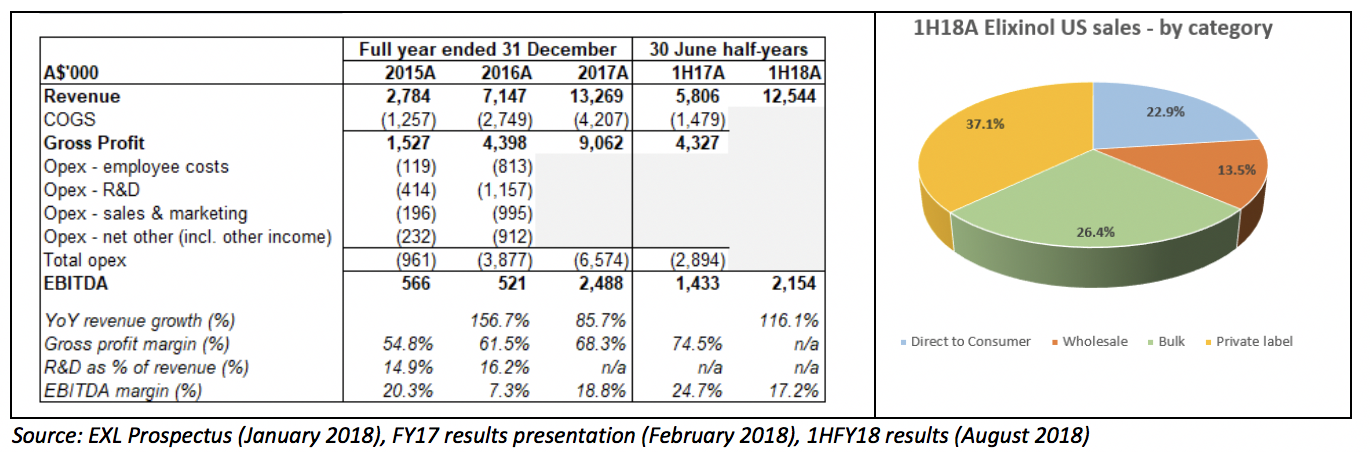

The US business is the largest contributor to group revenue and earnings and is likely to be for several years to come. Founded in 2014 after the US Farm Bill was passed, Elixinol US is a vertically integrated manufacturer and distributor of industrial hemp-based CBD nutraceutical and skincare products. Domestic volumes account for ~85% of sales, and exports to distributors in 40 other countries (predominantly Europe, Japan and South Africa) the remainder. The US product range comprises 30 SKUs including hemp oils, capsules and essences, topical CBD-based products such as lip balms and skin creams, and even CBD dog treats (aimed at treating pet anxiety). Elixinol US has grown quickly since inception and in the last financial year (to December 2017) nearly quintupled EBITDA on an 86% increase in revenue. For the half-year to 30 June 2018, Elixinol US more than doubled revenue, though EBITDA margins declined slightly – probably due to further investment in the business for growth (most likely sales & marketing ahead of the expected passing of the 2018 Farm Bill, key management hires, and also upgrades to back office systems to prepare the business for growth). Management have not provided formal full year FY18 guidance, though we note that 1H18 sales were already 95% of total full-year FY17 sales.

The pie chart above right breaks down US sales for the 6 months to June 2018 by category. The primary sales channel is the company’s website which accounts for the vast majority of the non-private label volumes, and sells to consumers, medical and allied health professionals and resellers. Hemp CBD products are still niche products at this point and not yet carried by mainstream retailers, predominantly distributed via specialist hemp CBD product wholesalers. The prospectus detailed that Elixinol US also contract manufactures private label products (presumably at lower margin) for “several other leading brands” – interesting to note that this comprised 37% of 1H18 sales.

The company formulates products in-house and over FY15 and FY16 this averaged ~15% of sales. Current new product development is particularly focused on recently entered vertical markets of skincare and pet/veterinary products (including anti-anxiety products under the Pet Releaf brand).

The US product range is manufactured at the Elixinol facility in Colorado using raw materials sourced from contracted licensed US suppliers; the company is not a cultivator of hemp crops itself. Elixinol uses plants with an above average level of CBD content – which is harvested using a CO2 extractor. The extraction and pre-processing is undertaken on-site via a partnership with H&W Holdings LLC (of which EXL holds an 18.5% stake). The US operations will be relocated to a new facility in Colorado which will be GMP-certified and which will represent a doubling of capacity by the time the new plant is operational in late 2018.

In April 2018, EXL moved to shore up its long-term supply of US premium CBD hemp by entering into a farming joint venture with Colorado-based agricultural company Kersey Ag Company LLC. The joint venture received US$1.8M of funding from EXL and has land rights for 35 years (including lease extensions). In late September, the group increased its ownership of its Japanese distributor to 51% via a further $2M investment. In addition to potential new partnerships and joint ventures, the company has also flagged that it may pursue bolt-on acquisitions in the US as it moves to build scale at a more rapid speed in what is a highly fragmented early stage market at this point. A portion of funds raised from the $40M capital raising last week will no doubt be earmarked for further alliances, investments and potentially acquisitions.

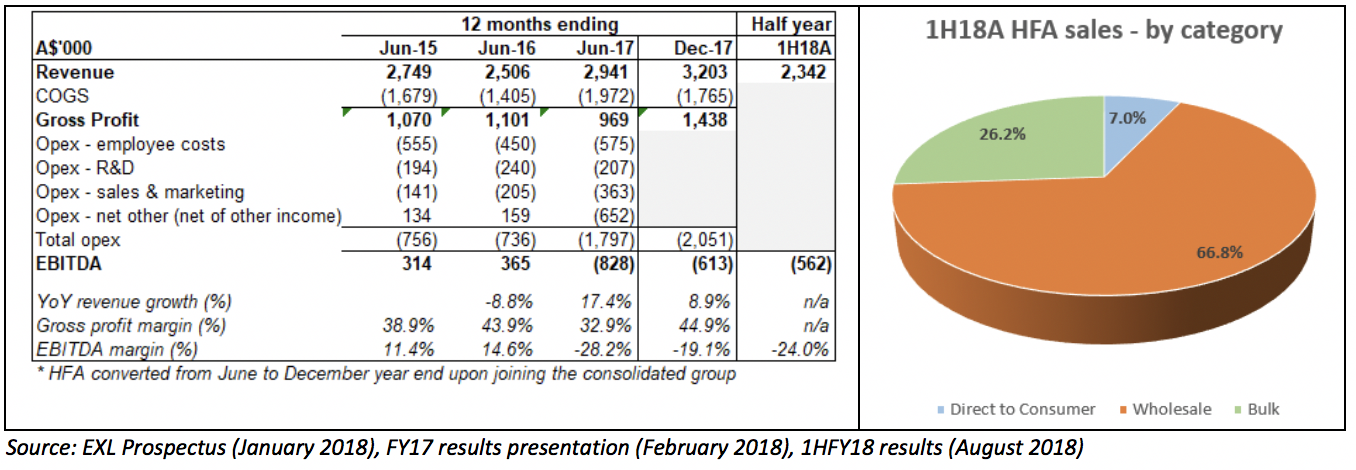

Hemp Foods Australia

Hemp Foods Australia (“HFA”) has the longest operating history of the group, having been founded in 1999 as a small hemp oils manufacturer which bubbled away with a limited product range (available only in health food stores) until more recently. The Australian product range was expanded in 2012 to include hemp seeds and hemp protein for export markets such as Europe and the US (where hemp foods were already legal) and as of September 2018 comprises 34 SKUs. In the US, a small range of HFA products are distributed by Elixinol US.

The long term domestic Australian growth potential of HFA was significantly enhanced in November 2017 when low-THC hemp was included as a food in the Food Standards Australia New Zealand code; previously hemp products were only allowed to be sold in Australia for external use (i.e. skincare) only. This law change enabled the marketing of hemp products as food and opened the broader supermarket retail and foodservices (i.e. supply of ingredients to restaurants, cafes and franchise groups etc). While demand for hemp-based foods has started to increase following this law change, the market in Australia is still tiny – with Bell Potter estimating it at only $20M in size currently, comprising HFA and 5 other small players (according to the prospectus) – although we would expect new entrants into the space in response to the favourable change in legislation, and I’ve noted Emma & Toms branded hemp snack bars (as part of their snack food range) in Woolies recently.

The latest financials for HFA (half year to June 2018) suggest that this business has enjoyed a positive sales lift from the November 2017 law change, with half year sales of $2.3M already 73% of full-year sales to December 2017. We would expect a significant increase in sales and marketing costs in support of the rollout of the HFA product range into its new retail channels – and so do not anticipate this business will be a meaningful contributor to group profitability in the short term.

Like Elixinol US, HFA is not a cultivator, with hemp plants supplied by contracted licensed farmers in Victoria, Queensland and New South Wales. Key supplier Tiverton Agriculture parlayed a 30% equity interest in HFA pre-IPO into a 3.6% shareholding (now 3.0% post last week’s capital raising) in the listed EXL group (making it the largest shareholder behind management, which pleasingly control 54% of the company (post capital raising)). HFA also utilises imported certified organic hemp seed from strategic international partners (including from Germany).

HFA manufactures hemp seeds, protein, flour and some hemp oil products at its facility in Bangalow (NSW) – which as of early 2018 was operating at only ~25% of current capacity (which could be quadrupled with further investment at that site – suggesting the Bangalow operations could process somewhere in the region of ~$50M of annual sales). Upcoming organic skincare range Sativa Skincare will not be produced at this site and will be outsourced to a specialist organic skincare manufacturer. Likewise, a new snack bar range to be launched shortly will be subcontracted to a third party manufacturer.

There are no plans as yet to market the Elixinol US CBD-based nutraceutical range in Australia as this would not be possible without a prescription (as, per the EXL prospectus, CBD remains a Schedule 4 item under the Poisons Standard administered by the Therapeutic Goods Administration (TGA)).

Elixinol AUS – medicinal cannabis (eventually)

The third part of the EXL group is a newly incorporated Australian entity which will focus on (eventually) importing, cultivating, manufacturing and marketing CBD/THC medicinal cannabis in Australia – but this entity first needs to secure the necessary licences for each of these activities (as well as for clinical trials). This unit plans to leverage the industrial hemp R&D experience of the US business in developing a portfolio of formulations and products, and then later Elixinol US’s expertise in manufacturing cannabinoid products.

The initial focus will be on first obtaining an importation licence, and then importing bulk raw medicinal cannabis materials – which will be used in the outsourced manufacturing of its first product range. Once the remaining licences and permits have been obtained, the company will proceed with its plan for establishing its own cultivation and manufacturing operations – for which $13.5M of the total $16M raised from the IPO (after costs) has been earmarked:

- Purchase land for the Elixinol AUS manufacturing facility ($2.6M)

- Establish the cultivation / greenhouse facility ($5.3M)

- Build the GMP/TGA-certified extraction & manufacturing operations ($5.5M)

Meaningful revenue from this business is likely to be a couple of years away at least. The company is hopeful of building the Australian medicinal cannabis cultivation and manufacturing facility in 2019 (subject to licence approvals being obtained).

EXL estimates the potential Australian medicinal cannabis market to be in excess of $100M (based off the assumption that 1.2% of the Australian population to be likely to use cannabis to treat various ailments, in line with US and Canada). The big money is therefore likely to be made offshore.

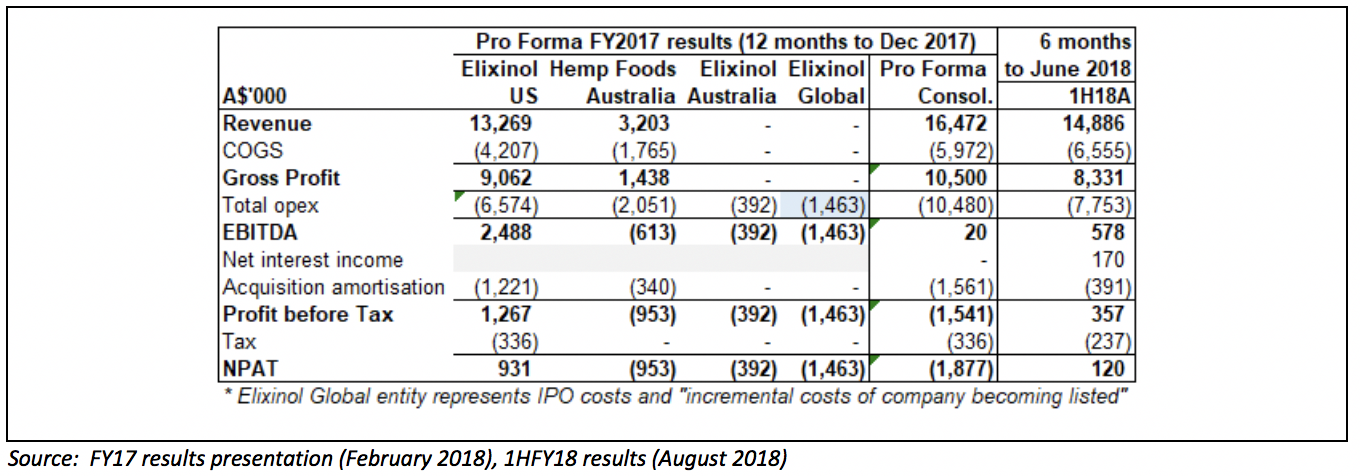

Consolidated CY2017 financials

Pro forma consolidated results for the FY17 year (ended 31 December 2017) are presented below, including one-off IPO costs and incremental listed entity costs – totalling $1.5M. Note that interest costs and income are reported within EBITDA for FY17 (not technically correct but not so uncommon in ASX financial reporting).

The company reported a small statutory NPAT for the half year to June 2018, in the process becoming the first Australian ASX-listed cannabis stock to report a profit. Depending on the level of incremental investment in the business following the capital raising last week, EXL is also likely to be the first Australian listed cannabis player to report a full-year profit when it announces FY18 results in February next year.

Closing thoughts

As you would expect from a nascent industry sector, there are a large number of moving parts, and it is likely that the cannabis sector will look very different – and probably comprise a number of new operators – in a few years’ time. At this point in time, a sizeable chunk of (sometimes hysterical) media commentary is focused on cannabis as a discretionary vice, and much less on its health benefits and potential to disrupt the healthcare industry.

There are many things which a potential investor in EXL (and the sector more generally) should consider before committing their capital, including but not limited to:

- Legislative environment: while to me it feels somewhat inevitable that the regulatory and legislative frameworks in the US (where the government has begun to focus on the potentially enormous tax revenues from a legalised market), Australia and other key international markets will continue to become more favourable and ultimately enable the production and sale of medicinal cannabis products, there is of course no guarantee that this will happen. I expect the legalisation of cannabis for recreational use will take even longer.

- Business risk: There is still something of a stigma associated with hemp-based products – likely the main reason, for example, why to date there have been minimal hemp-based products launched by the major global skincare brands (except for a hemp oil range by L’Oreal). For all the optimism around the space, it will likely take time to educate consumers and reverse the perception of cannabis as a dangerous drug with highly negative side effects.

- Big gorillas: You can expect though if the legislative framework loosens up enough and it looks like cannabis-based products will become mainstream, then the big boys will enter the space – in verticals such as pharmaceuticals and nutraceuticals, cosmetics, food and beverages, alcohol and tobacco, and likely many other segments. This is likely to come via a mix of M&A and strategic investments. And so we would not be at all surprised to see large players acquiring the smaller licensed medicinal cannabis operators which have navigated the complex regulatory hurdles to date and commenced development of a portfolio of cannabis-based products. This could also however involve the big players backing themselves to develop the capabilities internally (though prolonging the time to market versus acquiring a capability-ready target). While the entry of the larger, more well-known and better capitalised global players will immediately infer a sense of legitimacy in the minds of consumers, it would also represent a seismic shift in the competitive forces within the industry.

- Scramble to lock in key relationships: We have already seen increased consolidation in the cannabis sector and the formation of key strategic relationships – and we would expect this to only increase further as legalisation gets closer. M&A activity could impact on existing strategic relationships – for example, if a competitor acquired key suppliers or other companies which EXL relies on. As the industry consolidates over the medium term, the competitive forces within it (including the bargaining power of buyers and suppliers – for all you Porter nerds) could change significantly.

- Agricultural risk: It’s obvious to say but cannabis is an agricultural product, and as such is subject to the normal agricultural risks. These include plant diseases (such as blight), insects, the natural environment (frost, fire, flooding and storms), water availability and other factors. This of course has the potential to enormously disrupt the cannabis supply chain, and long term investors in Graincorp, Select Harvests, Tassal Group and even the recently listed Angel Seafood group could tell a cautionary tale or two.

- Lack of institutional ownership: It needs to be noted that at this point there are is almost no meaningful domestic institutional ownership of Australian cannabis stocks (except for The Trust Company’s 19% holding in pet medical cannabis player $CP1). This will be partly due to size (i.e. ASX-listed cannabis stocks likely being outside the investment mandate of all but Small Cap fund managers), but may also potentially be due to a degree of stigma associated with cannabis. Some legitimacy is leant to the sector by the presence of Canadian majors on the registers of $CAN (23% held by Aurora Cannabis) and $AC8 (10% by Canopy Growth). But until there is larger institutional ownership in the sector, share prices will continue to be driven by the speculation of smaller retail plebs (like you, dear reader, and I) – so if you are considering investing in $EXL (or indeed any of the other ASX-listed cannabis stocks briefly mentioned in this article), you will need to be prepared to weather some extreme share price gyrations over the medium term.

EXL reported a maiden (small) profit for the 6 months to June 2018. Assuming the continuation of 1H18 growth rates and consistent gross margins for the US and Australian businesses, a degree of operating leverage re overheads and, say, a 25% increase in losses from the early stage Australian cannabis business, EXL could generate NPAT of $2-3M for the financial year to December 2018 (its maiden full year profit). At the current share price of $1.65 this would represent a P/E of somewhere between 68x and 103x – which naturally sounds a bit “rich” out of context – but readers should remember that by definition a company is likely to be trading on a large multiple when it first becomes profitable, and gives no consideration to the PEG ratio (which enables the comparison of P/E ratio to medium term growth profile). Share prices of fast-growing companies don’t sit still for 3 years to allow the earnings to backfill – if the market believes the higher earnings growth can continue into the medium term, the share price will rise with it.

EXL is clearly not a Value play – but it may be a comparatively smarter post-hype (or first wave of hype) way to play the potential cannabis boom. EXL’s fast growing (and legal) US hemp business, and to a lesser extent the smaller Australian HFA unit, somewhat mitigate the risk of non-legislation of medicinal cannabis, and are growth engines in their own right. While this doesn’t quite provide a “free option” on the medicinal cannabis space, it does provide a degree of insulation, and somewhat reduces the speculative nature of the stock. But make no mistake, EXL is still a speculative stock which is expensive on traditional valuation measures (until the earnings of the fast-growing US business backfill into the current valuation) – and readers will need to make up their own mind whether EXL is a suitable investment candidate for their individual portfolios.

Disclosure: I (@Fabregasto ) have a position in Elixinol – accumulated in early September, and may add to my position in the future – again, not for at least 2 days after the publication of this article. Claude Walker also owns shares in Elixinol (and will not trade within 2 business days of publishing this article.

Please feel free to sign up to the forums and let us know what you think!

For early access to our content, join the Ethical Equities Newsletter.

This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.