Will Someone Buy Pro Medicus (ASX:PME) At Any Price?

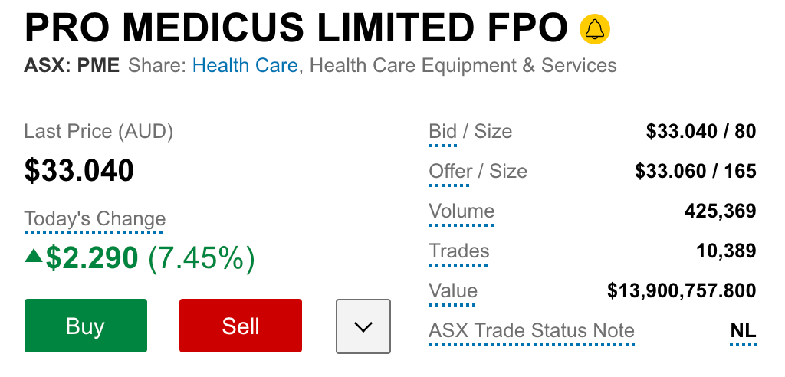

I'm on record as saying I think Pro Medicus is my favourite stock on the ASX. But the stellar share price run from around $1 five years ago to $33 today is truly stupendous. When we covered its results less than a year ago, we did not predict it would gain more than 200% in just one year.

We need multiple mental models to understand markets. At this point, I believe it's largely a waste of time to try to use a valuation model to understand the current pricing of Pro Medicus shares. The business is super high quality. It has far more room to grow than most people realise, given its stated aim to move beyond radiology, and into vendor neutral archiving (which it is already doing, profitably). But there can be no doubt that only through a series of long-sighted and optimistic estimates can one calculate significant upside at the current share price.

Obviously, I do not think Pro Medicus shares are a buy at any price. But someone thinks they are a buy at above $33 in July 2019. Let's take a look at why.

A sociological model combined with a supply/demand model.

Pro Medicus has a remarkably tight share register. Over half the shares are held by the founders who cannot currently sell due to their trading rules. Small-cap funds like LHC Capital and Lakehouse Capital have been in the stock for years, but are run by savvy operators who prioritise quality and know how to drip-feed shares and hold for the long term. Both those funds have disclosed selling (some of) their stock, but these aren't the kind to let go of high quality businesses on the cheap.

Furthermore, for a $3 billion company, Pro Medicus has a surprisingly large retail shareholder base. This is partly due to it being a darling of The Motley Fool, Ethical Equities, Three Wise Monkeys and more recently, momentum traders, and partly due to the fact that it had, for many years, a clear, understandable, exciting business plan with strong share price momentum. Retail investors often don't value shares themselves, so overvaluation will not cause them to sell.

While supply is scarce for the aforementioned reasons, the institutional complex has recently arrived on the scene, bringing huge demand for shares. First, we have seen a veritable explosion in broker coverage, from less than three analysts covering it a few years ago, to more than ten today. This has stimulated a lot of buying demand. Second, the company's rising share price has seen it added to first the S&P All Australian 200, and then the S&P ASX 200.

This means that many index funds are mandated to buy shares of Pro Medicus and many more index hugging funds are strongly inclined to buy them. I said to (paid) newsletter subscribers on Friday, "The main reason I am selling [Pro Medicus] slowly is because I think index funds and index huggers are forced buyers and I'm hoping for one last spike before reality hits."

As I write, the share price is up over 7%, largely off the back of the announcement yesterday evening that the company would enter the ASX 200 on August 7.

So, is this the final spike before reality hits?

I think that there are a huge amount of momentum traders in the stock, who are basically taxing the 'dumb money' index funds that are now forced buyers. While I don't know where the short term share price will top, what I do predict is when the hype comes out of this stock, it will come out very quickly. What we are seeing is a transfer of wealth from your best mate's superannuation fund to long term active investors (and momentum traders). The blind faith in "passive investing" will only create more of these kind of opportunities in the future.

Me? Pro Medicus is still my largest shareholding, but I've been selling a lot lately. I first bought the stock at 86 cents and accumulated more at below $1.20, around five years ago. Subsequently, I joined Motley Fool Hidden Gems where I recommended the stock -- and members got in at below $1.60. Finally, I publicly called it my favourite stock at around $3.50, and continued to regularly feature it as a Best Buy Now at Hidden Gems until I left the role last year (It had a share price of below $9.) I'm making hay while the sun shines. I've never sold so many shares as I have in the last few weeks. But when the dust settles, I'll still be holding on to some, because this company is such high quality that I want to hold at least some for the rest of my life (if I can).

While for many years Pro Medicus has been a classic example of growth at a reasonable price, over the last year the share price has veritably exploded in a frothy-mouthed frenzy of fomo accumulation and example of stock market euphoria.

But I'll be holding at least some Pro Medicus shares for what (I imagine) is the virtually inevitable retrace. I'm bracing for it.

Disclosure: Claude Walker hold shares in Pro Medicus. He sold shares earlier today, and intends to continue selling shares -- but not all his shares.

For early access to our content, join the Free Ethical Equities Newsletter.

If you don't yet use Sharesight, please consider signing up for a trial on this link, and we will get a small contribution if you do decide to use the service longer term, (which in turn should save you money with your accountant, or time if you do your own tax.) Better yet, you can get 2 months free added to an annual subscription.

This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.