The Gent's Manifesto: My Journey And Investment Philosophy

Ethical Equities Founder, Claude Walker has suggested that I share with readers some background on my investing journey to date. This is my own fault and the just desserts for my hubris in publishing portfolio returns on Twitter. However, in the spirit of continuing to share ideas and in the hope that readers may find something useful for their own investing journey, the following is an overview of the evolution of the Gent Portfolio over the past few years, and then – more helpfully – some background on my style and what I’m trying to do.

Starting at the end

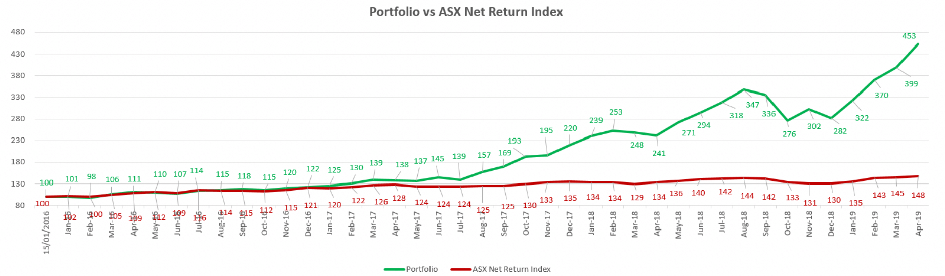

Here is the end result of my recent investing journey so far: portfolio returns to the end of April versus the benchmark I’ve chosen to use – the ASX Net Return Index (INDEXASX: XNT) (previously called the ASX Accumulation Index, which assumes the reinvestment of dividends back into the market). Please note that my portfolio balance includes small regular monthly contributions – which will have contributed about 20bps of the 353bps increase below (on a contribution basis only, pre including time weighted returns from that additional funding).

Net Return Index from: https://www.marketindex.com.au/asx/xnt

The portfolio is up 353% in a little over few years and clearly beaten the benchmark – but I’m extremely aware that this has been boosted considerably by tailwinds that are favourable to my style. Also, as a retail pleb I have considerable size advantages over the larger professional players – in particular that I can own much smaller companies than they can (whether due to their mandates or minimum cheque sizes), and that I can (usually) jump in or out of stocks without materially moving the share price. My investing style has largely stayed the same over this journey to date, but hopefully I am getting better as I absorb new information (from a mix of books, articles and podcasts – more on that later) and gain more experience. Not that this has stopped me making mistakes – you’ll see I’ve made some howlers – but hopefully I am making new and more exotic mistakes instead of repeating the classics.

Personal background and earlier spells in the market

I am approaching my mid 40s and over the past 18 years I’ve worked in fields that are either adjacent to the market or connected to the market in some way – though not directly professionally in stockmarket investing. My real world experience has included a few years in investment banking, several years in private equity, and several years in corporate finance – and I use the word “experience” here in the context of the Howard Marks quote that “experience is what you get when you didn’t get what you wanted”.

Nevertheless, my background has proven useful for my investing career to date, and I’ve been able to draw upon it when developing “gut feelings” about certain actual and potential investments. I’ve worked on buy- and sell-side transactions, met management teams and been involved in board meetings, dealt with a variety of different types of advisors, and have seen a bit of what is behind the curtain, so to speak. As readers would well know, gut feelings are often a necessary evil in investing outside the ASX Top 100 stocks – especially when there are gaps in information available which makes it difficult to see what is going on behind the scenes.

Before returning to the market in early 2016, I had been in and out of the market a few times over the preceding 20 or so years – but my two most active periods were in the mid-to-late 1990s (already, you know where this is going, don’t you?) and then for a few years prior to the GFC. This pre-Gent Portfolio “investing” experience was largely before the vast majority of my professional career – and is much closer to speculation than analytical investing. At those times I lacked the ability to properly parse financial statements and understand the broader context of companies and the industries in which they operate. Certainly, those periods were prior to later gained financial analytical skills and the development of a more rational decision making process. To wit:

- My first ever investment experience was a big fat ZERO: the infamous Star Mining and its Sukhoi Log deposit (apparently one of the world’s largest gold reserves). SCN is a classic study of sovereign risk, with the Russian government seizing control of the mine, (then) Foreign Minister Alexander Downer attempting but failing to save the situation and Star Mining shareholders losing their shirt; also

- At the time of the Dotcom crash I was foolishly dabbling in extremely speculative higher risk things like miners-pivoted-to-telcos and other similarly daft sh!t (in amongst some sensible things such as Fosters Brewing Group). The higher risk stocks were largely pre-meaningful-revenue (let alone pre-earnings) and many were opportunistic cash-ins on the Internet 1.0 bubble. I even owned Options in pre-revenue mining-turned-to-telco companies! And so I paid the price on that speculative [email protected] – as I deserved to do. I had a poor grasp of risk/reward back then.

I did have some successes in the short interim period in the mid-00s (when my dabbling was closer to “investing” but still nowhere near as thought-out as my process is these days). This included a greater than 10-bagger with Cellestis (eventually taken over by Qiagen) and then early success with Nanosonics (drink for you Three Wise Monkey fans) way back when. I cashed out of the market (from memory around 2007) to use the funds for other purposes.

The Gent Portfolio (2016 – 2019 YTD (April))

When I re-entered the market in 2016 I had been sitting on the sidelines for nearly a decade – during which time I had significantly enhanced my financial analytical and commercial due diligence skills through my aforementioned day jobs. While I re-acclimatised to the market and got back into the grind of vigilant stock and portfolio monitoring, I decided to take a fairly cautious approach initially.

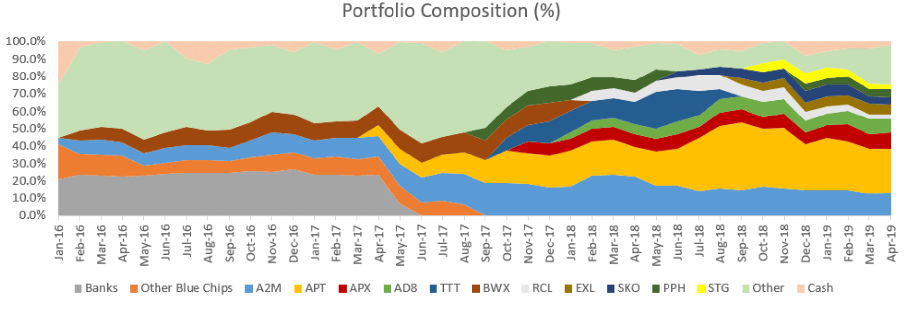

The evolution of my portfolio (focusing on key stocks) is illustrated below. At its official inception in January 2016, the Gent Portfolio largely comprised:

- Traditional dividend-paying blue chips such as 3 of the big 4 banks, Woolies and Crown;

- Supposed blue chips but actual-future-turkeys QBE, AMP, Flexigroup and Ardent Leisure (all sold largely pre downgrades, though from memory I weathered one on Ardent Leisure);

- (Then) higher risk oil-related stocks Santos and Origin Energy (which back then some commentators believed could go under with the WTI crude price below $30); and

- A smattering of growth stocks which together comprised 20% of the then portfolio: A2 Milk, BWX and Catapult Group (made a measly 20% on CAT through impatience, missed out on a further 80% gain (but also subsequent crash)).

2016

Going back to the main chart at the start of the article, you can see that for the first 12 months or so, the performance of the Gent Portfolio largely tracked the benchmark. Calendar year 2016 included some good results:

- Nice returns on Origin (+71%) and Santos (+60%) as the oil price rebounded, though exited way too early on both (in hindsight);

- Handy gains on the banks as they rebounded from their late-2015 nadirs (between 10% and 35% up excluding dividends (reinvested via respective DRP programs);

- Some good returns in small caps such Cogstate (+51%) and Vitaco (+37%, fortunately taken over as it delivered a profit warning during the protracted takeover process); but net of

- Some complete fails in the Mid Cap space such as Mayne Pharma (-47% after successfully nailing the absolute top [FACEPALM] and then averaging down a few times [Edward Munch “The Scream” emoji]) and Baby Bunting (-24%), as well as losses in mediocre mid-caps such as OFX (more foolish averaging down) and Capilano Honey.

During this time A2 Milk was up 66% and BWX 20%. BWX I would eventually hold to a 98% gain (missing the top by about 15%) – but I abandoned it soon after the Andalou acquisition (which immediately felt “off strategy” to me) and fortunately pre the profit warnings which have occurred since. Watching BWX from the sidelines and profit downgrades from other serial acquirers I fortunately haven’t owned has made me personally very wary of the growth-by-equity-diluting-bolt-on-acquisition model.

While my performance was broadly *meh* vs the benchmark, the time in the market generating actual profits and losses, and the time spent researching stocks gave me the chutzpah to want to take the training wheels off and focus more on what I’m most interested in: growth companies and those that can potentially become multi-baggers (more on that later).

Sometime during 2016 I started listening to investment podcasts, reading investment blogs and classic investment books and generally trying to sponge as much information as I could to help my decision-making and investment-screening process. I have a large pile of investment books I’m slowly working my way through – probably not helped by the fact I’m buying new ones quicker than I’m reading the ones I already have. I also initiated my pre-investment checklist around this time (which continues to evolve) – which has definitely helped me screen potential investments better, but has definitely not stopped me from committing various investment crimes.

Overall, a key driver of the increase in overall portfolio value since 2017 has been Afterpay (added in April 2017 at $2.45 initially pre the merger with TouchCorp, back when the ticker was $AFY). Afterpay has been without doubt the single biggest contributor to the performance of the portfolio. When screening the stock, I thought I could see potential for two Economic Moats: early signs of Network Effects and also Switching Costs (retailers not wanting to switch out of a payment platform which materially increased basket size). The latter is debatable but the former has certainly proven true in Australia IMO.

2017

Also driving performance during 2017 was the doubling of BWX (exited early 2018), the tripling of A2 Milk (though I took profits below $3 and at around $7 – compare this to recent trading above $15 [FACEPALM]), and success with new investments in Pushpay and Titomic (both since exited, however I re-entered Pushpay during the market melt-down just before Christmas last year). Calendar year 2017 contained yet more head scratchers (and valuable lessons) however – such as:

- Failing spectacularly in trying to catch falling knives in Vocus (-28%) and BPS Technology (-21%, which I misinterpreted as a Deep Value play);

- Speculative fails such as Nuheara (-30%) and Mitula (-36% post a painful profit warning which exhibited operational incompetence (theirs as well as mine)); and

- A couple of examples of not doing enough research – the one which has stuck with me the most is Smart Parking (only a 7% loss – but I flipped quickly from thinking it was an interesting novel new technology pre-investment to post-investment realising the technology was literally everywhere already and deployed by much bigger companies than SPZ. This realisation spurred me to deepen the competitor analysis I do pre-investment).

The end of 2017 (and early 2018) also included a hospital stint (re-admission to deal with an infection picked up during an initial knee operation) and heavy antibiotic treatment which lasted a couple of months. This period – probably due to boredom but also at least in some part due to the heavy duty antibiotics (which definitely messed with me physically) – was characterised by much higher levels of trading and arguably higher levels of risk taking. While overall this period was profitable, the net positive outcome is driven by a single 51% return from a relatively large position in Elmo Software – which covered for a string of small losses on lower quality flotsam and jetsam. I learned a valuable lesson about over-trading and not sticking to my system, but it could have been much, much worse and thankfully I wasn’t buying Bitcoin at the December 2017 peak in my delirium and hospital pyjamas.

So, despite various flavours of stupidity, the portfolio was up 79% for 2017 with A2 Milk and Afterpay responsible for a good chunk of gains.

2018

These 2 companies continued to underpin returns throughout 2018, as did Appen (added belatedly in late 2017) and Audinate (early 2018), as well as Titomic (+321% overall gain before exit) and Pushpay (+75% for the first time I held it). In 2018 the portfolio posted a 28% return – however this was down 20% since the highs of August, with the market going Risk Off in early September.

One of the reasons I *wasn’t particularly fazed* by the selldowns in November and December was that a number of my stocks in the portfolio had already shredded 30-40% in September and October (ouch!), and didn’t lose that much more over the rest of the year. I added to positions in new stocks Serko and Straker Translations as well as re-entered Pushpay (then down 30% from its August high) in the week before Christmas – which felt very uncomfortable at the time. *What I should have done* was add more to core higher conviction holding Appen (which has since nearly tripled from the December low – but then Appen and I have a painful past (saga described later) and I’ve struggled previously with valuation on that one at times (despite its long history of earnings upgrades).

Calendar year 2018 wasn’t without new and exciting investment crimes however – including but not limited to:

- Ignoring price action and being stubborn with Know-Your-Customer software companies Kyckr (just seen down a whopping 75% since I exited – phew) and I Sign This (annoyingly since doubled – L) – both ~20% losses after being up 30-50% each;

- Giving the benefit of the doubt for far too long (and being a baggie) with seed technology company Abundant Produce (38% loss, but since re-entered recently at one third of my exit price following 2 positive Australian distribution announcements); and

- Copping a 54% loss on Pivotal Systems – a technology provider to the cyclical global semiconductor industry – sadly a lesson not learnt until the recent profit warning for Revasum.

These are all smaller companies – which are typically riskier than large- and mid-caps – the reminder for me here is not to ignore share price and volume signals – particularly in higher volatility periods, as small- and micro-caps can disproportionately suffer in market downturns.

Thankfully, overall there was less churn in the portfolio through 2018 – as I finally (hopefully) learned to stop wasting time on lower conviction companies and try to maximise attention on my higher conviction names.

2019 YTD

Portfolio performance in 2019 (to the end of April) has been frankly ridiculous – and likely unsustainable (more on that later) – with a 61% gain for the first 4 months, which I would be ecstatic to hold onto for the rest of the year. Key drivers of this result have been Afterpay (+106% in 2019), Appen (97%), Audinate (+81%), A2 Milk (+55%) and first cannabis investment Elixinol (+86%), as well as recent IPOs Next Science (+60% to end of April) and Ecofibre (+120%). Given the performance of Afterpay since I first entered the company (up 940% to the end of April and further since) and its increasing proportion of the total portfolio, I’ve sold one quarter of this holding (and also lightened some A2 Milk) partly for risk management purposes, but primarily to fund my participation in the two aforementioned IPOs and new positions in a handful of other companies that I like the look of.

Portfolio stratification and composition – end of April 2019

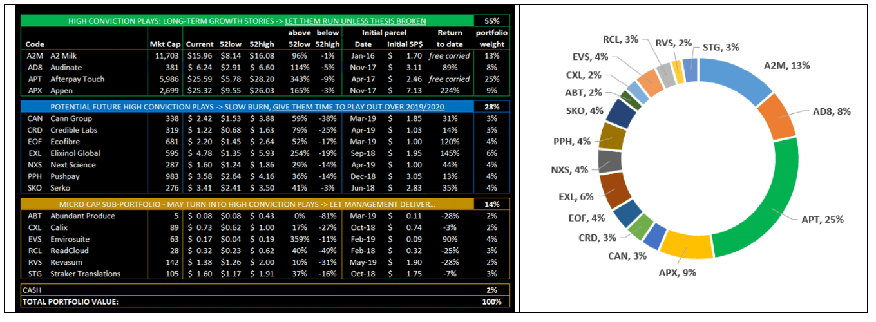

The table below left (an abbreviated version of my main dashboard (which includes VWAPs and actual returns)) shows how I think about my portfolio, which includes dividing it into three tiers:

- Tier 1: higher conviction stocks – which *I personally* believe are reasonably likely to be longer term multi-baggers (and have started this compounding process already) – and so I plan to hold until I see evidence to the contrary (i.e. that growth is likely to slow considerably);

- Tier 2: companies that I like as potential longer-term high conviction stocks (may move into Tier 1) – but where I am looking for more evidence (careful not to repeat a past mistake of jumping to a high conviction belief too quickly based on share price action alone); and

- Tier 3: companies that I like the look of but are typically earlier on in their development than Tier 2 companies and will likely need at least 12 months of monitoring to make a more accurate later assessment.

This stratification isn’t at all revolutionary and I know other investors who think about their portfolios similarly anyway, but I find it helps me focus more on (1) letting Tier 1 companies run until I see evidence that my initial investment thesis is coming apart; and (2) continually monitoring my other positions for signs that my thesis is either wrong or playing out as hoped – and, if the latter, averaging up and increasing my position (which I struggle with due to my atrocious Anchoring Bias but hopefully am getting better at).

New positions are typically 2-3% of my overall portfolio size until they prove (usually via the next set of reported numbers and key metrics) they deserve to be added to – or divested entirely.

Since the end of April I have trimmed slightly – such that cash is now up to 5%. Philosophically I am normally largely fully invested, with cash having averaged ~3% since inception of the portfolio (though I did trim holdings to increase cash weighting to 8% in September 2018 as I felt the market going Risk Off – and redeployed these funds three months later).

It’s worth mentioning at this point that I monitor my portfolio very closely indeed. I have the ASX Today’s Announcements page sitting in the background all day long at work and I’m constantly scanning intraday for (1) news on my companies which may change my perspective, and (2) potential new investments – especially during 4C and half/full year results seasons. I believe that higher levels of monitoring are needed when investing in Growth stocks and small- and micro-caps generally – as these companies are more likely to experience volatile up and downwards share price movements (in comparison with larger more stable blue chips – though blue chips are not immune from profit warnings, see AMP, IOOF and others).

Prior to buying my first shares in a company, I aim to make sure that I have figured out internally what my personal investment thesis is for the company – what needs to be true in order for the company to be a long term multi-bagger, usually a combination of financial metrics (revenue, margins and profitability), market share and competitive position, and whether potential Economic Moats are actually evolving as hoped (all covered in the Pre-investment Checklist section below).

My overall investing style: aiming to be a baggie of a different kind

For all my adventures and misadventures since the start of the Gent portfolio, my investing style and aim has largely stayed the same: I am trying to find companies that can become multi-baggers over the longer term. In an ideal world, I’d have a portfolio in 20 years’ time comprised of CSLs (up 260x in 25 years since its 1994 float, it had a 3-for-1 stock split in 2007)

*Waits patiently for half an hour until roaring laughter dies down.*

But this is actually not that far-fetched.

If you were to compare the composition of the ASX Top 100 two decades ago versus today, you would see that a number of companies have seeming vaulted into this bracket from nowhere in 1998, and a lot of this is driven by technological advancements over the intervening period as well as the high quality of management teams of those companies. In just the last decade there have been many examples of considerable multi-baggers on the ASX – including but not limited to):

- Appen: up 51x since its IPO at $0.50 in January 2015 (just over 4 years);

- Afterpay: up 27x since its IPO just 3 years ago;

- Altium: up 92x over the last 10 years;

- Promedicus: up 27x in the last 10 years;

- Webjet is up 13x over the last 10 years; and

- Xero is up more than 9x since 2013;

The above returns of course assume that investors stayed the course over the journey and weren’t either tempted to take profits (as earnings multiples expanded considerably) or shaken out of their positions during times of market turmoil. But this absolutely proves that the key to generating multi-baggers in your portfolio is having the mental stamina and conviction to hold these stocks for that long in the first place.

Furthermore, the last 10-20 years is not an unusually fertile once-in-a-century period which provided the environment for technology companies to generate supernormal returns. There were 100-bagging stocks nearly a century ago:

- Thomas Phelps’s 1972 book “100 to 1 in the Stock Market” (not yet read but in the pile on my bedside table) details the 365 US stocks which were 100-baggers between 1932 and 1971.

- Christopher Mayer’s 2015 book “100 Baggers: Stocks That Return 100-to-1 and Where to Find Them” (have read, recommended) updated this analysis and found a further 365 US stocks which were 100-baggers between 1962 and 2014.

It is of course impossible to predict with any degree of certainty that any company is going to go up 10-50x from the point you buy it. By definition, that company is likely to be a micro- or small-cap, and companies in the smaller end of the market tend to be higher risk with typically lower quality financial and operational information (i.e. versus larger caps with their typically more sophisticated reporting).

It should be noted that companies inherently bear an asymmetric payoff profile: you can only lose 100% (cold comfort of course if you do actually completely lose 100% of an investment) whereas the upside is uncapped in theory.

Of the investment blogs, books and podcasts I’ve digested so far, the content that has resonated most with me personally has been from Ian Cassell and his Microcap Club website (Ian has also been one of the key drivers of the interesting Intelligent Fanatics project). Ian seems to be more of a traditional Value investor, but I think a lot of the key learnings are still applicable at the Growth end of the spectrum – particularly in terms of hunting multi-baggers.

Pre-investment screen checklist

I mentioned earlier that I have developed a personal screening checklist for my own artful purposes in evaluating potential stocks – largely a combination of things I’ve pilfered from elsewhere so I claim no IP here – feel free to borrow any bits (if any) that resonate with you for your own checklist.

This continues to evolve over time and is by no means a fail-safe predictor of success, but it has definitely helped fine tune my decision-making process with respect to potential long term investments.

The Gent's Pre-Investment Checklist Is Has Been Emailed Exclusively To Ethical Equities Newsletter Subscribers. If that's you, check your email, otherwise, sign up here to automatically receive the link to this hidden content.

Right now the checklist simply adds to a score but isn’t weighted with higher points awarded to the more important factors – which is the next logical step. I have thought about doing this, and will probably re-calibrate in this way. However, I no longer use the checklist as the sole arbiter for the decision-making process. While the score is useful – certainly in knocking lower quality things out of contention – the most important use of the checklist IMO is to ensure I am thinking about the right things before I dip my toe in the water and buy a starting position in a company. The checklist has also helped me make faster decisions – especially if I can quickly see that a potential investment has most/all of the factors I care about most, and few/none of the red flags. This quicker decision time has also been very helpful, especially when I originally used to take as long as 2-3 weeks to analyse a potential investment (during which time the share price could move considerably away from me).

Before buying into a new company I try to do as much efficient research as possible – not “boiling the ocean” combing the internet for every last sentence on the company, but trying to extract the key information I need to help with the checklist. Typically this includes:

- Latest annual report, full-year results and half-year results – especially accompanying investor presentations

- For loss-making companies, last 12-24 months of 4C (quarterly cashflow) statements

- Last 12-24 months of ASX announcements – with investor presentations

- Broker research on the company and competitors (to the extent available)

- If the company has been floated in the past few years, the IPO Prospectus (often extremely valuable for industry analysis).

The Gent Investment Manifesto

“Manifesto” is no doubt overselling it, and I’d expect readers to have worked out many of these points themselves already, but below are some things that I’ve learned along the way which I try to remember:

- Don’t get jealous. I used to get jealous seeing others doing well on stocks that I didn’t have (particularly if I’d passed on that company). But it’s just not possible to be in every stock and you have to choose which ones you’re going to sink your funds into. Also, different investors have different strategies, I need to focus on MINE, and if I’ve chosen well, my time will come. It’s more important to focus on personal growth (i.e. comparing to yourself 2 years ago, not to other people).

- Investing is an emotional competition. Being able to keep a handle on your own emotions and psychology (in particular, feelings of greed and fear) is a key advantage in my view. You need to keep your eye on what the market is doing obviously, but keeping a clear line of sight on your strategy and goals and not being buffeted around by the emotions running rampant in the market prevents you from being shaken out of investments which can potentially be precisely as good as you thought they were before investing initially.

- Curate your information feeds. In connection with the previous point, and as discussed a bit further on, there is simply too much financial and market commentary out there – the vast majority of which I personally get zero value from. I read the AFR every day, but I ignore news finance segments, don’t watch Sky, and instead spend the time listening to podcasts and reading blogs and other information sources that I find much more useful and hopefully which will give me an informational edge at some point in the future. I’ve found that this curation has stopped my brain (which is easily distracted, not that dissimilar to the prototypical hamster wheel) from being filled with garbage which can slow down and pollute my decision-making process.

- You don’t need to have an opinion on everything. I’d much rather have deeper knowledge of a couple of dozen companies (so I can understand quickly if something changes) than shallow knowledge of 1,000 companies – and be slow to react to developments. This may be more to do with individual personality type, but I don’t need everyone to agree with me (in fact I love having a different view). For the same reason, I generally prefer not to use mental bandwidth to debate stocks.

- The natural extension of this to stick to areas where you have knowledge and edge, and to understand what you’re good/not good at. For example, I’m not very good at technical analysis and charting. Sure, I can eyeball a chart and make up my own mind as to whether I think it looks positive or negative, but I couldn’t definitely pinpoint when/where it is time to get into a new stock. Instead, when I have found a potential new investment, I start watching price action, trading volumes and the buy & sell queues like a hawk, trying to develop a “feel” for momentum and lack thereof. You may also have noticed I don’t hold any mining or oil & gas related companies – I’m just not good in that space, and until I spend the time to educate myself on that sector I would be operating at a disadvantage vs people who have many years trading and investing there.

- Turn over the most rocks. This is of course that famous Peter Lynch quote: “he who turns over the most rocks wins”. Lynch estimated that only 10% of companies were worth considering. You need to continually be looking at new ideas, because your portfolio probably won’t remain static over a 12-month period (unless you have chosen exceptionally well). You’ll always need good ideas to replace portfolio holdings that turn bad or don't work out as well as planned. Personally I love researching new ideas – though have to caution myself that they need to be as good as (or better than) those companies I already have to warrant inclusion, otherwise by definition I am diluting the position of higher conviction positions. This is of course connected to the great Warren Buffet quote (“Mercy! Is there anyone The Gent WON’T steal from?”) – about waiting for your pitch and not pulling the trigger on lower quality stocks.

- “The market is always right.” This is more about realising that we are small players in a huge ecosystem and are individually powerless to turn the tide. But also, we must recognise that sometimes we don’t have access to information that other market participants seem to, and that there may be a very real reason for share price movements which we cannot (yet) see. Investment is just as much about survival as anything else – you have to live to fight another day so that you can win later on – if you are completely wiped out trying to hold fast against the weight of the market you won’t be able to mount your comeback. This is a key reason why I’ve never used leverage (which would just add another layer of risk onto the already-higher-risk area in which I play) – I’ve seen what leverage and margin calls in particular can do to a portfolio.

- Try to take a longer term investment horizon. In particular, I try to look out 5-10 years and understand whether what a company does will “still be a thing” at the end of that period. I looked briefly at Big Unlimited (ASX:BIG), now bankrupt, at 70c (without seeing it for what it was) but passed quickly as I just didn’t believe it was going to “still be a thing” in 2027 or even 2022 (and missed out on a potential 7-bagger at the top). The key for me is to understand whether a company’s product or service will be redundant over that time period, or whether it will be something that is still monetisable or just bundled together with other products/services. An example of this email in the Internet 1.0 era – which we all take for granted now of course (but which didn’t stop MCI Worldcom paying more than $500M for Ozemail in 1998).

- Know your portfolio, and be ready to sell. You need to be up to date on all the stocks in your portfolio, to understand why you’re holding them and what could potentially go wrong to invalidate your investment thesis. The motivation for following companies this closely is that you can tell quickly if something is not working out and you need to abandon ship – such as signs of management incompetence or unethical behaviour, or if the longer term narrative is changing in a negative way (which can bring Growth company multiples crashing back to Earth).

- Think in levels of conviction. A large proportion of investors think in terms of DCF valuations and P/E multiples, and price targets derived from these valuation approaches. As I’ve discussed before on Ethical Equities, the standard P/E ratio does not factor in relative rates of earnings growth between companies. This is where the PEG ratio (P/E multiple divided by EPS growth rate) comes in. For example: I personally would rather own a company trading on a 40x P/E and growing at 20% annually (a PEG ratio of 2.0x) than a company trading on a 15x P/E and growing at 3% annually (a PEG ratio of 5.0), although the latter company is more likely to pay a dividend which narrows the difference somewhat. Unless a company’s valuation becomes truly crazy and the company’s actual revenue and earnings are years away from justifying that (i.e. even after using a PEG ratio), I try to think in levels of conviction – letting winners ride if they are still delivering strong growth. Taking profits in A2 Milk at $3 and watching the remainder of my holding soar above $10 (currently $15) really drove home this point for me personally. You have to remember that as each fiscal year rolls over, the forward earnings period rolls over too, the new year gets pulled forward in the DCF model, increasing base earnings (and terminal value) and thereby increasing DCF valuation as a whole – so valuations and price targets will rise year on year if the company is growing. You can see this happen in the market – going back to A2 Milk for example, I believe that over time the market starts to look through to the following fiscal year (June reporting year-end) EPS as early as April of each year. This is a great reason to try not to get persuaded by price targets and DCFs for fast growing companies, and to consider the PEG ratio as well. There is little point selling if the company is going to become a Hold (fair value) or Buy in several months’ time when the company rolls into a new financial year (and you would want to re-add the company to your portfolio).

- Let them bag. As mentioned much earlier (sorry, I should have scheduled an intermission) serious wealth creation comes from letting multi-bagging companies do their thing over time. As Ian Cassell has pointed out, every multi-bagger will have periods of stagnation as fundamentals backfill (earnings catch up to price) and bored, impatient old shareholders sell to new shareholders with a longer term perspective. Patience is a key source of advantage over other investors (short term traders especially) in the market. A multi-year run is comprised of many mini-cycles (look at the share price charts of A2 Milk and Appen for example). Yes it’s true that “nobody ever went broke taking a profit” – but the OPPORTUNITY COST (lost profits) can be extreme. How much money did I leave on the table in my A2 Milk profit-taking example above? Yes, I reinvested the proceeds into other things – and probably recycled the capital a few times since then – but have those things all gone up by 5x? I doubt it. Another thing I have been guilty of a bit – but not much thankfully – is trimming holdings as companies become bigger proportions of my overall portfolio. I know some people who do this continually – which is the exact reverse of how you get long-term life changing multi-baggers.

- High concentration is OK. In fact, being highly concentrated is not just OK, it’s one of the keys to building serious wealth over time and also outperforming the market in the process (provided you have selected stocks well, of course). Portfolio diversification is a key risk minimising strategy, but the more stocks you own, the more likely that your returns will mirror the index. Further, a number of recent studies have shown that after about 20 equally sized positions, the benefits of diversification disappear. But naturally, the lower the number of stocks in your portfolio, the higher volatility it becomes. Everyone will have their own ideas about what is the optimal number of stocks to own. Since the inception of the Gent Portfolio I’ve held an average of 12 stocks (as low as 9, as high as 17 at the end of April (which may be the upper end of my personal tolerable limit, I’m starting to get a bit twitchy). Maybe I’ve broken rule #6 above and let a handful of lower quality ideas into the portfolio? Perhaps, although two of these are recent IPOs Next Science and Ecofibre (which I do like longer term – to be proven, currently in Tier 2).

- Inflection points are particularly useful. I have long been on the hunt for companies reaching an inflection point (particularly the point where it reaches its cashflow and profit break-even point). Friend of Ethical Equities, Matt Joass, has written an excellent piece on inflection points – which also includes other factors which can lead to a structural spike in revenue and profitability – such as a new product launch or a turnaround. In tracking the quarterly cashflows of loss-making companies I am particularly looking for signs that a company is not far away from reaching cashflow break-even (which the market interprets generally as a major de-risking point) – especially for highly scalable companies where investment has been made in technology, systems and people, and where increasing revenue will lead to greater proportional increases in margins and profitability due to this operating leverage.

Shooting myself in the foot

All this planning and process is all fine and dandy, but I continually run afoul of rule #2 above – in particular, I find it a continual struggle not to succumb to my vast collection of cognitive biases.

There are many articles about behavioural biases and how they can impact investor performance. This Investopedia article is a good summary of the most famous biases, following on from the pioneering work of Kahneman & Tversky, including:

- Anchoring Bias – anchoring to a particular share price or metric

- Confirmation Bias – ignoring information that contradicts earlier impressions and absorbing only that which confirms them

- Loss Aversion – failing to sell losing investments because of the triggering of a capital loss and the recognition that the investor may have made a poor investment decision

- Familiarity Bias – such as filling your portfolio with very similar companies in the same industry

By far my biggest problem has always been overcoming my profound Anchoring Bias – in particular, failing to pull the trigger on a potential new investment because it has increased from a lower share price to which I’ve mentally anchored, but also failing to average up (buy more) of higher conviction (Tier 1) holdings as they have performed well and started to prove out my investment thesis. Hindsight is 20/20 vision but I should have been adding more Appen and Audinate in particular last year during the Risk Off phase.

My anchoring bias has resulted in the following Sins of Omission (i.e. notable absence of the following higher quality stocks from my portfolio):

- Altium: at around $10, waiting for it to fall back to $9 (current ~$33, all time high $35.59)

- Promedicus: at $9.10 before last Christmas, hoping for $8.50 (around ATHs of $20.52)

- Nanosonics: at ~$2.70 before Christmas – and having owned it from ~$0.50 to ~$1.05 a long time back, hoping it would come back to $2.50 (current $4.85, having hit $5 recently)

- Xero: at ~$20 in mid-2017, hoping it would fall back to $18 (where it started 2017) (currently around ATHs of ~$55)

- Polynovo: at 55c, hoping it would go down to 50c (current: $1.03, having reached $1.16)

I could add more but I’m turning into a goth as I write this section.

The last example is Appen – you may have noted that I do in fact have APX in my portfolio – because I finally belatedly did pull the trigger – above $7 following the acquisition of Leapforce.. having been frozen to my chair and unable to buy around $4.50 just weeks earlier.. because I was anchored to the $2.50 share price it had been trading at – just prior to not buying it at $2.80. YE GODS MAN!

Predictions of doom and my plan of attack

There is always, always, a tremendous amount of commentary in the financial media – a lot of opinions and predictions and very little accountability and measuring of accuracy after the fact from what I can see. The cynical part of my brain interprets a good chunk of this content as being designed to generate broker commissions as well as sell newspapers etc. There are perma-bulls and perma-bears (both of which will be right at some point), and those that clutter the ether in between. Long ago I decided that this garbage was distractive filler, and that spending more time on curated information sources is a much better way of (1) maintaining my sanity, and (2) saving my mental energy for learning more useful content.

For the last couple of years there has been talk in some quarters of another major global recession, or worse, a repeat of the GFC. The latter seems unlikely to me. I think the GFC was closer to the Great Depression (albeit over a much shorter timeframe) than a normal common or garden recession. A number of recent articles, such as this one from Morgan Housel discuss how investor mindsets are driven by the events experienced during their lifetime. For example, many investors who saw their wealth shredded by 90% over the harrowing 10 year period following the 1929 crash – then lived through the Second World War – were largely not mentally ready to be taking risks investing in the American consumer products boom which started in the 1950s fuelled by easy credit and low interest rates (Morgan again). I am wary of letting my fear of a repeat of the GFC constrain my optimism for future technological advancements and the potential accompanying investment opportunities.

There has also been commentary calling for a repeat of the Dotcom Crash (the bursting of the internet bubble in 2001) due to the elevated valuation multiples currently being enjoyed by the Australian WAAAX stocks (and other tech stocks globally). I definitely do think there is likely to continue to be periodic corrections in Growth companies over the medium to longer term – this is par for the course with higher growth companies as the market oscillates between periods of Risk On and Risk Off. I don’t, however, believe that there is another global reckoning which will see the tech sector come off 70-90% and remain subdued for several years. I don’t like to pull out “This Time It’s Different” Trap Card, but it feels nonsensical to compare the 1998-2001 bubble to now. The Dotcom bubble was Internet 1.0 – when the internet was relatively new, and we were all going to live our lives entirely online from exquisitely modern homes on Saturn by the year 2005. The bubble burst – and continued to deflate for years – because it became quickly apparent that prevailing technological capabilities were massively short of where they needed to be to deliver on the hype, and multi-billion market capitalisations for companies which were not generating meaningful amounts of revenue (let alone earnings) were of course completely nonsensical.

Roll forward to 2019 (and the nearly two decades of technological advancements in between which have made it possible to realise many of those Internet 1.0 era promises) and we have:

- Apple trading on a trailing P/E of 18x and generating US$266B of revenue for FY18;

- Facebook generating gross margins of 83% on US$56B of revenue (up 37% in FY18) and trading on a 26x trailing P/E; and

- Amazon generating US$233B of revenue for FY18.

Obviously these are three of the largest companies in the world, and [gum-chewing teenager voice] like, the most obvious examples ever, but the point remains: they are the vanguard of the tech sector, are all entrenched enormous and highly profitable businesses, and will not be plunging 70-90% in any Tech Crash 2.0. Unless, of course, we have a repeat of the dinosaur-killing asteroid which landed in the Chicxulub crater – in which case, guess what, your odd collection of pimply unloved Deep Value stocks is not going to save your portfolio.

That said, it does feel to me like we are in the last stage of a bull market, and there are a number of signs suggesting this to me – including but not limited to:

- The rush to IPO for a number of large loss-making companies including WeWork, Uber and Lyft (never mind the ridiculousness of a $4B valuation (40x revenue) for recently listed US meat substitute company Beyond Meat, or Pitbull recommending biotech stocks);

- A lot of backslapping on recent (insanely) profitable investments and from what I can see widespread feelings that it’s become easy to make money in the market in 2019 (especially from younger investors who’ve never seen a bear market, of which many of whom were previously ecstatic, then shattered, crypto speculators); and

- Spectacular share price movements in Growth names in 2019 – soaring way above previous mid-2018 highs to new pinnacles.

That great Warren Buffet quote about being fearful when others are greedy feels particularly poignant right now (to me). I do think there is a good chance that at some point in the next year or so we will experience a bear market and 20-30% drawdown. There have been different articles recently about the length and extent of corrections (10-20% drawdowns) and bear markets (20% or more), but broadly (using US figures as the ASX is likely to follow suit just as it has done continually in the past few decades):

- The average length and depth of a US correction is about 13-14% and 4-5 months:

- The average length and depth of a US bear market is 30-33% and 13-14 months.

That would not be fun (2H2018’s meltdown in Growth stocks certainly wasn’t) – but if history is any guide it’s inevitable at some point. But also, it’s not going to last forever and historically equities have returned to their long-term upwards trajectory afterwards.

Typically, stocks perceived by the market to be higher quality rebound first (i.e. before the more speculative names that soared just because they operate in the same sector etc). Hopefully my portfolio includes some of these higher quality names and any downturn in my portfolio would not be prolonged. It’s up to me and my process to select those higher quality names.

And if I have chosen companies which will continue to grow revenue and earnings and aren’t so impacted by either a falling share price or the reasons behind a broader market rout (i.e. a recession), then I’m personally not that fussed if the share price falls 20-40% (and like the thought of attractive buying opportunities). I’m not confident in my ability to time the market (selling before the plunge in order to buy back at the bottom), I don’t want to trigger capital gains in trying to be too cute, and if these are long term holdings for me which I plan to hold for years (as long as the company continues to grow in line with expectations of course), then why go through the hassle of selling to buy back later? That didn’t work for the masses of people who sold out of the market in late December 2018 (when press commentary was at its most bearish and everyone was certain of a global bear market (which hasn’t eventuated)) – with many stocks up 20-80% since those December lows (and some people only returning to the market in March when they thought it was “safe” again).

There have been many articles in the last few years about the danger of trying to time the market – and they revolve around the fact that a calendar year’s returns are generally driven by just a dozen or so key trading days, with the other 230-240 trading days in a year adding to not much. Not being in the market on those days can put a serious dampener on your returns. I’m not smart enough to know when those days will be and don’t believe I have any edge (i.e. versus the rest of the market) in timing when to liquidate my portfolio (duh, at the top, dummy!) and buy back my holdings (at the bottom!).

In the event of a downturn I’m more likely to be a buyer – providing I have some dry powder of course – hoping to add more to my higher conviction (Tier 1) names, potentially also Tier 2 depending on the extent of share price carnage and the opportunities presented for those companies. Each individual investor will have their own personal feelings about what is a sensible amount of cash to be holding at any given time – just bear in mind that this is also an “active” position (i.e. betting that stocks will go down).

Don’t try this at home..?

You might expect with my Growth style and ludicrous aim of hunting multi-baggers that I would be a perma-bull who gleefully throws cash around without any regard for potential danger, but actually in my personal life I am pretty frugal and fairly risk averse. I own a 13yo Mazda for example (will never own a Lambo – spending money on frivolities like that is not how to get or stay rich). If I had a time machine I would probably go back 20 years and slap younger me about the face about the way I wasted money on CDs and DVDs and other shortly-redundant material possessions. Too late did I realise the key point about compounding: you have to start ASAP – by delaying 5 years you are not forgoing the first 5 years where the snowball is rolling slowly downhill eking out yawn-inducing returns; you’re robbing future retired you of the last 5 years where your nest egg is growing each year at MULTIPLES of your initial investment.

I probably have a higher appetite for risk than others (which I try to couple with an analytical evaluation and research process which hopefully de-risks my strategy somewhat) – so I don’t recommend that readers set out to follow my strategy to the letter as your investment goals and horizons are likely to differ from mine. In particular, I don’t think you could follow my style if you weren’t prepared to keep monitoring your portfolio and the market very closely (which I know some would find extremely tedious). So I encourage readers to follow their own path and decide which investment style is for them – but I greatly recommend that you read as widely as you can, as that can potentially give you an edge over the masses in being able to successfully understand new companies from different industries (personally I like science and astronomy, itching to participate in the Rocket Lab IPO if that happens).

There are many different ways to make (and lose) money in the market – and this is mine. It will probably be anathema to self-righteous bearded value investors [thank you John Hempton for that awesome imagery (he said, stroking his self-righteous beard)].

I believe my investment style fits with my personality type and world view (optimistic about the pace of technological innovation, trying to look 10 years out). My style has worked recently but there’s no certainty that it will continue to work equally well in the future. I have a long way to go from an investment development perspective – there will always be new things to learn – and I’m looking forward to seeing where the path takes me. Onwards and upwards.

Thank you for reading this far if indeed you have.

============================

Epilogue: recommended reading/listening

Below is a short list of information sources – in the case of podcasts and blogs, ones that I listen to/read regularly – as part of an overarching mission to educate myself, broaden my horizons, and try not to be as ignorant as I have been for most of my life.

BOOKS

There have been a number of Recommended Reading lists published by various professional and retail investors in recent times – a good one here by another friend of Ethical Equities, the giant red cartoon hound 10foot Investor (Twitter: @10footinvestor). I would add a handful to this list (and would have added more if I’d made more progress with my ever-growing pile):

- 100-Baggers – Christopher Mayer

- The Most Important Thing – Howard Marks

- The Outsiders – William Thorndike

- Money Masters Of Our Time – John Train

- Zero To One – Peter Thiel

- The Little Book That Builds Wealth – Pat Dorsey (great discussion on Economic Moats)

- The Little Book That Beats The Market – Louis Navellier

- A Short History of Financial Euphoria – John Kenneth Galbraith

PODCASTS (and Twitter handles)

Australian

- Three Wise Monkeys (Claude Walker, Matt Joass, Andrew Page).

- The Acquirers Podcast (Tobias Carlisle).

- The Rules of Investing (Livewire).

- Australian Investors Podcast (Owen Raszkiewicz).

US

- Invest Like The Best (Patrick O’Shaughnessy: @patrick_oshag) – my single favourite podcast, with a wide variety of very smart guests from very many different fields, strongly recommend going back to listen to all of them.

- Capital Allocators (Ted Seides: @tseides).

- The Meb Faber Show (@MebFaber).

- Masters In Business (Bloomberg – Barry Ritholtz).

- Against The Rules (Michael Lewis).

- FYI – For Your Innovation (Ark Invest).

- The Disruptors – About The Future (only recently discovered, a long backlog of episodes to catch up on).

INVESTMENT BLOGS (and Twitter handles)

- Microcap Club: microcapclub.com/category/blog/educational/ (Ian Cassel: @iancassel).

- Morgan Housel: collaborativefund.com (@morganhousel).

- Michael Batnick: theirrelevantinvestor.com (@michaelbatnick).

- Nick Maggiulli: ofdollarsanddata.com (@dollarsanddata).

- Matt Joass: mattjoass.com (@MattJoass).

- 10foot investor: 10footinvestor.com (@10footinvestor).

This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). The author owned shares in the companies disclosed above at the end of April 2019. Authorised by Claude Walker.

The Gent's Pre-Investment Checklist Is Has Been Emailed Exclusively To Ethical Equities Newsletter Subscribers. If that's you, check your email, otherwise, sign up here to automatically receive the link to this hidden content.