ReadCloud Ltd (ASX:RCL) Quarterly Report

At the time of our last update on ReadCloud (ASX: RCL) in early December there had been a lot going on with the company over the previous few months – which in combination clouded the picture – in my mind at least – as to what we should expect over the remainder of this current FY19 period:

- Management had disclosed in late July that the sales pipeline ahead of the CY2019 school year was 6 times the size of the CY2018 pipeline 12 months earlier – which no doubt helped to propel the share price to its all-time high of 62c in mid-August.

- In mid-September the company signed a direct digital content distribution agreement with global major Oxford University Press which should significantly increase margins versus the previous indirect arrangements with RCL resellers (on those titles).

- In late October, the Sep-18 quarterly update revealed that several new large direct schools had been signed, and that via reseller OfficeMax a further several indirect schools had been locked in for the 2019 school year – this suggested a total of 80-85 schools based on the 70 schools that had been secured at the end of June.

- The Sep-18 quarterly update also announced a distribution agreement with the Australian Institute of Education & Training (“AIET”) – a provider of 34 different Vocational Education and Training (“VET”) courses to approximately 4,000 Year 11 and Year 12 students in more than 90 secondary schools in Victoria, SA and WA.

- Less than 3 weeks later in Nov-18, ReadCloud then announced the acquisition of AIET – comprising $350K cash up front which a further ~$450K of cash and ~$2M of RCL scrip payable to the vendors dependent on revenue and EBIT targets. The company flagged a 4.5x EBIT multiple for the acquisition – suggesting that AIET is forecasting EBIT of $650K for FY19 (and had achieved ~$1M of revenue in FY18, suggesting this business is very high margin and will be very accretive to RCL).

- However, in the same AIET acquisition announcement, the company disclosed that sales traction in the core school textbooks business had been impacted by curriculum changes for 2019 – causing publishers to need to alter their content and thereby delaying school purchasing decisions by several weeks. The company suggested this was pretty much a non-issue which just meant that the selling season would be extended deeper into early 2019.

The last two developments certainly had me stroking my beard in perplexed thought, but it was clear that we were unlikely to have a good handle on the financial impacts of all of the above moving parts for at least a few months – and so that’s where we were 2 months ago. [Exhale]

The company released its 4C quarterly cashflow for the December quarter (with accompanying operational update) on 31st January (“deadline day” – as evidenced by the slew of 4Cs from other small companies).

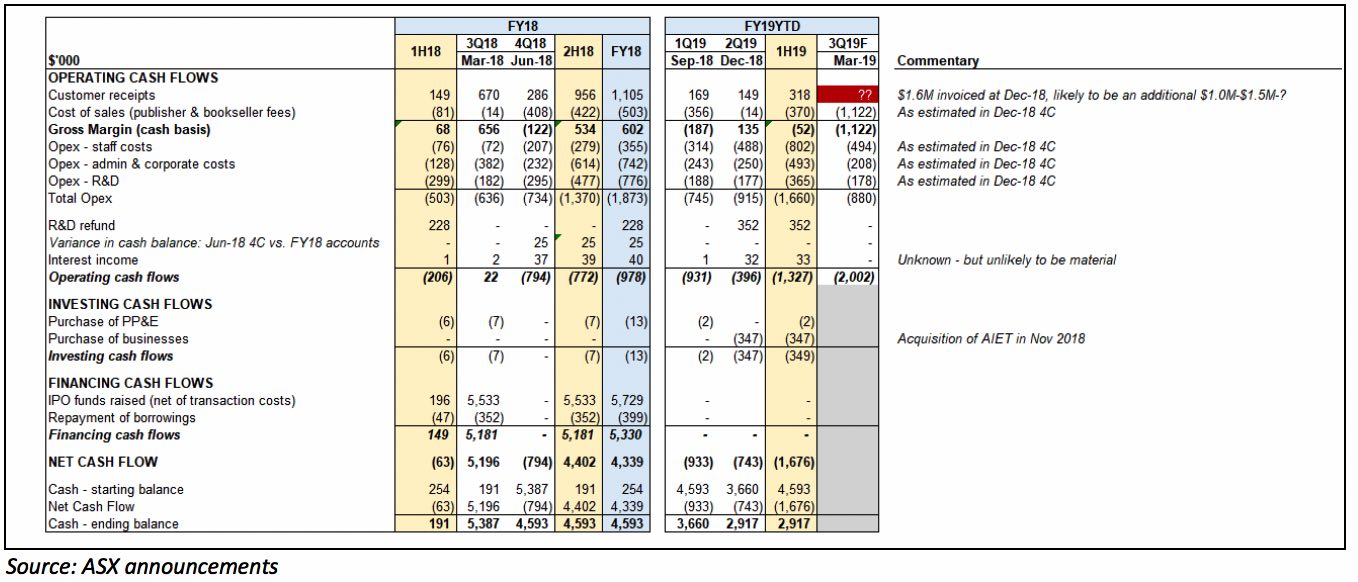

Summarised quarterly cashflow information (from RCL’s short listed life) is presented below, updating the table from our last report on company, adjusted for some minor item reclassifications and a small -$7K revision to the previous quarter’s cash outflows.

Several things jump out at you from the above – however it’s critical to read the accompanying commentary in the 4C to better understand the context (salient points from which I’ve added in bold below) – without which the cashflow report appears much less positive:

- Dec-18 receipts were actually below Sep-18 receipts by $20K. This was contrary to what I had expected – having understood that the December quarter was seasonally stronger from a cashflow perspective -> however given RCL only listed in early February (a week after the requirement to lodge a 4C report for the Dec-17 quarter), we didn’t have a feel for the Sep-17 vs Dec-17 cashflow profile. It’s important to note that in FY18, it was the March quarter which generated the majority of cashflow for the year (61% of total FY18 cash receipts, and ~4.5x the cashflow generated from the previous 2 quarters combined). IF the company generated the same proportional increase in the March 2019 quarter vs the Sep-18 and Dec-18 quarters – in comparison to the FY18 year – this would suggest somewhere in the region of $1.6M of customer receipts for the current quarter. The commentary in the Dec-18 4C bears this out almost precisely – not only confirming that the majority of annual cash receipts are received in the March quarter (having been invoiced in November/December every year) – but stating that there was $1.6M of outstanding invoices at 31 December, with the potential to generate more receipts from sales within the current quarter – including the invoicing of the majority of its Reseller revenue.

- This last point is particularly interesting. The company has communicated that for FY18 the reseller channel represented 71% of total sales (so ~$1.2M, excluding R&D income from the calculation) – down from 88% of total sales in FY17 in line with the company’s focus on increasing the contribution of higher margin direct Given the 48% increase in the number of resellers from 50 in FY18 to 74 estimated for FY19E, and commentary around increased momentum versus last year, that sounds like a meaningful increase on last year’s $1.2M of reseller revenue – the majority of which is to be invoiced and received in the March quarter per the above. So, is that an additional $1M to $1.5M on top of the $1.6M of outstanding receivables at December?

- The seasonality in Cost of Sales payments is still quite disconnected from the timing of customer receipts – as we noted previously, and potentially confirming our thoughts re annual payments – which makes longer term cashflow forecasting tricky. Note only $14K of COS for the Dec-18, but $1.1M due in the March quarter. 4C confirms this disconnect, though doesn’t refer to annual payments per se. There is definitely some lag effect happening in the numbers above, suggesting that the June quarter is likely to include significant COS outgoings as well (note that it was the June quarter in FY18 when the majority (~80%) of COS was incurred, not March – however the $1.1M forecast for March above seems to suggest less of a lag this year).

- It seems that based on the likely $2.5M to $3.0M ($1.6M above plus resellers (?)) that the company is tracking towards something like $4M for the full year – excluding AIET revenue. Per the 4C commentary, “almost all” of AIET’s revenue is generated and received in the June half. In FY18 this was ~$1M with some growth expected in FY19 – *suggesting* FY19E revenue of ~$5M. This would be an impressive increase from $2M in FY18 (including $0.3M of R&D incentive income) though tracking below the $7.5M FY19 revenue target needed to trigger the final tranches of management’s suite of performance rights (which also include the FY19 $2.0M EBITDA hurdle – though that hurdle may have been made far more achievable with the inclusion of AIET’s $0.6M of EBIT). This also suggests only a partial conversion of the 6-fold increase in the core RCL textbook pipeline trumpeted back in July (though arguably it would have been unreasonable to assume perfect conversion in the first place).

- Actual Dec-18 opex ended up being $915K - $240K (36%) higher than the $674K forecast in the Sep-18 quarterly report. This included transaction costs for the AIET acquisition, as well as 2 months of AIET staff costs from 1st November to 31st

As we noted previously, AIET looks like a good strategic acquisition: expanding the company’s offering in the secondary school channel, opening up cross-selling opportunities for AIET content in ReadCloud’s existing contracted schools, and generating significantly higher margin than RCL’s core school textbook content (with further potential synergies expected from the digitisation of the AIET platform which has already commenced).

The acquisition also significantly increased ReadCloud’s contracted school base to above 200 schools per the company’s AGM presentation. This was confirmed in last week’s operational update: 208 total schools estimated for FY19E, including 96 for VET courses and 112 schools for the core RCL business – a pleasing increase on the 80-85 suggested by the Sep-18 quarterly update (above) and indicating that the expanded salesforce has made inroads with direct school sign-ups. The operational update also disclosed that the AIET acquisition had also opened up potential partnership opportunities with other content publishers – time will tell the degree to which these convert into meaningful revenue.

As it did at the time of the AGM in November, management again shied away from providing financial forecasts for FY19. I had expected that by the end of January – with the new school year having just started (29th January for New South Wales and Victoria) – that management would feel more comfortable about providing guidance with the 2019 selling season presumably not far from wrapping up (though perhaps there are meaningful sales into February and March). While this is somewhat disappointing, as iterated previously there are a lot of moving parts here – especially with the AIET acquisition only just completed.

And yet the data points we do have are useful – though we need to bear in mind that any exercise in trying to fill in the rest of the puzzle using our own assumptions is fraught with danger. Full year FY19 revenue of $5M would be a significant increase on FY18 and would represent a strong base from which to enter FY20 (when I imagine the first synergistic and cross-selling benefits of the AIET acquisition would be realised (at earliest)). What level or profitability could the company generate in FY19 from $5M of revenue?

It’s difficult to use FY18 as a guide. As detailed in our initiation report on the company, based on the unexpected collapse in Gross Margin from 67-70% in FY15, FY16 and FY17 to just 27% in FY18 – driven by the unexplained material increase in Cost of Sales last year, the company recorded an underlying EBITDA loss of $147K (versus my expectations of a $0.5M to $0.6M EBITDA profit). (Please ignore the $1.2M “horror loss” trumpeted by the Stockhead article from the day of the results release, this ignored the $0.8M of one-off IPO costs and share-based payments).

Based on $5M of revenue for FY19, I estimate the company *could* generate NPAT of somewhere in the vicinity of $0.5M. This is predicated on the following (rubbery assumptions):

- An increase in gross margins back to the ~70% GM% level generated consistently prior to FY18 – if not an improvement to 75% or higher – based on the higher margins generated by the AIET business and the improved margins in the core ReadCloud textbook business (from the increasing mix of direct sales vs. resellers) and assuming no more Cost of Sales curve balls!;

- An operating cost base now including AIET of ~$3.5M; and

- Similar depreciation & amortisation to FY18 (though this is potentially higher including the acquired AIET assets), and the continuing benefit of carry forward tax losses.

But note that every single number outlined above is my assumption, and in the continued absence of guidance from the commentary, the range of potential outcomes for FY19 is pretty wide in my view. It’s possible that management provide actual full year guidance at the release of half year results at the end of February, but I suspect it more likely that we’ll need to wait until the March 2019 quarterly cashflow statement. That 4c is going to be key – not only will it include the vast majority of full year revenue and cashflow, from both the core ReadCloud textbook business (including the reseller channel) and AIET, but it should also provide clarity on whether more capital is going to be required to execute on the company’s strategy.

Cash was down to $2.9M at the end of December, meaning the company has burned through nearly half of the $5.5M raised in the IPO a year ago (1st year anniversary is this Thursday 7th February in actual fact) – although a meaningful chunk of this capital was used to increase the sales & marketing team in the pursuit of growth (the results of which we can’t yet quantify). It seems that no more capital will be required just yet – with March likely to be by an order of magnitude the highest cash generating quarter of 2019, and the June quarter still likely to include some meaningful cash receipts (from AIET in particular). But of course there will be the comparatively lower cashflow generating period to get through over the second half of the year, before customer receipts for the 2020 school year begin to flow in.

We continue to flag that RCL is very early in its life cycle and as a result is a comparatively higher risk, speculative stock at this point. There is a lot to be optimistic about – not just with the positive momentum in the core RCL platform business, but also if the AIET acquisition yields the financial and operational benefits flagged by management.

It’s also worth noting that at a share price of 30c (as of 1st February 2019), RCL has a market cap of only ~$13M – so arguably not much upside is reflected in the current share price, and any meaningful increase in profitability is likely to drive a significant increase in the share price. Investors will need to continue to await the next key reporting milestones for confirmation (or otherwise) that the investment thesis for the company is still intact.

Note From Claude: While I mostly agree with the Gentleman's take on the situation, I don't have confidence that gross margins will return to prior levels and I don't think management have done enough to explain the key drivers of margins within the business. For this reason, Readcloud remains a low conviction position for me, among my very smallest.

Please feel free to sign up to the forums and let us know what you think!

For timely coverage of small-cap stocks, join the Ethical Equities Newsletter.

Disclosure: I (@Fabregasto ) and Claude both own shares in ReadCloud and may buy or sell shares in the future – but not for at least 2 days after the publication of this article. This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.

Market cap of only $13m? Is this correct? There are 43.9m shares (listed) and 43.6m shares (Escrowed) totalling 87.5m shares. If you look at the company presentation of 18 November 2018, they present the market cap as $32.8m @ $0.375. If you go on the ASX website, it has 87.75m shares outstanding for a current market cap of $26.32m. However, if you use google finance or comsec it is only showing as market cap of $13m.

Link