Readcloud (ASX:RCL) H1 FY2019 Half Year Report

When we last checked in on ReadCloud (ASX: RCL) a month ago – RCL #3 (limited edition with the holographic cover) the company had just released its 4C quarterly cashflow & operational update for the December quarter. This new information helped clarify some outstanding questions following the frenzy of activity over the last 6 months of 2018 and the level of opaqueness that existing previously in regards to seasonality of revenue and outgoings. A quick summary of what we learned:

- The seasonal peak for cash receipts is indeed the March quarter every year (predominantly for customers invoiced in November and January). There was $1.6M of outstanding invoices at December period end which will be collected in the current quarter.

- The majority of Reseller revenue (which represented the bulk of total RCL revenue in FY17 and FY18) will be invoiced in this March quarter. While the company is transitioning to a higher proportion of higher margin direct sales, presumably this will be for new schools signed up to the platform, and not shifting Reseller volumes to the direct salesforce. FY18 Reseller sales were $1.2M, and the company has communicated that the number of Resellers has increased by 48% between June (50) and December 2018 (74).

- “Almost all” of the revenue from the recently acquired AIET is invoiced in the June half. This was $0.9M in FY18 with some growth expected in FY19.

- Combined with Reseller revenue, this suggested that RCL was on track for $4M of FY19F revenue at least – plus additional school sales achieved in the current March quarter (remembering that a meaningful portion of school sales had been delayed into 2019 by a change to the school curricula in Queensland). While below the $7.5M FY19 revenue target needed to trigger the final tranches of management’s performance rights, this would still be a large increase on the $2M in FY18 (which included $0.3M of R&D incentive income).

- The noticeable increase in operating costs for the December quarter was due to transaction costs for the AIET acquisition, as well as 2 months of AIET staff costs from 1st November to 31st

On Thursday the company released its half-year results for 1H19 (to December) and supplied an additional operational update. A lot of the metrics in that update were the same as those detailed in the 4C provided a month ago, but some of the information was new. Let’s look at this new intel, and then use it to parse the financials and what it potentially means for the remainder of FY19:

- Direct schools: The number of Direct schools has increased from 20 at June 2018 to 38 at December with a further 3 signed in the last 2 months, and more expected by the end of FY19. Average revenue per school increased in 1H19 as a result of expanding the RCL platform to additional year levels in existing schools – a good sign for the potential scalability of the business;

- AIET: Following the cancellation of the RTO licence of a leading WA provider to Vocational Education and Training (“VET”) schools in that state, AIET has signed up 20 new WA schools, plus a further 5 in other states in early 2019, to take its total to ~121 VET secondary schools. AIET’s RTO registration was recently renewed until 2025; and

- Resellers: Based on the 48% increase in Resellers in 1H19, management expect a significant increase in revenue from this channel over FY19/20.

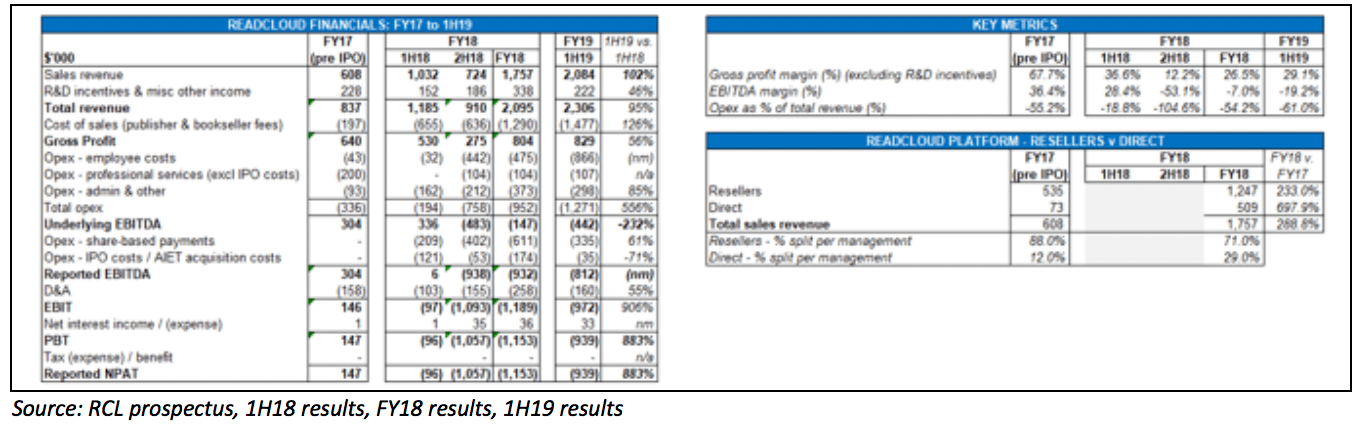

Back to the financials (summarised below). 1H19 revenue of $2.1M (excluding R&D rebates) was 102% higher than for 1H18 and is already higher than full year FY18. This was slightly higher than I expected based on the sum of 1Q18 and 2Q18 customer receipts plus the invoiced and uncollected revenue of $1.6M at December. It’s difficult to get a handle on half-by-half Gross Margin at this point – due to the timing of payments to publishers and booksellers (which have varied over the historical period, and may well vary again with the incorporation of COGS for the AIET business). Underlying EBITDA was a $0.5M loss, in line with 2H18. Higher opex reflects the increased cost base following the AIET acquisition (with invoicing occurring almost entirely in the second half -> cost ahead of revenue).

Based on the following factors (gleaned from management commentary to date), I believe that FY19 revenue is now likely to be in the region of $5M (excluding R&D income):

- Invoicing of AIET revenues in the June half ($0.9M previously but likely to be higher given the new VET schools signed (above);

- Invoicing of the majority of Reseller channel sales in the March quarter (which I would expect to be $1.5M to $2.0M based on the 48% increase in Resellers between June and December, and with reference to the $1.2M of Reseller revenue in FY18);

- A portion of the delayed RCL platform revenue slipping from 1H19 into 2H19 following curricula changes in QLD – unquantified but could be a few hundred thousand dollars.

Full year FY19 sales of ~$5M would represent a near tripling at the top line from FY18 – off a low base but certainly nothing to sneeze at, and signalling some significant momentum since the end of FY17 – with a near tripling of revenue also achieved from FY17 to FY18. This would represent a strong base heading into FY20, when we could reasonably expect to see the first meaningful synergistic and cross-selling benefits from the combination of the core ReadCloud platform with the AIET business. Opportunities include:

- Cross-selling opportunities for AIET content in RCL’s existing contracted schools;

- The digitalisation of the AIET platform (update: delayed slightly, will now be ready in advance of the 2020 school year); and

- Potential partnership with other content publishers in the wider VET market – with management disclosing that commercial negotiations have commenced in this regard (presumably in preparation for the 2020 school year, and too late to contribute to FY19F).

Management believe (per the 1H19 results commentary) that minimal additional headcount would be required to deliver significant growth – potentially suggesting the scalability that I originally expected to be a characteristic of this business (part of my personal investment thesis). Sounds positive – but they need to demonstrate this to me.

In our last piece on ReadCloud, I estimated that the company *could* generate a small profit (at NPAT level) in FY19 based off $5M of revenue and the improvement of gross margins back to pre-IPO levels. The volatility in COGS between periods (see table above) makes this difficult to predict – albeit management expect margins to increase in 2H19 – and so I believe that the company is more likely to generate a NPAT profit in 2H but not completely claw back the $0.9M loss for 1H19 above – and so record a smaller loss for full year FY19. I do expect the company to post positive underlying EBITDA however for FY19 (reversing the $0.5M 1H19 loss). Apart from COGS for the RCL platform, this also hinges on the contribution from the AIET business – which the company has described as generating higher margins that the core ReadCloud business, so potentially there is some upside to these rubbery estimates (we live in hope).

Again management have not provided any hard numerical guidance for FY19 – however the company had advised there will be an investor roadshow sometime this month with an accompanying investor presentation. This will be designed to increase awareness for the company and its growth profile – and hopefully may include some useful forecast information, or at least updated metrics on how the 2019 selling season has ended up (with school purchasing presumably finalised given we are now in March). If not, I would expect to gain this insight on the release of the March quarter 4C at the end of April (30th April “Deadline Day” if previous lodgement dates are anything to go by).

It would be nice to see some further breakdown of revenues between RCL/AIET, Resellers/Direct schools for the core ReadCloud platform, as well as other metrics such as average revenue per school or by student – but that may be wishful thinking so early in the company’s listed life. Glossy presentations and a sea of KPIs don’t necessarily translate into profitability – just ask Livetiles shareholders.

As we flagged in the last ReadCloud update, the March quarter 4C will provide some clarity on whether more capital is going to be required to fund the company’s growth into FY20.

- There was $2.9M in the coffers at the end of December, with a further $1.6M invoiced but not received as of that date.

- In the December 4C management estimated $2.0M of outflows for the March quarter including $1.1M of COGS – so that suggests the company will have around $2.5M plus any receipts received by then from the billing of Resellers and AIET customers (net of further COGS for those volumes).

- So it appears the company will be fully funded through the end of FY19 (excluding any further expansion of the salesforce ahead of the FY20 school year) – but note the seasonally weakest half of the year from a cashflow perspective is the December half.

I would hope the company has at least $2.5M-$3.0M in the kitty at June to get through the six months to December 2019. That’s because 1H19 operating cashflow was -$1.3M per our previous ReadCloud update, and we could expect that to increase to $1.5M including a full period of AIET staff costs. 2020 school year receipts would then start flowing into the bank account from January next year if normal seasonality is a good guide.

So there remains a lot to be optimistic about on this company, in my opinion. A 700-800% increase in revenue over 2 years (albeit from a sub-$1M base in FY17), while still posting only moderate losses, positions the company well for FY20. At a $13M market capitalisation, there would be meaningful share price upside from the company reaching its cashflow and profit breakeven inflection point in the next 12-18 months. In the meantime, I will await the upcoming investor presentation (this month) and next March quarter 4C (due end of April) with keen interest.

We continue to flag that RCL is relatively early on in its life cycle and as a result is a comparatively higher risk, speculative stock, at this point. We will provide a further update on the company in our next issue (RCL #5 Return Of The Killer ReadCloud) following the release of the March quarter cashflow report.

Disclosure: I (@Fabregasto ) own shares in ReadCloud and may buy more shares in the future – but not for at least 2 days after the publication of this article. Claude Walker owns shares in Readcloud and will not trade them for at least two days after the publication of this article. This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.