Author: Fabregasto

On Wednesday, ReadCloud (ASX:RCL) announced its maiden full year results as a listed company.

Background

ReadCloud is an emerging Australian education technology company which provides digital learning solutions to Australian secondary schools. Specifically, ReadCloud’s Software-as-a-Service (“SaaS”) eReader platform delivers entire school curricula in one app. Within this app, teachers and students can collaboratively share notes, questions, videos and website links, and import third party content such as YouTube videos and TEDTalks.

The platform includes data analytics (so teachers can track actual reading time) and integrates with each school’s Learning Management System, to synchronise timetables and classes. The eReader platform is more cost effective for schools than traditional hardcopy textbooks, and in short, investing in the company is a play on the digitalisation of the classroom.

From the limited financial information included in the prospectus, ReadCloud’s growth trajectory seems to have been considered and steady and without the long runway of cash burn often seen in the technology sector. Founded in 2009, the first version of the eReader was published for iPad in 2011, and in 2013 the platform was deployed in two pilot schools. Per the prospectus, over 2014/2015 the current senior management team joined the company and redefined the commercialisation strategy. From three schools in 2015, the platform had been rolled out to 50 schools and 21,800 users at June 2017. Unlike a number of ASX listings in recent times, ReadCloud was already profitable at IPO, generating positive NPAT in FY16 and FY17 (albeit before incurring typical annual ASX listing fees and corporate expenses which it will from this point forwards).

In order to fund the next phase of growth, ReadCloud listed on the ASX in February 2018 with little fanfare (which has proven to be characteristic of management (a plus in my view)). The company raised $5.5 million (after costs) with which it aimed to fund an expansion of its sales and marketing team, plus further investment in the eReader technology platform.

ReadCloud generates revenue from selling licences for its eReader software and for eBooks in the digital library. At IPO this digital library included more than 170,000 titles via direct distribution agreements with global publishers such as Simon & Schuster, Allen & Unwin and Penguin Random House, and educational publishers such as Jacaranda and Macmillan. These agreements automatically make new eBooks available on the eReader platform as soon as they are released by these publishers.

The company operates two distribution channels:

(1) Direct sales to schools under 1-4 year contracts, with the majority of revenue received at the start of the school year (when that school’s curriculum is purchased); and

(2) Via resellers – such as Officemax (a large school book and stationery supplier) and Jacaranda (a sizeable textbook publisher).

ReadCloud also white labels its platform for a number of channel partners.

As you would expect, the company generates higher margins from supplying schools directly: the prospectus quoted respective gross profit margin per user of $42 from direct sales in FY17, versus $15 per user via the reseller channel. The planned use of IPO proceeds is to grow its direct sales capability. Management hope this will lead to significant gross profit growth as the product gains traction. In FY17, 88% of sales were achieved via the lower margin reseller channel, and 12% via ReadCloud’s direct salesforce. The prospectus set a target to double direct sales to 24% of total revenue for FY18, but actual FY18 results showed this had already increased to 29%.

Accelerating growth into FY19 and reported FY18 results

The prospectus included no financial forecasts, but did include a June 2018 target of 45,000 users across 75 schools. In a quarterly update to the market in late April, ReadCloud announced it had at that point surpassed 50,000 users across 70 schools and that, following a significant increase in inbound enquiries from potential new schools, the sales pipeline ahead of the 2019 school year was at record levels. In a late July 2018 update the company disclosed that the sales pipeline for CY2019 was more than 6 times the level of the pipeline at the same time last year.

In the April 2018 update, the company noted that the $500K FY18 EBITDA hurdle (needed to trigger a portion of performance rights held by management (more on these later)) would not be met due to the decision taken to scale up its workforce to meet the strong sales pipeline. While management easily met the first half of the Class A performance rights target with 8 months to spare, the decision to pull forward expenditure into FY18 in order to accelerate the growth trajectory in FY19 (and “sacrifice” a portion of management incentives in the process) is noteworthy. However, the FY18 EBITDA hurdle may not have been met, anyway, based on the full year FY18 results released yesterday.

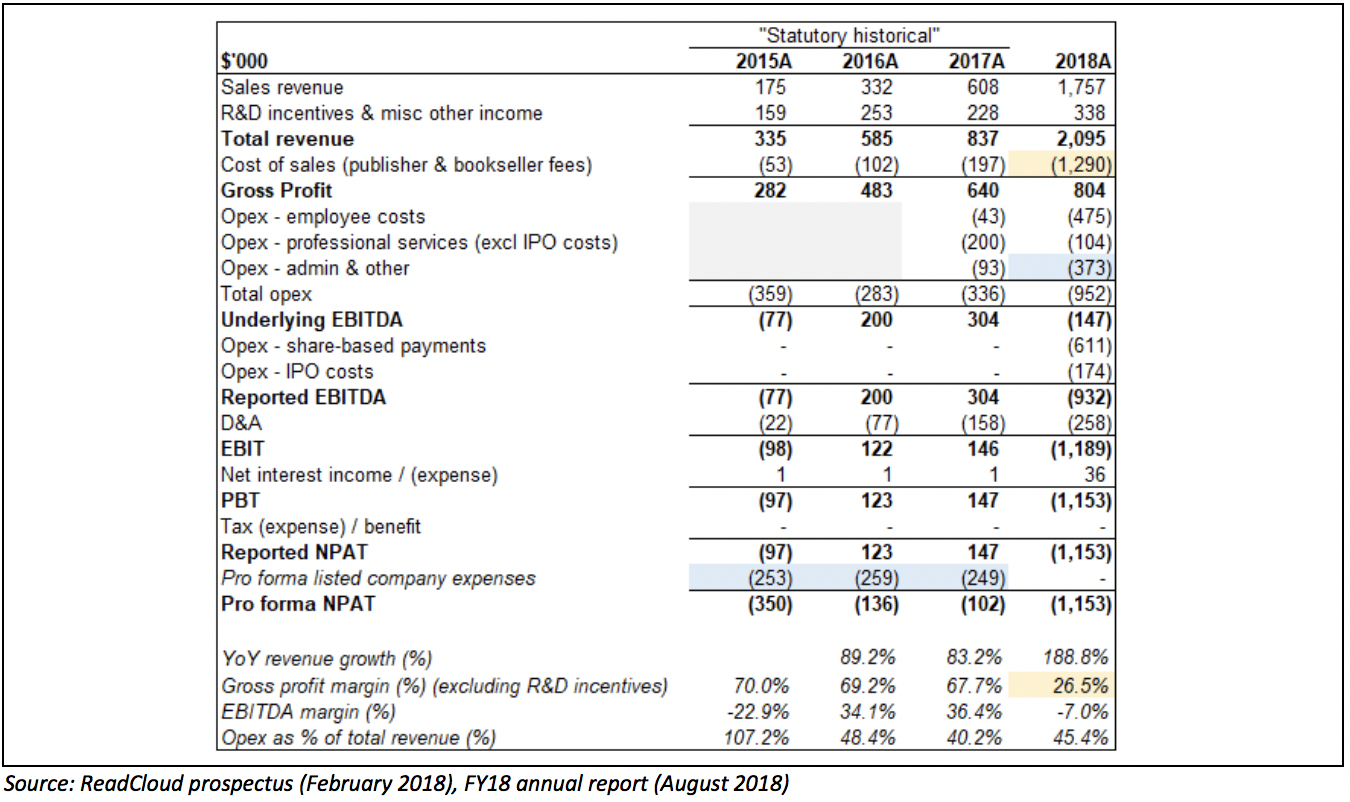

The FY18 results confirmed the late July guidance that FY18 revenue exceeded $2 million – a significant increase from FY17, though obviously off a low base. As is not unusual for a newly listed entity, maiden reported full-year results included some significant one-off costs related to the IPO (presented below Underlying EBITDA (management’s definition) below).

As noted above, the company previously did not incur corporate expenses associated with being a listed company: blue shaded costs below are management’s estimates of these costs from FY15 to FY17 (which seem a little on the low side), included in Underlying EBITDA in the FY18 results.

The first thing that stood out to me from the FY18 results is the unexplained significant increase in publisher & bookseller fees – from ~30% of sales between FY15A and FY17A to ~73% of sales in FY18A – and the resulting decrease in gross profit margin. The annual report commentary explained this away as “a result of growth in sales during the period”, but this was unexpected (to me), and a 559% increase in cost of sales on a 189% increase in sales revenue – which looks like it may contain a large one-off payment – requires some explaining in my view.

All else being equal, if ReadCloud had generated the same ~68% gross profit margin for FY18 as it did in FY17, Underlying EBITDA would have been $723K higher (and $576K instead of -$147K). Approximately $0.7M of R&D costs were capitalised during the year.

FY19F and management performance rights

The expansion of the sales and marketing team flagged in the prospectus (which has driven the significant increase in the CY2019 pipeline as noted above) is behind the material lift in employee operating costs in FY18. The June 2018 4C included estimated quarterly cash operating expenditure outflows of $430K (excluding ~$300K of R&D spend, the majority of which I’d expect to be capitalised). This suggests that the annualised cost base of the business is now closer to ~$2M at the commencement of FY19. This sounds “about right” given the business is probably targeting revenue of around $7.5M for FY19F – being a trigger for management’s performance rights (discussed shortly, I promise).

I say “probably” because no formal FY19 guidance has been provided by the company (just as no forecasts were included in the prospectus). The FY18 results press release also did not provide a further update from the positive commentary included in the June quarterly 4C (just one month ago, to be fair). Shareholders will already have surmised that the company is not “flashy”, and doesn’t bombard the ASX announcements department (if there even is such a thing) with bombastic press releases on its progress.

I don’t mind this at all – I prefer management to be focused more on execution and growing the business, and less on spruiking the company on Soviet-era-looking internet forums and engaging in nefarious behaviour on Twitter. But it does mean there may not be a further update on progress until ReadCloud’s AGM in November.

So – as with all genuine high-growth companies, this is going to come down to execution. Specifically, the conversion of the strong sales pipeline communicated by the company, into actual sales.

Cash at the end of June was $4.5 million (noting $5.5 million was raised in February). The company has flagged previously that the December and March quarters are the seasonally strongest quarters from a cash flow perspective. This is to be expected with Australian school years commencing in January / February and school curricula presumably purchased between November and March.

The June cash balance of $4.5 million should comfortably fund operations through the quieter September quarter, and through the seasonally higher Q2/Q3 sales cycle – but clearly actual sales conversion will be critical for cash generation through the back half of FY19 (duh, Gent). And then, through the seasonally quieter first quarter of FY20.

Now, to the performance rights. As brazenly noted in the May 2018 investor presentation (Thorney Group, who put on the conference, holds ~13% of the company), “management are rewarded for doubling user numbers again for FY19”. The full suite of management’s performance rights – which vest in halves (50%/50%) – comprise:

- Class A: 45,000 users by December 2018 (met); 100,000 users by December 2019 (pending)

- Class B: FY18 revenue of $2M (met); FY19F revenue of $7.5M (pending)

- Class C: FY18 EBITDA of $500K (not met); FY19F EBITDA of $2M (pending)

- Class D: share price VWAPs of $0.30; and $0.40 for 30 consecutive (presumably trading) days (likely met, given the share price has not been below $0.40 since 18th June).

Shareholders will be hoping that management are successful in triggering the FY19 $2M EBITDA hurdle above. The big question is whether they mean reported or underlying EBITDA. If it is reported EBITDA, the majority of this $2M EBITDA would fall to NPAT. In this scenario, investors can dream of a ~20-25x P/E ratio for FY19F (based on yesterday’s $0.43 share price). Claude’s note: colour me sceptical.

Business momentum heading into FY19 is strong based on management commentary. The May 2018 investor presentation referenced a significant shortening in the sales cycle – via two examples of a successful sale to a large school in 2017 (4 months) versus another in 2018 (3 weeks). The company attributes this to growing awareness of ReadCloud’s platform – which will be key to meeting FY19 targets. Also key is likely to be a partnership with the Queensland Secondary Principals’ Association (QSPA) which was announced in May, and which gives ReadCloud exclusive marketing access to 175,000 students in 210 Queensland schools over a 30-month period until November 2020.

Looking beyond FY19: dare to dream

ReadCloud’s stated target market is the Australian secondary school sector, comprising 2,700 schools and 1.6M full time students – but there doesn’t seem any natural impediments to expanding into the adjacent Australian primary or tertiary markets, or indeed moving offshore. The company cited a forecast by business intelligence firm ORC International that 63% of Australian schools (~1,700 of the 2,700 schools above, likely to be in the region of 1M students) will be completely digital by 2020.

In the company’s characteristically un-flashy manner, the May 2018 investor presentation also casually included a line referencing the $5.8 trillion global education market, 2% of which is digital according to IBIS. ReadCloud’s existing alliances with global publishing giants would likely position it well for any future international expansion – though we are getting a little ahead of ourselves in daring to dream these dreamy little dreams. Management’s near term focus is, rightly, on the Australian secondary school market, and on converting the strong pipeline leading into the CY19 school year. Nail that first, global domination can come later. Cool? Cool.

Going forward, as with most SaaS companies, ReadCloud’s platform should be inherently scalable as it adds users, with the potential to generate significant ROIC in future years if/when the product gets real traction.

Small cap volatility

While the potential growth runway is undeniable, and the recent trajectory is impressive, readers should note that ReadCloud is on the more speculative side of the spectrum. At yesterday’s closing price of $0.43, its diluted market cap is under $50 million. Trading is relatively illiquid and the stock is not widely known at this point (certainly not big enough to have attracted broker coverage just yet).

Recent price action has been volatile. Its late May investor presentation drew the market’s attention to the strong growth in FY18 and potential market opportunity. The share price ran from $0.33 at that point to $0.45 in the week preceding the release of its June quarterly 4C statement in late July. The quarterly 4C confirmed full year revenue of $2.1M and so the share price quickly ran up to its all-time high of $0.62 in mid-August. However, the share price retreated to $0.47 immediately prior to the release of results (potentially profit taking and nerves ahead of results), and plumbed an intraday low on Wednesday of $0.41. Savvy investors will note however that the sell-off from $0.60 on 21 August down to $0.43 yesterday has been on very low volume – only ~850,000 shares traded in total over this 7-day trading period.

As noted above, there is potentially an information vacuum for the next 2-3 months until a further update is provided at the November AGM. At that point in time, the company should have reasonably good visibility as to pipeline conversion and what the start of the CY2019 school year will look like. Until then however, the share price may be volatile and potential investors will need to determine for themselves if ReadCloud is in line with their risk appetite.

Disclosure: I (@Fabregasto ) own shares in ReadCloud – accumulated between February and early August 2018 at a VWAP of $0.396 – and may buy more shares in the future – but not for at least 2 days after the publication of this article.

Note from Claude:

This is an excellent and thorough piece of writing about a relatively unknown and fascinating small company. I own shares in Readcloud and I am inclined to purchase more in the future (not for at least 2 days after publication, though).

However, I note that there are unanswered questions. First, why did gross margins take a hit? Second, do the performance rights trigger with underlying EBITDA? And Third, why, if management are focussed on the business, is one of the performance rights hurdles based on share price?

In my view the decision to incentivise management based on a temporary share price trading range lacks a compelling rationale. So although I like this stock; I own this stock; and I may buy more of it: I am cautious.

For early access to our content, join the Ethical Equities Newsletter.

Disclosure: The author (aka the Gentleman), and Claude Walker own shares in RCL at the time of publication. This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.

Thanks heaps Fabregastso and Claude for the excellent writeup. I first heard of this company after the Thorney Group investor presentation but had been reluctant to buy in due to my lack of research. Your research has been of tremendous value to me and has helped me grow my understanding of the business immensely. I will keep a keen eye on the company going forward to see how they answer the important questions you raise re. gross margins & performance rights. Cheers guys :)

LinkNice article Fabregasto. I decided to have a closer look tonight based on the back of it.

LinkThere's no doubting of the moved to digitalised books from my end, or the potential market size. But I do have some doubts of ReadCloud's competitiveness in the market. Apart from Claude's question around the gross margin compression, a couple of other things struck me:

- The two schools highlighted in the May Investor presentation are both poor performing government schools (https://www.myschool.edu.au/school/47491 and https://www.myschool.edu.au/school/47451). I'd question whether these types of schools are true early adopters that are leading in educational trends...

- Found quite a few competitors in the space by searching "[high school name] ebooks". Examples: https://learningfield.com.au/, https://www.campion.com.au/digital-learning/, http://educationalebooks.com.au. The examples are suppliers to some good performing government schools in Melbourne metro.

- The competitors above seem to have similar products, value proposition and list of publishers. Some of them are existing book stores with a digital arm, while others partner with physical stores - to provide a holistic physical/digital offering.

Interested to hear your thoughts.