A major reason to study short-sellers is that a weak short thesis can create opportunities to buy underpriced equity.

Case in point is Nanosonics Ltd (ASX:NAN), the maker of the Trophon EPR, a mechanical unit that uses nanonebulant disinfectant to more effectively and efficiently sterilise ultrasound probes.

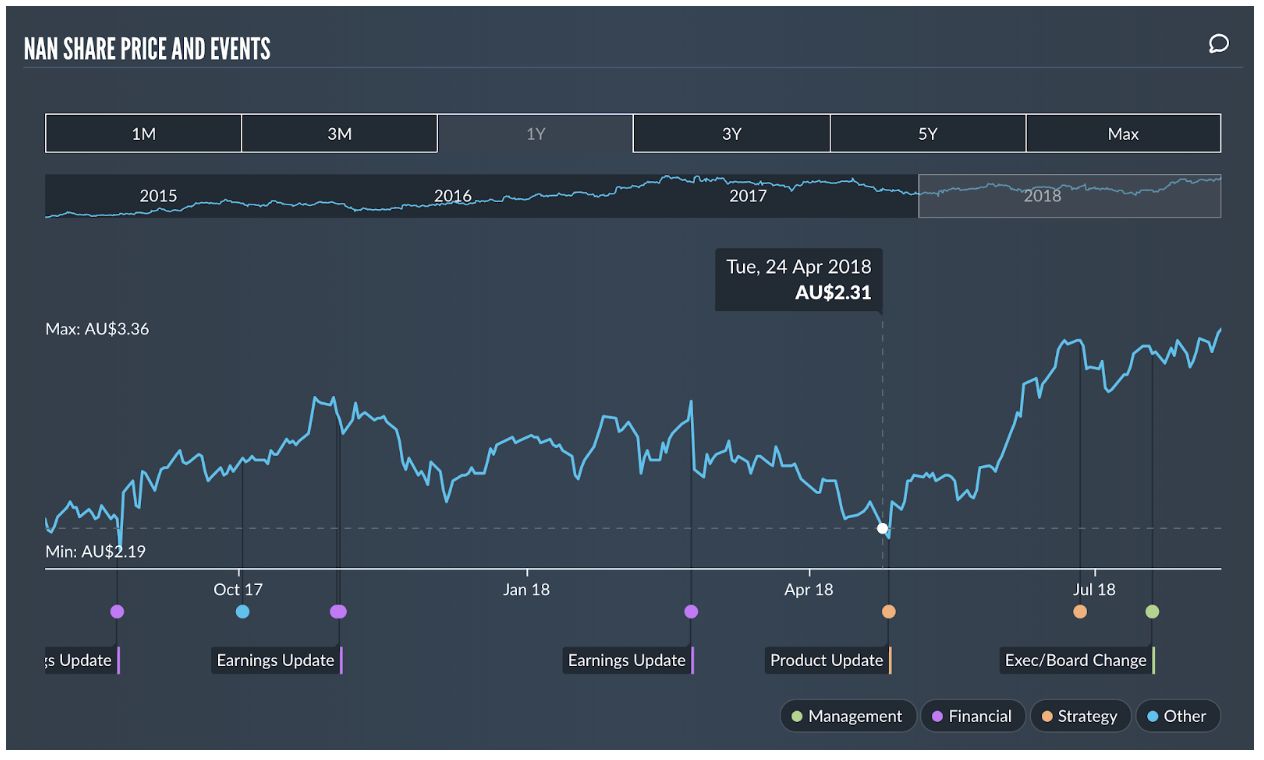

The company recently saw its share price sold down to about $2.30, as you can see below (click to enlarge).

(Think this graph looks cool? Try Simply Wall St)

(Think this graph looks cool? Try Simply Wall St)

While markets are said to be a weighing machine in the long term, they are a voting machine in the short term. Short sellers can temporarily depress a share price because they borrow stock and then sell it, creating artificial supply. Unless existing buyers buy more shares -- or new buyers emerge -- the share price will therefore drop, all else equal. Notably, the market ‘voting machine’ allocates votes not according to skill or intelligence but simply according to the amount of capital ‘voters’ are willing to sink into an investment thesis (whether long or short)

So when market participants with plenty of capital get the wrong idea about a company, and decide to short-sell it, there is the potential to predict a short squeeze. Here’s how I think you can spot a short squeeze.

The Start Of A Squeeze

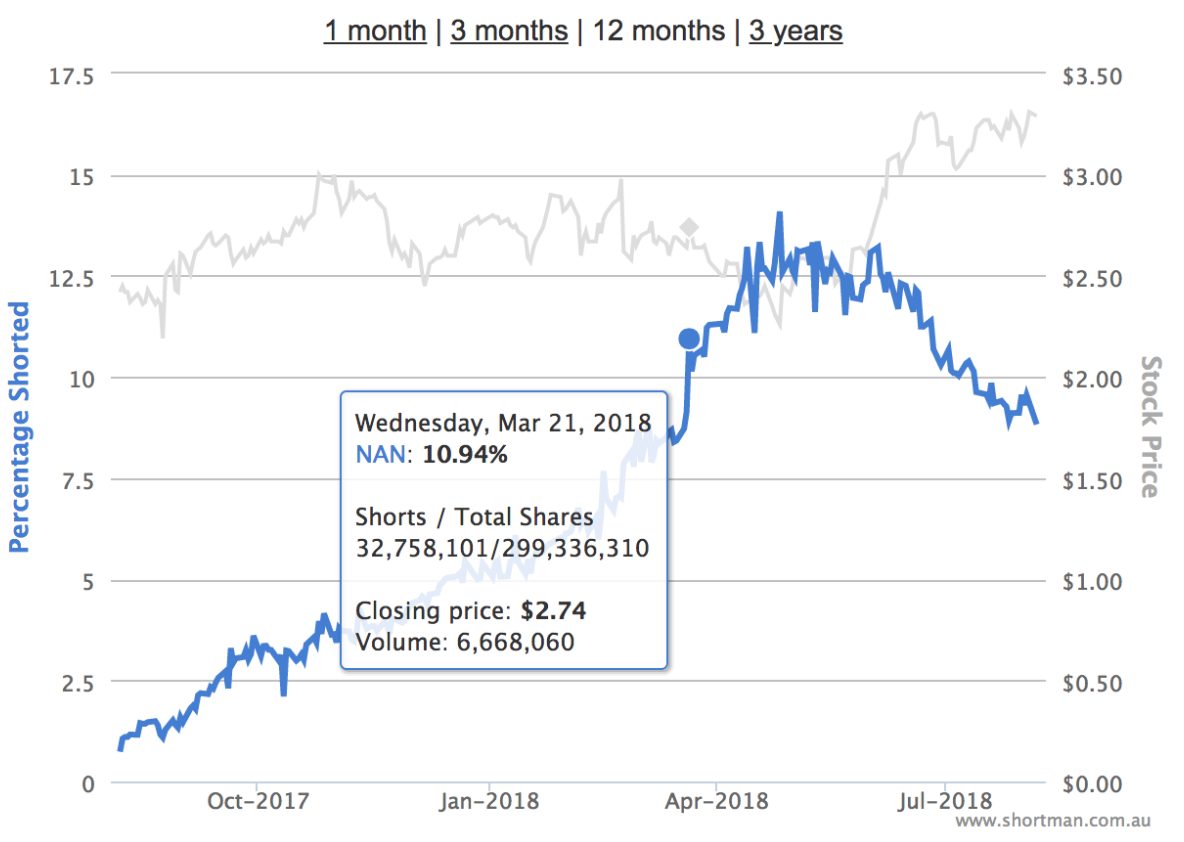

Throughout 2018 I observed the short interest in Nanosonics gradually build. The chart below shows that as the short position was built at a time when the share price ranged from about $2.40 - $2.90, with most volume trading at around $2.50 - $2.70. By April, some 14% of the company was sold short at around that price.

On Thursday 26, April, the share price spiked down to below $2.30, just as the short interest spiked up to its peak, on the chart above. This suggests that the short seller dumped shares in the hope of generating irrational selling.

On April 27, when the share price jumped back, it seemed likely that the jig was up, and the squeeze was beginning. And I wondered aloud whether it was on.

I wonder if the shorts are feeling the squeeze... #ASX $NAN

— Claude Walker (@claudedwalker) April 27, 2018

Disc: long pic.twitter.com/s789pFq2Ne

With short interest having dropped from 14% at $2.30, to 8% and $3.30, it’s clear that some of the share price rise is attributable to capitulation by short sellers who now have to buy back the stock at higher prices. Yesterday, the price popped to $3.44: new twelve month highs. In large part, the move has been driven by substantial holders JCP Investment partners, who were buyers at recent lows but have recently reduced their holding above $3. Their deep pockets frustrated the short sellers at the bottom. But it is almost certainly shortsellers capitulating that is driving the share price today.

Do Your Research

Of course, the key ingredient in a short squeeze is that there is no credible short thesis. A credible short thesis is required to convince shareholders that the stock is overvalued. Otherwise, the potential gains from short selling will be limited by buyers who see value.

When Nanosonics short interest started to grow I was confused. Typically good short sellers will target a company with severe weaknesses or rampant overvaluation. While Nanosonics doesn’t produce steady earnings, the company has over $60 million cash in the bank, has around $60 million in revenue per year, and could easily make a profit if it reduced investment in new products. It seems likely that -- at current highs -- the stock is somewhat overvalued. I wouldn’t be surprised if it drops on earnings, but I also think that it makes sense to buy this stock at around $2.50.

I put the feelers out to see if I could find the short thesis for Nanosonics. I had numerous helpful suggestions -- slowing revenue growth, over reliance on GE Health as a distributor, the fact that its patents will expire, and the likelihood of losses as the company launches the Trophon 2, and its (as yet unspecified) new product. I asked the CEO and CFO, but they were none the wiser. Importantly, however, they did not seem overly concerned about it. This is a crucial tell: those with serious skeletons in the closet are typically extremely worried to learn someone has a financial interest in shining a light on them.

As the trade started to move against the short sellers, one would expect that if there was a compelling short thesis, they would have published it. Instead, around half of the short positions have been covered, mostly at higher prices. Whatever happens when Nanosonics releases its full year results, it seems like a stretch that this will be a particularly profitable trade for the short sellers. This is particularly true because long term shareholders are unlikely to want to sell before the company reaps the benefit of taking over the direct sale of its consumable products, such as the disinfectant solution that the Trophon uses.

Nanosonics will be taking over the distribution of the consumable products from July 2019, and that will bring higher margins on the largely recurring ‘blade’ part of the ‘razor + blade’ business model. The uplift is likely to be very material, and recurring.

In the short term, Nanosonics could well disappoint. It has communicated well that a number of factors will mute revenue growth. It is increasingly moving to rental style agreements, which reduce capital sales, and the new version of the Trophon could cause a destocking event with GE Health. On top of that, unit sales have been slowing a little, as the low hanging fruit is already converted.

When I recommended it to members of Motley Fool Hidden Gems at around $2.55, there was minimal chatter about Nanosonics. Today, the herd has veritably arrived; twitter awash with tweets about Nanosonics. Sentiment is high, and the shorts won’t have to keep covering forever. But it could go higher still.

I’m an investor in Nanosonics for the long term. My position is not so large that I need to reduce it, and I am not inclined to try to trade around sentiment. This stock could certainly go higher from here -- and eventually, I think it will.

But whereas I would happily accumulate shares in the company (all else being equal) at around $2.60, I am certainly not buying at this price. But I’d consider Nanosonics to be worth holding. Now is the time for long term investors to sit back with the popcorn. Spare a thought for squirming short sellers -- we need them to have a healthy market.

For early access to our content, join the Ethical Equities Newsletter.

The Author of this piece, Claude Walker, owns shares in Nanosonics. This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.

Thanks Claude, a very interesting read. I've happily held Nanosonics for a few years and have often wondered why the price bounces around so much. Good to see the return of EE, all the best Pete

Link