Nanosonics (ASX:ASX) FY 2019 Full Year Results Analysis

We joined the Nanosonics (ASX:NAN) journey at Ethical Equities when we published this report predicting a short squeeze last year, when the price was around $2.60. Yesterday, the company, which sells the Trophon device and associated consumables, has delivered a record full year result for FY 2019. That saw its share price spike 32% to close at $6.50. You can hear me outline the (old) short squeeze thesis at around 18min 30s in this podcast.

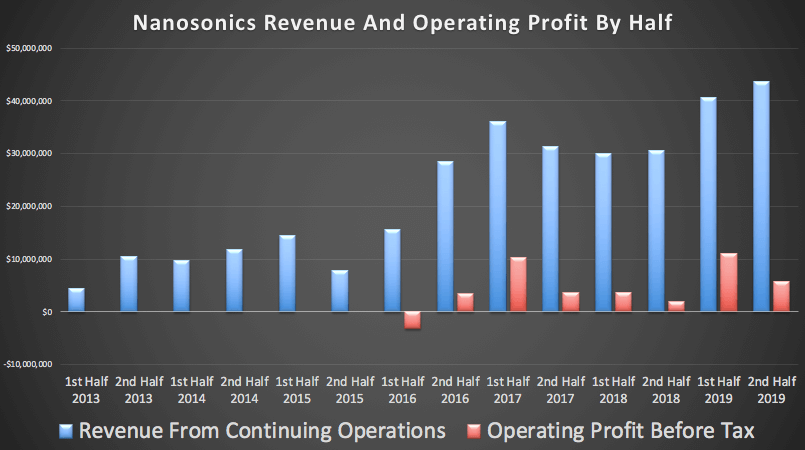

For the full FY 2019 year increased 39% to $84.3 million, with installed base of the Trophon grew across all regions. As you can see below, the company is continuing to grow revenue strongly, albeit not smoothly, due to changes in selling model and the release of the Trophon 2. It just so happens the second half was an improvement on the first half, in terms of revenue, but not in terms of profit, as you can see below.

Note: This post was supported and assisted by Strawman founder, Andrew Page. I recommend Strawman as the best ASX stock forum available.

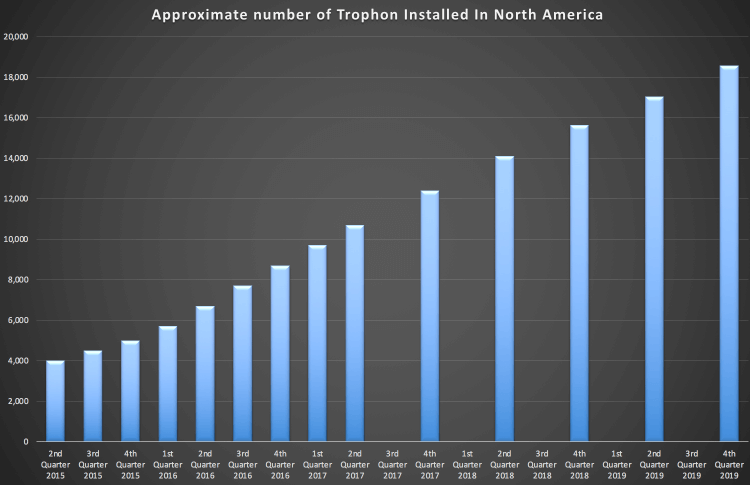

As you can see below, the number of Trophon units installed in North America continued its long term climb to reach 18570, with the growth rate steady at about 1500 per half.

Nanosonics has 75% market penetration in Australia and NZ, and is finding much growth there anymore, but on the conference call the CEO said that he sees no reason that the company cannot reach a similar market share in the USA. At current (absolute) growth rates, that implies around 10 years of growth in the US (albeit with a declining rate in percentage terms). So, a long runway remains.

Looking to Japan, the CEO reminded listeners that they do not have guidelines for adoption there (which are required to compel purchasing of high level infection control devices like Trophon.) However, he said, "things should start kicking in very positively from 2021”, which implies he thinks that "the fundamentals for adoption", as he calls them, are falling into place.

On top of that, the company has taken over the distribution of its consumable products in the US from July 2019. That means that instead of selling its consumables through GE for some of its customers, it will sell consumables directly to customers and get a better margin. The impact of this margin uplift is expected to be fully felt in the second half of FY 2020.

Importantly, however, operating expenses grew by around 15% in 2019 due largely to a 27% lift in headcount and an increasing R&D spend. The company said costs would increase significantly in the current year, forecasting $67 million in operating expenses (a 36% increase) for FY2020 as the business readied itself for its “strategic growth agenda”. That includes new products, sales & marketing and business development. We now expect the second product to be announced in the 2020 financial year, and note that this is expected to weigh heavily on profit in the short term.

While the company did achieve record profit before tax and revenue in FY 2019, we note the (significant) exchange rate benefit in these results. Without that, revenue growth would have been 29% instead of 39%. This benefit is unlikely to be repeated and may in fact reverse in future periods, so it would be unwise to build a model based on sustained growth at those levels.

On the call the CEO said that the impact of upgrades to Trophon 2 was “quite minimal during the year… probably sub-100” in the US. That means the capital sales in the US were new installed growth and what they sold to GE into their inventory. This bodes well for the company's prediction that growth in capital sales remains at constant absolute levels. Over 30% of the current installed base is due for renewal in the next two years, and that replacement cycle, even if not well conformed to, should help.

Buy, Hold, or Sell?

Nanosonics is a profitable business with over $72 million in cash on hand. However, after the share price pop yesterday it has a market capitalisation of $1.95 billion, giving it an enterprise value of $1.88 billion. Against that, it produced free cash flow of $2.6 million in FY 2019, putting it on an astronomical EV / FCF ratio of 722. The company is now trading on 22 times revenue, which is pretty phenomenal given it is a medical device maker, rather than the sexiest software stock you've seen.

For contrast, Resmed (ASX:RMD) the sleep apnoeia device maker, trades on around 8 times sales and Cochlear (ASX:COH), the hearing implant company on around 8.5 times sales. For Nanosonics, even if we bullishly assumed 30% revenue growth for five next five years, and some margin improvement, returns from here would arguably be lacklustre.

As I have previously disclosed, I had already begun selling my Nanosonics shares, at lower levels. For the last year or more, I have been holding on to Nanosonics stock because I believed, correctly as it turns out, that the people who had short sold 13% of the company when the share price was under $3 would receive a severe lesson and be forced to cover at higher levels. With short interest now sitting at about 3%, that thesis has largely played out.

As such, I intend to take more profits from Nanosonics after publishing this report. Because I believe Nanosonics is a great quality company, I will almost certainly be retaining a small holding, so that I remain engaged with the business and capable of understanding it properly. I would very much like to participate in another short squeeze of such epic proportions in the future. I'll take an 100%+ gain in about a year whenever I can.

However, I strongly believe that the company is very generously priced at current levels. While the business could continue to perform very well over the long term, and the stock could become even more richly valued, to quote Andrew Page, "should growth not materialise as expected, the downside could be severe." He too, has taken some profits.

Nanosonics is a high quality business that is making the world a better place by reducing the transmission of the HPV virus, among others. That in turn reduces the number of people who get cervical cancer. That is very considerable pain and suffering alleviated. At current share prices, I will be doing some selling for sure, but am unlikely to sell out completely. I will likely sell in only small increments, as I am enjoying the sport of watching to see how ridiculous the price can get, and basking in the glow of what has to be one of the most satisfying short squeezes I have ever seen.

Thanks again to Andrew Page for helping with this article. We recommend you continue the conversation over at the Strawman forum for Nanosonics.

For occasional exclusive content, join the FREE Ethical Equities Newsletter.

Disclosure: Claude Walker owns shares as disclosed and will not buy any for at least 2 days after publication (but does intend to sell a few as disclosed).

This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.

If, somehow, you are not already using Sharesight, please consider signing up for a free trial on this link, and we will get a small contribution if you do decide to use the service (which in turn should save you money with your accountant, or time if you do your own tax.)

"The Ethical Equities website contains general financial advice and information only. That means the advice and information does not take into account your objectives, financial situation or needs. Because of that, you should consider if the information is appropriate to you and your needs, before acting on it. In addition, you should obtain and read the product disclosure statement (PDS) of the financial product before making a decision to acquire the financial product. We cannot guarantee the accuracy of the information on this website, including financial, taxation and legal information. Remember, past performance is not a reliable indicator of future performance."