Laserbond Limited (ASX:LBL) HY 2019 Results: Planning Pays Off

Surface engineering company Laserbond reported great results on Friday. Revenue was up 45% to $10.5 million as guided in January, but EBITDA exceeded guidance of $1.8 million coming in at $2.1 million and up 293% from last year. NPAT was up 635% to $1.2 million, operating cash flow jumped from $0.2 million to $1.8 million and free cash flow improved from $0.3 million to $1.8 million. Unusually for a manufacturer, investing cash flows were positive, although at least $0.5 million of expenditure is planned for the second half.

Turning to the balance sheet, cash of $2.8 million exceeds $2.5 million of financial liabilities. This was an improvement from a net debt position of around $0.5 million at the end of June 2018. Such cash generation is impressive in light of the strong growth the company is experiencing and enabled a substantial increase in the interim dividend from 0.2 cents to 0.5 cents.

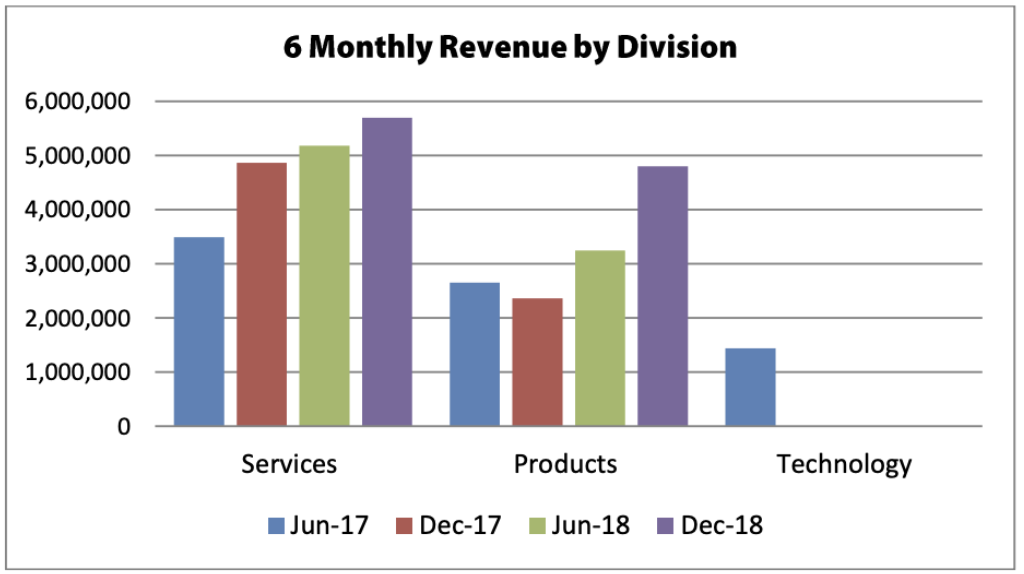

The products division was the key driver of growth in the half with revenue up 103% to $4.8 million and also saw an improvement in gross margin from 42.5% to 49.6% due to efficiencies of scale. Growth is expected to continue with the company recently winning its first orders from a US steel manufacturer at the end of last year for its Composite Carbide Steel Mill Rolls.

Meanwhile, the services division recorded revenue growth of 17% to $5.7 million and is also expected to continue growing. Furthermore, gross margins are expected to return to historical levels of around 50% in the next 12 months, up from 45% for the first half.

The technology division registered no sales in the half but the company incurred some costs related to a $1.8 million order with a UK multinational that will flow through as revenue in the second half. Management are confident of securing further deals in future.

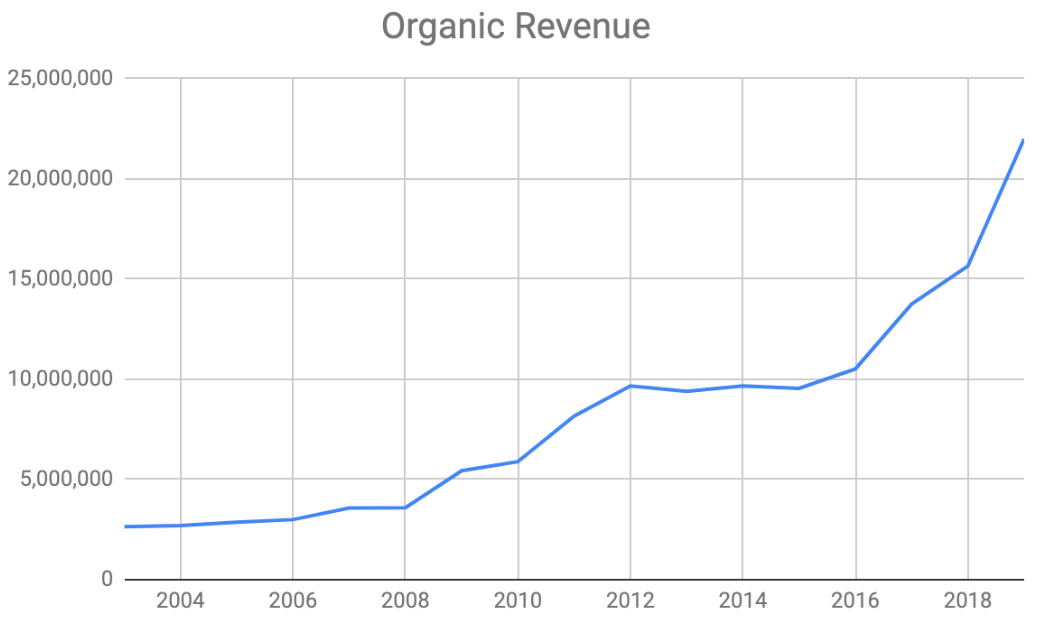

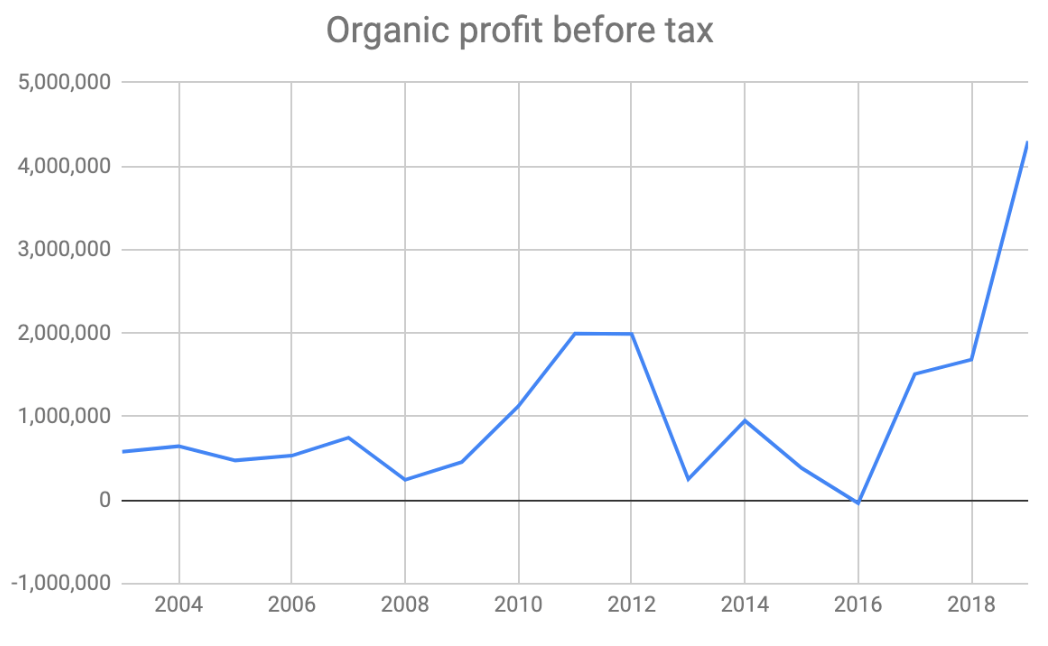

In light of all the above, my 2019 forecasts (included in the charts on the original writeup) look achievable. $22 million of revenue implies a repeat of H1 plus the UK technology sale. EBITDA of $4.3 million is just over double the first half result.

At Thursday’s closing share price of 38.5 cents, Laserbond is trading on an EV/NPAT in the mid teens using my EBITDA forecast for 2019 and adjusting for interest, depreciation and tax. History shows that Laserbond’s profitability can be volatile and so you could argue the company is fully valued at this multiple. However, I would point to the long-term revenue growth trajectory, the talented Hooper brothers who founded and still run the company, and the minimal share dilution that has occurred over the years.

Profit is unlikely to keep growing in a straight line from here and consequently there will probably be better opportunities to pick up some shares. But there may not, and if you believe in the long-term future of Laserbond then the shares are not particularly expensive at these prices.

I hold Laserbond shares and intend to continue holding while the growth story remains in tact. Assuming it does, I will be looking for an opportunity to add some more shares on any significant price weakness.

For those interested, this piece I wrote last year provides further detail on what the company does and its history. However, since writing that article, Laserbond’s share price has risen almost 100%.

Please feel free to sign up to the forums and let us know what you think!

For early access to our content, join the Ethical Equities Newsletter.

Note from Claude: Regrettably I did trim my position in Laserbond prior to these results, after the strong share price appreciation. That seems to be a mistake I make pretty often, and I'll put it down to the fact that I haven't followed the company very long, and I was trying to be too cute on valuation.

These results came in above my expectations. This is a very promising start to our coverage of Laserbond (all Matt). I will keep an eye on the share price and should there be a sell-off as a result of wider market malaise, then I would consider Laserbond a prime candidate for accumulation. So far I've been really impressed with what I've seen and if, as we increasingly believe, this is a good quality business run by honest and competent management, then they could achieve a lot in the long term.

Disclosure: Matt Brazier and Claude Walker both own shares in Laserbond at the time of publication, and will not buy or sell for at least two days after publication of this article. This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.