Laserbond (ASX:LBL): Guidance, Thesis Update And Site Visit

This is the third time that we have covered Laserbond. We first introduced the company in October 2018 and also reviewed the HY 2019 results.

Introduction

Last week I visited Laserbond’s Smeaton Grange facility and met with CEO Wayne Hooper and Financial Controller Matthew Twist. Wayne and Matthew were open, friendly and generous with their time. I spent three and a half hours on site, spending time in the company boardroom and having a tour of the shop floor including the R&D laboratory. The factory is more like a workshop as much of the work done at Smeaton Grange is bespoke services such as reclamation. The 5,400 m2 premises contains 2 laser systems and a High Pressure High Velocity Oxy Fuel (HP HVOF) thermal spray setup, but the majority of the space is used for machining.

Business Segments

Laserbond has three divisions which are Services, Products and Technology.

Services is where customers send their existing parts to Laserbond to be repaired or improved. The company has been offering services since it was founded in 1992 and it remains the largest segment by revenue. Services do not always involve extending life or using Laserbond’s proprietary technology and around 60% of group revenue is derived from laser cladding.

There is little in the way of competition for the Services business . Being close to the customer is critical as lead times dictate cost. There are a few small companies around the world that specialise in laser cladding, but they typically do not have a presence in Australia. The advantage of location is one reason why Laserbond is looking to expand geographically, but more on that later.

The Products division is the fastest growth area and manufactures parts which undergo laser cladding to extend useful life. Customers are mostly OEMs and Laserbond relies on two such customers for 46% of its total revenue. Laserbond provides OEMs with differentiation for their own products, which mitigates customer concentration risk.

Own brand products are yet to take off. There was a false start with the DTH Hammer released in 2015. The product has struggled to gain traction because it is only superior to cheaper Chinese alternatives in the harshest environments. Also, the DTH Hammer is designed for the Drill and Blast industry which is fragmented and so hard to sell into.

A more recent product, Composite Carbide Steel Mill Rolls, looks more promising. It lasts three times as long as competing parts, but is more than three times as expensive. Despite this, it saves customers money through reduced downtime. The product is currently used in Australian steel mills and is undergoing testing at five sites with a major US customer. The US steel industry is 15 times larger than Australia and so these steel mill rolls have the potential to become a significant contributor to revenue.

--

Correction thanks to Gregory Hooper, CTO and founder:

"Our Composite Carbide Steel Mill Rolls are lasting more than 5 times longer than competing parts and are less than double the price. This development would be regarded as step-change within the steel industry and addresses a costly wear issue that has been a problem for many decades. The manufacturing of our Composite Carbide Steel Mill Rolls utilises our Patent Pending Laser deposition method."

The current strategy for the Products division is to develop products where laser cladding provides an obvious advantage over existing alternatives. This could mean that the product range becomes thinly spread across a range of geographies and sectors instead of addressing a specific industry. In turn this may improve revenue diversification, but could also mean that fewer economies of scale are attainable. For example, the company would constantly need to break into new industries and its sales and marketing teams may remain unspecialised.

--

The Products division is perhaps more likely to encounter competition than Services as manufactured parts can be more easily distributed internationally. For example, Caterpillar carries out laser cladding internally on some of its products. Laserbond generated just $2.6 million in export sales last year and so the division is still too small (and will remain so for some time) to attract the attention of such competitors.

The company also licenses its laser cladding technology overseas, involving a large upfront fee for equipment and ongoing license fees of around $200 thousand per year for training and support. I had wondered if this could hurt Laserbond’s competitive position in the long-run, but learned that the company does not give away all of its knowhow when it sells a technology package. It is constantly innovating in any case and so the technology it sells becomes outdated over time.

The first technology deal was with a Chinese company and involved Laserbond receiving an ongoing percentage of the customer’s sales, but this has translated into little revenue to date. Management has learned from this and the latest sale, which was to a UK multinational, is based on hours of usage which can be monitored by Laserbond remotely.

Economic Moat

I believe Laserbond has a sustainable competitive advantage because of its R&D capability. It was the first to introduce HVOF to Australia in the early 1990s and created its first laser cladding system in 2001. Laserbond has improved that early laser setup significantly, both in terms of efficiency and quality, and still manufactures its own systems today. The reason it originally decided to manufacture its own equipment was because it was too expensive to buy it ready made. New entrants would have the same problem today. They would either have to go through years of learning to develop a similar solution in-house, or pay the likes of Laserbond to provide them with one at much greater cost and which would need upgrading over time.

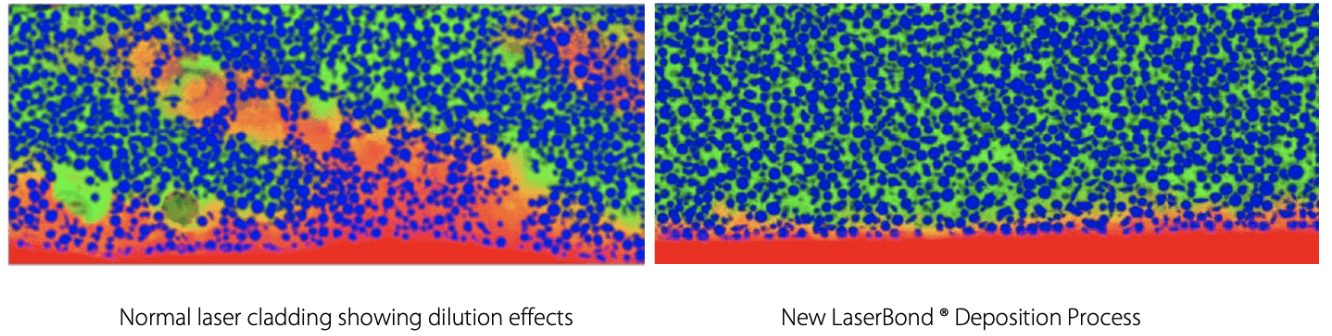

The three colours in the pictures above represent different elements. The improvement from the left panel to the right panel typically represents a doubling of useful life for a product. The breakthrough was developed by Laserbond in 2014 and patents are still pending. The company believes its laser cladding technology is the best in the world.

The other element of Laserbond’s moat is its expertise of knowing which solution to apply in each application. For example, spray surfaces are a good solution for corrosion, but do not stand up so well to wear as there is no metallurgical bond. Alternatively, some materials cannot be welded as heat from the process breaks down their qualities.

Laserbond has demonstrated and refined its expertise over many years developing strong relationships with customers in the process. Some of these customers are now willing to buy products from Laserbond because of this shared history. These relationships are critical as Laserbond’s products are usually more expensive than alternatives and so customers would probably not buy them unless they were convinced of their superiority.

As laser cladding is not necessary or even desirable in many cases, it may not make sense for a large equipment manufacturer to simply copy Laserbond’s technology and apply it to all their products. This could benefit Laserbond as it may leave exploitable gaps in the market which are too small to interest larger competitors. In this way, Laserbond could become a niche parts supplier to various industries over time. Added to this, selling spare parts is an intrinsic part of the business model of some manufacturers. It is not in their interest to significantly extend the life of such parts.

Historical Performance

Laserbond has achieved remarkably consistent sales growth over the years despite generating most of its revenue from the mining sector. This is for two reasons. It is growing relative to the broader industry and it is exposed to mine maintenance and not mine construction. Indeed, customers are perhaps more likely to look at extending the life of equipment during tough times rather than replacing it.

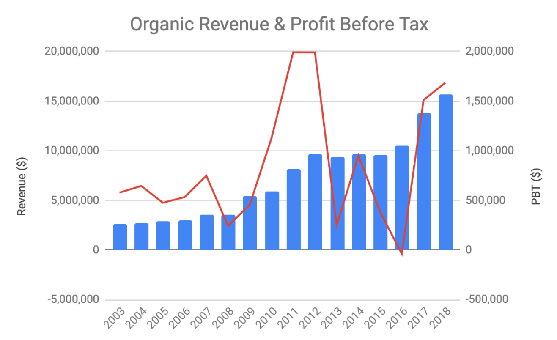

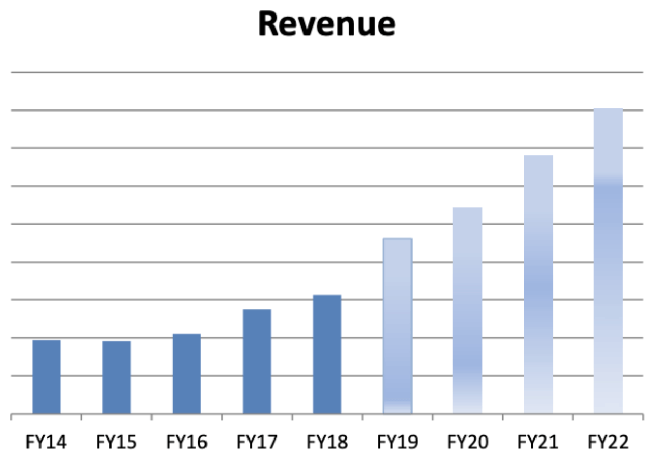

You can see below how revenue (the blue) has grown steadily over time, while profit before tax has swung around a bit.

Between 2013 to 2016 the mining industry contracted sharply coinciding with Laserbond’s expansion into South Australia and with it moving into a much larger facility in NSW. Consequently, operating costs increased substantially at a time when revenues plateaued impacting profitability.

Such volatility is also caused by a low base effect and so as Laserbond grows profitability should become more stable across the cycle. However, Laserbond is and will remain a business with high fixed costs, which must invest in advance of expected growth and so profitability will remain bumpy.

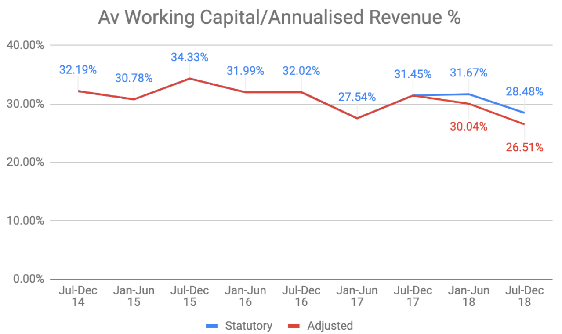

Various exceptional items relating to the upgrade of the Cavan laser rig and the recent UK technology sale are included in working capital at 30 June 2018 and 31 December 2018. Excluding these, in the first half of 2019 the average working capital to annualised sales ratio was 26.5%, its lowest level since the first half of 2015, as can be seen below.

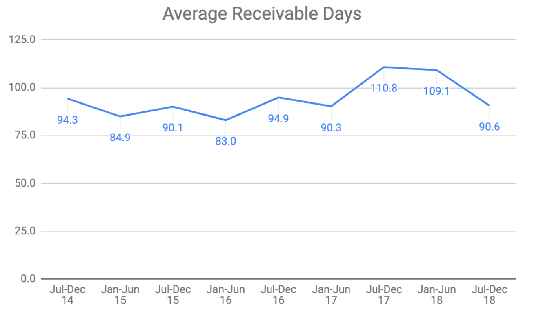

26.5% is still high and it is clear from breaking working capital down into its constituent parts that receivables is the main contributor. As can be seen below, receivables days have averaged around 3 months over recent years. This is a long time to wait to get paid and may say something about the balance of power in Laserbond’s relationship with its large OEM customers.

Outlook

Over the past couple of years, revenue growth has been strong and this looks set to continue. Currently, the company is experiencing a shortage of machining staff and has had to turn away some business for which it could not guarantee sufficient turnaround times. A lack of skills locally has led the company to source employees from overseas. It has experienced significant delays in doing so due to the recent government transition from the 457 to the Skilled Migrant visa program. Hopefully, this is a one time only event and such delays are not repeated in the future.

The above chart is taken from the latest investor presentation and includes forecasts from FY 2019 onwards. Horizontal lines mark $5 million increments and so the FY 2022 forecast is $40 million. In the context of the above figures, it is worth considering that Laserbond’s revenue visibility is limited as its sales cycle is only a few weeks long and the company has a missed forecasts in the past.

The following chart was taken from the 2015 Annual Report and includes forecasts at the time.

As you can see below, these targets haven’t yet quite been reached, and it has taken a couple of years longer than anticipated. The main reason for the lag is that the DTH Hammer product did not take-off as hoped.

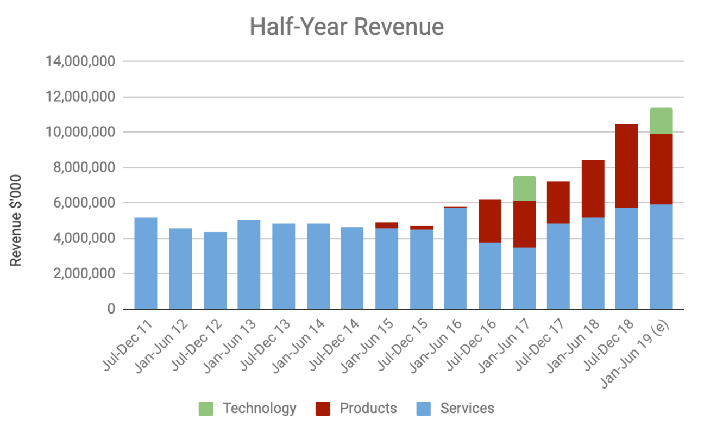

From July 2016 the Products division includes OEM products (previously in Services). Jan-Jun 19 figures are based on the mid-point of FY 2019 company guidance.

Aside from missing revenue targets, there is also a risk that focus on growth comes at the expense of returns. The company has publicly stated that it is looking to expand geographically, either through an acquisition or a greenfield site. Strong sales growth means funding is tight and so such a move would likely be accompanied by a capital raising, as was the case when Laserbond expanded into Queensland and South Australia. However, if geographical expansion happens, it would probably only require a small raising.

The company has expanded into Queensland and South Australia previously. The Queensland expansion was via the ill-fated acquisition of Peachey’s Engineering in 2008 and later disposed of in 2013. A number of unfortunate events unfolded following the acquisition of Peachey’s. A family tragedy impacted the long-standing manager of the business, it was dependent on work from Rio Tinto which scaled back operations in the area and the LNG boom caused high wage and rental inflation.

The South Australia expansion has been much smoother. Laserbond opened a greenfield site in Cavan in 2013, towards the end of the mining boom. Although this meant that growth was slow in the first couple of years, it gave the company the opportunity to develop valuable R&D significantly improving the performance of its laser cladding technology (as per the coloured images from earlier in this article).

Laserbond recently replaced the laser at its South Australia operation. The new unit cost around $0.5 million and its installation has led to a reduction of around $100 thousand per year in energy costs. In addition, production output has doubled. Further improvements will come from the installation of a second laser in the next couple of months. The two lasers will be controlled by a new robot system, allowing one person to operate both lasers whilst reducing downtime. Similar opportunities exist to upgrade the two lasers in NSW, where there is also the opportunity to add a third. Such investments promise excellent returns on investment.

Clearly, there exists spare capacity within existing facilities. Smeaton Grange currently operates on two shifts rather than three and as stated above could take another laser. A second laser is about to be installed in Cavan. The fact that the company is looking to add another site despite an apparent surplus of spare capacity may say something about the wealth of sales opportunities that lie ahead. It may also be related to a buoyant share price.

Valuation

Laserbond’s share price has roughly doubled since listing in 2007 at 20 cents. Grossed up dividends represent a further 6 cents to give a total return of 130% in just over 11 years, or 7.6% compounded per year. This is a decent performance, but I own Laserbond shares because I am expecting better returns in the future.

If management’s FY 2022 forecast is achieved then today’s share price of 40 cents, representing a market capitalisation of around $40 million, will appear cheap. Assuming 12% net profit margins, the stock would be trading on a FY 2022 price-to-earnings (PE) multiple of 8 assuming minimal dilution between now and then.

UK listed Bodycote is the global market leader in heat treatment, dwarfing its nearest competitor. Like Laserbond it offers surface engineering technologies such as HVOF, but crucially does not currently offer laser cladding. Neither does it have operations in Australia.

Bodycote generates strong returns on capital, also experiences stable revenue combined with lumpy profit and trades on a mid-teens forward PE multiple. Laserbond trades on a similar multiple and is growing much faster than Bodycote so is arguably relatively undervalued.

Conclusion

I remain a supporter of Laserbond as it has many features that I look for in an investment. Management are entrepreneurial, long-standing and their interests are well aligned with shareholders. Laserbond’s R&D capability provides it with an economic moat and it has few competitors. Although the business is exposed to the mining cycle and dependent on some large OEM customers, it is becoming more diversified. The company is undergoing rapid sales growth and management has an abundance of excellent capital allocation opportunities.

There is a risk that the mining sector turns down in the near term and takes Laserbond’s profits (and share price) with it, as happened in 2012. But it is also possible that the company achieves its sales targets over the next few years and richly rewards investors in the process. In the first scenario I will probably sell my shares and look for an opportunity to re-enter when conditions improve. Otherwise, I intend to keep hold of my shares as long as the company continues to improve and the share price remains sensible.

Disclosure: Matt Brazier and Claude Walker both own shares in Laserbond and will not trade for at least two full trading days following publication. This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.

Remember: Email Subscribers Get Hidden Research First

Only subscribers to the Ethical Equities newsletter receive our best and most actionable research. Sign up here to automatically receive a link to this hidden content.

Dear reader,

Ethical Equities costs thousands per year to run.

If you'd like to see us thrive, and you don't yet have a Sharesight account, please consider signing up for a free trial on this link, and we will get a small contribution if you do decide to use the service (which in turn should save you money with your accountant, or time if you do your own tax.) And on top of that you can get 2 months free added to an annual subscription.