I often get asked by investors for suggestions about investing in Exchange Traded Funds (ETFs) and Listed Investment Companies (LIC).

While ETFs are a great modern tool for gaining instant portfolio diversification, far too many investors misunderstand what a listed investment company is. A listed investment company is where you invest with a manager, but you can't even be assured that you will be able to sell your investment at its true net asset value. As such, you should generally only ever buy an LIC at a discount to net asset value.

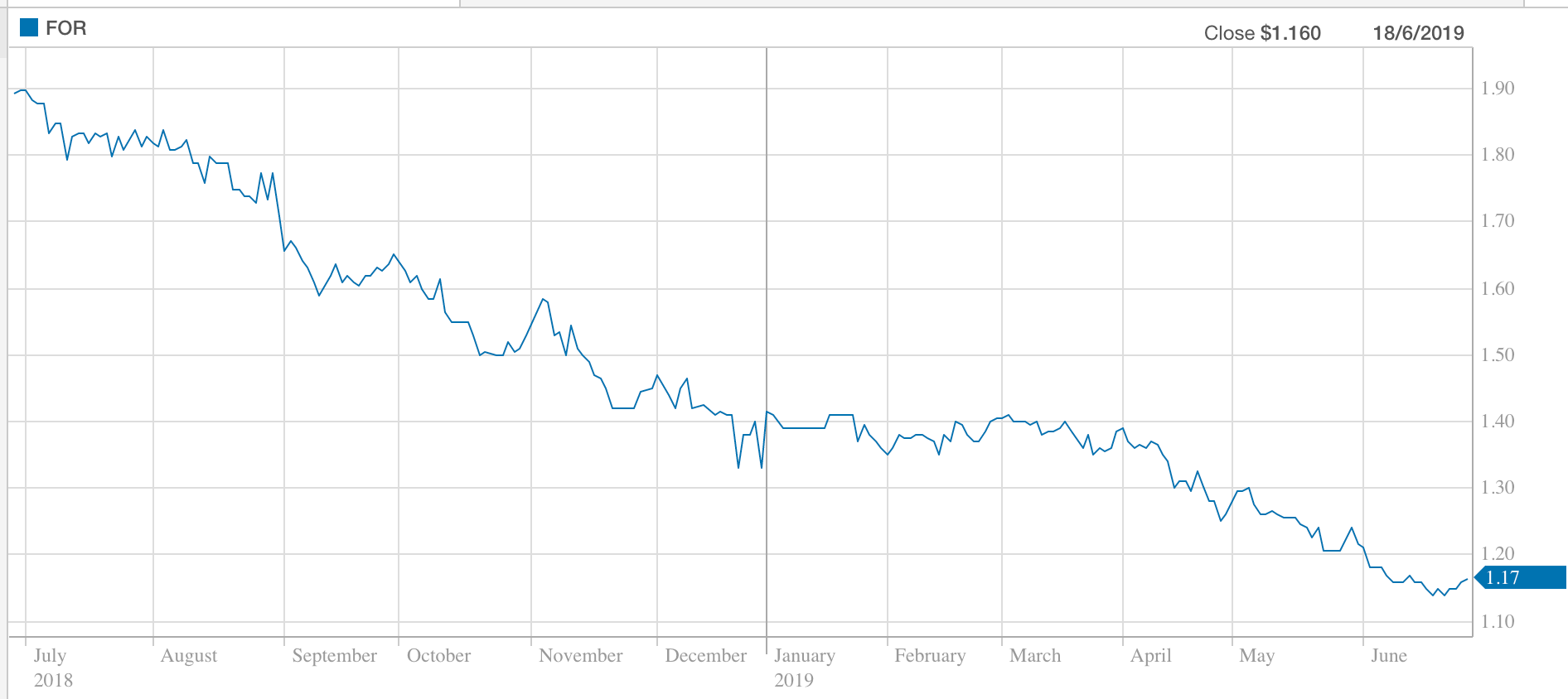

The Forager Australian Shares Fund (ASX:FOR) provides a useful cautionary tale in this regard. One year ago shares traded at $1.90, which was a premium to the net asset value (NAV). Anyone buying on that day was basically either betting that the premium would be maintained (greater fool theory) or that the investment returns would be so good that it would justify the premium. The fact that there was a "deep value" fund trading at a premium to NAV was a sharp irony, apparently lost on many.

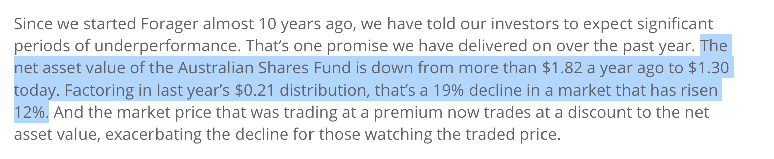

To their credit Forager has publicly reflected on this performance by looking at their Net Asset Value taken from yesterday which has the effect of including the larger dividend paid previously. To wit:

However, that calculus changes today, and I believe a truer picture of investor returns (and therefore sentiment) can be deduced by looking at the actual price paid, and then the potential price received.

If you take the performance from June 28, instead of June 27, the Forager Australian Shares Fund has declared a dividend of 1.35 cents for the period, and the share price has declined from $1.90 to $1.17. That's a decline of about 35% in a market that is up over 10%. If that doesn't have investors re-thinking their strategy, then what will? While it's true that the actual investment performance in the fund has been better, that is of scant comfort to the investors, highlighting the harsh realities of investing in a LIC. Investors who are rethinking the strategy must now find a buyer, and after that underperformance, buyers are harder to find. This highlights the pro-cyclical insanity of paying a premium for a deep value fund. But will the same investors who paid that premium now sell at a discount?

Is ASX:FOR Undervalued?

Forager NAV is currently $1.28, but the share price is $1.17, an 8.5% discount to Net Asset Value. Despite the crushing nature of an LIC (for investors), it is surely a structure any fund manager would lust after, so I can't blame them for taking the opportunity when it was there. Management seem honest and competent, although I find it confusing that they ignored my warning that Freedom Insurance was a sell, and continued to hold.

Since I could scarcely be more stylistically divergent from Forager, I follow their disclosures, because if I ever agree with them on anything, then that is interesting to me. Dicker Data (ASX:DDR) is an example of a stock I have held that they have also held (although it's a big position for me, and it's not in their top 5 holdings, and I don't know if they still hold it.)

In any event, I think their current cohort of major holdings still hold some high risk/ low reward investments such as Thorn Group (ASX:TGA), which has $300m in debt against a $45m market cap, and Experience Co (ASX:EXP), which is relying on tourist growth in North Queensland. However, there are also some higher quality businesses such as Carsales (ASX:CAR), which seems to to have a better risk-reward profile, despite being a pro-cyclical business.

Most importantly, it is true that growth stocks have been hoovering up capital which has generally fled lower-growth "value" stocks. Should that tide change, we could see an improvement in performance by Forager. If they are able to outperform in the coming year, that might have the flow on effect of narrowing the discount to net asset value. As such, if the market were flat, and Forager generated a 5% return, then the discount might narrow to 5%. That would mean a gain of perhaps 8% in a flat market. I think with the current discount the downslide from a widening of the discount is, at least, limited.

Therefore, I tend towards the view that units in Forager (ASX:FOR) are currently mildly undervalued.

Ultimately, I wouldn't invest in Forager because it invests in companies like Thorn Group, which has a history of breaking consumer laws, thus harming customers. However, I do think it is ironic that growth investors could use some profits from hot growth stocks to buy discounted units in a "deep value" fund from the same "deep value" investors who preferred premium-priced units in a "deep value" fund over growth stocks, one year ago.

Disclosure: The author, Claude Walker, owns shares in Dicker Data and will not sell them for at least 2 days following the publishing of this article.

For early access to our content, join the Ethical Equities Newsletter.

Ethical Equities is currently underfunded. If you don't yet use Sharesight, please consider signing up for a free trial on this link, and we will get a small contribution if you do decide to use the service (which in turn should save you money with your accountant, or time if you do your own tax.) Better yet, you can get 2 months free added to an annual subscription.

This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.