The purpose of this article is to follow up on comments I made available to Newsletter subscribers about a month ago.

On the 17th of June, in the hidden report on Codan, I wrote:

I would love to be able to provide more in depth research to you right now, but alas, time does not permit it. I expect the share price to remain volatile for a while. At $1.50, the PE under the hypothetical worst case scenario would be just of 13, which is not outrageously high, but not a bargain either. Shares are currently trading at $1.65. A lot of hot money will be selling over the next few days, and you never know how low it might get, but even at current prices, I think Codan is undervalued, and I bought a few shares this morning. However, I am going to consider the position carefully over the coming week, and I consider my purchase a “research position” – the perfect incentive to take a closer look at the company.

The low on that day was $1.60. In the subsequent weeks, Codan shares went as low as $1.47. On the 18th and 19th of June, no fewer than five of the eight directors bought shares at prices ranging from $1.56 to $1.60. The shares are currently trading at $1.85. For someone who bought shares at $1.60, that’s over 15% return in a month.

As a recent buyer myself, I am now considering whether I would like to be a long term shareholder and I’d like to share some of the concerns I have about Codan.

Their radio business in unlikely to earn much: their recent acquisition should earn about $1.2 million to NPAT at a minimum. Their mining services devision is even losing money, albeit a relatively small amount. Codan announced that its full year profit would be $45 million.

Minelab is the good business. It sells metal detectors in many countries in the world, and reportedly has the best product. It faces a risk from cheap imitators and we must conservatively assume that Chinese companies already have their proprietary IP.

Fortunately for Codan, the brand and quality control is very important, especially as faulty metal detectors result in people dying where they are used to find land mines. Similarly, trust in the equipment is important when looking for gold or coins.

The previous guidance – for a repeat of the first half in the second half – would have resulted in a profit of about $53 million. In April, the company responded to this price query by saying that it did not know of any information that could have caused the sudden drop in share price. I find it hard to believe that sales into the African markets were not slowing at that time. However, because Codan supplies distributors in those countries, it may not yet have dawned on them that unrest was making it impossible to sell their metal detectors.

If we assume that they were on track to deliver $53 million in April, at that stage they had already made about $39.5 million. In that scenario, since April the company has made just $5.5 million. That would imply a NPAT of $22 million a year, broadly in line with FY2012 and FY2011 ($23.1 million and $21.8 million respectively).In the profit downgrade, the company said:

“The African markets that are currently being impacted by civil unrest are due to hold government elections early in FY14. With the return to more stable trading conditions, coupled with the work to develop more new gold detecting markets for our products, the Board remains confident that the company is well-placed for a successful FY14.”

This inspired me to speculate as to what markets are being impacted. I believe that the main impacted markets are Mali and Guinea. That is because both of those countries descended into instability as a result of the Malian coup (they both have armed Islamist fighters, and are neighbours). Both of these countries are also major gold producers, so I wouldn't be surprised if Codan was selling metal detectors into these markets. Evidently, there is gold to be found.

If that is the case then the dates to watch are 28 July and 24 September 2013. These are the election dates of Mali and Guinea respectively (fits the bill, right?). All indications are that the Malian elections will be a complete farce. Based on what the Australian Government says, I wouldn't want to live in Guinea, either. I think that the unrest will continue for a while. Maybe even years.

Finally, no-one seems to be talking about it, but I’m a bit worried about the fact that Codan secure networks were reportedly hacked by the Chinese. Four corners covered the breach, probably resulting from a Codan executive using free Wi-Fi in China.

How much would I buy Codan for

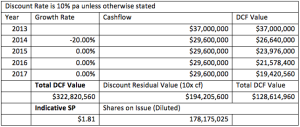

I therefore think we should assume that underlying NPAT is $22 million (in line with the last two years). If we average the cashflow for those two years, we get $33 million. In the first half of this year, cashflow was $22 million. I’ve simulated a discounted cashflow model, to get an idea about what kind of returns Codan would be likely to generate for holders. In this model, I assume cashflow for 2013 to be $37 million, then I assume it will contract to just below $30 million as a result of the inability to sell into certain African markets in 2014. I then assume there will be no growth, but that Codan will fetch 10x cashflow in 2017.

The Author owns shares in Codan. None of the above is advice.

The Author owns shares in Codan. None of the above is advice.

Edit: Please note I subsequently sold my shares for an average price of just under $2, as described to subscribers in this article.

It's free to receive the monthly Newsletter.

Codan is not a good organisation... there are too many bosses.

LinkThey are spending a lot of money on management, that is why the share price has gone

down a lot.

[Edited for quality and grammar]

Hi James,

LinkAs I point out in <a href="http://ethicalequities.com.au/why-im-no-longer-interested-in-codan-asx-cda/" rel="nofollow">this article</a>, the share price is going down because of a massive drop in sales to Africa, and underperformance of the other divisions.