I won't be posting much research on this website for a while, so it's fitting that I bow out with a public note on 1300 Smiles Limited (ASX: ONT).

But first, let me declare my bias. I like Dr Daryl Holmes, the CEO, on a personal level - he seems like a trustworthy person, and not just because of the exceptional value he has created for shareholders.

One CEO I quite like has a private driver whisk him away from the AGM - taking two beers for the road. Another has his own super yacht. But 1300 Smiles has a CEO who catches the train to meetings with bankers and speaks proudly of the charity boat he has helped fund and also helps staff as a dentist. As with Australian Ethical Investments Limited (ASX: AEF), not only are 1300 Smiles shareholders automatic philanthropists, but the profitable activities of the company help build a better society. That's because the company's strategy is to make dentistry services accessible to the widest possible segment of society, by keeping costs low.

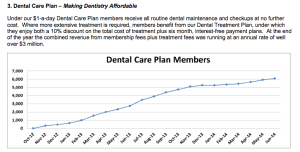

It's the personnel - all of them - that make this company great, but shareholders and patients are also conspiring to support a good cause, because 5% of the ongoing payments received from all new members in the 1300 Smiles $1-a day Dental Care Plan are donated to YWAM Medical Ships. This ongoing funding will assist YWAM to address critical oral health problems in some of PNG’s most remote and vulnerable communities.

And before I touch on my recent chat with Dr Holmes, we should take a quick look at his best yet annual letter to shareholders. I particularly recommend his soap-box moments - they are essential to understand the numbers.

But first, here's my favourite bit (click image to enlarge):

Update 27/11/2014 -- The company has kindly included an updated graph of the Dental Care Plan Members in the AGM address by Dr Daryl Holmes (which I suggest you read).

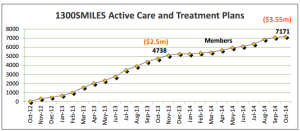

And of course, we shareholders should always keep an eye on this important metric (click image to enlarge):

I met with Dr Holmes recently for a coffee and we covered a few different topics - nothing you can't find for yourself. However, I will give some of my impressions.

It seems possible debt might come into the mix again, now that the company is running a bit low on cash, after the excellent BOH Dental acquisition. As you might have guessed from past history, the company would consider taking alone if the right opportunity to acquire presents before cash is replenished. Dr Holmes attitude towards debt seems not to have changed.

On the subject of acquisitions, once you talk to Dr Holmes in person you can really see that he's still happy with the BOH acquisition - certainly, it appears we have brought on board some of the foremost talent in the industry. Even when some of the older dentists retire (and this goes for multiple practices) there seems to be top performing younger dentists ready to fill their shoes.

Like me, Dr Holmes is pleased with the recurring revenue generated by the Dental Health Care Plan, although we do take some credit risk with that one - a fact often forgotten in good times. Nonetheless, the inspired program is bringing in millions of dollars a year already, and it hasn't even been running for long! Shhhh....

As for valuation, well, I'm not in the mood to share, but I will say I am considering entering the market again myself (as a buyer, if this current sell-down spreads). We shareholders remain stubbornly attached to our holdings.

Possibly the biggest single reason for that is the top-notch capital allocator running the show. Buying a share in 1300 Smiles is giving your capital to Dr Holmes and his team to allocate it as they see fit. History shows that they buy and run dental practices profitably, with an eye to community wellbeing, and charitable hearts. At current prices, the dividend is superior to a bank account if you take into account franking credits, and I expect it will grow over time. I would rate the chances of shareholders being treated poorly as low.

One thing I thought was interesting is when asked about the company's investment in Dental Members Australia, Dr Holmes simply said it was an opportunistic bargain. The way I see it, if he keeps gradually expanding his circle of capital allocation competence, shareholders will probably do very well over time.

Thanks for reading everyone, but we're out of time.

The Author owns shares in 1300 Smiles. Nothing on this website is advice, ever. This post is for entertainment (and for my own reference!)

Please do follow me on twitter @claudedwalker.

The Free Newsletter is going on indefinite hiatus but you can sign up to receive the older hidden research (including my original 1300 Smiles Notes)

Claude

LinkThanks for sharing part of your journey.

Thank you for your posts. You've helped others to invest more ethically too. Much appreciation.

Link