It wasn't until I went to do another update on the Hypothetical Ethical Portfolio that I noticed that the last update significantly understated my hypothetical returns.

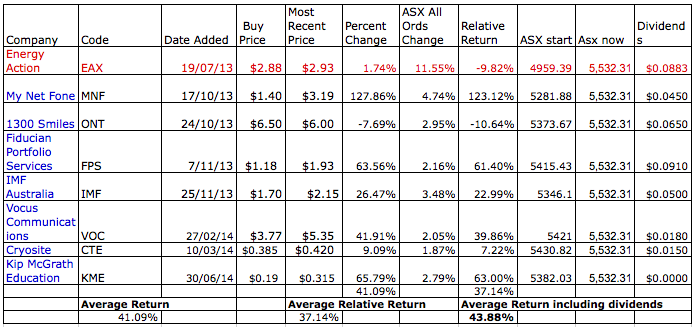

Whatever: the point is that as of the 12th of September 2014 the hypothetical picks are up an average of 43.88% when including dividends, and are outperforming the market by an average of 37.14%, based on an average time period of less than a year. The ASX All Ordinaries are at 5,532.310, for the record.

Anyway, it's important to note that the returns are majorly skewed by My Net Fone - which has returned over 125%.

So what's my secret?

Luck, of course. Take out My Net Fone and Fiducian Portfolio Services, and my outperformance wouldn't look so good. With the removal of Energy Action, which I also sold in real life, the portfolio only has 7 holdings, well below that of a decently diverse portfolio.

A friend recently asked me "How do you choose what goes into the hypothetical ethical portfolio?"

That's a good question, and even an avid reader of the full history of the hypothetical ethical portfolio, would struggle to spot a pattern because...

The hypothetical ethical share portfolio has no proper strategy.

The first 3 picks were simply the 3 most recent posts I'd done at that time, that I actually owned shares in myself, but since then I chose companies that I would buy myself, and that I think have better long-term prospects than the market is giving them credit for. The main criteria is that I actually get my act together and write it up before the price gets away from me. Personally I severely regret not adding Servcorp and Capilano Honey to the portfolio, since I was planning to but just never really got around to it before the share prices increased significantly. Generally, I only add high-conviction picks to the hypothetical portfolio, although it is also supposed to be a learning process for me.

The point of the portfolio is simply to prove that a moderately intelligent person can easily beat the market while avoiding investments that harm society or the environment. You can do that more ways than one, and I'm sure many of you are.

Please note that Energy Action has been sold from the Hypothetical Ethical Porftolio - an intention I signalled prior to open of trading on the day the report was released. I've frozen the "Most recent price" at $2.93, which is below the price it traded on open, which was $3. I've done this because of Dean's somewhat reasonable critique of my original plan to add Vocus at $3.50 on a day that the share price spiked to $3.77. I ended up adding it at $3.77, as you can see below. It would have been easy for someone to sell Energy Action shares at $2.93 if they read the report when it was released.

Nothing on this website is advice, ever. I hold positions in Cryosite Limited ASX:CTE, Fiducian Portfolio Services Limited, ASX:FPS, Vocus Communications Limited, ASX:VOC, 1300 Smiles Limited, ASX:ONT, My Net Fone Limited, ASX:MNF, Bentham IMF Limited, ASX:IMF and Kip McGrath Education Centres Limited, ASX:KME.

Newsletter subscribers get (monthly-ish) emails when I write my best content, that’s just the way it is.

The Hypothetical Ethical Share Portfolio

Follow @claudedwalker