I’m going to keep it short and sweet. I’ve sold out of all my Affinity Education Limited (ASX:AFJ) because my thesis is broken. In my very recent article on the company, I compared Affinity Education to G8 Education Group. I wrote:

Maybe Affinity Education has bought the worst Childcare Centres on the market, or their centres are simply not as impressive as G8′s. Because of a relatively short history as a company, we just don’t know when it comes to Affinity Education.However, I’m happy to hitch my wagon to the master of operations at Affinity Education, Gabriel Giufre. Ms Giufre has 14 years of experience working in childcare, is a major shareholder, and build up Eternal Echoes Pty Ltd, a company that sold its management rights to Affinity. She will be assisted by Ms Fiona Alston, who seems like the kind of person who will make sure that the childcare centres nurture their young charges. If these women deliver, I think Affinity Education will be rerated.

I can no longer support these propositions (they may be true, they may not be true). The sentence in bold is no longer true. This thesis is broken.

If you look around, you will realise you are at a website called Ethical Equities. It's called this for a reason. I seek only to invest in ethical companies: it is not unknown for companies on this website to be criticised by readers, after all everyone has their own ethics. I have been convinced that Affinity does not belong on this site.

Gabriel Giufre is married to one Samuel Christopher Giufre a.k.a Christopher Samuel Giufre. This fellow is currently being sued in Queensland. One of the people suing him has a litigation guardian (the other is Westpac). The court has not ruled on Chris Giufre's cases. He might be entirely innocent.

These facts prevent me having the level of confidence in the company that I previously had. Affinity Education is removed from the Hypothetical Ethical Share Portfolio at $1.50 (yesterday's close - I updated the old article yesterday to reflect this), and if you have a problem with this, I suggest you find out why somebody who requires a litigation guardian is suing him.

At any rate, none of this reflects whatsoever on Affinity Health, I just have particularly pedantic standards of risk management, plenty of fish in the ASX All Ordinaries.

This is the only mention Chris Giufre gets in the Affinity Education Prospectus [my bold]:

Gabriel Giufre holds an indirect interest in eight of the Managed Centres. Gabriel’s interests arise either as a result of her husband Chris Giufre being a director of a company that owns a Managed Centre, or companies in which Mr Giufre has a direct of indirect shareholding in turn owning shares in the owner of a Managed Centre, or Gabriel being a potential beneficiary under a discretionary trust, the trustee of which holds an interest in one or more of the Managed Centres. Gabriel does not have any active role in any of entities that own the Managed Centres.

-----

Affinity Education bought the management rights of 11 childcare centres from Eternity Echoes Pty Ltd, a company controlled by the Giufres. Eternity Echoes is a top 20 holder of Affinity Education. According to the prospectus, “The business assets of Eternal Echoes will be acquired for $1 million of equity with the majority of the acquired assets represented in goodwill.”

------

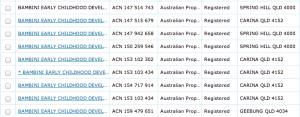

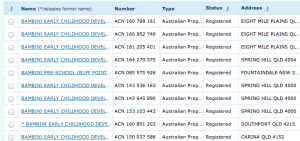

Affinity Education also bought a childcare centre from Bambini Early Childhood Development Boyne Island Pty Ltd, of which Gabriel Giufre is a director and shareholder. This acquisition was made with cash and shares. To quote the prospectus: “all but one of the Owned Centres will be receiving cash as consideration.” Incidentally, Chris Giufre is apparently the founder of Bambini Early Childhood Development. I found this presumably out of date information on Zoom.info:

"Chris also founded the Bambini Early Childhood Development Group in 2006, and is involved in all aspects of the business which include acquisitions, design, construct and supervision of operational management to develop prestigious childcare centres in Queensland. His focus is to manage the company's continued growth and prosperity by collectively directing affairs and guiding the organisations consistent profitability. Chris is actively implementing a vision targeting the niche sector set to challenge mainstream childcare to sustain a competitive advantage."

--------

The prospectus says:

"Affinity Education is acquiring the management business of Eternal Echoes (the Management Entity), which has operated and managed a number of child care centres since being founded in 2005"

----------

Here's some more publicly available info:

----------

----------

----------

-------------

So, I feel pretty bad about altering my opinion so quickly. Maybe share price will continue to go up... I think this business is about buying smaller businesses for, say, 4 x EBIT and then being priced on the market at 6 x EBIT, or whatever. It just goes to show that publishing a thesis is a great way to have it tested. Thanks.

The Author has no financial interest in Affinity Education. Nothing on this website is advice, ever. This post is for my own reference!

Sign up to the Free Newsletter to receive the best research, first.

<img src="http://ethicalequities.com.au/wp-content/uploads/2015/01/More-Guifre.png" alt="http://ethicalequities.com.au/wp-content/uploads/2015/01/More-Guifre.png" />

Link

Well catchy headline Claude but it's probably a bit early to make such comparisons.

LinkABC went under from too much debt. They overpaid for many assets including the takeover of listed entities here and in the US. At this stage of the game AFJ has limited debt as the first group of centres have been paid for with equity.

If you're looking for the next ABC, despite its great run so far G8 is the company that has the geared balance sheet along with a huge amount of intangibles.

If you're looking for [edit: management that may not be up to scratch] you only have to go as far has the G8 MD, Chris Scott. His previous listed company, S8 had a long running legal dispute with unit owners. In the end Scott was fined $130k and received a life ban from operating as a letting agent in QLD. He was also fortunate the OFT withdrew criminal allegations that to attempted to give false and misleading documents to an OFT official while an S8 director. Google Chris Scott

So, if you can't run a letting business why not move on to childcare?!

Hi Mark,

LinkYes, you're right...

Headline changed accordingly.

I originally called it "Is Affinity the next ABC Learning" as a mirror to my last article. You make good points.

As usual, your comments are much appreciated here. Thanks.

Thanks for your contribution on Affinity Education. There are many facets of this company that I don't understand, but let's just consider one: Market communications.

LinkFirst, I don't understand why the company has not released any information to the market about the progress of service integrations. Putting to one side the obligatory ASX notices regarding changes in substantial holdings and a handful of acquisition notices, there have been no market announcements since listing in December 2013. I don't know if this is usual for an IPO, but in this specific case I do find it surprising. For example, one of the material risks flagged in the Prospectus was that the services in the company may operate for a period without CCB Approval status whilst the change in ownership was resolved. In short, this means that for the period in which a service hadn't been granted this status, families attending the service would not have been able to receive childcare benefit or childcare rebate. A quick scan of the ACECQA website suggests that Affinity has sucessfully navigated this risk, but it would reassure the market if Affinity communicated this. Additionally, I would have thought that the company would be in a position to start releasing some financial guidance, especially given that the company has now seen through the Dec-Jan period which they had identified in their prospectus as being the most difficult time of the year for trading.

Second, I don't understand why the company has not attempted to reconcile two very different views about the size of the childcare sector in Australia. Affinity, in its prospectus and in attributed comments published in the AFR, leads the reader to conclude that there are upwards of 4,800 long day care services available for purchase and consolidation; G8 education in two separate presentations made available on the ASX since November 2013 describes the 'addressable market' as being approximately 4,000 services. Affinity's assessment of the size of the market for purchase is flawed. To the best of my knowledge the company has not issued a clarifying statement.

My first observation above goes to the topic of materiality; my second to an attitude to disclosure. Isn't a lack of investor information enough to preclude Affinity from being considered as an 'Ethical Investment'?

Hi Karl,

LinkThanks so much for your well-considered comment. You ask:

"Isn’t a lack of investor information enough to preclude Affinity from being considered as an ‘Ethical Investment’?"

The answer to that would depend on the facts of the situation, but put simply the answer is: "It may do"

Generally speaking, lack of good communication would be a reason for me to avoid an investment on commercial reasons. Having said that: I don't expect the wider market to agree with me, and I believe on the balance of probabilities the AFJ share price will continue to re-rate (at least over the medium term). I want no part of it, as you know.

Thanks for your contribution.