Answer: No. The buy thesis is broken by announcement dated 3/6/2014. Update to come.

Update 3/6/2014: The original research has been coloured an annoying green colour because I no longer stand by it. I am keeping it here because I don't want to whitewash it. However, I don't encourage people read.

When I wrote the below research Resonance Health was trading in basically the same range it is currently trading, 4.7c -5c. However, since then a lot has happened and I written this update on Resonance Health Limited ASX:RHT.

An interesting new addition to my watch list operates within the nexus of medicine and technology. Its name is Resonance Health Limited (ASX: RHT). Resonance health owns software that analyses data obtained through magnetic resonance imaging (MRI) of a patient's liver to determine an accurate measurement of liver iron concentration. No new equipment is required at the diagnostic site, although the MRI clinic does need to send the scan to Resonance for analysis. After 2 business days, Resonance Health sends the analytical report of the patients liver iron concentration back to the MRI centre, and the doctors take it from there.

The big reason that I think Ferriscan will continue to be used more often is because in some instances it replaces an actual liver biopsy. The advantage is not so much improved accuracy as it is lower cost and less pain for the patient. That means, that patients and insurers would generally support the process. Furthermore, I suspect (purely intuitively) that medical professionals are more likely to take up a new technology when they know that it will reduce patient trauma. Indeed, I believe patient welfare is either the most common or second most common motivation for people to become doctors.

Ferriscan definitely faces competition, but it was pleasing to see it was named in this academic article. The most recent half yearly report stated that “The volume of image analysis services provided by the Company in the 6 month period was 35% higher than in the corresponding half-year, resulting in an increase in sales revenues to $1,048,869 for the half-year.” However, it's worth noting that a mention in an article doesn't mean much, and there are definitely other ways to diagnose liver iron content. It's simply not clear that Ferriscan is the best. Nonetheless, the sales in the USA indicate that doctors can be convinced to use it.

The company has a two other products in the pipeline. One for diagnosing fatty liver disease and one for liver fibrosis. The most important (and next to be commercialised) is HepaFat scan, a diagnostic tool for – yep you guessed it – diagnosing and monitoring fatty liver. This is not completely novel by any means. To quote an academic article abstract published in 2009: “Several magnetic resonance (MR) imaging-based techniques--including chemical shift imaging, frequency-selective imaging, and MR spectroscopy--are currently in clinical use for the detection and quantification of fat-water admixtures, with each technique having important advantages, disadvantages, and limitations.” HepaFat scan has FDA 501(k) marketing approval on the basis that it is substantially equivalent to existing products. The hypothesis is that HepaFat scan will replace some biopsies (with the support of insurers and patients). However, as a doctor friend of mine pointed out, a biopsy is a sample and an MRI is a photo - you will generally be able to get more information from the sample (which surgeons can take from various parts of the liver).

The company “is currently investigating a number of commercialisation paths” for the HepaFat-Scan, though it was pleasing to read that it is “is now available to specialist clinicians and pharmaceutical companies developing therapies to address fatty liver disease using the same service delivery model as FerriScan.” That’s exactly what you want to read because it implies that the ROI on Hepa-Fat Scan will be better than FerriScan as the company can leverage existing systems and networks to roll-out the product.

Resonance Health Future Cashflow Valuation

The thesis for investing in Resonance Health assumes that the company isn’t far from becoming cashflow positive, and that the current capital raising will be the last. The company is currently raising capital at 5c per share to fund the commercialisation of HepaFat-Scan and the Liver Fibrosis test. I get a buy price of about 5c, assuming the capital raising is largely successful.

| Year | Growth Rate | Cashflow | DCF Value | FCF Improvement | |

| 0 | 2014 | -$200,000 | -$200,000 | ||

| 1 | 2015 | Maiden free cashflow | $150,000 | $135,000 | $350,000 |

| 2 | 2016 | 300.00% | $600,000 | $486,000 | $450,000 |

| 3 | 2017 | 80.00% | $1,080,000 | $787,320 | $480,000 |

| 4 | 2018 | 45.00% | $1,566,000 | $1,027,453 | $486,000 |

| 5 | 2019 | 30.00% | $2,035,800 | $1,202,120 | $469,800 |

| 6 | 2020 | 16.00% | $2,361,528 | $1,255,013 | $325,728 |

| 7 | 2021 | 14.00% | $2,692,142 | $1,287,643 | $330,614 |

| 8 | 2022 | 12.00% | $3,015,199 | $1,297,944 | $323,057 |

| 9 | 2023 | 10.00% | $3,316,719 | $1,284,965 | $301,520 |

| Total DCF Value | Discount Residual Value (10x cf) | Total DCF Value | |||

| $21,413,106 | $12,849,648 | $8,563,457 | |||

| Indicative SP | Shares on Issue (Diluted) | ||||

| $0.046 | 463,000,000 | ||||

| Cash Per share | |||||

| 0.010799136 | |||||

| Indicative SP w/ cash | |||||

| $0.057 | |||||

This estimate of future free cashflow is my best guess of an achievable long term path. It indicates that the company is worth buying from about 4.6c to 5.7c, depending on how much value you accord to the cash, that they hypothetically would have, if the current capital raising is fully subscribed. Of course, if the capital raising (priced at 5c per share) is not fully subscribed, then it would make only a small difference to this valuation, because it would reduce the number of shares on issue.

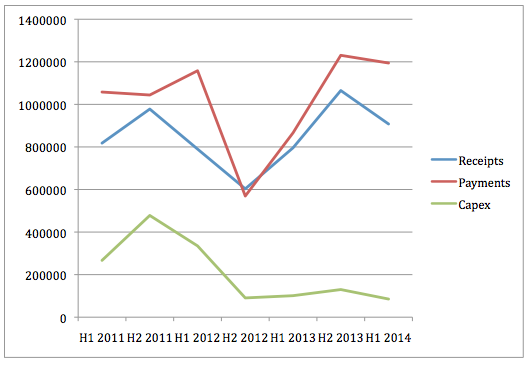

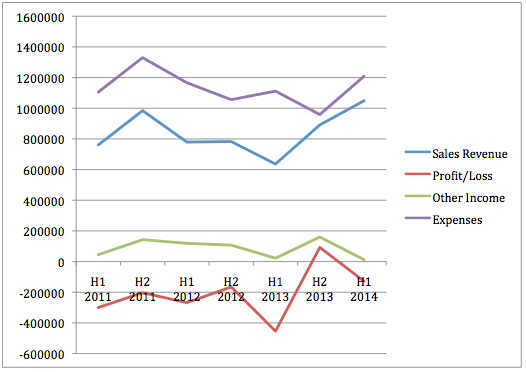

The company has just released the latest Appendix 4C, - the Quarterly Cashflow statement for the quarter to 31 March 2014. The sales volume for the quarter was up 6% on the preceding quarter, and the operating cashflow was positive, at $91,000. To my mind, that makes the estimate above (for maiden free cashflow of $150,000 in FY 2015) look quite achievable - perhaps even too conservative. Because the guesswork is quite difficult, I've included the amount that cashflow would have to increase each year. Put simply, if you don't think Resonance Health can grow cashflow at well above $400,000 per year, then you definitely disagree with my analysis - and that is quite reasonable. As the charts below clearly show, sales revenue is not currently growing at the required rate. Having said that, in the quarter to March 2014, the company reports receipts from customers of $649,000. This means that it is reasonable likely that the company will record the best ever half in terms of receipts, in the second half of 2014.

A guessing game

I had a look at the history of revenue, expenses, receipts and payments as preparation for my guesses about future free cashflow. Either way, it’s quite difficult to predict that Resonance Health will earn over $3.3 million in free cash flow in FY 2023. While I do think that it is reasonably achievable, I'm not convinced that it is particularly likely.

Resonance Health Cashflow graph

Resonance Health Profit Graph

The company is extremely coy about where its revenue comes from: clinical trials and normal patients are not treated as different segments. However, the company did inform us that clinical trials revenue was up 91% and normal patients revenue was up 47%. By my calculations that means that back in HY 2013 (the pcp) revenue was about 60% patients, 40% trials, but that in HY 2014 it was more like a 53%/47% split. NB: this was corrected as there was previously an error in the "total revenue" for H1 2014.

| H12013 | H12014 | Increase Factor | |

| Patients | 376825.3182 | 553933.2177 | 1.47 |

| Trials | 259128.682 | 494935.7826 | 1.91 |

| Total | 635954.0002 | 1048869 |

Clinical trial margins are obviously better, but extremely lumpy. However, it’s not unreasonable to expect that the company will be able to secure some clinical trial revenue for Hepa-Fat Scan too. Certainly, that is the impression that the company seeks to convey in their recent capital raising presentation that stated: “246 trials currently registered on clinicaltrials.gov for non-alcoholic fatty liver disease.”

Risks

First of all, the current capital raising might fail. That would make the projected growth extremely difficult to achieve. Further, the analysis above assumes HepaFat-Scan can be commercialised. This is yet to be proven.

Summing up

This is one of the most speculative companies I’ve ever written about, the only more speculative one being Vmoto (ASX: VMT). Resonance Health has never given money back to shareholders, and it hasn’t even turned a profit based on its core business. I do own shares in Resonance Health, but I don’t consider myself capable of valuing such a company – I'm out on a limb here.

There’s more to be written about Resonance, especially on the subject of management, but suffice it to say right now that I’m willing to trust management for now. The largest shareholder is Executive Director Simon Panton, who doesn’t have much of an Internet footprint, from what I could find, but who has “successfully” run a business, according to the Resonance Health 2013 Annual Report. If anyone has views about the management team, please be in touch, I’m underwhelmed with the amount of info I could find. Total directors remuneration for FY 2013 was $367,000, which is not unreasonable.

I am certainly not sure that Resonance Health is undervalued. However I do think on the balance of probabilities the company is worth more than 5c per share.

The Author owns shares in Resonance Health. Please note that a share entitlement offer is currently open at 5c per share, the author is entitled to shares under the other and currently intends to take them up. Nothing on this website is advice, ever. The purpose of this blog is to keep track of my decisions and invite feedback

Sign up to the Free Newsletter to receive the best research, first.

Hi Claude,

LinkThanks for your efforts here.

Definitely one for the watchlist.

I admire the way you have pointed out the areas that need more investigation.

Have you noticed any seasonality in the business? and what, if any impact do you seen from the budget for them

Hi Simon,

LinkThanks for contributing yourself.

I have not noticed any seasonality - I think the fluctuations of clinical trials disguise any patterns, though I may be wrong.

I can't see any impact from the budget, unless of course Mr Rabbit's medical research slush fund gets up and they happen to grant money to Resonance Health... doubtful, to say the least.

Generally, more government spending on health (both here and overseas) is certainly beneficial to Resonance, as a broad generalisation.

It's largely about whether they can grow revenue or not, in my view. It could be a long wait with Resonance as expenditure on the fibrosis scan will reduce free cashflow (when it arrives). If their scans do actually save the system money, then that will probably happen over time.

I would like to find a doctor who actually orders their scans to ask what has motivated them.

Well now they have announced a heads of agreement to buy a cash bleeding company of marginal relevance so you may as well throw this research out the window. What a joke.

Link