My investing journey started in 2009, but I didn't really have a clue what I was doing at that stage, and I was essentially a mug punter taking random bets in between law lectures. We all start somewhere.

I spent the next two years applying myself to my law degree, and didn't have much time for investing. By the end of 2011, I graduated, and by early 2012, I was on my own, unsure of what to do next, but gradually realizing a career in the law was not for me.

I took a job with a solar company and -- too emotionally exhausted to socialize much -- I spent a lot of my spare time doing actual research. You can see my first attempt at writing a research report right here. I note that the company in question has thumped the market, and wish I'd had the courage of my convictions.

The main purpose of this website is to prove that ethical investors can thump the market, and I think that the Hypothetical Ethical Portfolio, goes some way to making that point. It does, however, have a few flaws. It's not a real money portfolio, and my position (which I am really loving) as a Investment Research Analyst for Motley Fool Hidden Gems, precludes me from continuing with it.

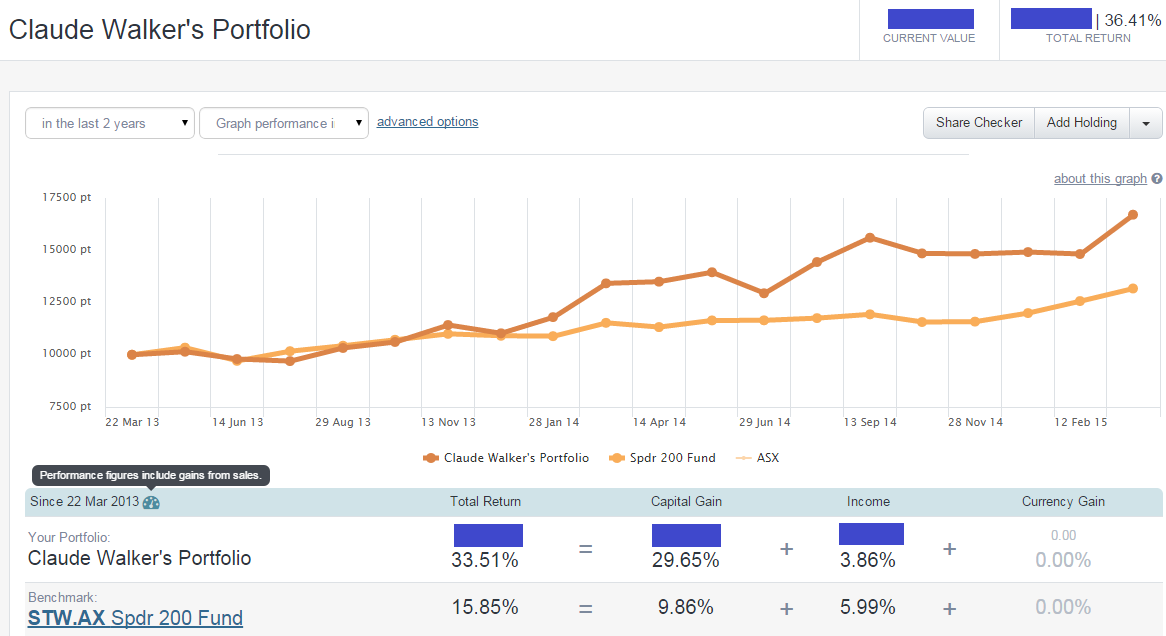

However, I thought regular readers -- if there are any left -- might be interested to know how my actual portfolio has fared over the last two years, since I started this website.

And it's been a big 2 years.

It was in early 2013 that I got my investing education growing and started investing full time. A boutique fund manager and lawyer taught me a lot in those days and I can thank him for improving my process, despite the fact he would probably disagree with the many of my positions. I'd definitely say that my results from early 2013 somewhat represent "cleaning house" as I improved the quality of the companies I owned.

Then, as the bull market charged on, my philosophy tailwind investing paid off reasonably well. I made many many avoidable mistakes along the way though, and I'm always aiming to improve. Most investors who know me well, know that my tendency is to sell too soon. However, I do believe that is partly due to the fact that for much of my investing life I have needed to take money out periodically for personal expenses. I'd say the biggest change over time has been that I hold positions for longer. Also I readily acknowledge that 2 years of performance doesn't prove anything... it's just my journey so far.

It was in March or April 2013 that I started this website -- most of all, this is a two-year follow up for anyone who first joined me back then. Long time readers, thanks for motivating me from the start.

And to everyone, thanks for reading and thank you to all the wonderful people who have contacted me, signed up to the newsletter or commented -- I really appreciate the interactions!

I'm not sure how accurate Sharesight is, since I've been adding cash to my portfolio for most of the last two years. However, it's probably not too badly distorted, because the majority of my cash was already invested by mid-2013. I'm not entirely sure of the algorithms that Sharesight use, but it is a decent way of keeping track of things, I believe. Early indications are that I'm not wasting my time with this, so that's a positive. Touch wood.

Nothing on this website is advice, ever. This post is for entertainment (and for my own reference!)

Please do follow me on twitter @claudedwalker.

The Free Newsletter is going on indefinite hiatus but you can sign up to receive the older hidden research.

Can't resist an update on trailing 2 year performance:

Link<img src="http://ethicalequities.com.au/wp-content/uploads/2015/05/Trailing-2-years-e1432261052923.png" alt="Claude's Portfolio Total Return" />

"You can see my first attempt at writing a research report right here. I note that the company in question has thumped the market, and wish I’d had the courage of my convictions"

LinkHAHA...brilliantly said. I think there's many a new investor who feels the same way.

Thanks heaps for running this website.

srsly guys

Link<img src="http://ethicalequities.com.au/wp-content/uploads/2015/06/Performance-2-years-to-June-6-2015-e1434441891278.png" alt="Claude's Performance 2 years to June 15, 2015" />

2 year portfolio performance update <img src="http://ethicalequities.com.au/wp-content/uploads/2015/12/Sharesight-2-year-Portfolio-Performance-Dec-2015-e1451435185617.png" alt="Claude Ethical Equities 2 Year rolling Portfolio Performance" />

Linknot too happy with the drop back to under 40% p.a. <img src="http://ethicalequities.com.au/wp-content/uploads/2016/01/2-years-rolling.png" alt="2 year rolling performance" />

LinkHi Claude, I was wondering if you were still around?

LinkI had a few email exchanges with you regarding a few stocks a couple of years ago, one of them being LHC.

I'm not sure if you still post on HC (well done on escaping if you have) but would love to hear your ideas on the company.

Hi Kevin,

LinkI'm still around, but my investing content is reserved for paying members of Motley Fool Hidden Gems -- I work as the Research Analyst under Scott Phillips on that service.

I remember your emails.

I hope you're well,

Claude