Some readers might be interested to know a little more about the Discounted Cash Flow model that I use on this website, as it is quite eccentric. I've had a few questions, but to date, no-one has been able to work it out.

My required rate of return is 10%, but I actually discount cashflow by 10% - that is, I multiply estimated cashflow by 0.9 (per year in the future) to get my “DCF Value.”

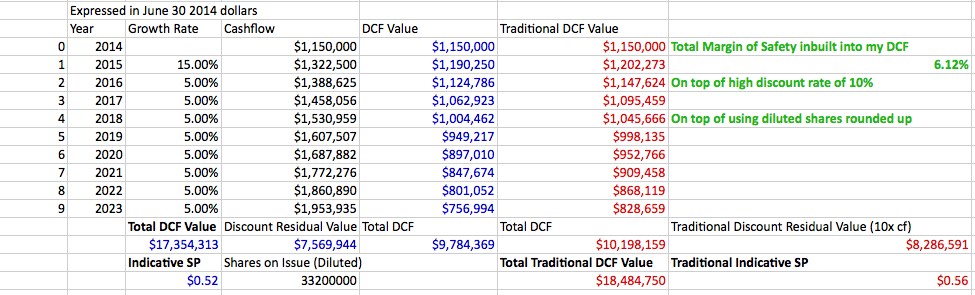

I suspect both of you reading this use the more traditional discounted cashflow model that is based on a required rate of return. I choose to discount at 10% even though that implies that zero risk money (or the benchmark) would earn just over 11.1% per annum. I do this because it incorporates a dynamic margin of safety, that is, the margin of safety implicit in the “DCF Value” for year number 9, is considerably greater than the margin of safety implicit in the “DCF Value” in year 2. I also use diluted shares on issue or, sometimes diluted shares rounded up. I also usually adjust my values for where in the year we are. The inbuilt unavoidable inaccuracy of the process necessitates conservative assumptions about future cashflow.

Below is an example that compares my method to the traditional method. Traditional DCF (for 10% discount rate) is Present Value = Future Cash Flow divided by (1.1 to the power of n) where n is the number of years into the future. The table below uses June 30 2014 as "Present Value." Click on the image to see a larger version.

Hi Claude,

LinkThank you for your very valuable explanation. I use the 'Traditional DCF Value' and I guess your method gives you extra margin of safety.

Kind regards,

Stefanie

Thanks Stefanie, it has been described as baffling, but I'm used to it now. I often to traditional DCF when making the 'sell' decision.

Link