Author: Mark Susanto

The CEO of Energy Action (ASX:EAX), Ivan Slavich, continued to put runs on the board in 2018. The energy management consultancy reported the following, yesterday:

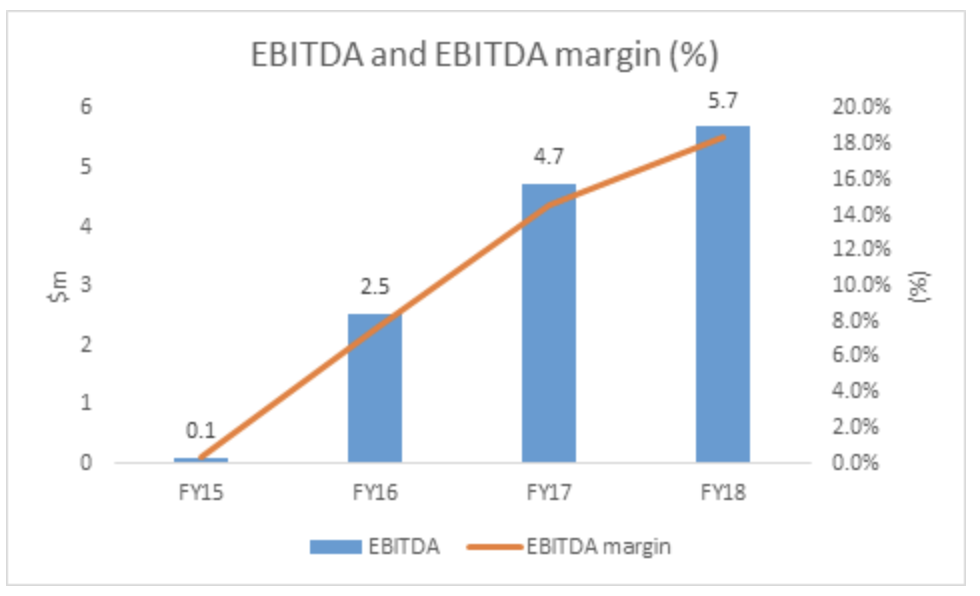

- Operating NPAT up 3% to $2.6m

- Statutory NPAT up 46% to $2.6m

- EBITDA up 21% to $5.7mOperating cash flow up by 92% to $6.9m

- Revenue decreased by 5% to $31.2m

- Net debt reduced by $3.1m to $3.8m

- Fully franked dividend of 4c

A Turnaround Story

The turnaround story here is not too uncommon. Energy Action once had a nice little business which was capital light and high margin. Under the old management, the business committed major unforced errors; ‘di-worsification’, neglecting their existing technology, and taking on too much debt. Theirs was a misguided strategy, as we publicly and correctly predicted it would be.

Cue the new management, who do some things right, such as keeping costs under control, marketing their existing business and not acquiring low margin projects businesses.

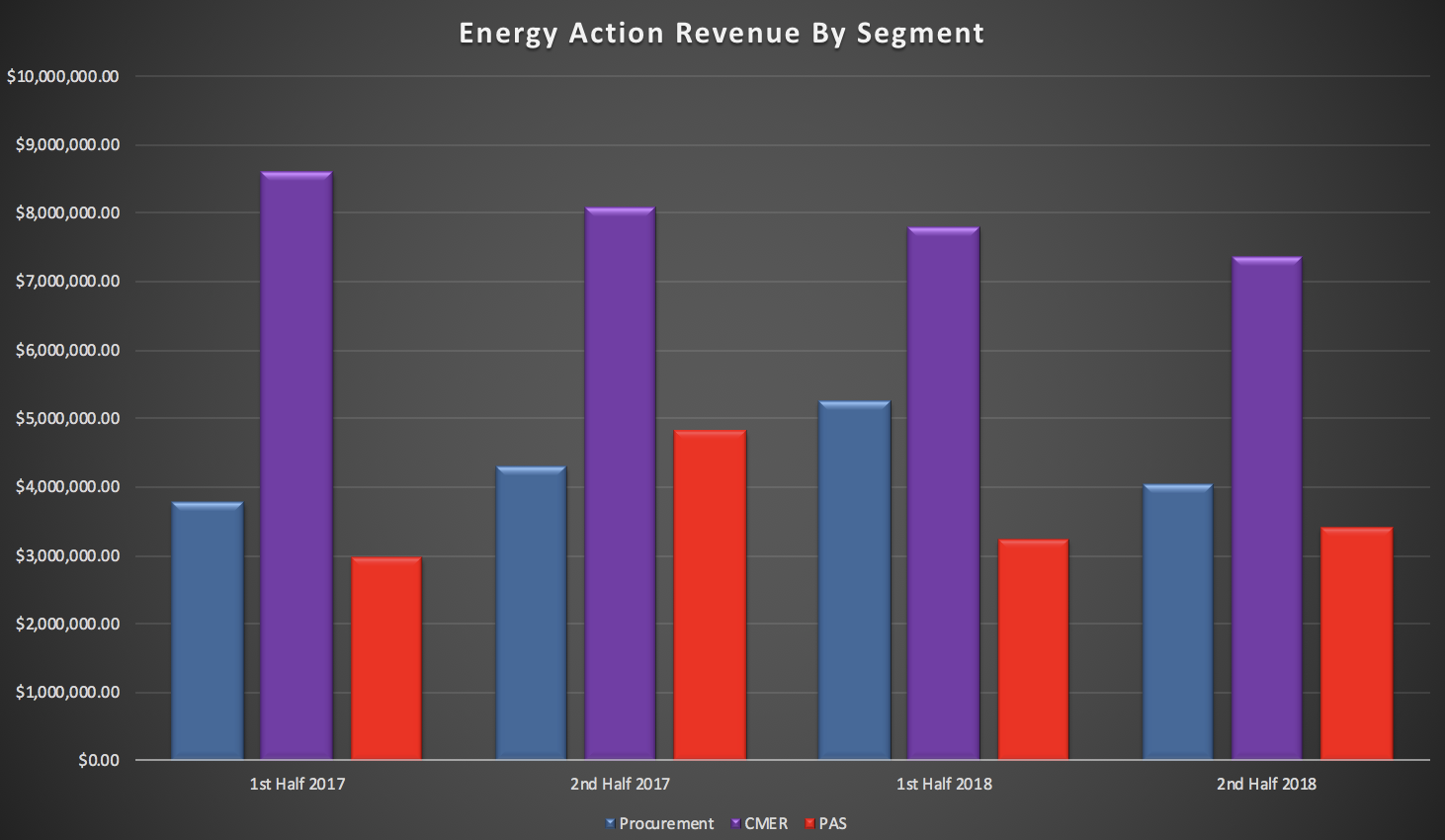

Keeping costs down is doubly important because they are not experiencing top line growth in most of their businesses. We can see this when we drill down on the main segments. You can see the revenue of each segment, in the chart below:

The Procurement segment

Energy Action helps their client purchase energy through structured products, tenders and the AEX auction. Revenue grew by 15% to $9.3m for the year. Their number of AEX auctions was largely flat, while the number of electricity tenders grew by 18% and gas tenders declined by 22% due to tightness in the market

Contract management and reporting segment

In this segment the company provides services for bill validation and network tariff review. Revenue declined by 9% to $15.1m for 2018. Sites under management has declined due to the loss of a a large, yet low margin contract for 3,100 sites.

Project and advisory services (PAS) segment

Here, the company provides energy project and consulting work for buildings and organisations. Revenue declined by 15% to $6.6m in the last year. There was an active decision here to focus on higher margin consulting work and move away from lower margin supply & install project work.

Despite the top line decreasing by 5%, EAX has increased its margins due to tight control on costs and the move away from low margin project work. Management has said that they will continue to reduce costs through Business Process Outsourcing (BPO) and automation.

The cash generating capability of the business was in full show in this report -- this was the first time they have had positive free cashflow to firm (FCFF) in several years. Without any more deferred consideration payments from past acquisitions weighing on its books, Energy Action has drastically improved its conversion of EBITDA (earnings before interest, tax, depreciation, amortisation) to cashflow. , Indeed, it boasted an EBITDA to cash conversion of 121%.

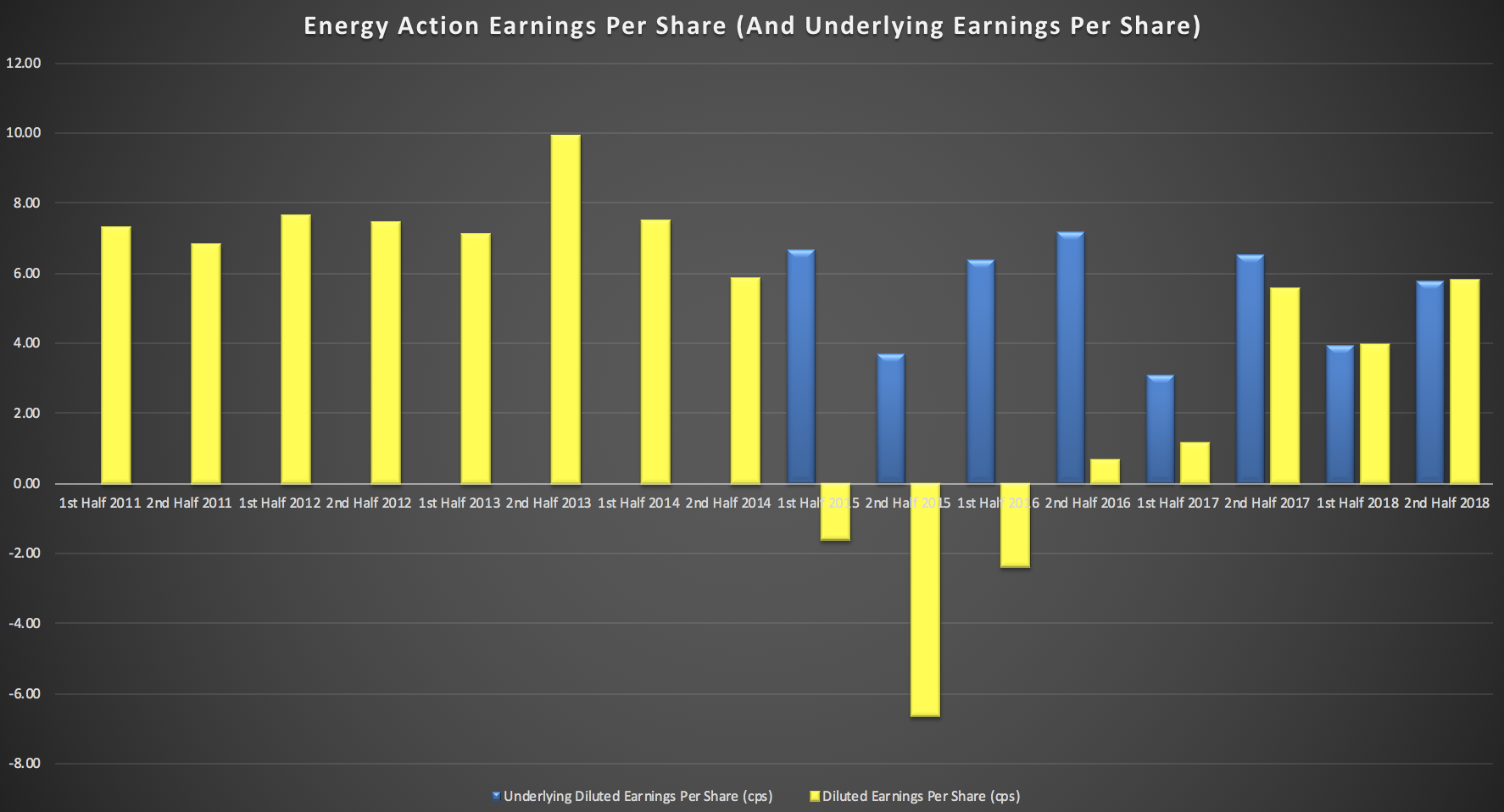

Another nice thing is that there are no further “one-off” costs that plagued the statutory profit in the years prior to Mr Slavich’s tenure. You can see this in the chart, below. The yellow is the statutory profit, the blue is the profit excluding certain very real costs.

This is not to say that there hasn’t been any restructuring this year. In fact, the company restructured their sales business into a regional sales model, created a product manager role for Energy Metrics, and moved the PAS business to a consultancy arm under a new general manager.

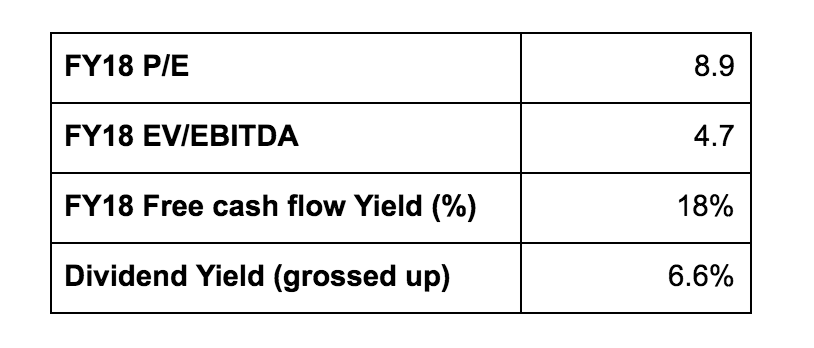

At the current price of 86 cents, I think the stock appears cheap on the following ratios;

However, there are a few things to watch out for. The biggest problem is the lack of revenue growth.

The procurement business, which is the only business that experienced revenue growth this year has done so on the back of average $/MWh doubling over the past 4 years. This is while the number of successful AEX auctions has declined by ~30% over the same time period. If the price of electricity declines significantly in the next few years, I would expect their business to be impacted.

In the contract management business we consider the sites under contract with Energy Metrics to be a key metric, because these services earn higher margins. The number of sites served by Energy Metrics has dropped about 16% over the past 4 years. This was on top of the aforementioned loss of significant contract on the lower margin software.

One concern I have is that the slowing sales may be reflective of some structural headwind that I haven’t managed to identify. If that’s the case, the business could struggle to improve, even once the ship is in order.

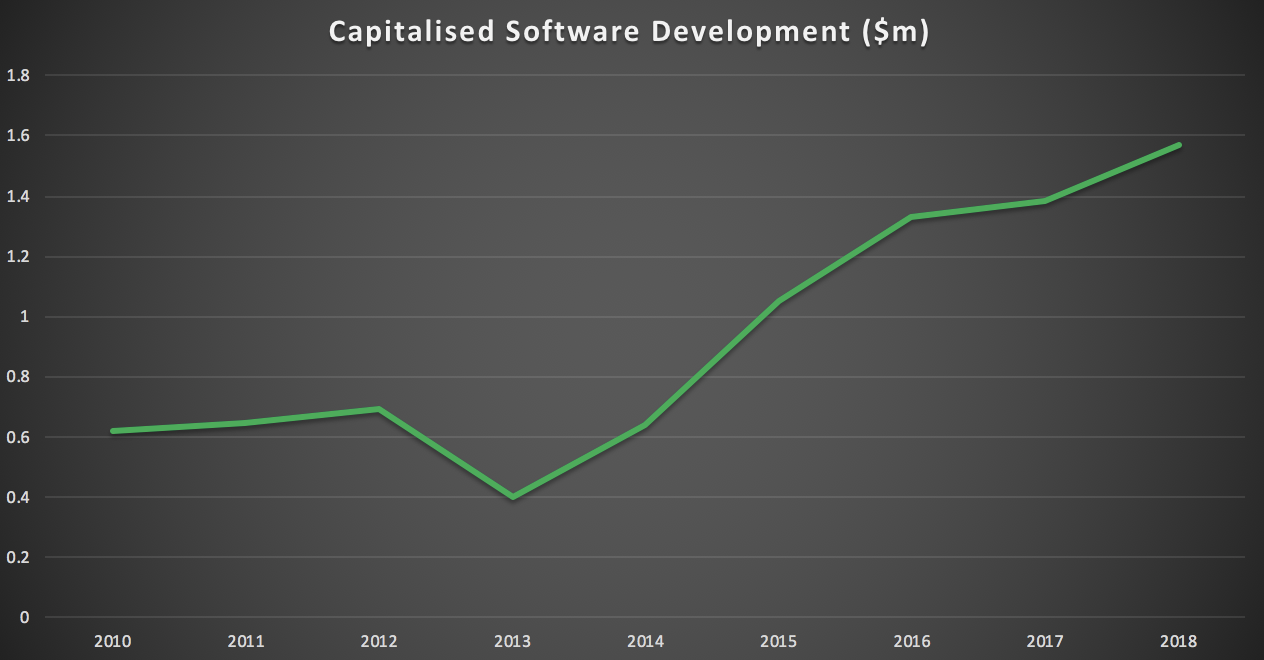

Management clearly sees these challenges and they are tackling them head on. Their focus for 2019 is to increase revenue. They will refresh Energy Metrics and develop new procurement products & services. These efforts may mean an increased level of capital expenditure, especially in terms of software development. You can see how spending on software has been increasing, below:

Finally, on 6 August, management flagged a strategic review to consider “various strategic options available to the Company to maximise value for its shareholders…[including] the potential sale, joint venture or merger of the Company with or to another organisation.” They expect this to be done in 6-12 months’ time.

I believe the company is an interesting investment proposition.

Claude tells me he is disappointed to read about the strategic review, since he thinks it is a waste of money. However, he is pleased with how current management are addressing the challenges facing the company, and he will continue to hold his shares.

The author, Mark Susanto owns shares in Energy Action and will be holding for the time being. He may sell in the future if something better comes along but will not sell for at least 2 full trading days following the publication of this article.

For early access to our content, join the Ethical Equities Newsletter.

Disclosure: Claude Walker and Mark Susanto owns shares in Energy Action. This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.

Terrible update today, saying first half profit to be 50% lower than pcp. There are some green shoots (they say, but who'd believe them?)

LinkThe CEO is resigning and the strategic review turned out to be a "one-off" distraction and a complete waste of money.

Board should resign.