Elixinol Global Ltd (ASX:EXL): Growing But Still Early Stage

A lot has been happening with Elixinol Global (ASX:EXL) since we initiated coverage on the company in late October. During that time the stock price has more than doubled to hit a high of $3.55 earlier this week, before falling 11% today in response to the release of EXL’s 4C (quarterly cash flow report) for the December 2018 quarter.

As a quick refresher, EXL is a profitable US-based vertically-integrated manufacturer and distributor of hemp-based nutraceutical, dietary supplement and skincare products, and also here in Australia a manufacturer and marketer of hemp food and cosmetic products. The company also has designs on becoming a cultivator, manufacturer and distributor of medicinal cannabis products (leveraging its expertise with hemp goods) via an early stage Australian business (recently renamed Nunyara Pharma per the Dec-18 4C). Please refer to our initiation report on the Elixinol and to some background detail on the science of cannabis and cannabinoids, the global hemp and recreational and medicinal cannabis markets, and also a snapshot of the evolving regulatory landscape.

There has been a lot of enthusiasm towards the stock in the past few months, fuelled by the signing just before Christmas of the 2018 Farm Bill by President Trump – which ended the prohibition of hemp under the Controlled Substances Act. As we foreshadowed back in our October articles, hemp is now classified as a standard agricultural product (naturally, hemp was the world’s largest agricultural crop for thousands of years and farmed for food and as an industrial fibre in clothing, building materials and medicine). Broadly, this means that hemp farmers will now be able to access crop insurance and US Department of Agriculture programs, and will have greater access to banking services and mainstream payments technology; and (2) hemp products can now be transported across US state lines, and are able to be advertised in mainstream journals and newspapers – thereby opening up the national mainstream retail market. The positive ramifications for EXL’s US-based CBD-derived hemp products business are obvious.

More generally, media commentary and market analysts continue to focus on the increasing momentum in the US and globally for the legalisation of medicinal and recreational cannabis, while there has been a string of M&A deals in the past couple months both amongst existing cannabis players and companies looking to enter the space, as well as more tie-ups between cannabis operators and food & beverage and healthcare companies – all ahead of the expected regulatory reform and opening up of regional – and potentially global - markets.

But we’re getting ahead of ourselves – there is some way to go before global legalisation of medicinal and recreational cannabis – and from EXL’s perspective the company is focused in the meantime on executing the rapid expansion of its profitable hemp products business. Shortly after the signing of the Farm Bill, the company announced that it would proceed with appointing national advertising, PR and marketing agencies to improve awareness of the Elixinol brand and immediately commence its assault on the US national retail market.

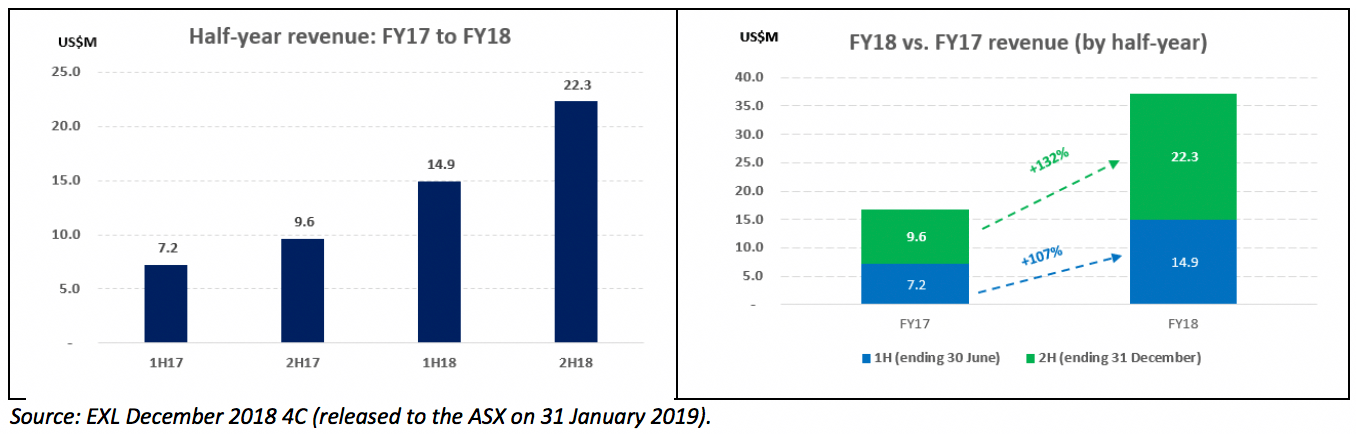

The December quarter 4C revealed a significant increase in revenue for FY18 (financial year end is December) – up 121% from FY17 – and as can be seen from the below an acceleration of growth from the June 2018 half (+107% versus 1H17) to the December 2018 half (+132% versus 2HFY17.

Full year results won’t be released to the market until late February – so til then we won’t know the level of profitability generated by the company in the fiscal year just ended. The company generated a maiden (small) profit in the June 2018 half, and in our initiation piece we hypothesised that the company could generate NPAT of ~$2M for FY18 based on a continuation of 1HFY18 growth rates, similar margins in the established US and Australian businesses, further start-up losses for Nunyara, and a degree of operating leverage with respect to opex. However, readers should be cognisant that given the significant market opportunity available to Elixinol as a result of the opening up the US hemp market, it’s also possible that near term profitability is deliberately put on the backburner while the company invests in its supply chain and sales & marketing capabilities to meet the accelerating demand for hemp-based products – with the expectation that this would hopefully result in a significant boost to market share and profitability over the medium term.

The December quarter 4C also provided an operational update which included the launch of the new Sativa Skin Care range (moisturisers and creams, shampoos, deodorants) in the US (and also available in Australia on the Hemp Foods Australia website), the launch of Essential Hemp branded snack bars in Australia and preparation for the launch in 1Q19 of a product in the “ready meal” category, the ramping up of European marketing operations, and increased R&D investment in the future product pipeline.

And as announced to the market last week, the company also entered the New Zealand market following the passage of the Misuse of Drugs (Medicinal Cannabis) Amendment Act – which enables the sale of EXL’s CBD products to patients on a prescription basis. We assume that NZ sales won’t meaningfully “move the needle” revenue or earnings-wise over the short term, but are hopeful that this development can be replicated in larger markets.

The 4C also included some commentary which one might potentially attribute to “growing pains” for a company growing so quickly: (1) some minor delays associated with the planned commissioning of the new Colorado manufacturing facility – scheduled for first half of this year, and which will double US production capacity from current levels; (2) lower than expected yields from the maiden harvest of high-CBD hemp under the NCHPP farming joint venture; and (3) frustration that Nunyara had not yet been awarded medicinal cannabis cultivation and manufacturing licences by the Australian Office of Drug Control.

It’s conceivable that this less-than-rosy commentary was a key driver for the share price decline today, as well as the lack of any specific guidance for FY19 (which we think was always more likely to be provided at the release of full year results next month), and potentially also because some market participants were hoping for higher FY18 revenue than was achieved. Given the doubling of the share price in the last few months – despite the “Risk Off” period endured in the Australian market since late August – the share price had arguably overshot and was due for a correction at some point. It’s also not unusual for high-growth companies such as EXL to be bought heavily leading into results and then sold off once numbers are released as certain investors “Buy The Rumour And Sell The Fact” etc.

The share price action since we initiated on the company (*probably* more correlation than causation, though hopefully we have some degree of EXL ownership in the Ethical Equities community) has highlighted the speculative nature of the stock, and the significant increase in the share price has made the company even more expensive in a traditional fundamental sense. On the other hand, as we highlighted back in October not many companies have the potential growth profile of Elixinol.

We still think that EXL is a comparatively smarter post-hype (or first wave of hype) way to play the potential cannabis boom – as the only listed ASX cannabis player which is (1) generating meaningful revenue, and (2) profitable, albeit only recently and potentially with meaningful near term profitability deliberately pushed back while the company attempts a land grab in the US market.

Given recent share price movements, readers will need to make up their own mind whether EXL is a suitable investment candidate for their individual portfolios – but clearly the company is not a Deep Value play and it will likely be years before it pays a dividend.

With a view on the longer term potential of the company I personally will continue to hold while I wait to gather more information on the likelihood of my personal investment thesis playing out (i.e. whether management can deliver on the large market opportunity).

Note from Claude: I am tempted to sell but also holding on for now (and I will not trade for at least 2 days after publication of this article). For me, a profitable full year result would be bullish. A loss would have me a concerned.

Disclosure: I (@Fabregasto ) have a position in Elixinol – though sadly not added to since our initiation report – and may add to my position in the future – though not for at least 2 days after the publication of this article.

Please feel free to sign up to the forums and let us know what you think!

For timely coverage of small-cap stocks, join the Ethical Equities Newsletter.

The Author of this piece, Fabregasto, and Editor, Claude Walker, own shares in one Cannabis stock Elixinol Global. This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.