Elixinol Global (ASX:EXL): It's Not Easy Being Green

It’s high time we checked in on Elixinol Global (ASX:EXL) post the release of the company’s 1H19 results late last month and following a very busy last several months which we’ll summarise in this update. This time however we’re going to do things backwards and start with the financials – where some of the developments since we last published on Elixinol in February have begun to manifest. Then we’ll triangulate the numbers to the narrative to understand where the company is at this point in time.

Financial performance 2019YTD

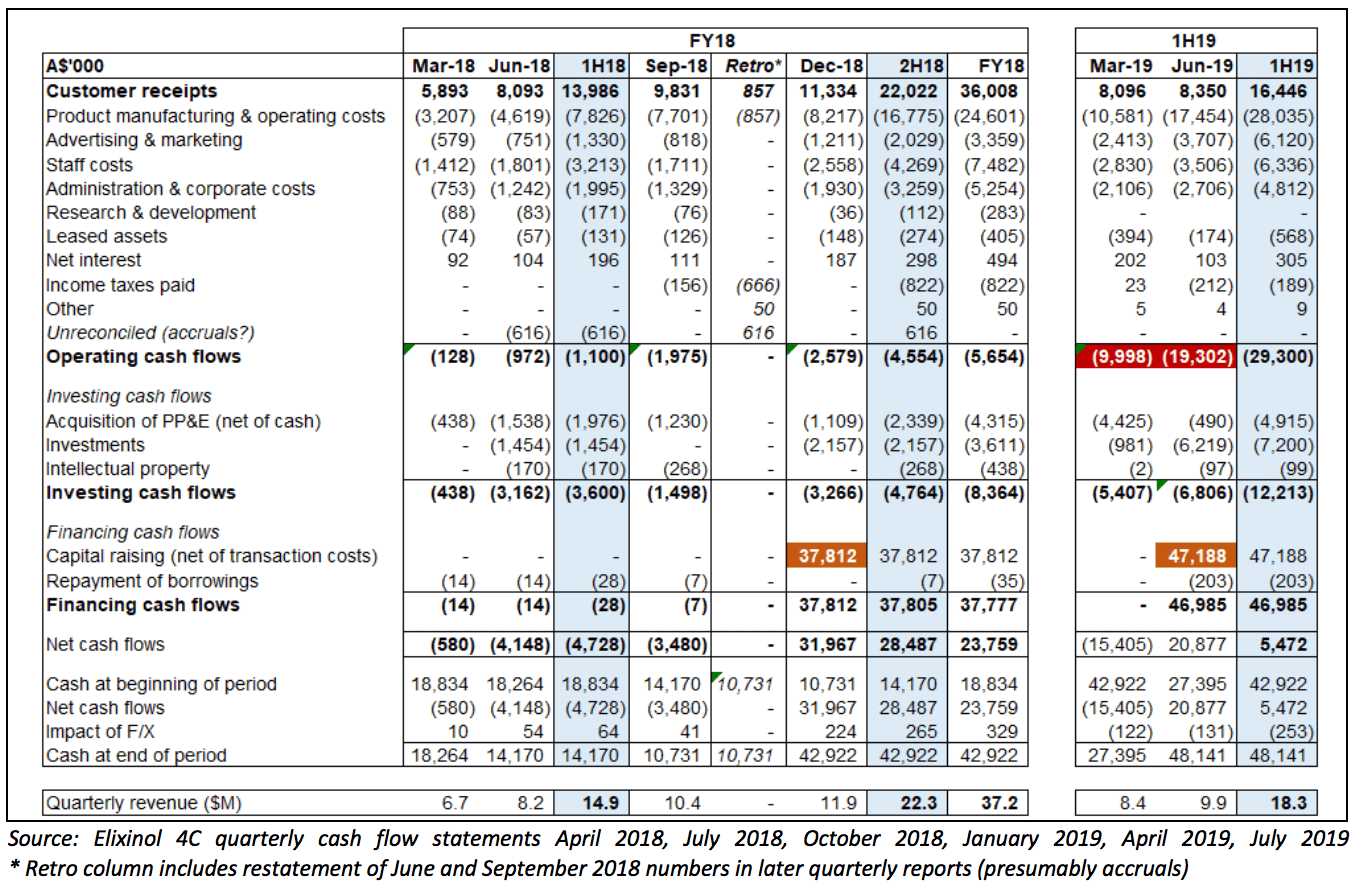

Let’s start with an overview of the company’s quarterly cash flow statements released since its IPO in very early 2018 (including quarterly revenue numbers announced to the market at the same time).

The most striking thing about these cash flow numbers is the significant blowout in negative operating cash flow. This is predominantly as a result of what looks like increased investment in the supply chain (in the form of significant purchases of raw materials) and also increased investment in the business – both ahead of revenue. The blowout in negative operating cash flow has also not been helped by a slowdown in revenue growth.

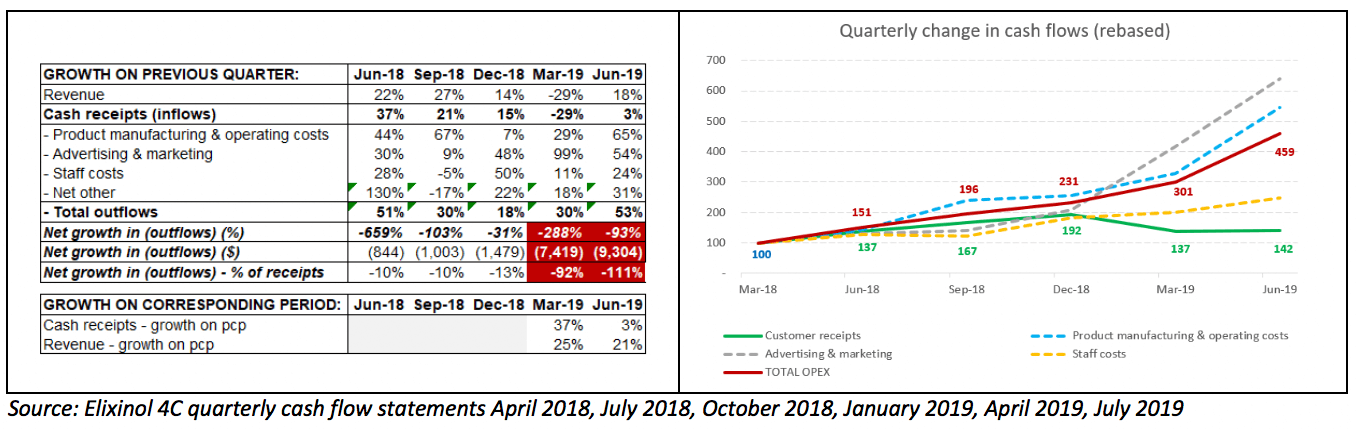

The table below illustrates more obviously the material acceleration in net operating cash outflow over the last 2 quarters, with quarterly net cash outflow increasing by ~$17M between December 2018 and June 2019: caused by a ~$14m increase in outflows and a ~$3M decline in quarterly receipts on an absolute basis (although revenue has increased versus the corresponding quarter in FY18: +25% and +21% respectively for March and June).

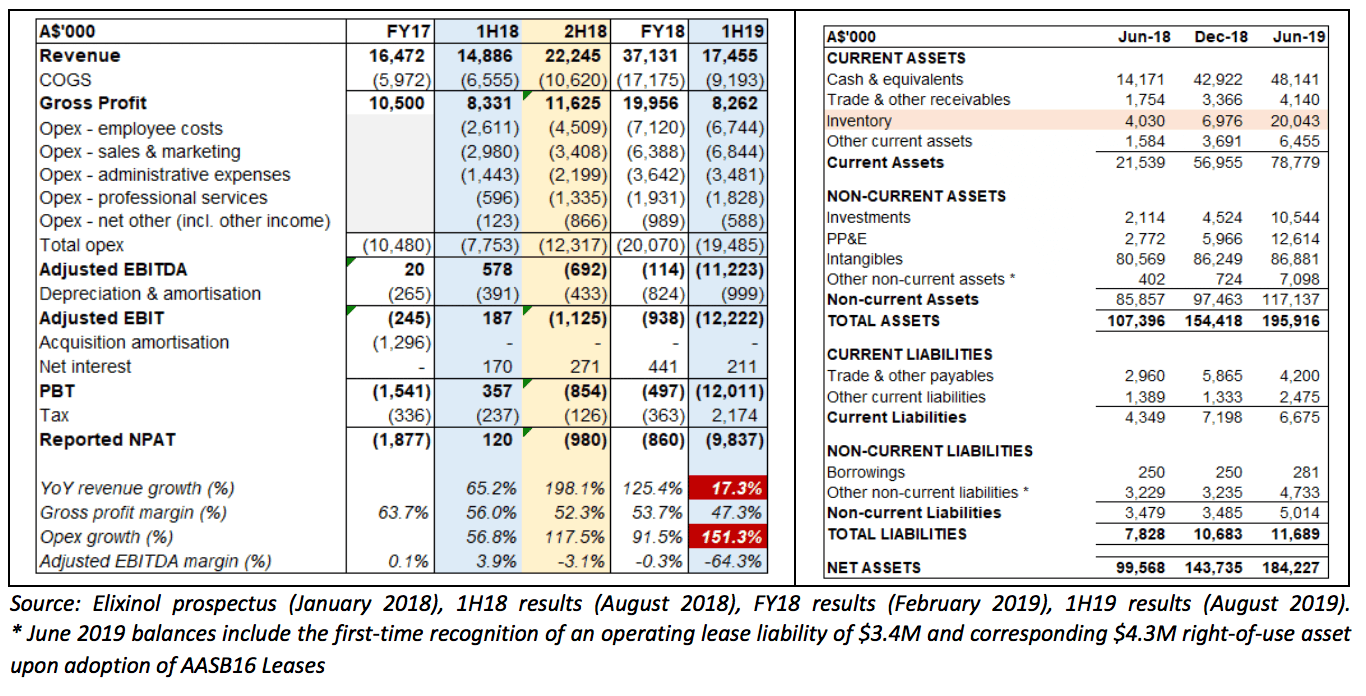

This increase in the operating cost base of the business over the first 6 months of this year is the key driver behind the material decline in financial performance for the period reported by Elixinol late last month (as summarised below left) – in which the company reported 1H19 opex nearly equal to that incurred for the whole of FY18 and an EBITDA loss of $11M. Note that the P&L reflects only the increased investment in the cost base; the suspected advance stockpiling of inventory is borne out in the balance sheet (below right) – which of course won’t go through the P&L until corresponding revenue is generated from the sale of those raw materials in future periods. The inventory build itself is not necessarily a concern – I understand that the shelf life of raw materials is several years.

This material increase in the cost base plus advance investment in raw materials was no doubt a major reason for the $50M capital raising announced around my birthday in June (guys, you really *shouldn’t have*) – presumably as well as the flexibility to make opportunistic investments. This was the second capital raising in 9 months following a $40M rattle of the tin in September last year, and the $86M net monies raised (net of costs) basically explains entirely the $85M increase in Net Assets between June 2018 and June 2019.

Significant increase in competitive activity

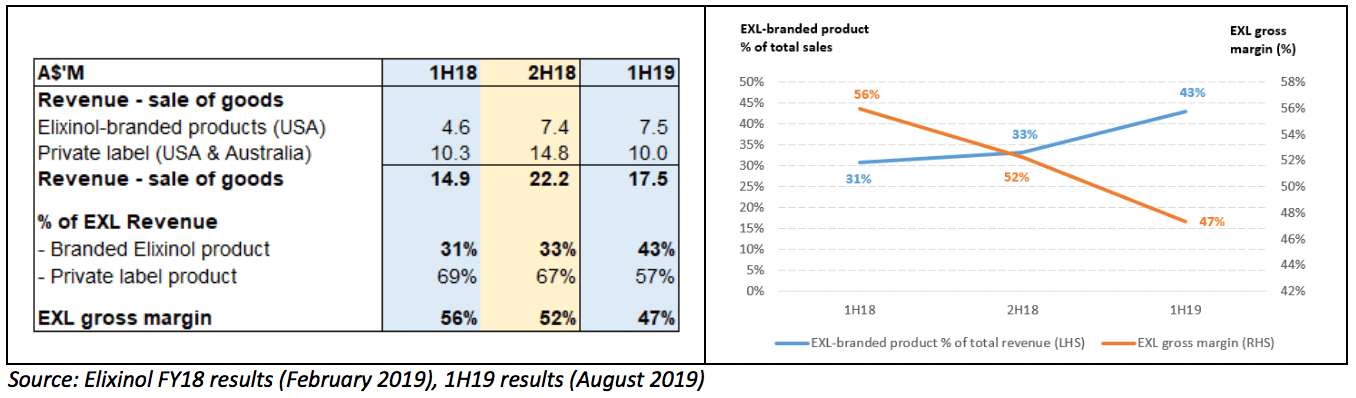

So, let’s rewind back to April and the release of Elixinol’s 4C (quarterly cashflow report) for the March quarter. As can be seen from the first table in this update, quarter-on-quarter revenue declined from $11.9M in December 2018 to $8.4M (which was still up ~20% from the March 2018 quarter – but absolutely below what the market was expecting). In that 4C management announced a change in strategy to pivot away from lower margin private label sales in the US and instead focus on higher margin Elixinol-branded products. This makes sense strategically – not just from the perspective of theoretically generating higher margins, but also from the point of view of not enabling competitive product. One would then expect that the natural result of this strategic decision would be an increase in gross margin, all else being equal.

The table and chart above however suggests that all else has not been equal over the past two quarters, with gross margin in fact declining from 56% for the June 2018 half to 47% in the June 2019 half – at the same time that the proportion of *higher margin* Elixinol-branded products as a proportion of total sales has increased from 31% to 43%. While to a degree this can be driven by sales mix, one would not ordinarily expect a gross margin (%) decline of this magnitude. What this suggests is that pricing for Elixinol’s premium product has decreased – and the most likely driver of this is pricing pressure from increased competition.

In a previous article on Elixinol in February 2019, we noted that on the FY18 results investor call, management had acknowledged that a significant number of new competitors had entered the market in response to the relaxation of the regulatory regime in the US. Further, we opined that “it will be interesting to see how successfully the company can defend and grow its market share as the market expands at a rapid rate and new competitors flood into the space – and the impact that this will have on margins”.

Management made a point of saying on that February 2019 investor call that it was confident that the combination of its premium product, long history and market share, and large production capacity would position it well to defend its market position. We should remember that consumers don’t necessarily care that much about a longstanding brand in what they perceive to be a brand new and rapidly expanding market. The excerpt below from the 1H19 results release suggests that competition over the first half of 2019 has indeed been intense and that sales have been impacted by a flood of lower quality competitive products into the US marketplace (where Elixinol has historically generated the vast majority of its sales).

Accelerating global expansion and significant new investments

It’s unlikely that competition is elevated in the US market alone; competition is likely to be rising all around the world in response to the emergence of CBD nutraceuticals and hemp food products, and the once-in-a-lifetime relaxation in the regulatory regime surrounding medicinal and recreational cannabis – including a landmark Australian development announced yesterday (see final paragraph).

Diversifying outside of its home US market has for some time been a strategic imperative for Elixinol. In early February, the company announced its direct expansion into Europe via the establishment of sales offices in the UK, Spain and Netherlands, and the appointment of a European MD and the recruitment of a European sales team. Pleasingly, over the last 4 months further progress has been made in the region:

- In April, the company announced a new partnership with UK pharmacy buying group Cambrian Alliance Group (which represents ~1,200 UK pharmacies) and a new distribution agreement with a major UK distributor (from which it had already received a purchase order for 60,000 SKUs);

- In July, Elixinol announced an exclusive arrangement with German pharmacy distributor MedVec International to market Elixinol-branded and white label products to its network of more than 15,000 German pharmacies, and also revealed a partnership with PharmaCare to create CBD capsules for UK retailer Holland & Barrett; and

- In August, the company announced a new distribution agreement for Belgium and Luxembourg with Belgian distributor 25th

Elixinol has also made further inroads into the US with the appointment in April of US retail broker Presence Marketing (which services ~15,000 US stores), and the first agreement (via Presence Marketing) to commence distribution to a large US retailer (which I understand to be Albertsons) – 330 stores in initial phase, expanding to more than 1,000 stores in time.

In June the company announced the formation of a 60:40 (respective Elixinol: RFI ownerships) joint venture with US-based RFI Ingredients to develop CBD-infused ingredients for the food and beverage and nutraceutical industries, and then in July Elixinol acquired the global intellectual property rights for Bionova’s microencapsulation technology – in order to deliver Elixinol’s CBD-infused product via capsule form. Presumably this JV will be key in the supply of CBD capsules to Holland & Barrett in the UK.

Most interestingly of all (at least to me as a near term driver of volumes), in April the company also acquired a 25% stake in Pet Releaf, a US manufacturer of CBD-infused products for pets, for ~US$4M in cash and $2M in EXL scrip. With Elixinol having been Pet Releaf’s exclusive CBD supplier for more than 4 years, this acquisition further cements this relationship. Then in early August the two parties entered into a contract under which Pet Releaf will purchase a minimum of US$18M of Elixinol’s CBD product over an initial 18-month term. I believe this is significant as it underwrites a material increase in the company’s annual revenue run-rate, and also signals that demand for Pet Releaf’s products is increasing at a rapid rate (especially as Pet Releaf’s total FY18 sales were just US$8M).

Closing thoughts = highwire tightrope

Both the current September 2019 quarter (for which the company will lodge a 4C in late October) and the next December 2019 quarter (4C end of January, followed by FY19 results in late February) are going to be pivotal for the company. DUH, me.

The material inventory build over 1H2019, the flurry of new distribution agreements in both Europe and the US, and the new take-or-pay contract with Pet Releaf suggest that the company is likely to report a material increase in revenue over the next few quarters. If that occurs as expected, then the current comparatively lower growth half-year period will have been a necessary period during which time a significant amount of recalibration has been undertaken – not that management has been resting on its laurels, with a number of key agreements executed during this period.

There are clearly a LOT of moving parts here. In amongst all of the above described developments over the past several months and against the backdrop of intense (and potentially irrational) competition in the US, there have been some material changes in the leadership team. Significant new regional hires have been made to lead the growing new markets Elixinol has entered into. In April, Board member Stratos Karousos became more hands-on as Chief Commercial & Legal Officer, and then in July became even more hands-on as the new CEO (with long time CEO Paul Benhaim transitioning to Chief Innovation Officer).

One recent development we haven’t yet covered relates to Nunyara - Elixinol’s early stage Australian medicinal cannabis business. In July, Nunyara obtained a licence for the manufacture of medicinal cannabis, but is still waiting for a licence to cultivate the cannabis to be used in the manufacturing process. Management has flagged (somewhat ominously) that the company will review its capital requirements in relation to Nunyara. So, despite the $48M cash balance at June, and my feeling that operating cashflow will improve considerably over coming quarters as the net $14M inventory build over 1H2019 converts into sales (and therefore cash – though may well still be negative), it is entirely possible that there is another capital raising in the next 6-12 months to support the establishment of a manufacturing facility.

As an illustrative datapoint, ASX-listed Cann Group will have spent upwards of $130M (funded by a mix of equity and debt) to construct its large cultivation and manufacturing facility in Mildura which will be able to process 70,000kg of dry flower annually. Cann’s situation is different to Elixinol’s: Canadian cannabis major Aurora Cannabis holds a 23% stake in Cann and earlier this year the two entered into an offtake agreement under which Aurora will acquire all of Cann’s output until 2024 (beyond that needed for Australian medicinal cannabis demand). I’m certainly not predicting that Nunyara will require a manufacturing facility anywhere near this size – or will even need any additional equity funding at all – but this should give readers a feel for what may be another material capital raising on the horizon.

As we have flagged since we initiated coverage of the company in October last year, EXL is a high-risk investment – and right now it is arguably higher risk than it was back then. *Fortunately* (spoiler: actually not at all fortunate for existing EXL shareholders like yours truly), the company’s share price is materially cheaper than it was – and at yesterday’s closing price of $1.96 is down 67% from its peak in early April at the height of the cannabis boom. The haemorrhaging of the Elixinol share price has no doubt in part mirrored the malaise of cannabis stocks globally as the air has come out of the cannabis balloon. Former poster child Tilray, for example, is down 84% in the last 12 months and is down 67% over the past 6 months. But make no mistake, the market was underwhelmed by the half-year results released by Elixinol last month and the quarterly 4Cs for March and June – delivering results below expectations is a sure-fire way for the air to come out of a momentum stock’s share price.

With news yesterday that the ACT has become the first Australian jurisdiction to legalise the possession and cultivation of cannabis for personal use (and one would expect other regions to follow in time), it is possible that the ASX cannabis stock rollercoaster may reignite for a period. Readers should temper their enthusiasm for what this will mean for Elixinol specifically (given its focus on the US and Europe and comparatively miniscule operations in Australia). Readers should also continue to view the company as a higher-risk speculative investment – but believers in the long term widespread use of CBD products and cannabis more generally will be heartened by this news. At this stage I plan to keep holding my Elixinol shares – though I will be keenly watching the 4C released late next month.

=============================================================

Disclosure: I (@Fabregasto ) have a position in Elixinol. In the future I may add to or sell my position –though not for at least 2 days after the publication of this article. I also hold a position in Cann Group (not covered by Ethical Equities) mentioned above, and also in Ecofibre (which we do cover – please see here for our coverage of Ecofibre’s FY19 results).

Please note Claude Walker has previously broadcast his intention to sell his Elixinol shares here and here – and having followed through on that, no longer owns the stock.

For occasional exclusive content, join the FREE Ethical Equities Newsletter.

This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.

If, somehow, you are not already using Sharesight, please consider signing up for a free trial on this link, and we will get a small contribution if you do decide to use the service (which in turn should save you money with your accountant, or time if you do your own tax.)

"The Ethical Equities website contains general financial advice and information only. That means the advice and information does not take into account your objectives, financial situation or needs. Because of that, you should consider if the information is appropriate to you and your needs, before acting on it. In addition, you should obtain and read the product disclosure statement (PDS) of the financial product before making a decision to acquire the financial product. We cannot guarantee the accuracy of the information on this website, including financial, taxation and legal information. Remember, past performance is not a reliable indicator of future performance."