Elixinol Global Ltd (ASX:EXL) Quarterly Cashflow Q1 2019

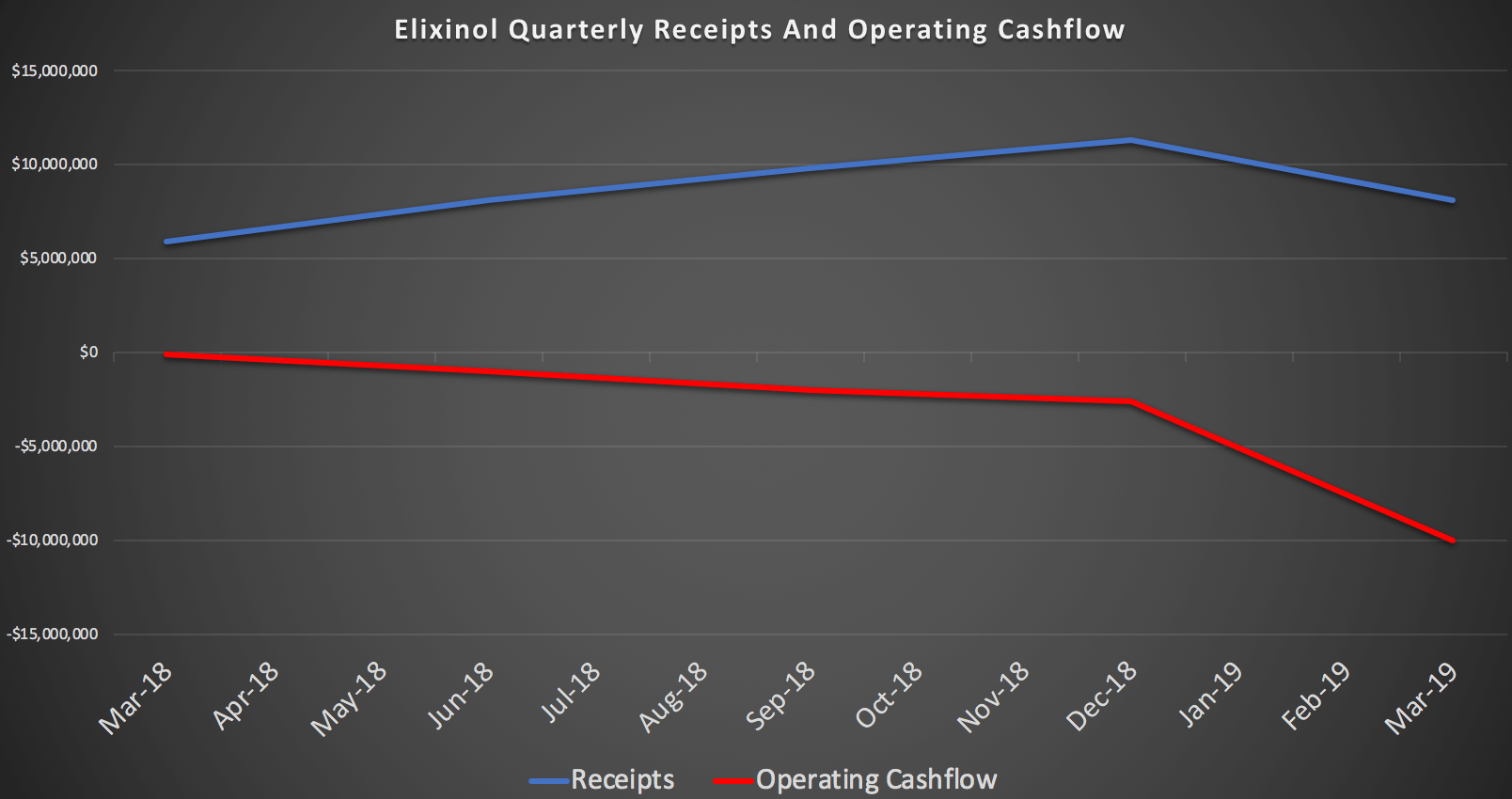

Cannabis oil company Elixinol (ASX:EXL) yesterday released its quarterly cashflow report, showing that cash receipts were not impressive, given that it operates in a growing market. As you can see below, the receipts from customers decreased significantly, but expenses did not -- leading to a very poor operating result.

The company said that this reduction was “driven by Elixinol’s strategic decision to reduce focus on low margin private label business in the US to enable increased capacity for expected future growth of higher margin branded products and provide the ability to capture further market share.” This is extremely concerning.

However, it is also confusing because the company also said “Private label sales were significantly lower largely due to the Company restructuring supply arrangements with a private label customer whereby the Company will no longer perform private label services but instead will supply only bulk CBD products.”

It is not obvious to me why moving from private label services to bulk CBD products is a higher margin activity. In any event a couple of sentences seems like an alarmingly flippant explanation for what is, on the face of it, an extreme quarter-on-quarter drop. If this was indeed a carefully thought out strategy, then it should have been justified at length and in very precise detail.

In the worst case scenario, the strategic decision only made sense because private label customers were increasingly low margin. That is, they were putting continual pressure on Elixinol to reduce prices, or else they would go elsewhere. If that’s the case, Elixinol made the right decision, but are unable to compete on price, which shows they either lack scale or low-cost operational systems.

In the best case scenario, Elixinol has decided to use its capacity to fulfill its own branded business, which was being constrained by the private label services. While this scenario could be true based on the announcement, I don’t think it is explicitly stated, so it may not be an accurate understanding. In this case, we should see a stonking improvement in both receipts and operating cashflow next quarter, and the thesis would remain viable.

However, even in the best case scenario, in my opinion, the company has shot itself in the foot.

It is better business to ensure you are a trusted and reliable business partner, who will not suddenly stop supplying a customer private label services because it no longer suits you to do so. Rather, in my view the company should manage its own capacity so that it can maintain its business relationships, while also growing their high margin direct sales. Ultimately, that will allow it to be a more powerful player in the cannabis oil market than it could be if it focuses only on its own brands.

There might well be a time limit private label clients, but if we are at the beginning of a rapidly expanding market, I’m not so sure that it makes sense to do that now. And in any event, if that is what the company has chosen to do, then the decision should be explained and justified clearly to shareholders.

As a result of this analysis, I can only conclude that in the best case scenario my confidence in the company is now lower than it was, and two days after this post, I intend to sell a significant chunk of my Elixinol shares.

I do note, however, that Fabregasto, who wrote our initiation report on Elixinol, is currently more optimistic about this quarterly than I am.

Claude Walker owns shares in Elixinol and will not sell for at least 2 days after the publication of this article.

For early access to our ethical investment ideas, join the Ethical Equities Newsletter.

This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.