The Mysterious Fabregasto's Initiation Coverage Of Ecofibre (ASX:EOF)

Ecofibre (ASX:EOF) listed in late March and has been a strong performer – closing its first day at a share price of $1.70 (a tidy 70% gain on the $1.00 IPO price for those who participated in the float).

The stock fell back to below $1.50 in the following week, with a number of (probably retail) shareholders happy to lock in a handy stag profit, but it has subsequently powered to a recent high of $2.64 (with the most recent close being $2.12).

The enthusiasm for the stock since listing is likely to be at least partly attributable to the stellar run of Elixinol Global (ASX:EXL). (You can read our coverage of Elixinol's FY 2018 Results). In truth, there are some striking similarities between the two. But (“Gah!” said grammar nerds, starting a sentence with “But”!) there are also a couple of key differences.

Like EXL, Ecofibre comprises three operating businesses, two of which operate in the same space, have been trading for some time, and are generating revenue. They are:

- A US-based manufacturer and distributor of hemp-based nutraceutical, dietary supplement and skincare products; (Ananda Health) and

- An Australian-based manufacturer and marketer of hemp foods (Ananda Food)

Ecofibre’s third arm is pre-revenue, and focused on commercialising the production of hemp-based textiles and composite materials (Hemp Black). Unlike many listed players, EOF has deliberately decided not to focus on the emerging medicinal cannabis space at this time (with the current regulatory framework making this market difficult, in management’s view).

For more background on the cannabis sector, please refer to our broader sector piece on Cannabis Stocks, The Industry Opportunity.

Because it is a freshly listed company yet to attract broker coverage, there is a limited amount of publicly available information on Ecofibre, apart from its prospectus, its website, and its maiden quarterly cashflow report. The IPO was not underwritten and the prospectus was prepared by the company itself – and as such is a little on the “skinny side” in terms of detailed descriptions and elaboration – but we will make do with what we have.

Ananda Health

This business launched in early 2017 and at this stage generates the majority of Ecofibre’s revenue and earnings (just as Elixinol’s US business does for it). Ananda Health is focused primarily on the manufacture and sale of zero-or-low-THC hemp-based nutraceutical products under the Ananda Hemp and Ananda Professional brands – predominantly in the US market. This division also selectively undertakes bulk white label contract manufacturing for certain “strategic” customers – presumably in order to absorb latent production capacity as well as generate additional revenue and margin. This contract manufacturing comprised ~10% of 1H19 sales per the prospectus.

Ananda Hemp sells CBD-oil and hemp-oil derived products (predominantly dietary supplements) via its website to wholesalers, distributors and directly to retail customers. The product range is marketed towards the health and wellbeing customer segment, in particular consumers seeking anti-inflammatory and anxiety relief or assistance with sleeping. Key Ananda Hemp products include CBD oil herbal extracts for humans (in a variety of strengths) and also pets, hemp extract gel capsules, hemp flower extract topical cream, and also a cannabis infused Ananda Bliss oil for “your inner sexpot” (Hello Sailor! [Ed: Keep it PG, Mr “Gentleman”]).

Ananda Professional is a brand distributed exclusively throughout independent pharmacy chains – with differentiated branding and packaging, but essentially mimicking the Ananda Hemp range above (excluding the racier Ananda Bliss oil).

Ecofibre signed its first pharmacy customer in 1H18 and formally launched this brand in 2H18. This brand was sold in ~1,500 independent US pharmacies as of late February 2019 (out of a total of ~22,000 nationally per the prospectus) – suggesting a store penetration rate of just 7% and ample opportunities for growth. As consumer awareness of CBD-based products increases following the signing of the US Farm Bill into law in December 2018 (discussed in our $EXL coverage), we think demand will increase. Management aim to accelerate new product development in line with the significant market opportunity in the US – although competition is likely to increase too, as newer players enter the market with their own expanding product ranges.

Ananda Hemp sales to retail customers comprised just 5% of total 1H19 sales, with the remaining 85% (after including white label above) derived from Ananda Hemp wholesale and Ananda Professional.

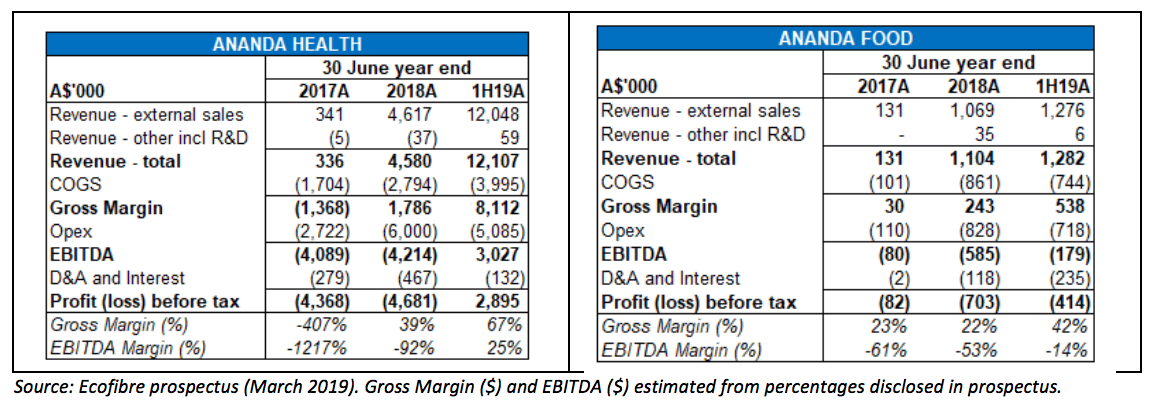

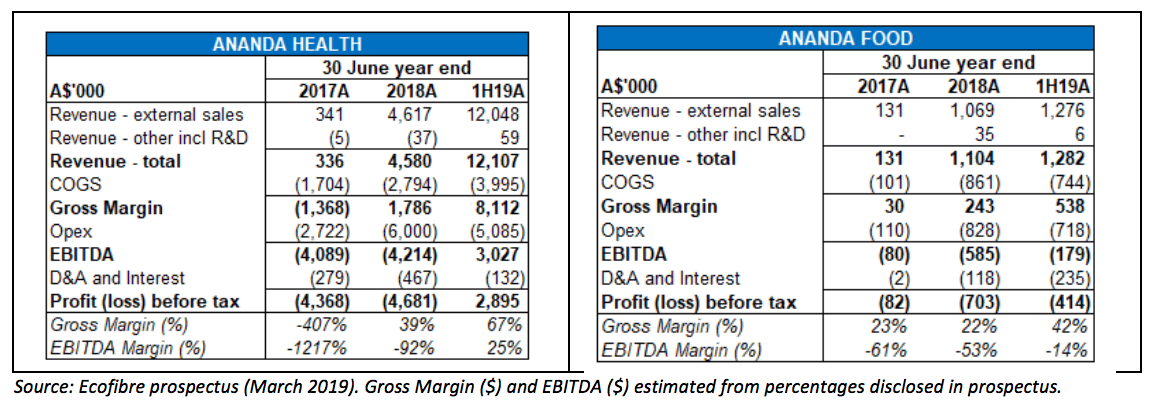

Sales have grown quickly since inception of this business – as demonstrated by the financial information disclosed in the prospectus (compiled and presented below left). Note that Ananda Health sales for 1H19 are already 160% higher than sales for the whole of FY18. We are loathe to make lazy projections based on a limited number of data points, but if no further growth was achieved in 2H19 (i.e. vs. 1H19), full-year FY19 sales would be in the ballpark of $24M (422% revenue growth from FY18). This would be very impressive growth even though it will not continue ad infinitum. On top of that, gross margin has increased to 67% in 1H19 from 39% for FY18, suggesting a degree of scalability in this business.

The US operations are vertically integrated. Ananda Health processes high-CBD concentrated hemp sourced from contracted local farmers at its Kentucky production facility to produce “dried green material” which is used as the base feedstock from its hemp extract product range. Per the prospectus, this site has been extended twice since commissioning in 2016 in order to accommodate growth, and a bottle and packaging line was added in July 2018.

Ananda Food

This business was launched in late 2017 post the inclusion of low-THC hemp as a food in the Food Standards Australia New Zealand code (which effectively legalised hemp as a food in Australia). Currently Ananda Food is focused purely on the Australian market, but has plans to expand into Asia at a later stage.

The Ananda Food product range includes hemp protein powder, hemp flour, hemp seeds and hemp seed oil. The majority of these volumes go through the wholesale channel which includes health food stores, grocery stores, and distributors, but there are also some white label and bulk customer sales per the prospectus.

While still small, this business is growing quickly (like the US division above it achieved higher sales in 1H19 than for the whole of FY18), and appears on track to break even in FY20.

Ananda Food contracts the growing of cannabis crops to growers in Tasmania, New South Wales and Queensland – using genetic material supplied by the company in order to produce maximum quality crops, over which Ecofibre retains ownership at all times. In November 2018, a manufacturing facility was commissioned in Newcastle which will focus on de-hulled seed, hemp protein and fibre powders. As part of its vertical integration strategy (i.e. to mirror the US operations), Ecofibre is also seeking to bring in-house the pressing of hemp seed (into oil) which is currently outsourced.

Hemp Black

This division is focused on developing hemp-based textiles and composite materials in partnership with Thomas Jefferson University (“TJU”, which is a top 20 shareholder in the company).

Hemp farming is not a recent innovation from the hipster community, it dates back to the beginning of recorded human history. Cannabis originated on the Central Asian steppes and was being used as early as 8000BC as an industrial fibre in clothing, building materials, lighting fuel and medicine. For thousands of years hemp was the world’s largest agricultural crop and was farmed throughout Europe and East Asia. As such, there is a long history of humans using hemp in industrial applications.

Ecofibre’s prospectus quotes research from Grand View Research Inc’s Industrial Hemp Market 2019 report that expects:

- The global hemp fibres market to grow from US$1.7B in 2018 to US$4.4B in 2025; and

- The global hemp textiles market to increase from US$955M in 2018 to US$2.8B in 2025.

Given the ubiquity of hemp as an industrial fibre throughout human history, I personally feel that these 2025 market estimates are likely to be on the conservative side, but time will tell. It is also well worth noting that hemp uses less water than cotton, and it would therefore be a positive for parched river systems if we used more hemp.

Hemp Black commenced operations in mid-2017 (when Ecofibre and TJU formally started collaborating) and is still in the R&D phase and yet to launch its first product. The relationship between Ecofibre and TJU is governed by a Research and Share Subscription Agreement (“RSSA”) under which TJU provides research services to the company until December 2022 – for which Ecofibre will not pay more than US$5M in total (excluding licence fees).

All intellectual property will be owned by TJU but Ecofibre will have global exclusive rights in regard to the commercialisation of products using this IP. Interestingly, under the RSSA, TJU has the ability to take payment for its research services in EOF stock (issued at A$0.537 per share per the prospectus).

Should TJU take all of its R&D fees from 2019 to 2022 in scrip – as it should with the EOF share price currently hovering at 4x this level already – TJU’s ownership in the company will grow from 1% currently (obtained via the conversion of R&D services to date into shares) to 4%. In addition, the prospectus detailed that TJU has an option to subscribe for a further 12.2M shares (representing ~4% of the company) at the same A$0.537 share price – provided that TJU has elected to receive payment in EOF shares for all R&D services provided under the RSSA.

The prospectus outlines two potential paths for commercialising the Hemp Black technology:

- Hemp Black bi-component fibres: via the pyrolysis (heating) and then spinning of fibres into different patterns and concentrations which per the prospectus may have anti-odour and anti-microbial properties, moisture management, thermal regulation and low friction. Potential commercial applications include multi-filament yarns, performance and athleisure apparel, 3D printing filament, and fabrics used in motor vehicle seats and office furniture, amongst other uses.

- Hemp Black Nano: the use of hemp flower extract to create CBD-rich fibre mats with potential anti-inflammatory benefits which could be incorporated into wound dressing and textiles, and in drug delivery and filtration technologies.

Last year TJU filed six provisional patent applications – however the IP and potential products themselves remain confidential at this stage under patent law. Management currently anticipate that the first prototypes of these products will be introduced to the market in mid-FY20.

Ecofibre has commissioned the equipment needed to produce the feedstock required for this first generation of products, and has commenced the establishment of a dedicated Hemp Black commercial facility at a new site in Kentucky which is expected to be completed in the June 2020 quarter. In addition, the company has commenced establishing its supply chain for Hemp Black operations, and has identified a commercial partner to spin Ecofibre’s pyrolised bi-component hemp fibre at commercial scale – with this partner injecting $3M of equity into the company in December 2018.

The company does not expect Hemp Black to become a manufacturer of the products described above – but envisages that this business will be a supplier of the technology (presumably under licence and including royalties), Hemp Black feedstock and CBD extracts.

Financials & “Valuation”

Consolidated historical financials for Ecofibre appear below including the Ananda Health and Ananda Food business, and also Hemp Black (which incurred $1.3M of costs in FY18 and also for 1H19). The company is clearly growing very quickly, and if there was no growth in 2H19 from 1H19, Ecofibre would achieve 364% top line growth versus FY18 – impressive albeit impossible to sustain indefinitely.

The prospectus contained no official forecasts – perhaps unsurprising given the growth trajectory and potential difficulty in nailing down accurate forecasts in this environment.

My read of the prospectus suggested to me that the company is on track to break even in 2H19 – this view was supported by the company yesterday, with the release of its 4C quarterly cashflow report for the March quarter. The commentary included in the 4C noted that Ecofibre achieved unaudited revenue of $10.1M for 3QFY19 – more than 75% of revenue generated in the December half and suggested that growth has accelerated further in early 2019 (annualised $40M of revenue ignoring seasonality).

Pleasingly, the 4C also included the company’s first guidance for FY19E with respect to year-on-year growth for revenue, gross margin and opex (included in the table above), as well as confirmation that management believe Ecofibre is on target to record a small profit for the current financial year – that’s better than breaking even exactly and capturing the Infinity P/E Multiple, a very rare Pokémon indeed.

The table above extrapolates an estimated small profit based on this guidance (and holding several other things constant from FY18 (as broadly suggested by 1H19 actuals). Note however that if March quarter revenue was $10M and there is no discernible seasonality in the business, we would expect FY19E revenue to be closer to 6x FY18 levels (~$34M) – which would require June quarter revenue of $11M, not at all absurd given the apparent acceleration in revenue in 3QFY19 vs 1H19.

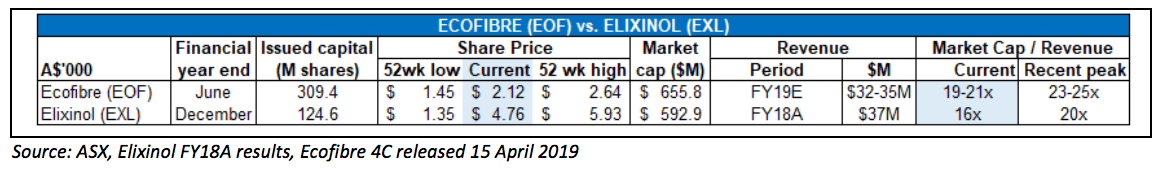

Ecofibre listed with a market capitalisation (at the $1.00 IPO offer price) of $309M (excluding the option held by TJU) – which has swelled to $656M at yesterday’s close. The current market capitalisation is a rich valuation indeed for a company just breaking even, however its growth trajectory is impressive and clearly the market is less bothered with traditional valuation measures and more focused on medium term growth potential – as it is with peer Elixinol:

At current respective share prices, Ecofibre is trading on a 19-21x multiple of FY19E (June year-end) revenue. That is actually higher than Elixinol, although the limited financial information we have does suggest that EOF is growing faster than EXL at this point in time (EXL only grew revenue by 125% in the year to December 2018). Note that the revenue figure above is EXL’s latest FY18 (December year-end) comparable, and that annualised revenue for Elixinol to June 2019 is likely to be closer to $50M given its growth trajectory – which would put EXL on a 12x revenue multiple – more than a third lower than Ecofibre. Of course, if EOF can continue its growth trajectory in FY20 (which will commence in only several weeks), then the forward revenue multiple will decrease significantly. Note that even a doubling of revenue in FY20 from FY19 would represent a considerable slowdown from the 450% increase flagged by Ecofibre management for FY19E.

The takeaway of course is that it is EOF and EXL trade on comparatively eye-watering multiples because these companies are enjoying this spectacular growth in a rapidly expanding market which is benefiting from regulatory tailwinds. Both companies have also just recently reached their inflection points from a cashflow and profitability break-even point of view – and as such traditional valuation measures such as P/E multiples make these companies look very expensive indeed. We have previously discussed on Ethical Equities the PEG (P/E multiple divided by medium term % Growth rate) ratio – which factors in respective earnings growth rates and thereby enables more informed comparisons of company valuations – particularly between sectors and especially when comparing Growth vs. lower growth companies.

Closing thoughts

As noted in our last piece on Elixinol, the market for hemp-based nutraceutical, dietary supplement and cosmetics products is currently in a hyper-growth phase – which will attract a raft of new competitors all keen to get a slice of this rapidly growing market. To this end, Ecofibre investors will be keen to see how the company can grow market share and defend against new market entrants – and will be very focused on preliminary FY20 guidance, which I hope will be given in August at the release of full-year FY19 results.

The next few years represent a land grab as the global market opens up gradually as different countries relax regulations at different speeds, and existing and new industry participants wrestle to build defensible market positions. It will take some time to identify which companies will be the long-term cannabis winners. Ecofibre, with its focus purely on hemp is another comparatively smarter way to play the cannabis boom (but without the uncertainty in relation to licenses for medicinal cannabis cultivation and export etc). In particular, I personally find the Hemp Black division very interesting, though it is unlikely to be a significant revenue generator for a couple of years at least – however Ecofibre CEO Eric Wang (18% shareholder, alongside Chairman Barry Lambert (of Count Financial fame) who controls 24% of the company) has stated publicly that he believes in time Hemp Black will eventually be the largest part of the business.

The company may also move into the medicinal cannabis at a later stage. Chairman Barry Lambert has been a vocal advocate of the legalisation of medicinal marijuana for several years, with his granddaughter suffering from Dravet Syndrome (a severe form of epilepsy), and donated $34M to the University of Sydney in 2015 to establish the Lambert Initiative for Cannabinoid Therapeutics.

We feel that EOF, along with EXL, represents the second wave of the ASX cannabis boom (or Cannabis 2.0 if you will) – denoted by more professional, better organised, and more appropriately capitalised operators than those that mostly comprised the first wave over 2015 to 2017 (including a number of back door listings and pivots from other industries).

While the share price return of EOF to date is dwarfed by those briefly enjoyed by the first wave of more speculative players, there is little doubt that the company has been caught up in the renewed hype for cannabis stocks in 2019 following the passing of the US Farm Bill in late 2018, and the explosive YTD returns of EXL (at its recent high point up 137% from the end of December). As such, investors in EOF should expect continued volatility for the time being while cannabis stocks are once again in vogue with the shorter-horizon trading community, and we recommend Ecofibre only in small doses to readers with a high risk appetite (as with EXL).

Personally I am very curious to see initial FY20 guidance provided in August – and will be holding my EOF shares in the meantime.

Note from Claude: I am very proud to present this excellent research into a second investable ASX cannabis company. However, I do note that I would not mind if the company did not provide any specific guidance.

Disclosure: I (@Fabregasto ) subscribed for shares in Ecofibre in the IPO (though due to scaling back only received half the number of shares I was hoping for) – and may add to my position in the future – though not for at least 2 days after the publication of this article.

Claude Walker owns shares in Ecofibre and will not sell for at least 2 days after the publication of this article.

For ethical investment ideas I back with my own money, join the Ethical Equities Newsletter.

This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.