Dicker Data Ltd (ASX:DDR) FY 2018 Results: Record Revenue

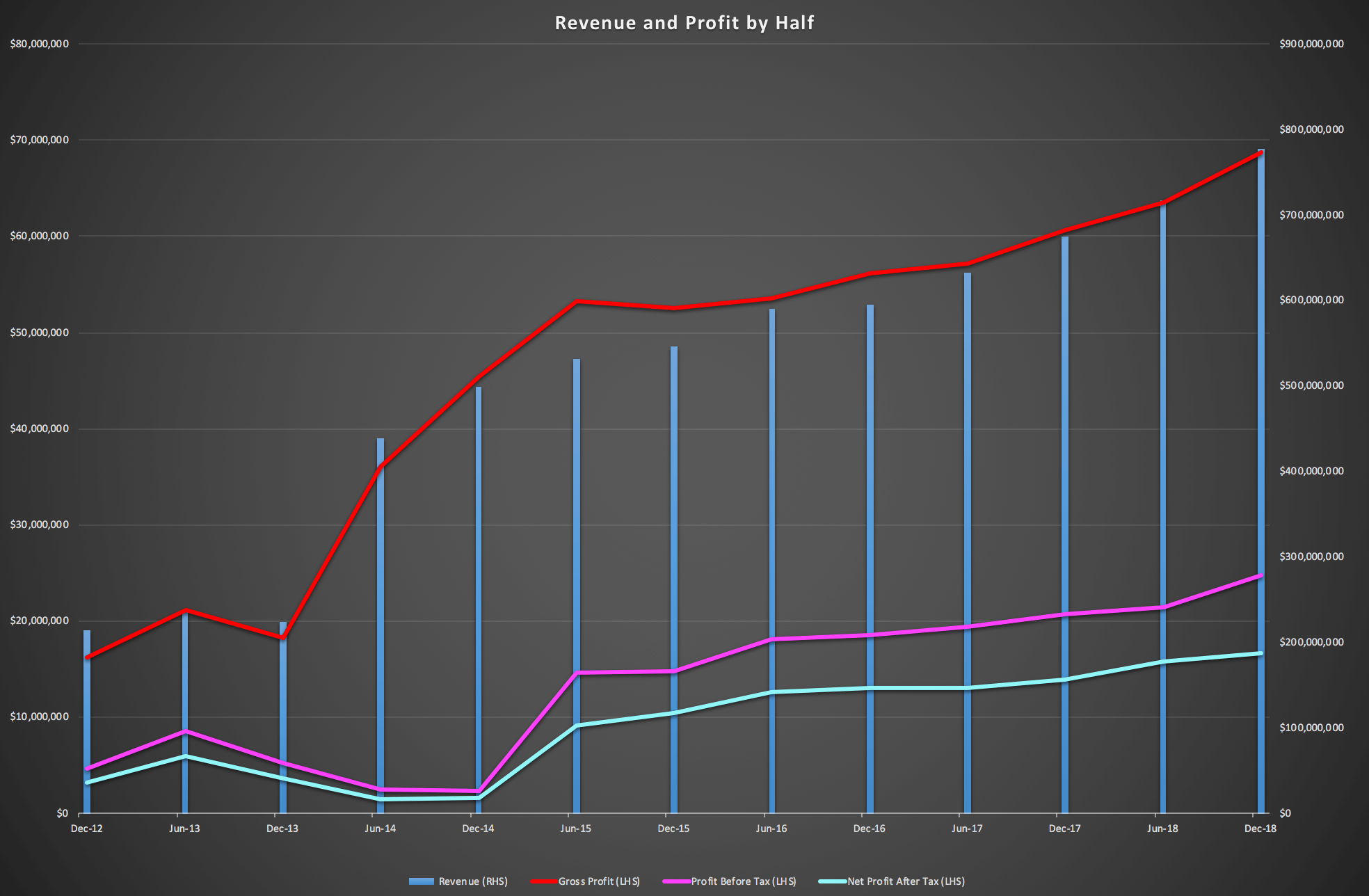

IT distributor Dicker Data released a typically solid set of full-year results yesterday. Revenue rose 14.4% to $1.5 billion, net profit before tax was up 16% to $46.2 million and NPAT improved 20.5% to $32.5 million. A one-off tax credit assisted the NPAT result. You can see below how the improved profit was ultimately a product of record half-year revenue.

Net debt increased 21.3% to $103 million (1.9x EBITDA), operating cash flow dove 70.5% to $12 million and free cash flow tumbled 73.2% to $10 million. Cash flow is volatile in this business because of high working capital (inventory plus receivables less payables) requirements combined with skinny operating profit margins (3.1% in FY 2018).

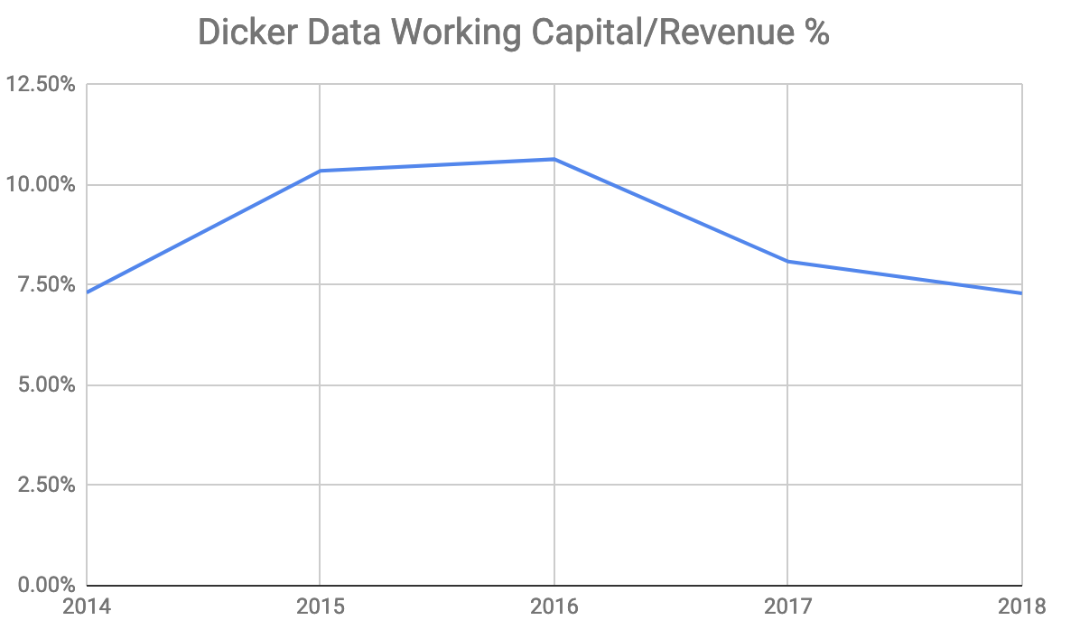

This means a relatively small percentage move in working capital over a period can overshadow profit and play havoc with cash flow. Over time these moves balance out, assuming working capital remains under control. And this has been the case to date, as you can see below.

Even though working capital is well managed, additional working capital is still required to grow revenue. Therefore, cash flow will fall short of profit whilst Dicker Data grows which is what happened this year even though working capital/revenue fell.

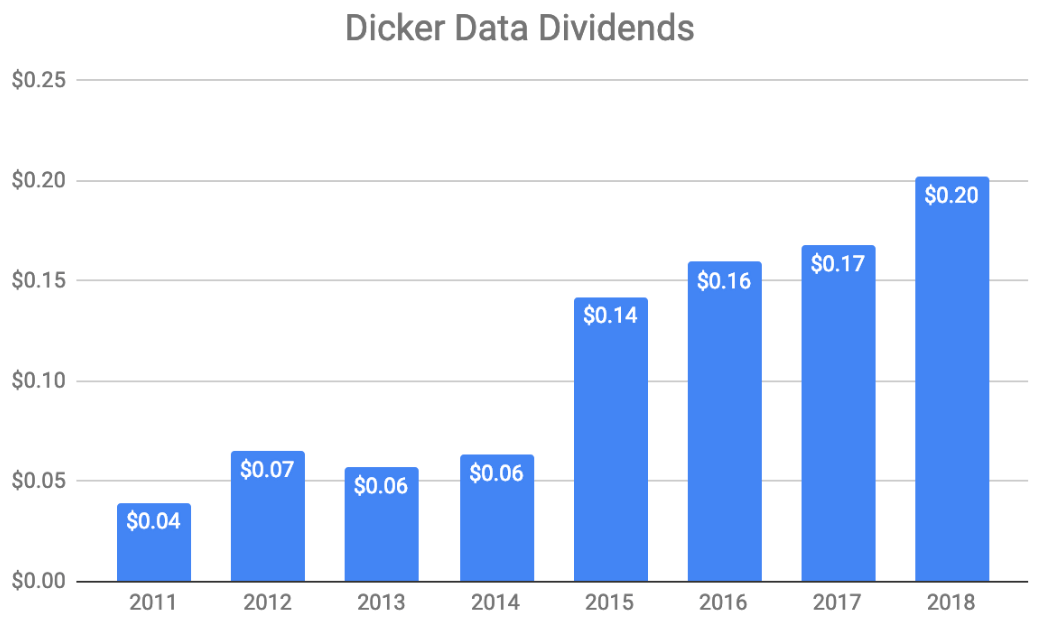

Despite its inconsistent cash flow and respectable growth profile, the company pays substantially all of its profits out as dividends each year. It does this by using debt to finance its working capital position. Total dividends for FY 2018 rose 9.8% to 18 cents representing a dividend yield of 5.5% at current prices.

Although working capital requirements are high, fixed asset requirements are relatively low and so Dicker Data generates a high return on capital (27.6% in FY 2018) and a very high return on equity (41.9% in FY 2018). However, return on capital will moderate over the next couple of years as the company upgrades its warehousing facilities for a cost of around $55 million.

Dicker Data is run by founders David Dicker and Fiona Brown and has provided outstanding returns for shareholders since listing at 20 cents in 2011. The annualised return for those lucky enough to have held since then is approaching 50% including dividends. Including dividends, the stock has returned about 24% since we chose it as our Preferred Dividend Stock for November 2019 in our hidden report for subscribers.

This impressive result is partly due to the lean capital structure described above, skilled and shareholder aligned management and tailwinds in the IT industry. Another factor is a scalable business model which offers customers an ever growing range of IT vendors and products.

The stock trades on an EV/NPAT multiple of just shy of 20 or a P/E multiple of 16 which is reasonable given the quality of the company and secular IT growth trends.

Note from Claude: I have little to add to this other than to remind readers that the founders own most of the business and management incentives are well aligned with shareholders. I thought these results were good.

Please feel free to sign up to the forums and let us know what you think!

For early access to our timely content, join the Ethical Equities Newsletter.

Disclosure: Matt Brazier does not own shares in Dicker Data at the time of publication. Claude Walker does own shares in Dicker Data and will not trade them for at least two days after the publication of this article. This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.