Beyond International (ASX: BYI) have reported results that were slightly worse than my expectations. The core businesses remain strong, but the digital acquisition has floundered. I sold my shares in Beyond at $1.50, although they last traded at $1.66. I believe the company has no margin of safety, and is potentially overvalued at the current price. The company has no debt and has cash of over $10 million. This article may seem negative to some... but really, it's because I'm holding Beyond up against high standards. This is a well run company.

Beyond International has four business segments. Three of them fall squarely within the organisation’s circle of competence: they achieve a high return on investment, they are growing, and the most important business, production and copyright, earns significant foreign revenue (and thus stands to benefit in FY2014 from the lower Australian dollar.) As I wrote previously, due to hedging the company is yet to benefit from this. This business is highly likely increase profits further in Australian Dollar terms because of the more favourable exchange rate.

Pleasingly, the Board brought the dividend up to 4c per share. I think that this is sustainable (assuming they don't buy any more Digital Businesses). It seems like the appropriate thing to do and demonstrates their good judgement. The dividend is, however, unfranked.

The problem with Beyond International is their Digital Marketing businesses. Beyond paid over $2 million for these “assets” and they have thus far only lost the company money. I can understand why the company wishes to diversify in this way, but so far the strategy has not worked.

When I spoke to CEO Mikael Borglund, he expressed confidence in the team working in the Digital Marketing business. At the time, when I was considering selling my shares, I spoke to a friend of mine who runs a (much, much smaller) competitor to Beyond’s Digital Design and Web-business (First). Whereas the board of Beyond seem to have precisely zero experience in building a business like First, my friend has done just that, achieving a ridiculously attractive return on investment (at this early stage). If I had a chance to invest in his business, I would. He simply doesn't need the capital because he is in a business that should have very low capital requirements. My friend did not think First looked like it was particularly attractive to potential clients. He saw no significant product differentiation at First. He didn't think business at First would improve. Having said that, he does have high professional standards (and it shows).

I have enormous respect for Borglund and his team. They are probably running the most attractive media business available on the ASX, although I also think Prime Media (ASX:PRT) is a decent investment. Their skill, knowledge and market position in their core businesses is unparalleled in Australia, and this gives their business an edge. However, I do not believe they have been able to attract the necessary talent to run their new acquisition. Perhaps I am simply impatient, but I believe something is going wrong there. Most likely, they are overpaying their employees. This is an understandable error. The situation arises because the best in that business can simply set up their own businesses as the capital requirements are so low. What is required is intelligence, tenacity and a very strong work ethic (much easier to summon when you are starting your own business).

There is an opportunity to run this business well: but it requires taking a risk on personnel. I have enormous respect for the value of experience; in most industries (such as my own) youth is an obvious disadvantage. In digital design it is an advantage. If only the board could find entrepreneurial talent like themselves to run the Digital Marketing businesses. The digital business should be a cash cow, as are the businesses built by the long-serving team at Beyond. Instead, it is a turnaround play. I wonder what would happen if First were staffed by a group who were in their twenties, grateful for the opportunity and all remunerated on minimum wage plus generous performance incentives?

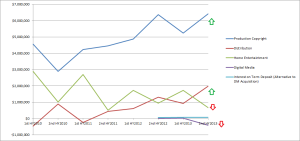

Earnings before Interest, Tax and Foreign Exchange Adjustments, by Segment

As the above graph shows, Beyond had a great half in its two better businesses. Although Home Entertainment was down, they have shown they can continue to operate this profitably despite the changing consumer behaviour (namely, the move towards acquiring content in digital form). I expect this business to get worse over time, but I think it is still valuable. More than offsetting this decline, the Production and Copyright segment had another good half, as did the Distribution business. I think that both these segments should be able to remain steady (albeit lumpy) or grow, even as the way people access content changes.

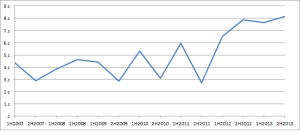

Beyond International Earnings per Share by Half

I've adjusted my buy price for Beyond. I'd now buy it between $1.05 - $1.20, reflecting the boost I expect from the lower Australian dollar. It's worth noting that at these prices the company is undervalued in my opinion (which is why I would buy). In retrospect, I was too hasty to sell my shares earlier this year, but as I said then, I had other uses for the capital. I no longer assign value to the Digital Marketing business. Therefore, if that started to be profitable, my buy price would increase. On the other hand, if the Digital Marketing business doesn't improve, one would have to consider assigning a negative value to it.

The Author has no financial interest in Beyond International. Nothing on this website is advice, ever. This post is for entertainment (and for my own reference!)

Sign up to the Free Newsletter to hear about it when I find an ethical company at a price I find attractive!