Cannabis Stocks On The ASX

Like cryptocurrency, cannabis stocks have become a hot topic in the investing world, as various jurisdictions around the world loosen regulation around marijuana. That, more than anything else, has driven market operators to float a variety of businesses that aim to benefit from this theme.

So, first, a word of warning: from a probabilistic point of view, and reflecting the very real prospect of much larger and better capitalised players moving into the space, these are, on the whole, a very risky bunch of businesses. Our view is that most of the cohort will probably dilute today’s shareholders to oblivion – or worse. But for those businesses that do succeed, there is certainly the potential for upside to be very considerable.

So here's a quick summary of the ASX-listed Cannabis companies:

Auscann Group Holdings Ltd (ASX:AC8) seeks to commercialise cannabinoid medicines. Its “initial therapeutic target area is chronic neuropathic pain”. It says it “is currently on track to release its Australian produced unique capsule cannabinoid medicines in the new year.”

FY 2018 Receipts from customers: zero

Market Capitalisation: $247 million

Botanix Pharmaceuticals Ltd (ASX:BOT) has “a near-term focus on moving Phase 2 clinical programs (acne and atopic dermatitis) into the clinic and progressing the dermatology pipeline (psoriasis and antimicrobial product).”

Receipts from customers: zero

Market capitalisation: $67.4 million

Cann Group Ltd (ASX:CAN) “started harvesting medicinal cannabis at its Southern facility in Melbourne in August 2017.” It also imports cannabis oil, and announced recently that “the first patients have been supplied, following specific patient-product approval through the Therapeutic Good Administration’s Special Access Scheme.”

Receipts from customers: $0.6 million

Market capitalisation: $369 million

Cannpal Animal Therapeutics Ltd (ASX:CP1) “was founded to create a new standard of care for companion animals via the development of cannabis-derived therapeutic products.” They have completed a Phase 1A study and have commenced a Phase 1B on a product “which is being developed as a pain control for companion animals."

Receipts from customers: zero

Market capitalisation: $7 million

Esense-Lab Ltd (ASX:ESE) performs “analytics on mass spectrometry based instruments to identify and quantify plant metabolites, i.e. the terpenes,” and “the first plant eSense-Lab is targeting for re-engineering into a. 'virtual plant' is cannabis.”=

FY 2018 Receipts from customers: zero

Market Capitalisation: $9.5 million (post dilution from capital raising in September)

Eve Investments Ltd (ASX:EVE) sells a range of honey products through its subsidiaries. Future products include “potentially a Cannabis Honey product from cannabis that will be grown on its Robyndale plantation.”

FY 2018 Receipts from customers: zero

Market Capitalisation: $16.2 million (including future dilution from in-the-money options)

Elixinol Global Ltd (ASX:EXL) sources and sells products like hemp oil and hemp flour through its Elixinol and Hemp Foods Australia brands.

HY 2018 Receipts from customers: $14.2 million

Market Capitalisation: $236 million (including dilution from recent capital raising)

Lifespot Health Ltd (ASX:LSH) recently bought a company that sells a “smart cannabis vaporiser”, after announcing it would explore cannabis related opportunities in 2017.

FY 2018 Receipts from customers: $0.2 million

Market Capitalisation: $6 million (post dilution from recent acquisition)

Medlab Clinical Ltd (ASX:MDC) sells dietary supplements including a cannabis oil product which “is currently being trialled at the Royal North Shore Hospital by Prof Stephen Clarke as an adjunct for opioid analgesia for the management of intractable pain in patients diagnosed with advanced cancer.”

FY 2018 Receipts from customers: $4.7 million

Market Capitalisation: $85 million (including future dilution from in-the-money options)

MMJ Phytotech Limited (ASX:MMJ) invests in a variety of cannabis industry businesses, but is currently suspended from trade on the ASX, as it fails to comply with listing rules

FY 2018 Receipts from customers: $0.07 million

Market Capitalisation: $76 million (when last traded)

MGC Pharmaceuticals Ltd (ASX:MXC) manufactures epilepsy medication CannEpil, which “is expected to be available for sale in Australia by December 2018.”

FY 2018 Receipts from customers: $0.3 million

Market Capitalisation: $69 million

RotoGro International Ltd (ASX:RGI) makes “an automated rotary hydroponic vertical farming system to produce uniform high quality medicinal cannabis at a reasonable cost.”

FY 2018 Receipts from customers: $0.45 million

Market Capitalisation: $50 million

Hydroponics Company Ltd (ASX:THC) grows cannabis and manufactures cannabis oil. It also sells hydroponics equipment under the Crystal Mountain brand.

HY 2018 Receipts from customers: $1.2 million

Market Capitalisation: $65 million

Zelda Therapeutics Ltd (ASX:ZLD) “is currently undertaking clinical trials in autism and insomnia in the USA and Australia.”

FY 2018 Receipts from customers: Zero

Market Capitalisation: $22.5 million

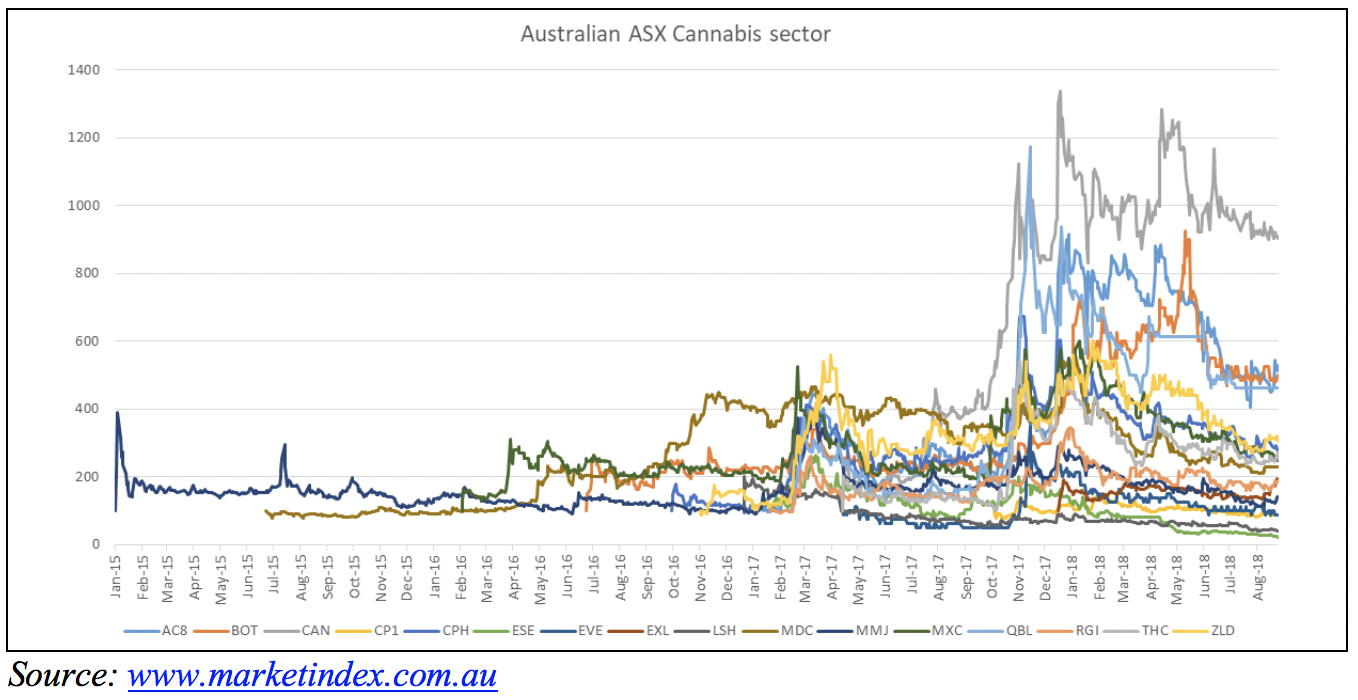

Below is a chart tracking the share prices (relative to IPO and pivot-timed capital raising prices) of the Australian ASX-listed cannabis stocks. The chart illustrates the extreme share price volatility over 2017 and 2018 as the market has salivated over the potential for the generation of supernormal profits from medicinal cannabis. These volatile share prices are consistent with underlying businesses that do not make much money – leaving market sentiment and speculative trading as the main driver of shareholder returns.

Of course, given the relative immaturity of the sector and the large number of moving parts here, it is difficult at this stage to accurately predict which stocks, if any, will become medium and long term winners. In reviewing the sector, I was appalled out how over-priced these stocks seem to be, as a group. Some of them seem to have virtually no prospects of surviving in the long term, and seem to exist purely to extract capital from retail investors.

However, there is one company amongst this group that we think offers an attractive, alibeit high risk, investment proposition. You can read about it for free right now by signing up to the Ethical Equities Newsletter, right here (the link will be sent to your email).

Please feel free to sign up to the forums and let us know what you think!

For early access to our content, join the Ethical Equities Newsletter.

Disclosure: The Author, Claude Walker, owns shares in Elixinol at the time of publication. This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.