Blackwall Ltd (ASX:BWF) FY 2019 Results And Initiation Report

BlackWall Ltd (ASX:BWF) is the management company for BlackWall Property Trust (ASX:BWR) and various other private property syndicates. The company is a turnaround specialist, buying under-occupied or over-leveraged properties and improving their fortunes via capital restructuring, change of use or investment in fixtures and fittings. Management is long-term focused and seeks to exit an investment only when it can no longer grow rent, and the after tax return from a sale exceeds expected future income from continuing to hold. In addition to its asset management activities, BWF also owns WOTSO which provides flexible workspace mainly to sole traders and startups. The majority of BWR’s properties house a WOTSO operation and around half of all WOTSO operations are located in BWR premises. As you can see, the two entities are inextricably linked and so a proper analysis of BWF also requires an examination of BWR.

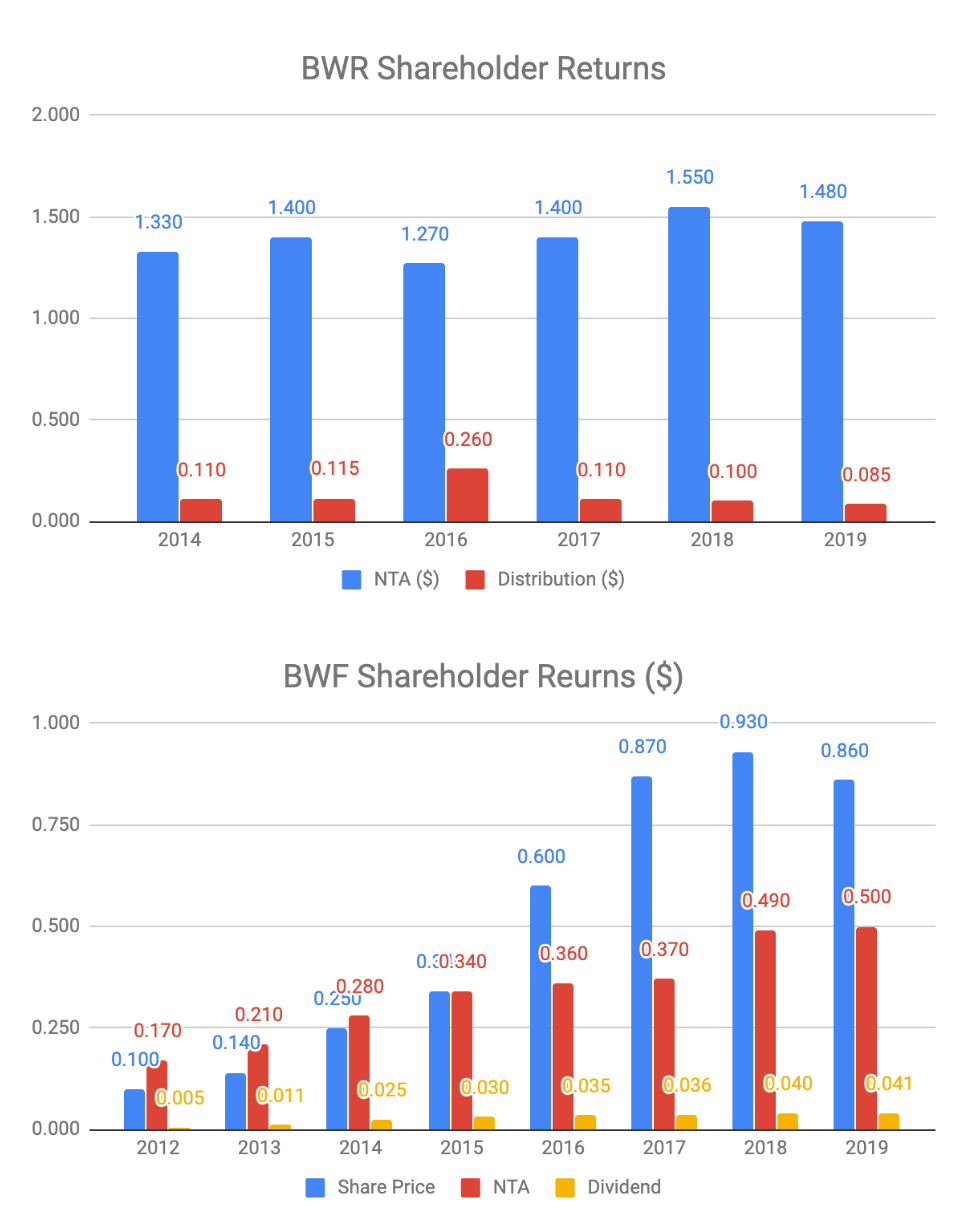

Historical listed performance

A couple of years after listing, BWR was successfully sued by a trust which claimed to have invested in P-REIT (as BWR was then) under special redemption terms prior to BWF taking control. The impact on BWR was twofold. Net tangible assets (NTA) per unit dropped from 30c (pre 10:1 consolidation) at the time of listing in 2011, to 22c just a year later as BWR recognised a provision of almost $20 million against the action. Then in 2014 BWR raised $7.8 million at 3 cents (an 80% discount to the prevailing price) through an entitlements issue to help pay for the damages and associated fees. This caused the NTA per unit to crash from 24c to 13c, but the low price ensured close to full participation and the shortfall was just 5.9%. BWF co-underwrote the deal along with Aims Property Securities Fund, the trust that brought the case against BWR.

BWR has performed well since this stumble early in its listed life. Since 2014 it has returned 74.5 cents (post 10:1 consolidation) of tax deferred distributions to unitholders, utilising the tax losses created by the legal stouch. NTA per unit has risen from $1.33 to $1.48 over the same period. Meanwhile, BWF has paid out 20.2 cents in dividends and grown NTA per share from 17 cents to 50 cents since 2012.

Coworking

Coworking is a new, fast growing sector (although serviced offices have been around for a while) and it is unclear what the long-term economics of the model look like. US based and Softbank backed WeWork is competing aggressively at home and overseas by securing prominent CBD locations on long-term leases and spending lavishly on fitouts. It loses money, but is well funded. Whilst there is some advantage in being able to offer customers access to offices in a multitude of cities, I don’t think it is a major draw since people mostly spend their time working close to home. Branding is important and WeWork’s heavy investment is helping in this regard, but I suspect it is spending more than is wise.

Blackwall CEO, Stuart Brown, sees coworking more like providing storage space (a business that BWF has been involved in) for people and so convenience is the key. This is why WOTSO is focused on suburbs where property is cheaper than in city centres, but demand is still strong. I think this is a winning strategy and evidence of a competent management team. WeWork may move into the suburbs too, but it wouldn’t make sense to open in an area already occupied by WOTSO while other neighbourhoods remain underserved. Therefore, it should be a while before the two companies bump into each other and by then BWF will have had time to establish itself. Other competitors such as Servcorp Limited (ASX:SRV), Regus and Victory Offices Ltd (ASX:VOL) are focused on CBDs (like WeWork) and cater primarily to the corporate market. A network of global offices is more desirable for these businesses because their customers are typically larger and often multinationals.

When the economy struggles WOTSO is likely to be badly affected since its clients are not tied to multiyear contracts whereas it enters into fixed term leases with landlords. This risk was born out when WOTSO launched in Singapore. Shortly after opening competition intensified, the site became unprofitable and remained so. BWF has now withdrawn from this building and fortunately has not had to pay a penalty in doing so. This experience has prompted BWF to seek management fee arrangements, where it receives a percentage of turnover rather than entering into leases, thus reducing the chance of losing money. The drawback of this structure is reduced upside as leasing arrangements are more profitable if high occupancy is achieved. BWF is applying a blended approach to the WOTSO portfolio with some management fee and some lease agreements depending on which option is likely to yield better results. With BWR often on the opposite side of the trade, management has the tricky task of maximising returns for both sets of shareholders (more on that later). An advantage that WOTSO has over its competitors is that it is still relatively small and so is not already enumbered with large lease liabilities. I would prefer it if WOTSO focused solely on management fees and said so to Stuart. My view is that the opportunity cost of a management fee model is insignificant when there is such an abundance of potential sites available.

WOTSO works (though perhaps not everywhere)

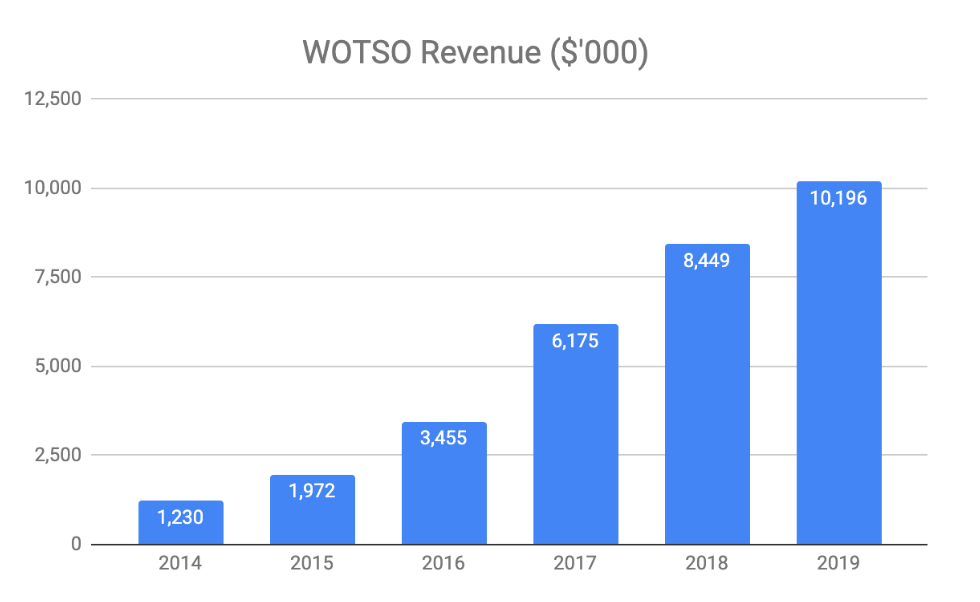

WOTSO revenue is growing rapidly as can be seen above and based on the research I have done it also has happy customers. I found videos created independently by WOTSO clients in Brisbane, Adelaide and Canberra all containing positive commentary about value for money and the work environment. Additionally, all WOTSO offices in Sydney, Adelaide, Canberra and Brisbane have an average review rating of at least four stars on Google.

I visited two WOTSO premises both in Canberra under the guise of a potential customer. The more established North Canberra location had two floors dedicated to flexible workspace. The ground floor was full and had a buzzing atmosphere, whereas as the third floor was quite empty and had more of a stark traditional office-like feel. I was told that the third floor is a transition space and occupants will be transferred to the fourth floor once it has been fitted out. The South Canberra location was only opened in October last year and most desks are still vacant. The surrounding area is sparsely populated and I am doubtful about the long-term prospects for WOTSO at the site. The fit-out is attractive enough and work is ongoing to improve facilities such as the installation of a reception desk. Both buildings house traditional office tenants in addition to WOTSO clients. A third Canberra location is planned for the Westfield shopping centre in Woden. This follows the success of the Westfield Chermside WOTSO space in Queensland. The appeal of working close to the shops is obvious and the relationship with Westfield could be a significant growth driver for the business. It should be noted that the two Canberra locations are among the three worst performing properties in the BWR portfolio so I doubt the over capacity I observed is representative of the group.

Although I was underwhelmed by the vacant areas in both Canberra properties, I was impressed by the customer value proposition. You can hire a ‘hotdesk’ for $220 per month. This typically includes services (all present in North Canberra) such as 24/7 access, reception desk for handling mail and meeting visitors, bike racks and showers, free tea, coffee, soft drinks, beer and snacks, onsite cafe and high speed broadband. Access to more than a dozen (and growing) WOTSO locations is also covered and there is no lock-in period. All the staff I spoke with were helpful and friendly.

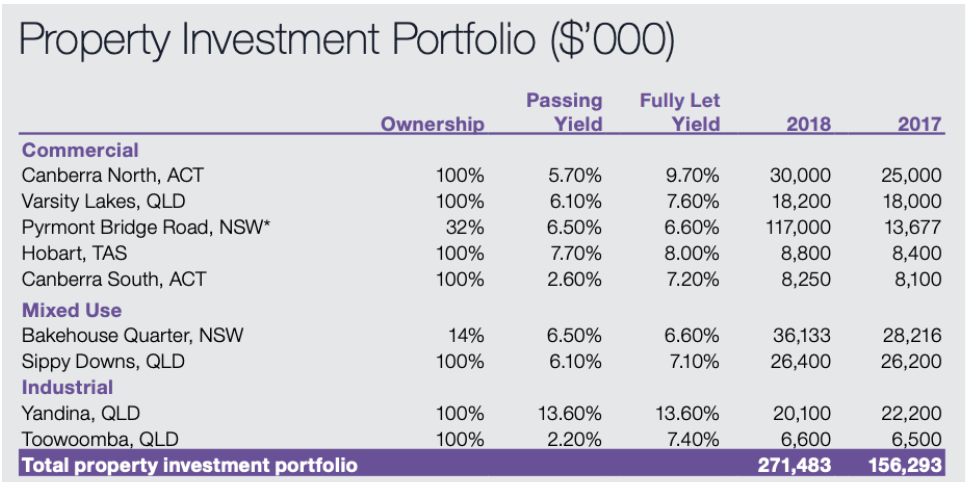

The Bakehouse Quarter

The Bakehouse Quarter is a commercial development in Sydney in which both BWR and BWF held a stake until its sale in April 2019 for $380 million. Blackwall’s founders and current board members, Seph Glew and Paul Tresidder, arranged the original purchase of the property in the 1990s and at maturity the investment delivered an impressive annualised internal rate of return in excess of 15%. The trust that owned the Bakehouse quarter has been rolled into BWR increasing the net tangible assets of BWR from $155 million to $220 million on an NTA for NTA basis. This is effectively a low cost capital raise for BWR and shows strong commitment by the Blackwall board given they collectively owned a significant portion of the Bakehouse trust. The Bakehouse Quarter is a good example of management’s long-term approach in action. The rejuvenation process involved converting part of the space to WOTSO offices, a trick repeated with a property in Pyrmont which looks set to be a similarly successful investment.

Insider incentives

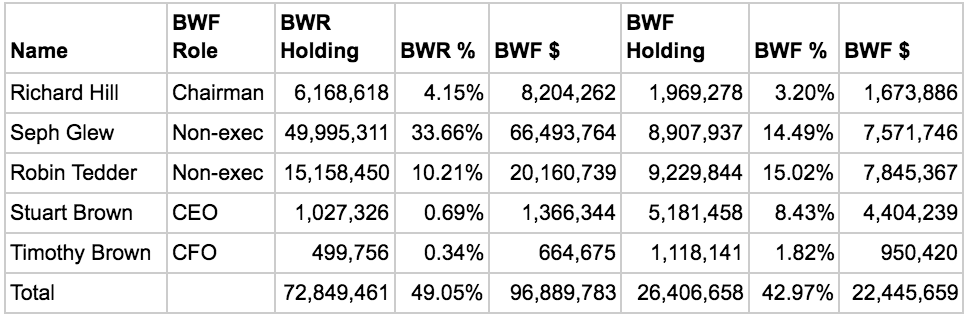

Insider ownership is particularly important in the case of BlackWall because there are potential conflicts of interest between the management company, the trust and the private funds which BWF also manages. Management fees are one area that could be open to abuse and another is lease terms between WOTSO and BWR. BWF owns $16.2 million of BWR representing about a third of BWF’s market capitalisation which provides some comfort for both sets of owners.

It is unclear from BWF’s accounts exactly how it derives asset management fees. BWF charges BWR 0.65% of gross assets but discloses neither asset values nor fees for the other funds it manages. When I asked Stuart if BWF should disclose these figures he said that it used to report total assets under management, but shareholders became too fixated on it. I think that investors have a right to know exactly how BWF generates fees as long as the information is not sensitive from a competition standpoint. Similarly, company results do not contain a breakdown of the commercial arrangements between WOTSO and BWR for each location. Revealing this would allay any fears that BWR or WOTSO is getting the better side of the deal. Occupancy figures for each WOTSO site are not disclosed either and Stuart says these will be given in time. He says that the metric is currently distorted by the ongoing conversion of additional space within existing buildings to WOTSO facilities.

As an example of the type of issue between BWR and BWF that potentially could occur, imagine a consistently loss-making WOTSO location within a BWR building. Would management want to close such an operation supposing it generates incremental income for BWR, but a smaller loss for BWF? This particular case has been partially addressed by the news earlier this month that WOTSO is to be spun out of BWF. More on that later.

The following table summarises the shareholdings of BlackWall’s directors in both BWF and BWR. As you can see the interests of management are well-aligned with investors in both entities. Insider ownership is much higher in the trust when measured in dollars and similar to the company in percentage terms. There may be a lack of transparency in the way management communicates with external shareholders, but this is trumped by strong alignment of interests.

In recent months directors have mainly been buying units in BWR on market rather than shares in BWF and I wondered if this says something about the relative value of the two securities. I asked Stuart about this and he said that the directors preferred to leave the little liquidity that exists in the company’s stock to other participants. He also said that he receives options in the company as part of his remuneration package and these already provide him with heavy exposure to the company. I note the trust is currently trading at a more than 10 percent discount to NTA so perhaps this also partly explains their choice.

Valuation

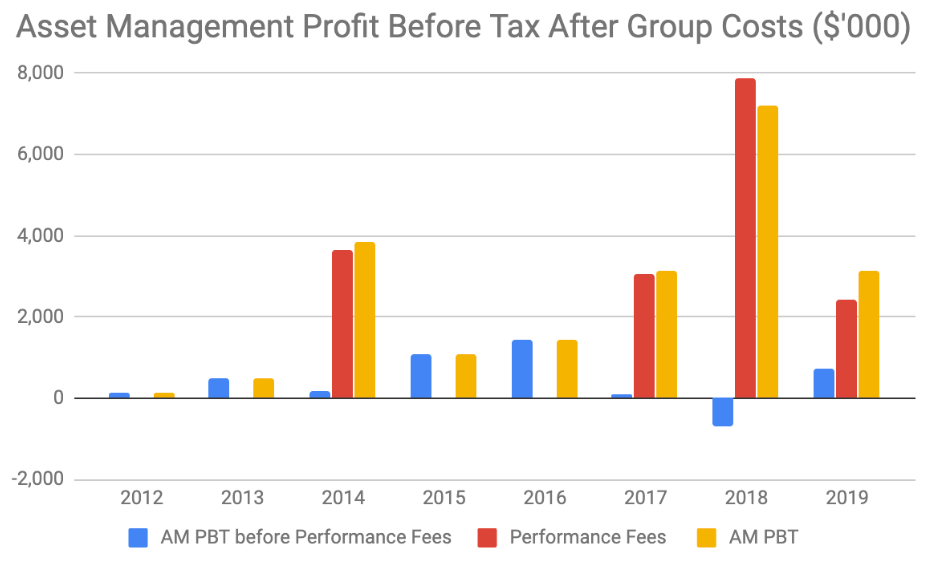

BWF suits a sum of the parts valuation. NTA per share is 50 cents and consists primarily of cash and BWR units. The asset management business generates recurring revenue based on assets under management (AUM) and pass-through property management fees with offsetting costs. Historically, it hasn’t made much profit other than when it has received performance fees as can be seen below. It received a total of $10.5 million in performance fees from Pyrmont Bridge Trust in 2017 and 2018. Overall, the division has delivered $20.5 million in pre-tax profits after all group overheads since listing in 2011. The WOTSO business is the fastest growing subsidiary with revenue rising from $1.2 million in 2014 to $10.2 million in 2019. Profit margins are still low and it takes several years for a new location to reach maturity. In 2019 WOTSO earnings before interest, tax, depreciation and amortisation margin (EBITDA%) was about 12%, but management thinks mature locations can achieve over 20%.

The remaining 55 cents of BWF’s share price that isn’t covered by NTA equates to about $35 million, which is $15 million more than the cumulative pre-tax earnings of the asset management arm in the eight years since listing. WOTSO has the potential to become by far the most valuable part of BWF, but the division delivered just $1.3 million EBITDA last year. I think that WOTSO and the asset management business are comfortably worth more than $35 million combined.

At the start of August, Blackwall announced its intention to spin-off WOTSO into a separate listed entity. Often this type of corporate action is beneficial to shareholders as it forces the market to value the parts of the group individually whereas conglomerates often trade at an intrinsic discount. I think that such a discrepancy exists with BWF as per the ‘sum of the parts’ analysis outlined above. A fund manager acquaintance made the point (which had not occurred to me) that a downside to the demerger is the doubling of listing costs which are significant given Blackwall’s size. I don’t think this will be much of a long-term hindrance provided WOTSO can maintain its growth trajectory.

I used to hold shares in BWF and have sold them since the demerger announcement because I wanted to use the money for an alternative investment. At my selling price I felt that BWF was the least undervalued share in my portfolio.

At the time of writing BWF shares last changed hands for $1.05 and I think the chances of holders suffering permanent loss of capital from here are low. The key question is regarding how much upside potential there is and this depends on the longterm success of WOTSO. If I held stock then following the spin-off I would probably only retain WOTSO and dispose of my interest in Blackwall management on market depending on valuations at the time. This is because I think that unlike the management company, WOTSO has the potential to deliver significant market outperformance over coming years.

The market may ascribe a lowly valuation to WOTSO in the short-term because of the additional corporate costs of two separate listings as mentioned above. In addition, sentiment towards managed office space providers is pretty poor at the moment. For example, Victory Offices recently listed on a price-to-earnings multiple (PE) of 9 times and continues to trade close to its IPO price despite boasting an impressive growth profile. However, I think both these risks are temporary and so would potentially see them as an opportunity to reacquire stock should they be realised.

Disclosure: Matt Brazier does not own shares in BWF or units in BWR and Claude Walker owns shares in BWF (a very very small position), but not units in BWR at the time of publication. Neither Matt nor Claude will trade either security for at least two days. This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.

For occasional exclusive content, join the FREE Ethical Equities Newsletter.

This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.

If, somehow, you are not already using Sharesight, please consider signing up for a free trial on this link, and we will get a small contribution if you do decide to use the service (which in turn should save you money with your accountant, or time if you do your own tax.)

"The Ethical Equities website contains general financial advice and information only. That means the advice and information does not take into account your objectives, financial situation or needs. Because of that, you should consider if the information is appropriate to you and your needs, before acting on it. In addition, you should obtain and read the product disclosure statement (PDS) of the financial product before making a decision to acquire the financial product. We cannot guarantee the accuracy of the information on this website, including financial, taxation and legal information. Remember, past performance is not a reliable indicator of future performance."