Pro Medicus (ASX:PME) 1H FY2020 First Half Results Analysis

Over the years, Ethical Equities has written plenty about Pro Medicus (ASX:PME). We received more feedback on that one stock than any other.

read moreViewing posts by Claude Walker

Over the years, Ethical Equities has written plenty about Pro Medicus (ASX:PME). We received more feedback on that one stock than any other.

read moreOne of the pleasing developments I've noticed over the last few years is the continually expanding selection of ethical funds available to Australian investors. But unfortunately, some funds could be considered to have much stronger ethical policies than others. For example, AMP Limited (ASX:AMP) has a fund called "The AMP Capital Ethical Leaders Fund".

read more

An Ethical Equities Supporter has requested I do more case studies of investments I've made in the past, which I think is good for learning, so here is the first one.

read more

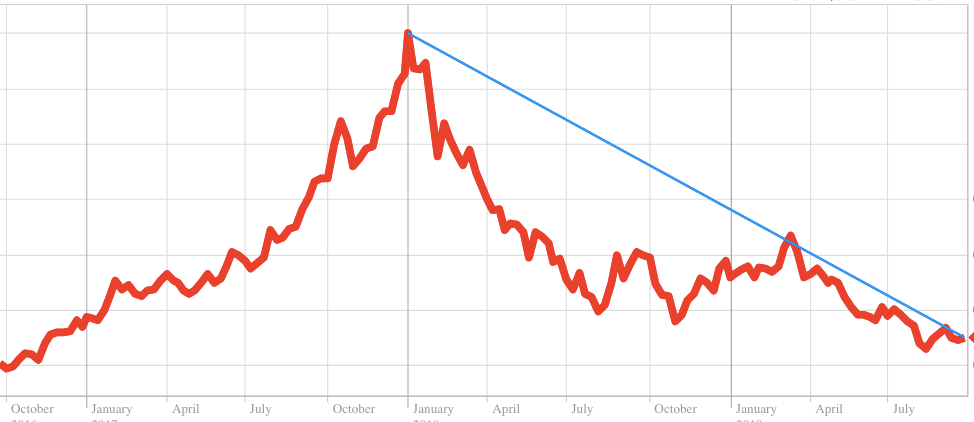

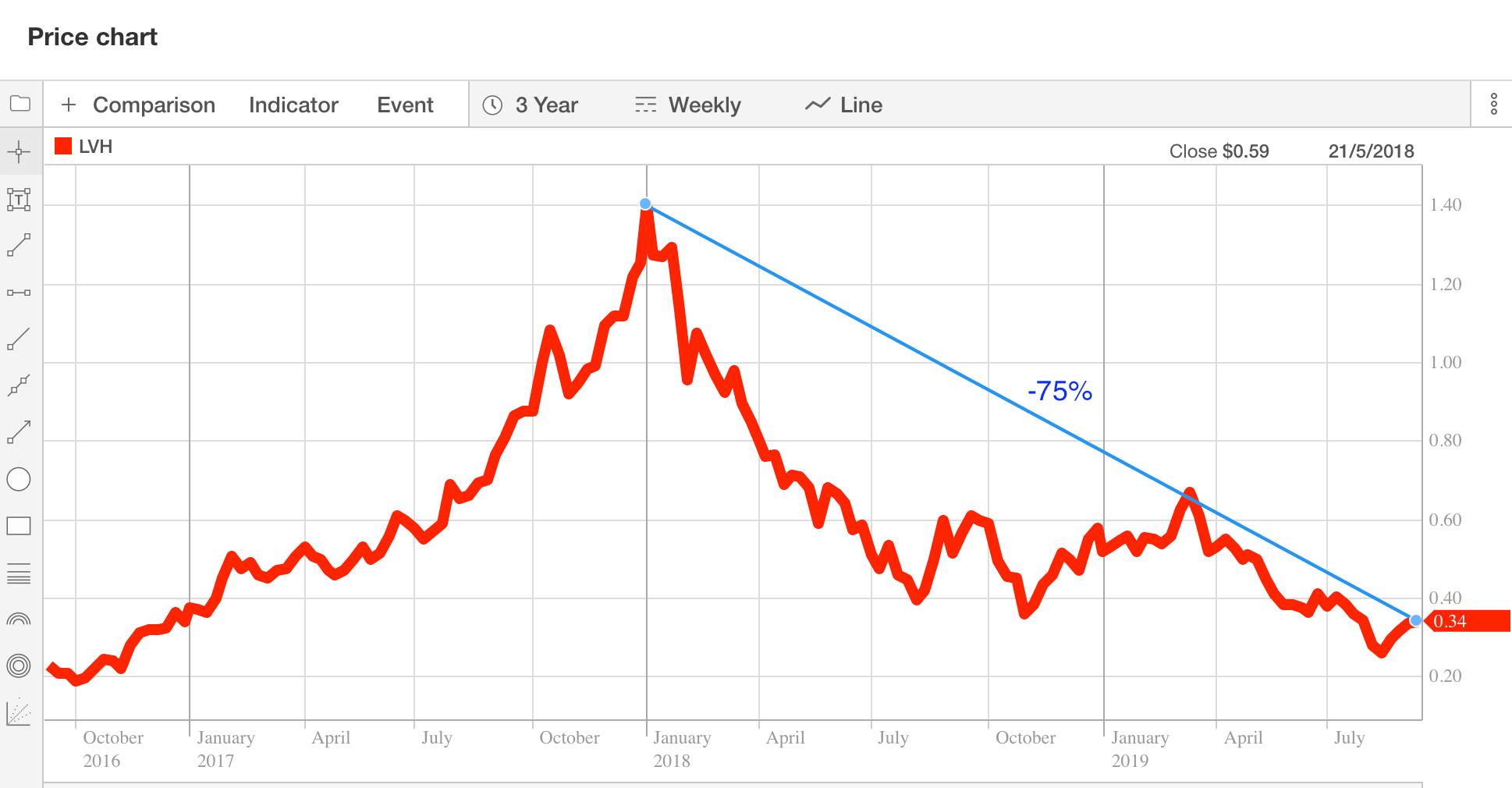

Livehire (ASX:LVH) is a “talent management technology company” with a market capitalisation of $84 million at the current share price of $0.285. The company has around $35 million in cash which we believe should be returned to shareholders since we believe the business is destined to fail and the business itself is worth nothing, at best.

read more

I recently shared "2 Rules To Avoid The Hype Trap" with Ethical Equities Supporters. Following those rules requires that investors can establish revenue growth, free cash flow and profit from the primary documents. It is always important to take these numbers from the accounts themselves, because companies will often highlight misleading adjusted numbers in their presentations, not the statutory numbers.

read more

On Friday last week, IT distributor Dicker Data (ASX:DDR) reported its results for the first half of 2019, demonstrating that it remains a great source of funding for its co-founder’s private race track and superfast racing cars.

read moreThis morning Vista Group (ASX:VGL) reported its results for the first half of 2019 and they were very disappointing, sending the shares down by about 30% to $3.60 (AUD), at the time of writing. Please note, all currency below is NZD unless stated otherwise.

read more

Yesterday radiology imaging company Pro Medicus (ASX:PME) reported revenue of $50.1 million for the full year, along with profit of $19.1 million, an increase of over 91% on last year. When I reported on the half year results, I noted that it would be hard for the company to grow half on half, since last half was such a strong half. I also expressed my hesitancy about the share price. It turns out I was too conservative, as the stock has gained well over 100% in the intervening period, to close above $30.50 on the day of the results.

read more

Back in December 2018, I explained on this podcast with Matt Joass and Andrew Page that I was short a stock called oOh!media (ASX:OML) as a hedge, since it is a poor business that is highly leveraged to the Australian economy.

read more