It has been a busy several months since we last checked in on Australian digital audio networking technology company Audinate (ASX:AD8) following the release of its 1H19 results in February (coverage here). Since then the share price nearly doubled (reaching an all-time high of $8.66 in mid-June) before trading back to the low-$6 mark briefly last month before recovering back above $7. The share price fell 6% today in response to the company’s FY19 results and is now 20% below its all-time high – more on that later, but first a re-cap of developments since our last report.

Capital raising and key growth initiatives

The $8.66 all-time high was achieved after the company announced in early June a $24M capital raising (comprising a $20M institutional placement and, welcomingly, a $4M Share Purchase Plan) – at $7.00 per share. The capital raise was launched to accelerate Audinate’s growth ambitions, specifically:

- Expansion into new overseas markets;

- Expansion of the Dante product range and investment to shorten software implementation periods;

- Development of the next generation Dante IoT platform; and

- Financial firepower to provide capacity for potential strategic acquisitions

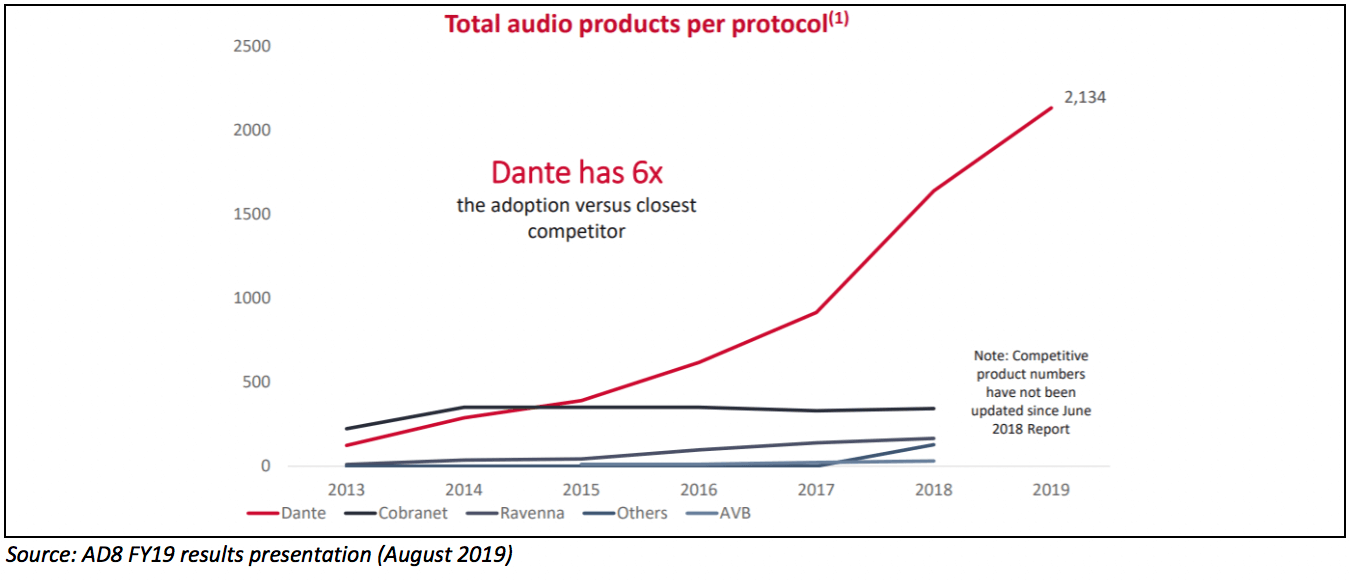

This all makes sense strategically – as we’ve mentioned previously, Audinate is executing a land grab and positioning itself to be the de facto industry standard in the emerging audio and video digital networking industry. The company is a long way ahead of competitors. Per the oft-updated protocol-enabled-SKUs chart from the FY19 results presentation below, almost 6x as many products in the marketplace are based on the company’s Dante protocol, than its nearest competitor.

However, competitor metrics have not been updated since June 2018 and therefore may not be perfectly accurate. According to Audinate, Cobranet had 343 products at June 2018; Audinate’s 2,134 is therefore 6.2x as many but doesn’t give Cobranet the benefit of any additional products released into the marketplace in the last 12 months.

The mention in capital raising materials of the next generation Internet of Things (“IoT”) Dante platform I found interesting – and this is the first time I’ve seen the company reference IoT before in its materials – but this makes complete sense to me. As Ethical Equity readers will know, IoT is the extension of internet connectivity into physical objects to enable the networked connection of devices and sensors for the purposes of monitoring and control. IoT is a constantly evolving area which is benefiting from developments in machine learning and real-time data analytics, and further advanced through progress made in miniaturising sensors and processors. Readers will no doubt recognise IoT in the consumer context of the “smart home” which in the prototypical example involves the use of smart devices (smartphones, smart speakers such as Amazon’s Alexa etc) to control appliances and devices within the home.

The professional AV market feels like a logical area to utilise IoT connectivity – and clearly management are already thinking about what the Dante Domain Manager software will look like in its next iteration. Neither the capital raising materials nor the FY19 results presentation contained any further information on this IoT initiative – so I look forward to more detail in time.

In relation to potential M&A activity, I might have missed it previously, but in the capital raising presentation was first time I saw this explicitly called out by management. Given the company’s heavy focus on developing its Dante platform and technology, I personally feel that any strategic acquisitions are more likely to be concentrated on bringing additional capability and skills into the organisation – as opposed to bolting on companies with similar products which presumably won’t be immediately compatible with the Dante protocol. The potential for M&A activity was not reiterated in the FY19 results presentation – so we will have to see on this front.

The Dante ecosystem

As to the expansion of the Dante product range, in mid-July the company announced the commercial release of the Dante AV (combined audio & video) product – which was launched at a European trade show earlier in the year and for which the company has high hopes. The company has estimated the Video segment of the professional AV market to be similar in size to the Audio segment (~$400M currently) – so the launch of this product would seem to double the company’s Total Addressable Market.

The release of Dante AV follows the release of 2 software products in June (which enable the interoperability of Dante with Linux software and also PC and Mac applications), and the release of a suite of Dante AVIO adaptors (which enable legacy analogue equipment to be interoperable with the Dante system). Capital raising proceeds have been explicitly earmarked for the development of further AVIO adaptors and Dante AV product extensions in the short term.

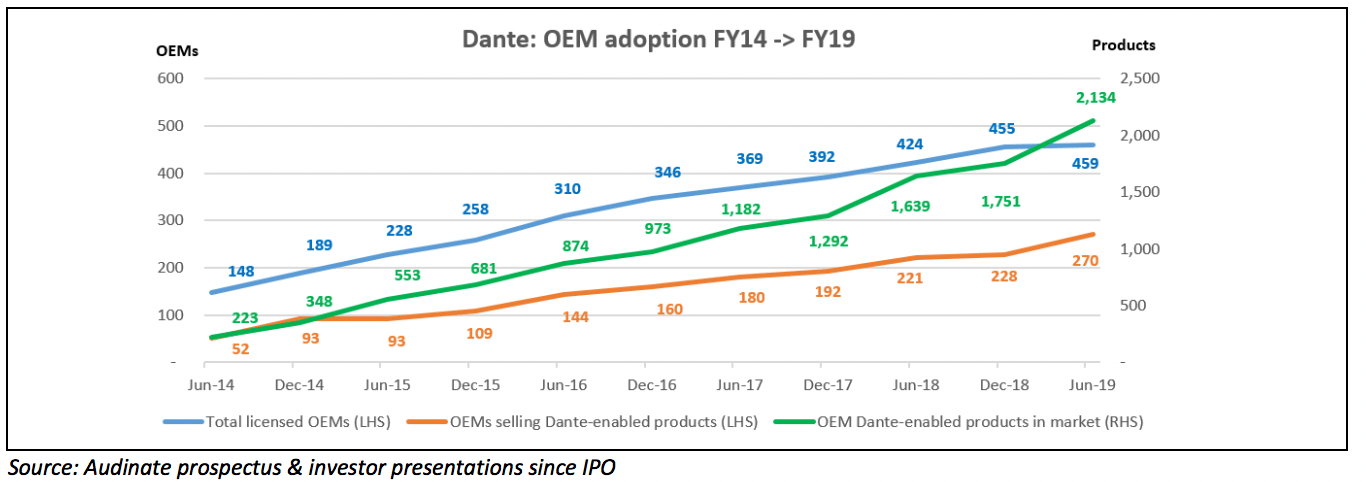

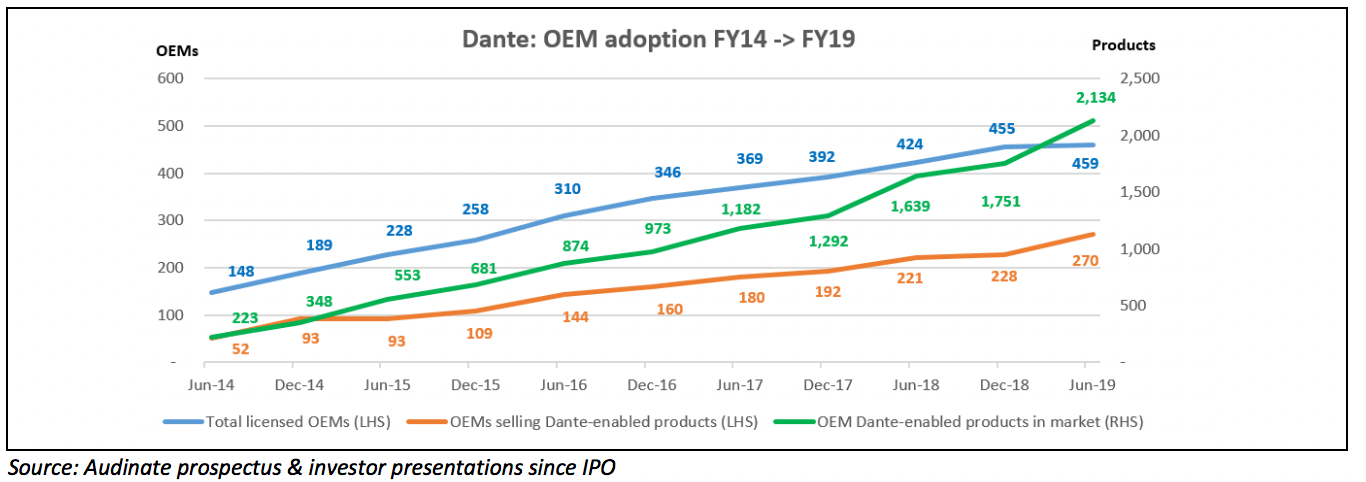

This acceleration of product development in my view only serves to strengthen the Dante ecosystem. If the company’s protocol does become the industry standard, in future all OEMs will need to have Dante embedded in their products. The chart below rolls forward the company’s key metrics to 30 June 2019 and in my opinion is *the* key set of metrics to understand for Audinate and its long term growth potential.

This chart illustrates the growing Network Effects in play here as the Dante ecosystem expands with each new OEM customer added and each Dante-enabled product released into the consumer market.

Note from the above that in the 12 months to June 2019:

- Licensed OEMs increased by 8% to 459 (CAGR since FY14: 25%. This includes pre-eminent global AV manufacturers such as Yamaha (a ~10% shareholder in the company), Sony, Bose, Roland and Bosch; and

- The number of OEMs selling Dante-enabled products increased by 22% to 270 (CAGR since June 2014: 39%).

In my view, the chart above directionally points to the company’s future growth runway. The blue line represents all OEM customers who have signed up to license Audinate’s technology, while the orange line represents those OEMs who have actually released Dante-enabled products into the market. The delta between the blue line and the orange line therefore represents licensed OEMs which are still in development phase (which I understand to be 12-24 months) and yet to launch their first Dante-enabled product. Critically, this delta suggests a significant future pipeline of Dante-enabled products which will be generating meaningful revenue for Audinate in the medium term – as only ~59% of licensed OEM customers as of June 2019 have yet released products utilising Audinate’s technology.

Most striking of all, the total number of OEM Dante-enabled products for sale (the green line) increased by 30% to 2,134 (CAGR since June 2014: 57%). This suggests an average of 7.90 Dante-enabled SKUs in the marketplace per OEM (an increase from 7.68 at December 2018 and 7.41 at June 2018). That means that Audinate continues to increase its penetration within its OEM customers’ product portfolios. I continue to believe that this represents a small fraction of the OEMs’ product range, and that further long term growth will be possible as existing OEM customers embed Dante in more of their products.

We should think of this chart like a funnel. One would expect that the majority of newly licensed OEM customers (blue line) will in time become OEMs selling Dante-enabled products in the global market (orange line). And over time if Dante becomes the de facto standard, then the average number of Dante products per OEM is likely to increase, and therefore the total number of Dante-enabled products available will also increase (green line). **In my opinion**, an increase in the slope of the blue and orange lines should in time result in an even steeper slope in the green line (and accelerating revenue for Audinate).

Management have previously estimated that there are more than 2,000 professional AV OEMs in Audinate’s target ‘Sound Reinforcement’ segment. As such, the 459 licensed OEMs at June 2019 represents customer penetration of only ~23% - suggesting there is still substantial potential upside from contracting new OEM customers and increasing the blue line above.

The company has also previously quoted research from Frost & Sullivan that the digital audio networking market would grow from ~$360M in 2016 to ~$455M by 2021. At that pace of growth, market size is probably currently ~$400M. Management has previously estimated that digital penetration of this market is still only 7-8%. If this is accurate, Audinate’s FY19 revenue of ~$28M (which should be entirely audio products given video-enabled products were only made commercially available in mid-July) would represent a market share of close to 90%.

FY19 results and illustrative FY20E projections

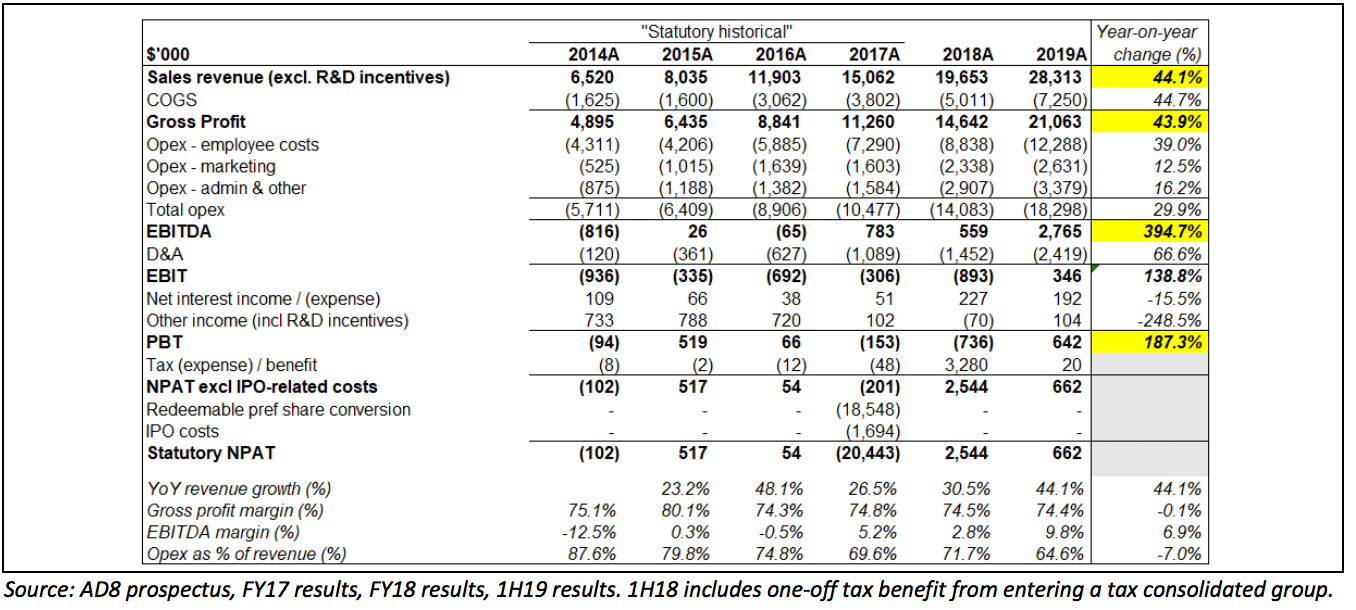

On Friday, the company released its FY19 results – which are summarised below.

The headline numbers are impressive: 44% annual revenue growth and improving EBITDA margins, demonstrating the company’s operating leverage. Gross margin has remained stable at 74-75% over the last 3 years which is a good sign, and the company will continue to invest in R&D to grow the top line and further entrench its already strong market position (signalling on the conference call that the R&D and engineering team will be doubled over the next 2 years).

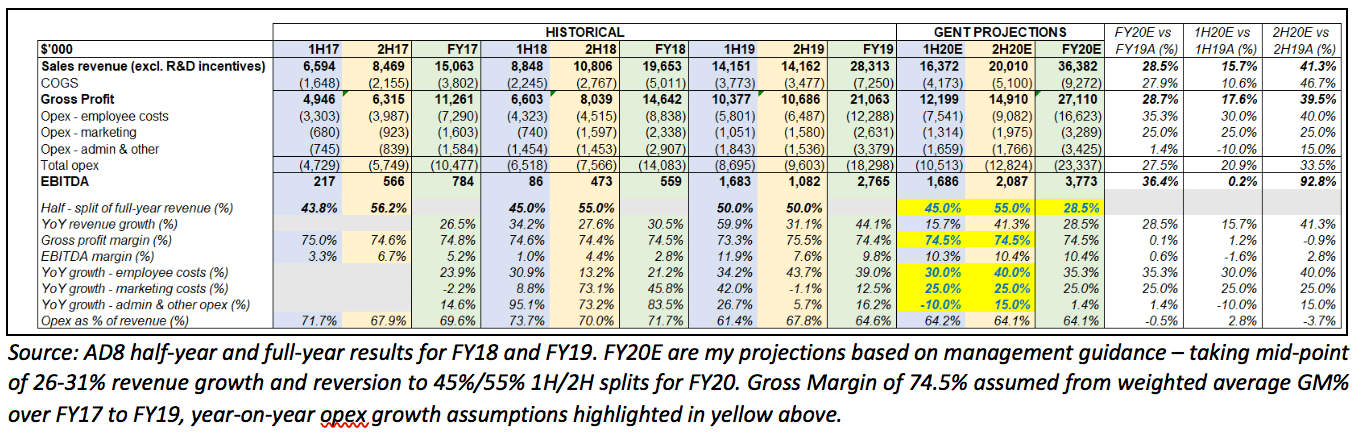

To understand why the market may have been slightly underwhelmed by the result, however, we need to dig into half-on-half performance. The table below shows historical 1H vs 2H performance for FY17 to FY19 and my attempt at projecting both halves of FY20E based on management’s guidance on revenue and seasonality.

Management provided FY20 guidance of 26-31% revenue growth and a reversion to historical 1H/2H sales splits (approximately 45%/55% in FY17 and FY18). Interestingly, management commentary was that economic conditions (including as a result of the tariff war) were creating potential uncertainty heading into FY20 and that 1H19 had benefited from the pulling forward of some customer orders from 2H19 (i.e. in advance of tariffs taking effect). We can see this in the fact that 1H19 ended up comprising 50% of full-year FY19 revenue – such that 2H19 demonstrated minimal growth on 1H19. However, such an explanation is difficult to verify, and it is possible that the second half was a bit weak. We note they did not mention this pull-forward when reporting the first half results.

My FY20E projections in the table above are based on management’s FY20 guidance above, plus some assumptions of my own, namely:

- 75% assumed gross margins (being the weighted average over FY17 to FY19);

- 35% increase in employee costs over FY20 as management expands its R&D efforts (staged 30% YoY in 1H20E, 40% YoY for 2H20E, assuming it will take time to ramp this investment);

- 20% increase in marketing costs to accompany the launch of the Dante AV (combined audio & video) product, and newly released software products; and

- Growth in miscellaneous opex of 8% in 1H20E vs. 2H19 and 7% in 2H20E vs 1H20E

These assumptions result in a forecast skewed towards 2H20E from both a revenue and EBITDA perspective (in line with management guidance) and slower growth of ~16% for 1H20E vs both 1H19A and 2H19A. Given the recent launch of Dante AV and the software products, I’m not surprised that revenue might be skewed towards the second half as there will likely be a lag before (A) these new products demonstrate real traction, and then (B) start receiving repeat orders from OEM customers.

This slower half-on-half growth from 1H19A to 2H19A (flat) – and then implied growth from 2H19A to 1H20E (16% is nothing to sneeze at but below historical levels) – is likely what drove the 6% share price decline today, and it wouldn’t surprise me to see a bit of further weakness over the short term as the market fixates on 1H20E numbers. But note the implied 2H20E growth – 41% at the top line based on guidance – above historical trend.

These assumptions result in a 36% increase in FY20E EBITDA to $3.8M – but clearly the key moving parts here are the actual revenue levels achieved (noting that management have historically skewed towards the conservative end of the spectrum in forecasting revenue) and the timing of the acceleration in investment in R&D (which of course is a short term hit to earnings in order to drive revenue over the medium to longer term – especially in the current Land Grab phase). The assumed FY20E increased employee costs may prove to be too aggressive – we won’t know until 1H20E results in February (given Audinate is no longer required to lodge quarterly cashflow reports).

Closing thoughts

I continue to believe that Audinate remains an attractive longer term investment opportunity. The key operational metrics suggest the business is now scaling nicely and demonstrating Network Effects (our favourite Economic Moat). There continues to be a significant growth opportunity in the migration of the audio networking industry from audio to digital (below 10% penetration currently), and approximately 77% of global OEM players haven’t yet started licensing the Dante platform and products. The company generates very high gross profit margins from its IP portfolio, and is focused on further expanding its product portfolio and innovative capabilities.

Given the Audinate share price is up 40% over the last 6 months alone, it wouldn’t surprise me if the stock took a breather and either tracked sideways for the next several months or retraced further in the current Risk Off environment. I would think very hard about adding to my position if the stock price returned back to low-$6 levels – reflecting my view on the long term growth trajectory for the company.

At a current market cap of ~$450M the company is clearly not a Value stock and relatively expensive on traditional metrics – particularly as earnings are sacrificed in the short term as management instead invest in R&D and growing longer term revenue. As we flagged in our previous note, the focus now is (rightly, in my view) on investing to build a dominant global leader – and so in the absence of meaningful profits over the near term we continue to suggest Audinate is a stock for readers with a higher appetite for risk.

_______

Disclosure: I (the author) owns shares in Audinate. I participated in the Share Purchase Plan and then bought more shares on market during the share price drop in July, and the company is one of my largest positions. I continue to view the company as a long-term portfolio cornerstone (Tier 1 High Conviction for readers who made it through the Gent Manifesto omnibus.) I may buy more shares in the future – but, as always, not for at least 2 days after the publication of this article.

For occasional exclusive content, join the FREE Ethical Equities Newsletter.

This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.

If, somehow, you are not already using Sharesight, please consider signing up for a free trial on this link, and we will get a small contribution if you do decide to use the service (which in turn should save you money with your accountant, or time if you do your own tax.)