Audinate (ASX:AD8) is an audio technology company that has previously been covered on these pages. Unusually for me, it’s amongst my largest portfolio positions despite a relatively short listed history and a lack of profitability. So I thought I’d take the time to review the recent quarterly results, as well as the AGM materials.

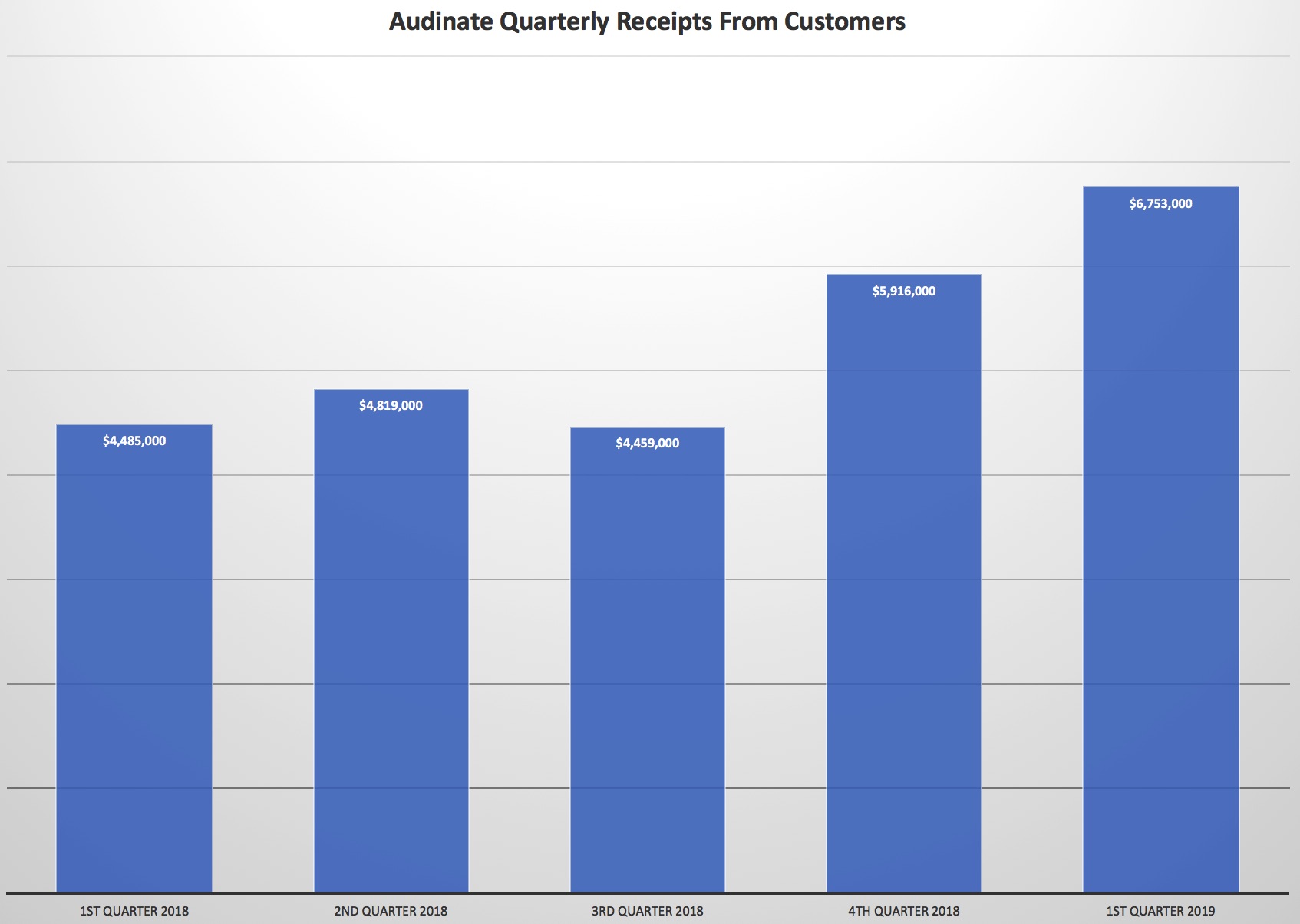

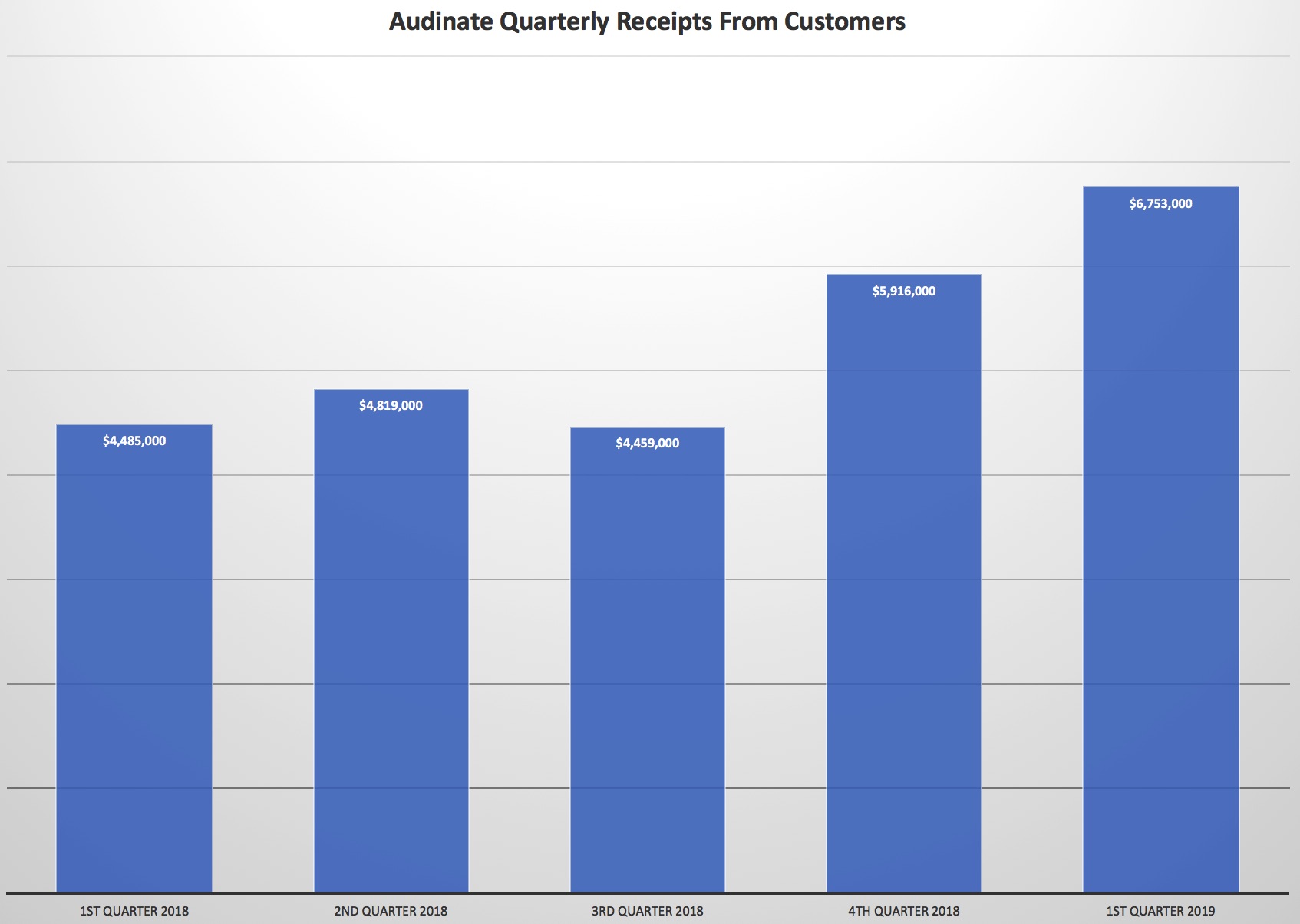

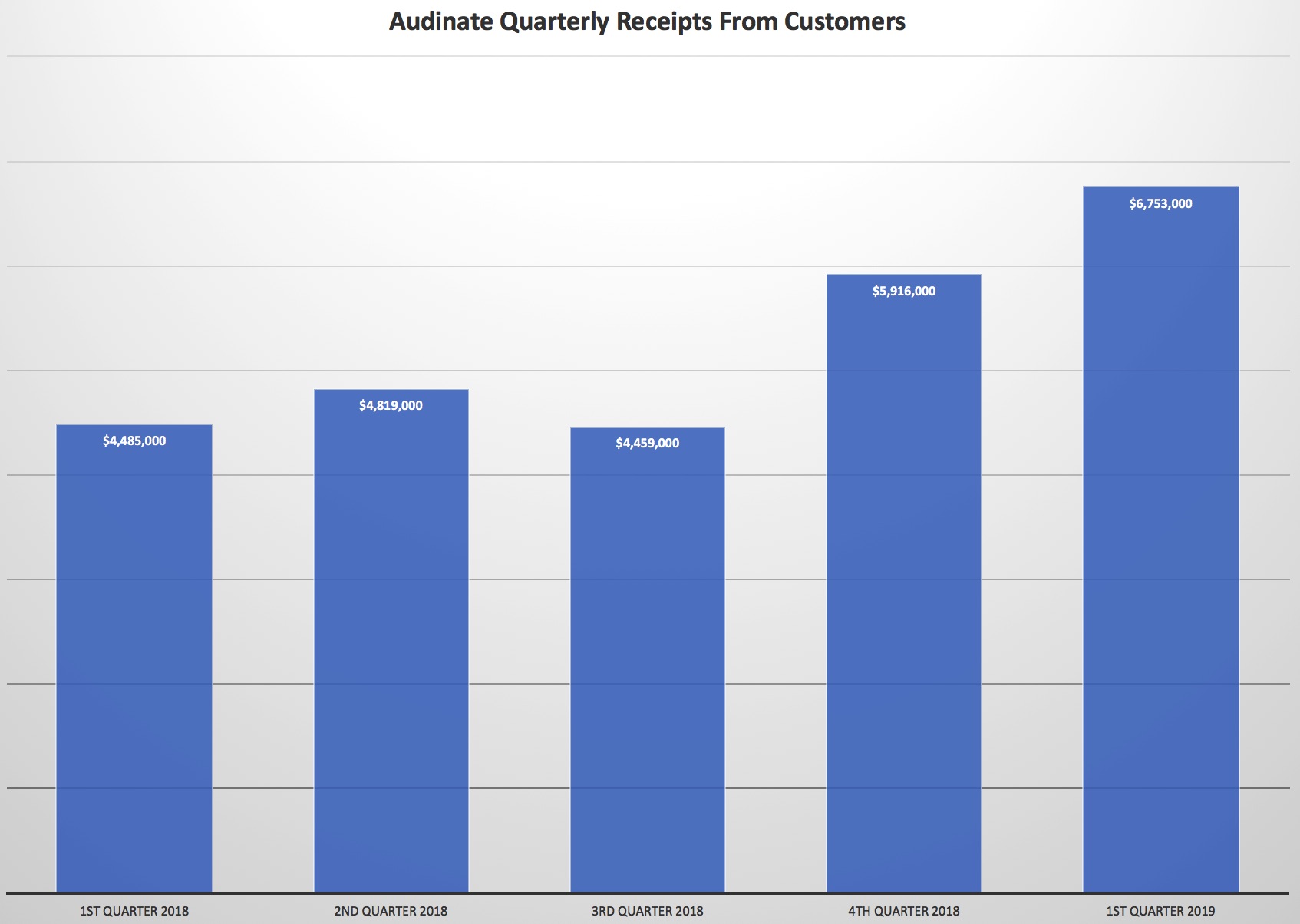

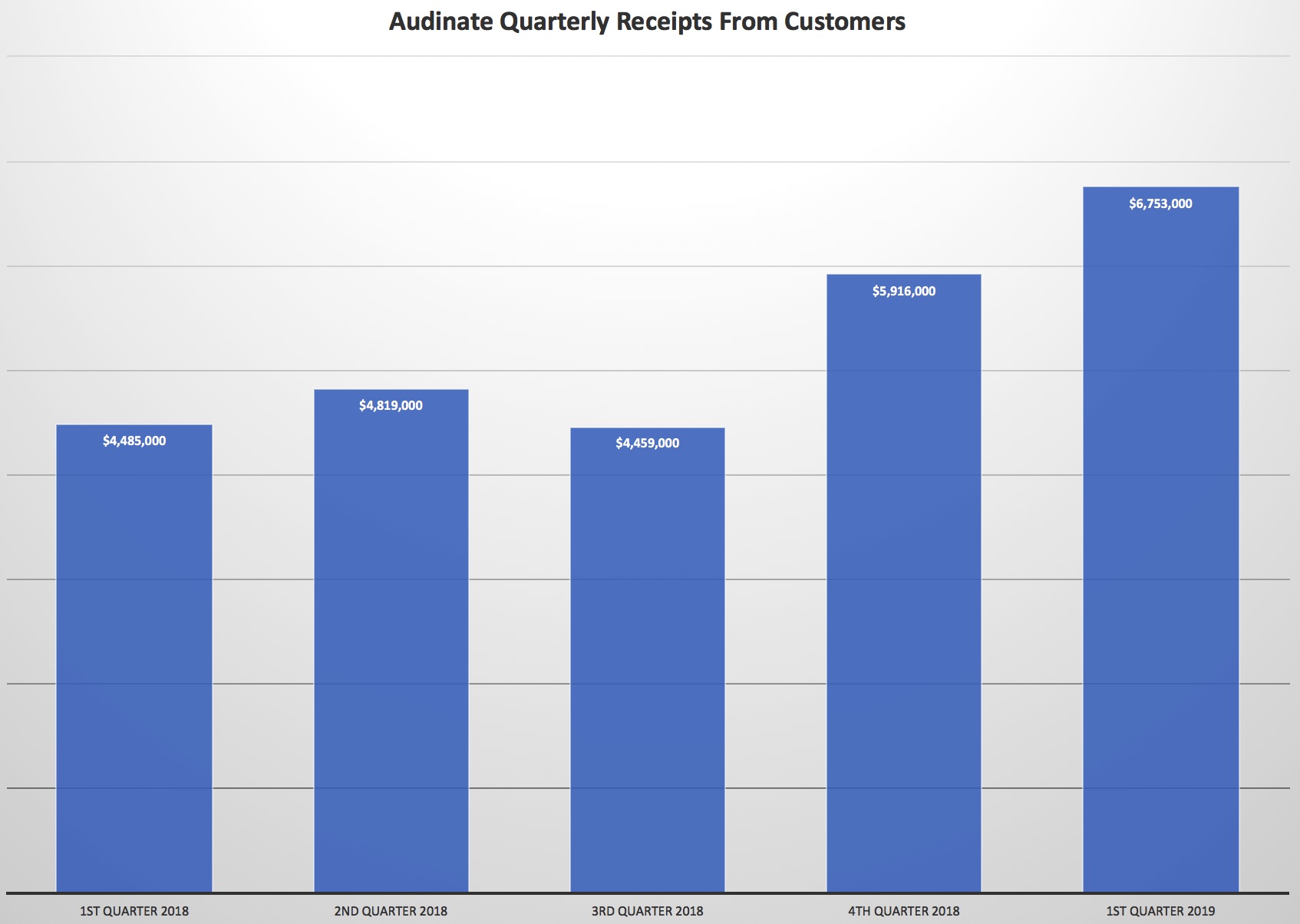

As you can see below, the first quarter of 2019 was record-breaking in terms of cash collected from customers.

Not only this, but the company achieved positive operating cashflow, implying the potential for a financial inflection point should revenues continue to grow. Capital expenditure was not oppressive, at under $1 million. Considering the $12.8 million on the balance sheet, I think it is quite reasonable to model Audinate as not requiring additional share capital. One of the reasons I would sell would be if this assumption proved false.

Importantly, the CEO claimed that “The initial sales of Dante AVIO adapters are another clear indicator of the growing network effect of our Dante technology.” Shareholders will be looking for further penetration into legacy systems through these adapters, because only once these systems are updated can the company hope to generate software revenue through Dante Domain Manager Software.

The recent AGM materials didn’t provide a whole lot new other than to update on the number of products that contain Audinate chips. As you can see below, growth seems to be slowing a little, but the company did promise to “Release a commercially available Dante video solution by end of FY19”. That means we should be able to have some confirmed sales of that product in the first quarter of 2020.

You can get a short run-down of what they are planning for their video product, by watching this video. Personally, I think it’s a good move, but I don’t expect them to become as dominant there as they have with audio, in part because they will not own the relevant protocol. I’m cautious but hopeful this will turn into a profitable business line.

Finally, the company has forecast ‘consistent’ growth in 2019, which I believe the market is interpreting as revenue growth in the vicinity of 30%.

Please feel free to sign up to the forums and let us know what you think!

For early access to our content, join the Ethical Equities Newsletter.

Disclosure: The Author, Claude Walker, owns shares in Audinate at the time of publication. This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.