Yesterday, Australian digital audio networking technology company Audinate (ASX:AD8) announced its full year FY18 results. The company joined the ASX on the last day of the FY17 financial year and has enjoyed a strong start to its life as a listed company, with its share price rising from $1.22 at IPO to above $4.30 late last month.

Audinate supplies software and hardware products to global Original Equipment Manufacturers (OEMs) under its Dante brand – which stands for Digital Audio Network Through Ethernet. These OEM partners embed the Dante platform and the associated hardware components (such as chips, cards, modules and adaptors) within their own products which are then sold into the professional Audio Visual (AV) market – products such as microphones, mixers, amplifiers, speakers, receivers and tuners, intercoms, headsets and public address systems. These products end up in recording and broadcast studios, airports and public transport areas, sporting stadiums and racetracks, night clubs, theatres and concert halls, universities, hotels, conference rooms and other public areas. The Dante technology was first developed in 2004, and the company founded in 2006 and spun out of the National ICT Australia (now part of the CSIRO) soon after to commercialise the technology.

Audinate’s blue chip customer base includes prominent OEMs such as Sony, Bosch, Bose, Roland and Yamaha – its largest customer (22% of FY16 revenue) and interestingly also a 10% shareholder. Having been a customer since 2009, Yamaha partnered with Audinate in 2012, making a $5M strategic investment. The following year it released its first Dante-embedded products.

As you can guess from the Dante acronym, Audinate’s software distributes digital audio signals across computer networks using standard IP networking. The company is leading the migration away from old world analogue point-to-point cabling. (The old system allows only one channel per cable and can therefore result in the kind of spaghettified tangled mess of cords that I’ve had in my lounge room for much of the last 20 years). The next generation digital technology permits the transmission of multiple channels via a single cable without any deterioration in signal quality, and typically is lower cost than traditional analogue installations.

The digital audio networking industry is still in its infancy – only ~$360 million in size in 2016 per market research firm Frost & Sullivan. It is projected to grow to ~$455M by 2021 – tiny compared to both Audinate’s target Sound Reinforcement segment (~$9B globally in 2016) and the broader professional AV market (~$150B) as a whole. However, it seems the migration from analogue to digital audio networking is a genuine structural shift and a (sine) wave the company is going to ride.

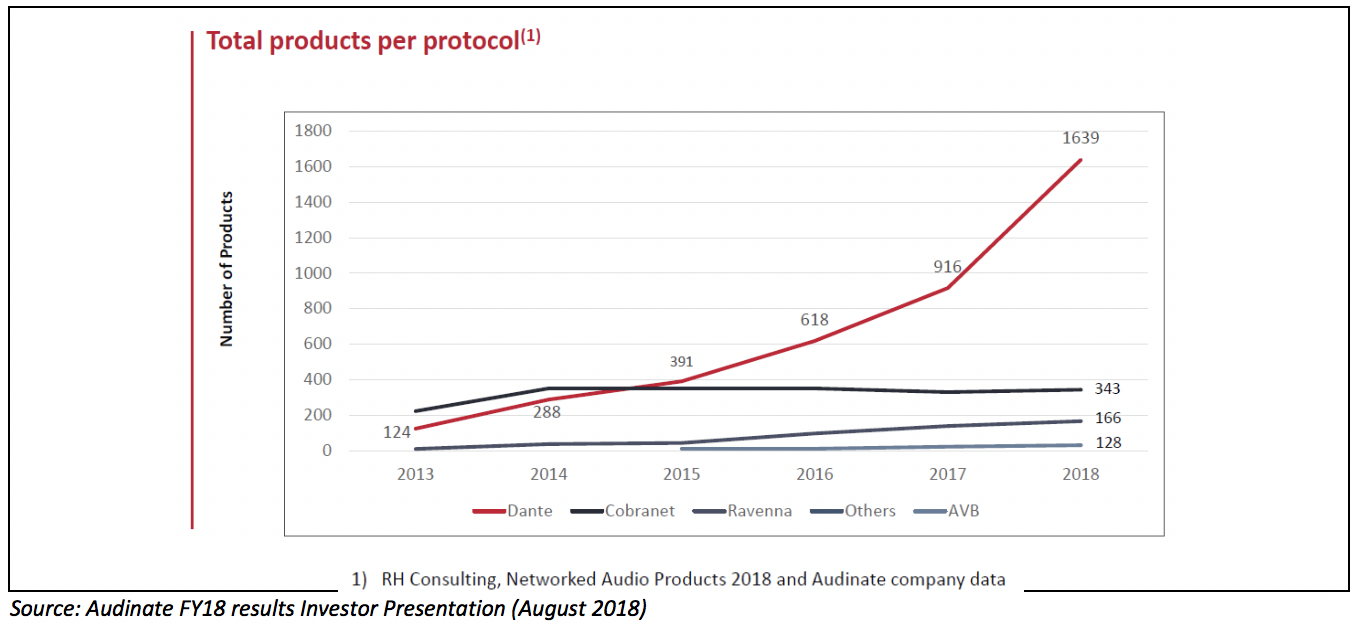

Audinate appears to be the largest player in the digital audio networking space – as measured by its continually reported benchmark of OEM adoption for its products versus its competitors (more than 5x its nearest rival as at June 2018 (per the oft-repeated chart originally in the prospectus – below)).

Note that the company’s nearest rival is Cobranet – apparently the first mover in the space (in the 1990s) but which appears to have been left behind (1) following a period of underinvestment since its acquisition by Cirrus Logic in 2001; and (2) by Audinate’s accelerating traction with OEMs over the past few years.

Observers with a keen eye may have noted that the number attributed to Cobranet appears to have increased from 220 per the previous version of this chart from February 2018 to 343 below. However, this may just be a definitional issue and doesn’t detract from the conclusion of the widening chasm when compared with Audinate.

Audinate is attempting a land grab. It is aiming to become the de facto industry standard and on the way build our favourite economic moat: the Network Effect. The Dante-enabled ecosystem grows with each new OEM customer and Dante-enabled product released.

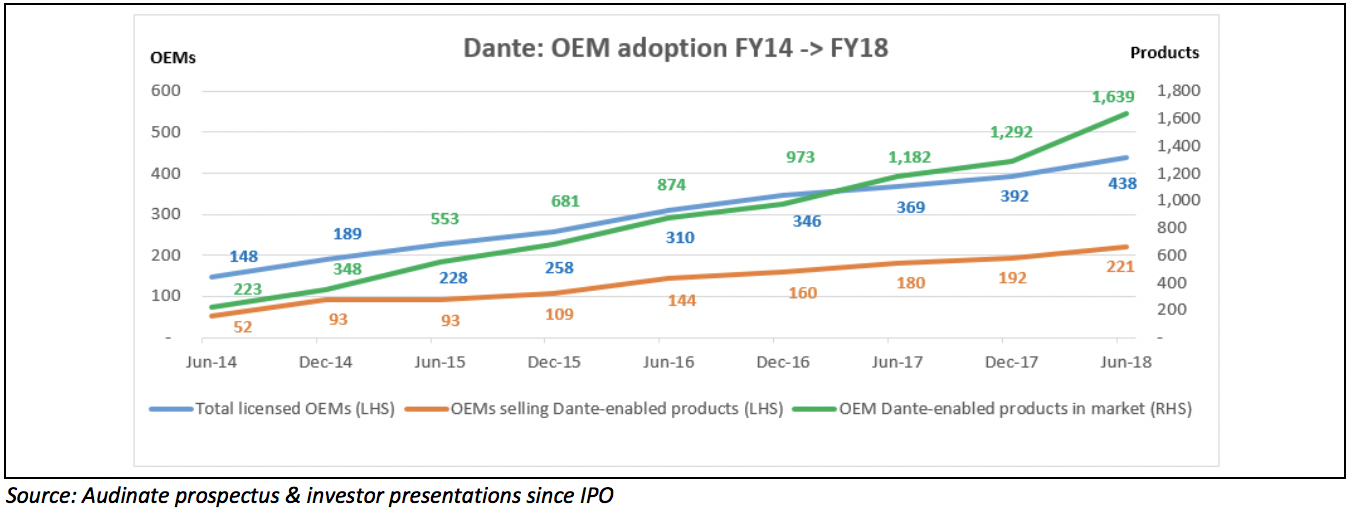

The key KPIs communicated by the company to track its progress on this front are summarised in the chart below:

The other metric it would be interesting to know would be the proportion of Dante-enabled products in the market as a proportion of each OEM’s product portfolio – which I haven’t seen pointed to. I would expect the 1,639 figure above (just 7.4 SKUs on average for the 221 OEMs) to be a tiny fraction of their range – suggesting there should be a long runway of future OEM product rollouts as the structural tailwinds strengthen. Also, nearly half of licensed OEMs at June 2018 are still in development phase and yet to launch Dante-enabled products, further supporting the medium-term revenue outlook.

The company estimates there are more than 2,000 professional AV OEMs in its target ‘Sound Reinforcement’ segment – in which case only ~22% have adopted the Dante technology to date. So if Dante does become the industry standard, there is a large potential revenue opportunity available to the company. Management believe digital penetration is only 7% of a ~$400M current market size. This suggests Audinate has ~70% market share based on FY18 revenue.

Audinate generates ~85% of its revenue from hardware components with the remaining ~15% from royalties, license, maintenance and software fees. Once an OEM has embedded the Dante technology into its products, it will need to reorder Dante chips, modules or cards, and pay royalty fees to the company.

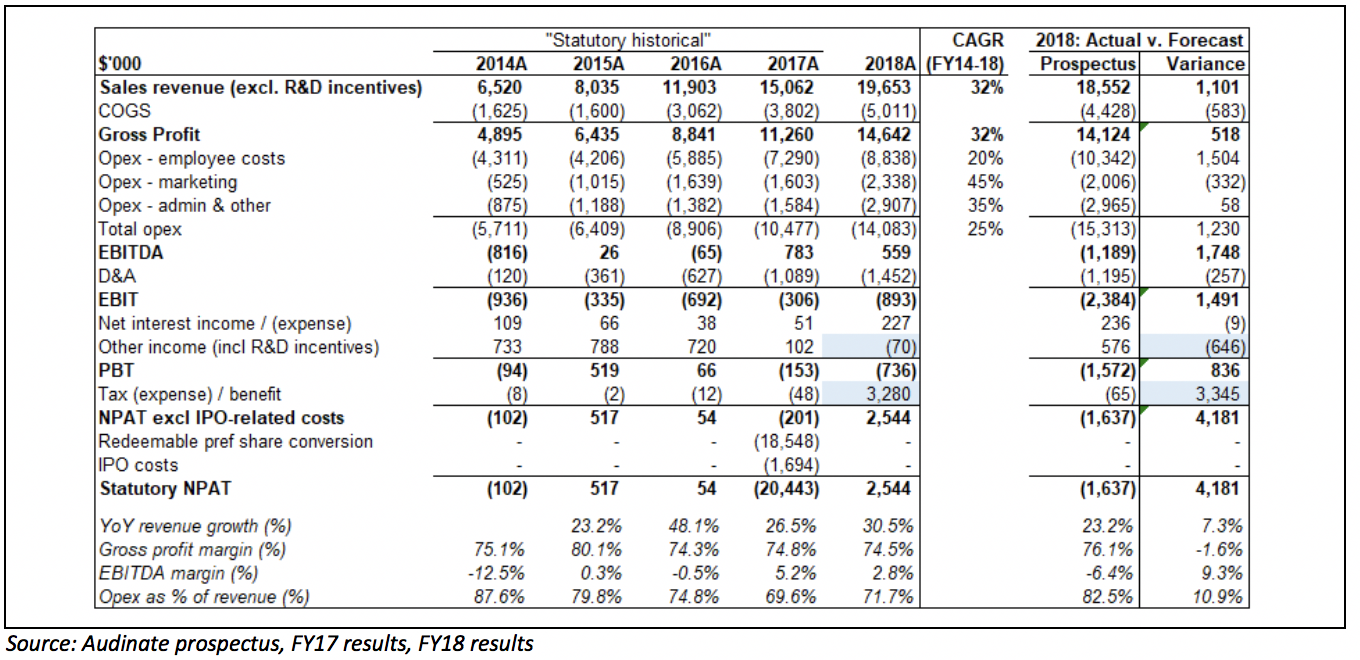

Revenue increased by 30% in FY18 from FY17 in A$ terms, or +35% in US$ terms (Audinate generates ~99% of its revenue from outside of Australia). Pleasingly, FY18 revenue beat the prospectus forecast by ~6%, and revenue has grown at a 32% CAGR since FY14.

Audinate generates very high gross profit margins (~75%) – reinforcing the company’s commentary around its strong IP portfolio (25 patents in force in US, UK, Germany and China as of November 2017 with 13 patent applications pending at that time). As the company aims to further strengthen its market position, management is focused less on the bottom line (noting that the core product portfolio is likely already nicely profitable given those gross profit margins), and instead is focused more on investing in R&D to expand the product portfolio, and in marketing to increase OEM adoption.

To that end, operating expenditure (opex) increased by 34% versus FY17 though according to the company this includes $1.2M of public company costs not borne previously. Adjusting for these costs suggests EBITDA increased by $1M in the financial year just ended.

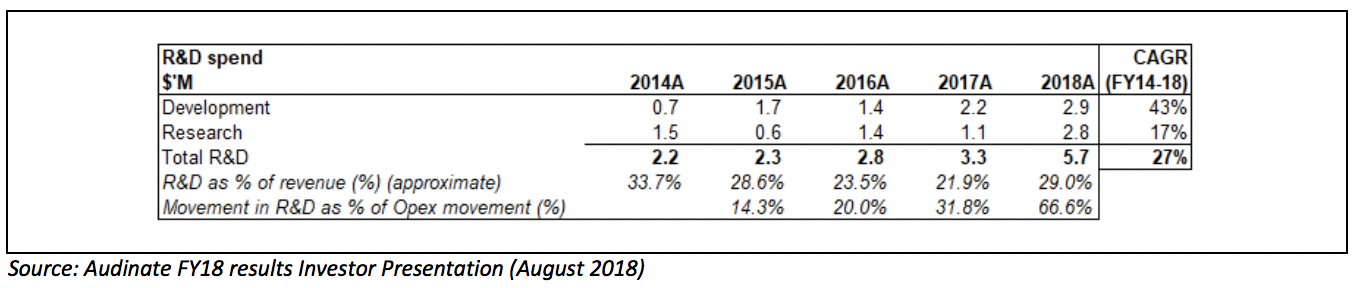

One positive for the future is that R&D investment increased significantly in FY18 – up 73% year-on-year and comprising two-thirds of the increase in total opex from the year prior. The intense R&D focus is aimed at growing Audinate’s addressable market from ~$400M currently to more than $1B.

To that end, the company previewed a video prototype in early June 2018 which it expects to release commercially to OEMs at the end of FY19 with initial revenues commencing in FY20. In the second half of FY18 the company also launched a system management software product (Dante Domain Manager) and a suite of Dante AVIO adaptors (which will enable legacy analogue equipment to be interoperable with the Dante system). On these recently launched products, management reported stronger initial sales than expected. We would expect further significant levels of R&D over FY19 and the medium term as the company aims to grow the market via expanding its product portfolio.

Management has also flagged further investment in the sales and marketing team to accelerate penetration with OEM customers. Actual marketing spending in FY18 of $2.3M was $0.3M higher than the prospectus forecast – although mysteriously FY18 actual employee costs ended up being $1.5M lower than forecast, which may reflect a higher proportion of capitalised R&D than assumed in the prospectus. Given the skew in the workforce towards engineers and development personnel as a proportion of total staff, and the material jump in R&D spend above, it seems unlikely that management skimped on making key hires in the engine room.

Finally, Audinate’s statutory NPAT benefited from a one-off $2.4M tax gain from the company entering into a tax consolidated group (not contemplated by the prospectus); the FY18 tax benefit line also includes the R&D incentive previously recognised in Other Income (which was forecast to be $0.6M).

In terms of the outlook for FY19, the company did not provide much in the way of hard number guidance – as is de rigueur – neither did fellow (much larger) growth stablemates A2 Milk or Aftepay. But there are many reasons for optimism ahead as directionally suggested by the Dante OEM adoption chart above.

The potential market opportunity for Audinate is significant. The company appears to have a dominant market share of a growing market which it is itself building. So far it has demonstrated an attractive combination of high margins derived from its intellectual property, and a strong recent growth trajectory.

This trajectory could accelerate given:

(1) the increasing trend in Dante-enabled products launched by its existing OEM customer base;

(2) the significant amount of licensed OEM customers still in development phase and yet to launch Dante-enabled SKUs;

(3) the increased investment in R&D to expand Audinate’s product portfolio and underpin the launch into new market segments (i.e. video); and

(4) the expansion of the global sales and marketing team to further grow OEM adoption (only ~20% of global OEMs to date).

Just don’t expect fat dividend cheques anytime soon. The next several years for Audinate are about maximising this land grab opportunity – reinvesting gross profits into building the value of the network and sacrificing short term NPAT for the long term benefits of the positive feedback loop. The aim is to become the industry standard in a much larger global market. Fingers crossed.

Disclosure: I (@Fabregasto ) own shares in Audinate – accumulated between January and June 2018 at a VWAP of $3.14 – and I am strongly considering buying more shares at least 2 days after the publication of this article. As Stephen King once said, “I write to find out what I think” – and writing this piece has further increased my enthusiasm for the company and its potential opportunity. This is however by no means a recommendation and readers will need to decide for themselves whether Audinate is a suitable investment for their own portfolio.

A note from Claude:

We are extremely lucky to have this comprehensive coverage from The Gentleman. It is one for those who never saw my original recommendation. Right or wrong, this is honest and thoughtful analysis.

As both of you still reading will probably know, I encouraged many people to buy this stock at $2.90. I bought myself around those prices. I continue to hold and – after 2 days or more – I shall consider adding to my holding. And a special thanks to the person who told me to recommend this at $2.00. That was next level, I should have listened.

For early access to our content, join the Ethical Equities Newsletter.

Disclosure: The Gentleman and Claude Walker both own shares in Audinate at the time of publication. This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.