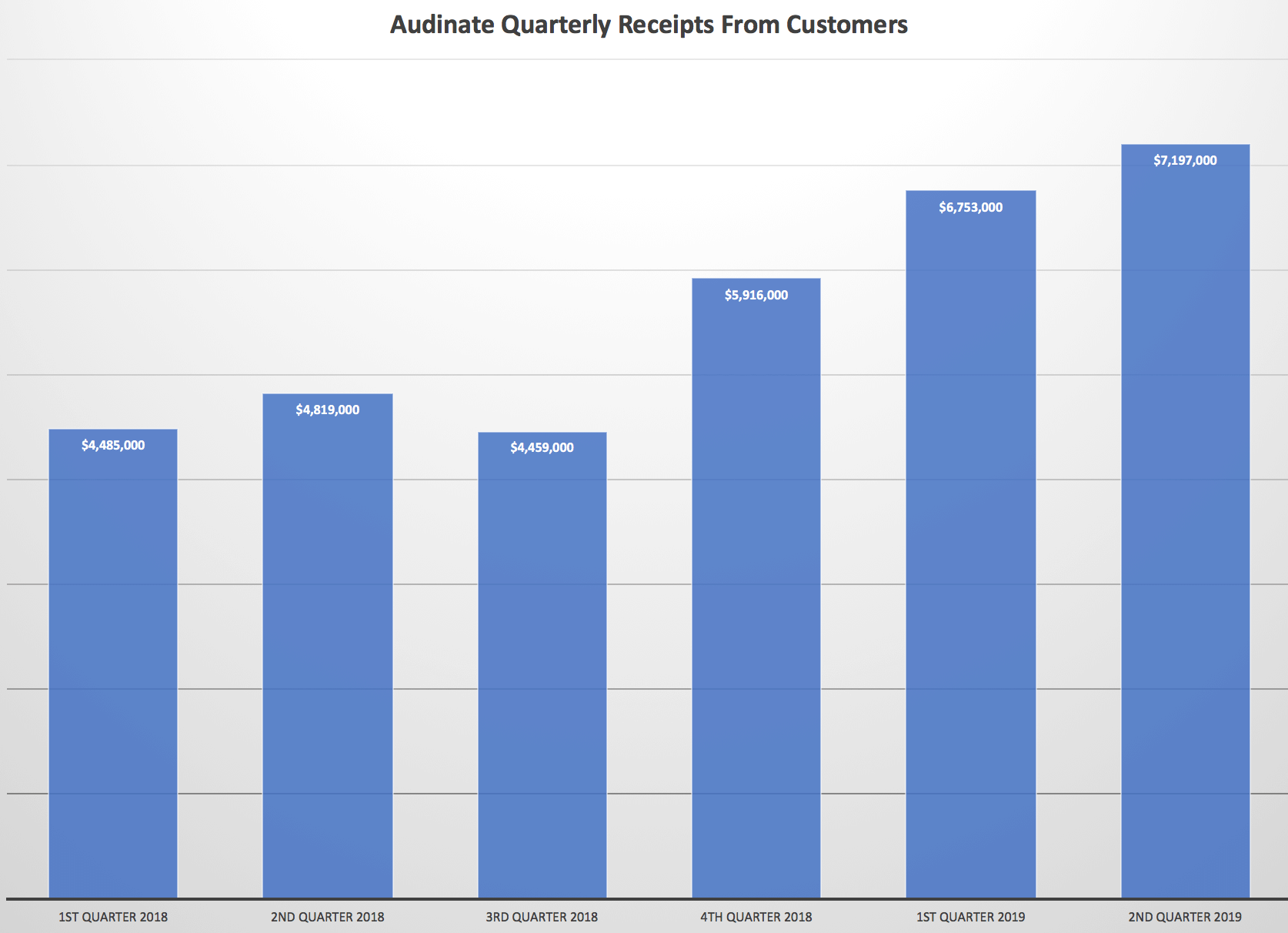

Audinate Group Ltd (ASX:AD8) today released its quarterly cashflow showing receipts from customers up 6.5% quarter on quarter, over $400,000 in operating cashflow and negative free cashflow of about $550,000. You can see how receipts have improved since listing, in the image below.

At this rate of cash burn Audinate could continue to fund its own growth for many years, due to the $12 million on its balance sheet, so I continue to consider the business funded to breakeven.

While none of this is groundbreaking stuff I believe these results are consistent with my thesis that the company can continue to grow through selling more product and that management are honest and competent in their reporting to shareholders. For example I note that they emphasised that the current quarter benefited from a stronger US dollar relative the the prior corresponding period. I don't think we will see the true value of Audinate's technology for 3-5 years, but as long as they keep selling more Dante chips then it seems quite possible their protocol will become completely dominant and remain that way for a decade or more.

Please feel free to sign up to the forums and let us know what you think!

For timely coverage of small-cap stocks, join the Ethical Equities Newsletter.

Disclosure: The Author, Claude Walker, owns shares in Audinate at the time of publication, and will not sell for at least two days after this article. This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker