Audinate (ASX:AD8) Half Year Results [H1 2019]

When we last checked in on Australian digital audio networking technology company Audinate (ASX:AD8) in late January, the company had just released its December 4C (quarterly cash flow) report – which revealed positive operating cash flow for the Dec-18 quarter and a 49% lift in cash receipts versus the corresponding quarter a year earlier.

As a quick reminder, Audinate supplies its Dante branded software and hardware products to global Original Equipment Manufacturers (OEMs) who in turn embed the Dante platform and the associated hardware components (such as chips, cards, modules and adaptors) within their own products which are then sold into the professional Audio Visual (AV) market. The company is leading the migration away from old world analogue point-to-point cabling to the digital distribution of audio signals across computer networks. In short, this technology is the wave of the future. Refer to our initiation report on AD8 from 6 months ago for more background information on the company and the industry as a whole.

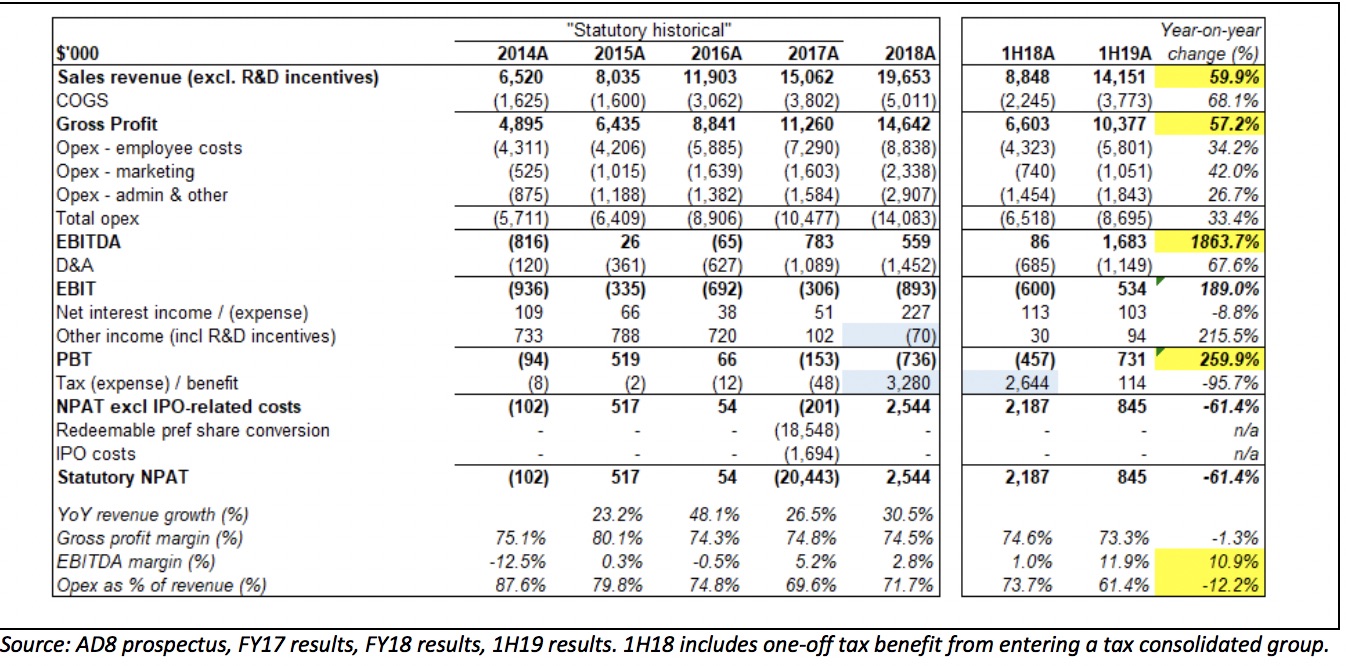

Today the company released impressive results for the first half of FY19 which illustrate a favourable combination of accelerating growth, operating leverage and strong Network Effect benefits. Let’s start with the financials:

Audinate posted a 60% increase in revenue (less in constant currency) versus the December 2017 half-year, a significant acceleration from the 32% CAGR between FY14 and FY18 above. Gross margin declined slightly from 74.6% to 73.3% - a function of product mix, and a result of a greater proportion of comparatively lower margin hardware component sales (+59% growth in units), and a lower share of higher margin software sales (+22% growth in units). Management commented on this morning’s conference call that this is expected to reverse over time as the network of Dante products expands – which will lead to higher margins in the future.

Who can complain about a company generating 73% gross margins, in any event? The company’s operating leverage translated into a material lift in half-year EBITDA of $0.1M in 1H18 to $1.7M in 1H19. This included additional investment in headcount and consulting costs as Audinate scales to meet the significant forecast increase in demand for its platform and products.

In addition, the company is debt-free with $12M of cash in the bank at December 2018. With the company reaching profitability in the current financial year, it is well positioned and capitalised to continue investing in the business to drive top line growth and increased profitability.

How did the company generate such a significant increase in revenue and profitability in 1H19, and what are the key trends and implications for forecast growth? Let’s look at Audinate’s key oft-reported metrics. The constant refreshing of KPIs enables us to better understand the main drivers and maintains a degree of management accountability.

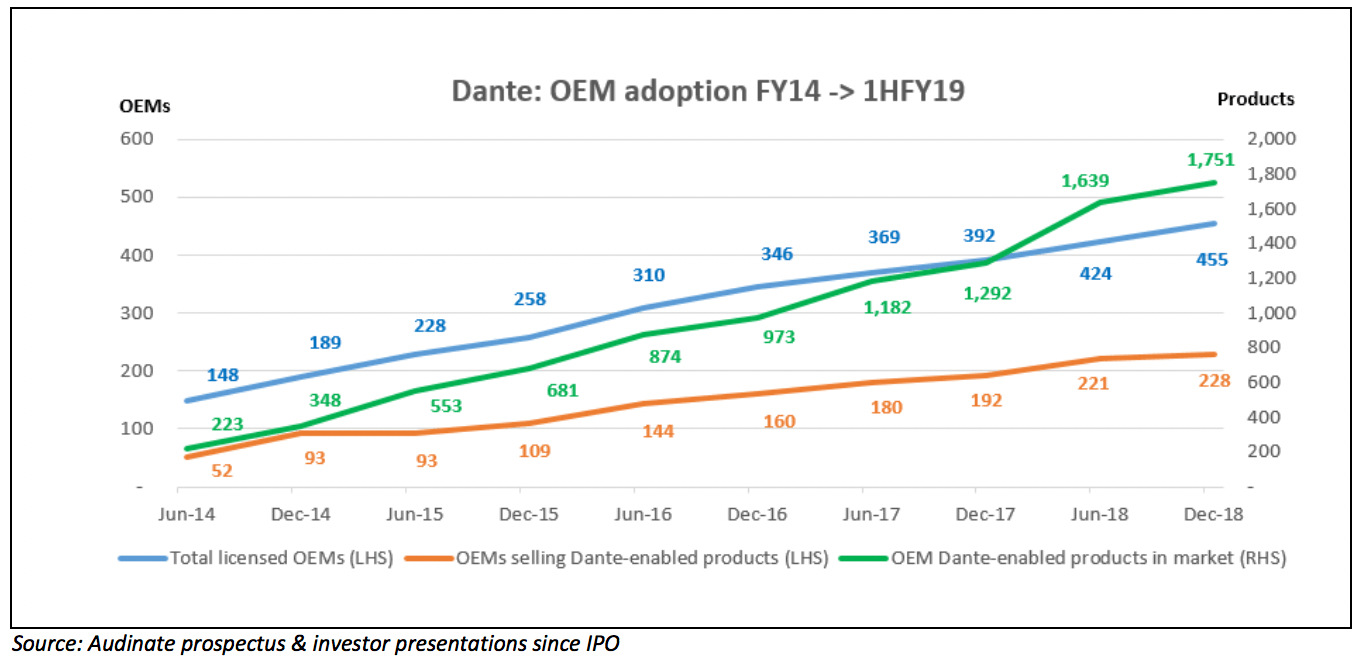

Audinate is attempting a land grab and aiming to be the de facto industry standard in audio and video digital networking – such that in future all OEMs will need the company’s technology embedded within their products. The updated chart above illustrates Audinate’s growing Network Effect – with the Dante-enabled ecosystem growing with each new OEM customer and Dante-enabled product released. In the last 12 months:

- Licensed OEMs have increased by 16% to 455 (CAGR since June 2014: 28%);

- The number of OEMs selling Dante-enabled products increased by 19% to 228 (CAGR since June 2014: 39%); and

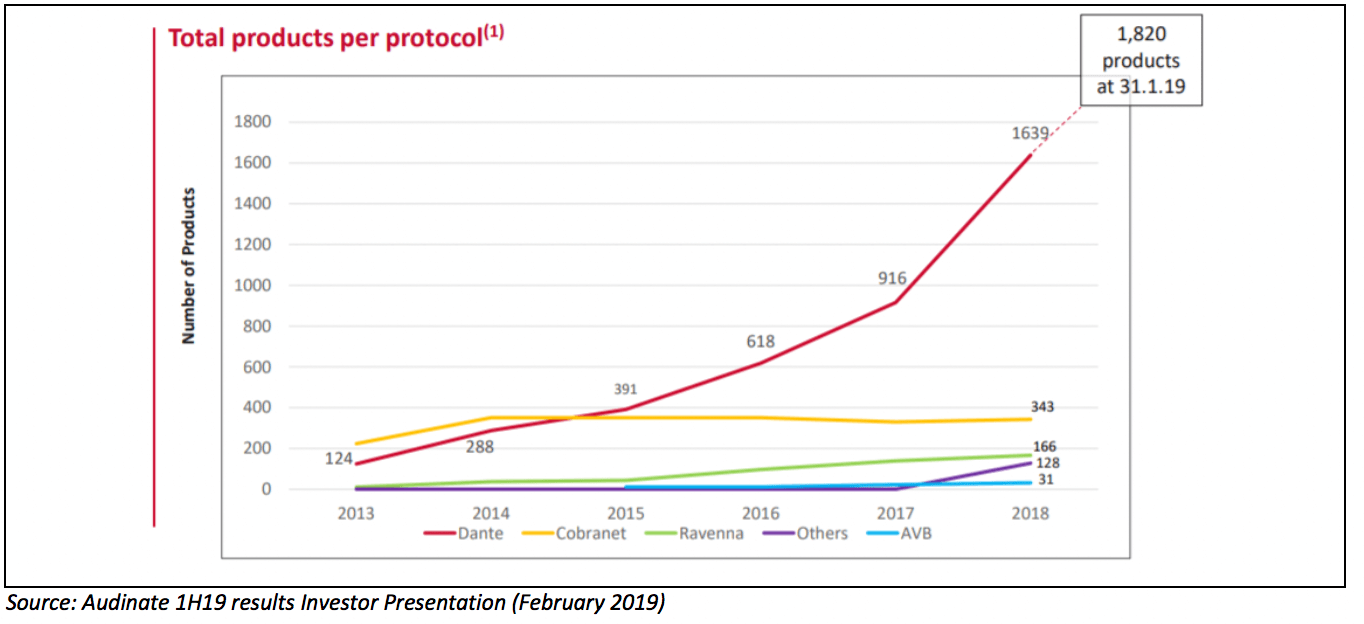

- Total OEM Dante-enabled products available for sale increased by 36% to 1,751 (CAGR since June 2014: 58%) and grew a further 4% to 1,820 in the month of January 2019 alone (as shown in the chart below).

Note that only about half of licensed OEMs at December 2018 had released Dante-enabled products into the market. The remaining licensed OEMs are still in development phase and yet to launch their first Dante-enabled product – suggesting a significant growth runway if you just double current run-rate annual revenue of ~$30M. Note further, however, that the above metrics suggest an average of 7.68 Dante-enabled products per OEM (an increase from 6.73 at December 2017). I would expect this to be a tiny fraction of the OEMs’ product range – suggesting further long term growth as existing OEM customers embed Audinate’s Dante technology in their other products.

But most importantly, Audinate has previously estimated that there are more than 2,000 professional AV OEMs in its target ‘Sound Reinforcement’ segment. As such, the 455 licensed OEMs at December 2018 represents customer penetration of only ~23%, suggesting significant potential upside from new OEM customers.

Previously the company has quoted research from market research firm Frost & Sullivan that the digital audio networking market would grow from ~$360M in 2016 to ~$455M by 2021. At that pace of growth, market size was probably ~$400M at the end of 2018. Management estimates that digital penetration of this market is still only 7-8%. If accurate, Audinate’s current annualised revenue run rate of ~$30M suggests the company enjoys a market share somewhere in the vicinity of 90%.

The company did not update competitor metrics in the chart above (showing June 2018 comparatives) but note that the chasm between Audinate and its rivals has presumably widened even further based on their respective lower historical growth rates.

Finally, management provided an update on the three most recently launched products:

- The Dante Domain Manager (system management software) recorded sales in line with budget for 1H19 with the distribution channel expanding to 133 resellers (+33% vs June 2018);

- Dante AVIO adaptors (to enable legacy analogue equipment to be interoperable with the Dante system) were ahead of budget for 1H19 with 77 resellers (+50% vs June 2018) in 45 countries appointed; and

- The brand new Dante AV (combined audio & video) product was successfully launched earlier this month at a European trade show and the market response has been positive to date – with a commercial launch of this promising new product in mid-2019

Management believe that the addition of these 3 products more than doubles Audinate’s target addressable to A$1 billion.

Once again, management did not provide any hard number guidance (in line with previous) but did reiterate a continuance of historical growth rates (probably around 30% per year). Based on 1H19 growth (60% versus 1H18) and the accelerating Network Effects observable in the key metrics above, I would not be at all surprised to see this exceeded.

The share price jumped ~10% to $4.80 in response to today’s result and hit an all-time high of $4.91 during intraday trading. This reflects an increase of ~50% from recent lows of around $3.20 plumbed during the peak of the Risk Off period in December – and so I wouldn’t be surprised to see some profit taking at current levels.

Despite this recent strong share price action, I believe that Audinate remains a compelling long-term growth story – driven by:

- The momentum in the business as its Network Effect continues to strengthen as the number of licensed OEMs continues to build, and the network of Dante-enabled products continues to grow;

- The substantial growth opportunity represented by the very low digitalisation of the audio networking market, the 77% of OEM players which don’t currently use AD8’s Dante products, and the fact that approximately half of licensed OEMs are still in development phase and yet to launch their first Dante-enabled product; and

- The very high gross profit margins generated from a growing product range and strong intellectual property portfolio, with continuing investment in R&D to further strengthen this position.

Audinate shareholders should not necessarily expect a significant ramp up in profitability from here – despite the strong 1H19 results, the company has flagged that it will continue to focus on strengthening its market position and will invest further in internal operating capabilities to that end. Management flagged on the conference call that 2H19 EBITDA margins are likely to be lower than 1H19 as a result. As we have mentioned before this is all about the end game – domination of a growing market and the substantial cashflows that would accrue to the company if successful.

Readers should continue to view Audinate as a higher risk stock and will need to decide for themselves whether the company is a suitable investment for their own portfolio.

_______

Disclosure: I (the author) own shares in Audinate – accumulated between January and August 2018 at a VWAP of $3.31. As foreshadowed in our AD8 re-initiation piece, I purchased an additional small parcel of shares 3 days after publication of that report. I am strongly considering buying more shares – but not for at least 2 days after the publication of this article.

A note from Claude: To paraphrase Munger, I have nothing to add to this analysis.

I consider these results from Audinate to be pleasing. However, I suffer a state of slight discomfort when my larger share holdings fail to generate free cashflow. I already knew, from the quarterly, that Audinate did not generate free cash flow in this half. Nonetheless, I anxiously await that milestone. Audinate is currently my third largest position and I will not buy or sell shares for at least two days after the publication of this article. I am very pleased that the share price is up over 30% since we made it one of our Best Buys Now For October 2018.

For early access to our content, join the Ethical Equities Newsletter.

Disclosure: The Author of this piece, Fabregasto, and Claude Walker both own shares in Audinate at the time of publication. This article contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.