Appen (ASX: APX) listed in early January 2015 at a $0.50 per share IPO price. Since that time, the company has been one of the best performers on the ASX, becoming a ~47 bagger. This remarkable run has been fuelled by significant top and bottom line growth which has been supercharged by a couple of canny acquisitions and a long history of earnings upgrades.

On Monday Appen reported a stellar set of results for the FY18 financial year (December year-end) and the share price responded with a 22% increase to $22.90. It has climbed further to $23.40 over the last couple of days. But enough of that, let’s look at the business itself and the Artificial Intelligence (“AI”) market in which it operates.

Company background

Appen is a leading global provider of high quality training data sets for the Machine Learning (“ML”) market. Machine Learning is an iterative process in which computers receive datasets and information about that data, and are then trained to perform a task using an algorithm, without explicit instructions, instead relying on inference and recognising patterns, with corrections and adjustments made by humans as required to improve accuracy. This intersects with traditional computer programming where computers were fed data and a program and simply derived the answer. Machine Learning is a subset of AI and differs from Deep Learning (a further subset of ML), which involves the development of a deep artificial neural network with the end goal of the computer learning and making intelligent decisions on its own (hello, SkyNet).

The company operates 2 divisions, with a degree of overlap and certain capabilities leveraged across both units:

- Content Relevance – this unit provides data sets for ML algorithms designed to improve content relevance (accuracy of search results) in online search. Data sets provided by this division link search engine users with relevant websites, products, videos, maps, social media content and advertisements – and can therefore be used for highly personalised marketing. The key customers for this business are therefore global search engines such as Google and Microsoft, who are keen to optimise their search algorithms to deliver the fastest and most relevant results with the least spam; and

- Language Resources – this unit primarily provides speech data collection and annotation services. This segment enables voice recognition and voice synthesis (i.e. in AI assistants such as Apple’s Siri, Amazon’s Alexa etc, or in text-to-speech systems), but also includes the compilation of pronunciation and other custom dictionaries, language translation and various types of linguistic analysis. This data is used by government customers (as in government surveillance), automated call centres, and manufacturers of voice-activated speakers and other devices including in-car systems.

The company’s datasets are created by a crowd-sourced human workforce of more than 1 million people spread across the world – in 130 countries and covering 180 languages (all stats per APX’s FY18 results investor presentation released on Monday). This broad geographic spread suggests to me the ability for the company to access the resources required to expand into other markets if requested by existing or new customers, or should management see opportunities in adjacent verticals.

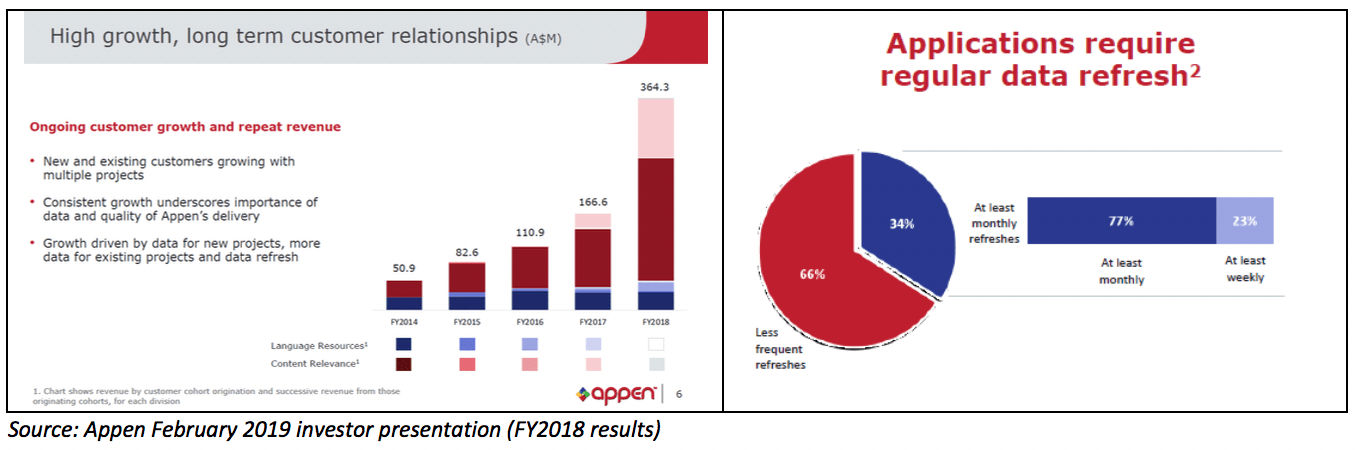

Revenue for both of these divisions is typically earned over 12-month contracts – but note that this work is typically project-driven and therefore lumpy, and not recurring per se – though Appen notes very little customer churn over the historical period and a high degree of follow-on projects per the chart below left. A meaningful proportion of this repeat revenue is generated from some customers’ need to continually refresh the data – as often as weekly in some cases (per the chart at bottom right).

The Content Relevance division was given a significant boost by the transformative acquisition of Leapforce in late 2017 for A$105M. This was funded primarily by debt but also a small ($30M) capital raising – the only time the company has raised additional capital since its IPO. Leapforce was a global leader in Content Relevance with a crowd-sourced workforce of >800,000 people – and the deal immediately established APX as the #1 global player.

The vendors received 20% of consideration in the form of APX shares (issued at $5.66 – so they will be ecstatic with the quadrupling of the share price since the transaction was completed) – escrowed for 3 years. I think this was a smart way to ensure alignment with the company and its shareholders. The transaction was priced at a comparatively cheap 5.9x forecast EBITDA. So it was hugely accretive (35% to EPS, before synergies).

The company said that the Leapforce integration has proceeded according to plan with some re-engineering of APX systems to optimise the combined platform. Management commented on the investor call that the acquisition has given the company “bulk scale” and positioned it well to take advantage of expected strong future growth. Management also estimated synergies of ~$6M in FY19 following the integration of Leapforce – funds which have been earmarked for reinvestment in R&D to further boost the earnings potential of the company.

In addition to Leapforce, Appen has made 3 other acquisitions since inception in 1996 (as a linguistic technology company):

- 2011: Merger with Butler Hill (US) – expansion into Content Relevance;

- 2012: Acquisition of Wikman Remer (US) – internal workforce management tools; and

- 2016: Acquisition of Mendip Media group – speech transcription services.

It wouldn’t surprise me to see another similarly transformative acquisition in order to gain new capabilities or enter adjacent markets. Management were keen on Monday’s investor call to hose down talk of any near term large acquisitions, but did state a couple of times that it is “keeping its eyes and ears open”. The company has recently expanded into China (with a beachhead established at Shanghai) – which is the next logical stage for large scale AI growth given that government’s stated intention to dominate the global AI market. The resulting logical question was asked around a potential acquisition in China to accelerate this expansion, however management were keen to stress that APX is taking its Chinese market entry slowly and that valuations of Chinese players have been “eye watering” – so shareholders should expect that growth in China is likely to be organic at this stage.

It also wouldn’t surprise to see Appen itself be a takeover target – there have been literally dozens of AI-related acquisitions by Google, Facebook, Microsoft, Baidu, Apple, Samsung, Tencent and other technology giants over the past 5 years. Even after the jump in the share price this week, APX’s market capitalisation is *still only* around $2.5 billion – certainly doable for these large tech giants with big cash holdings – though I’d imagine a high degree of dis-synergies from any tech giant acquiring Appen resulting from lost business from its rivals.

Talk of any takeover for APX is premature and probably just wishful thinking at this point. There is a significant growth opportunity open to the company (which as a shareholder I’d prefer management to execute on prior to any takeover) – so let’s take a quick look at the key industry drivers that have underwritten the company’s growth to date, and underpin its medium term future.

Growth of AI

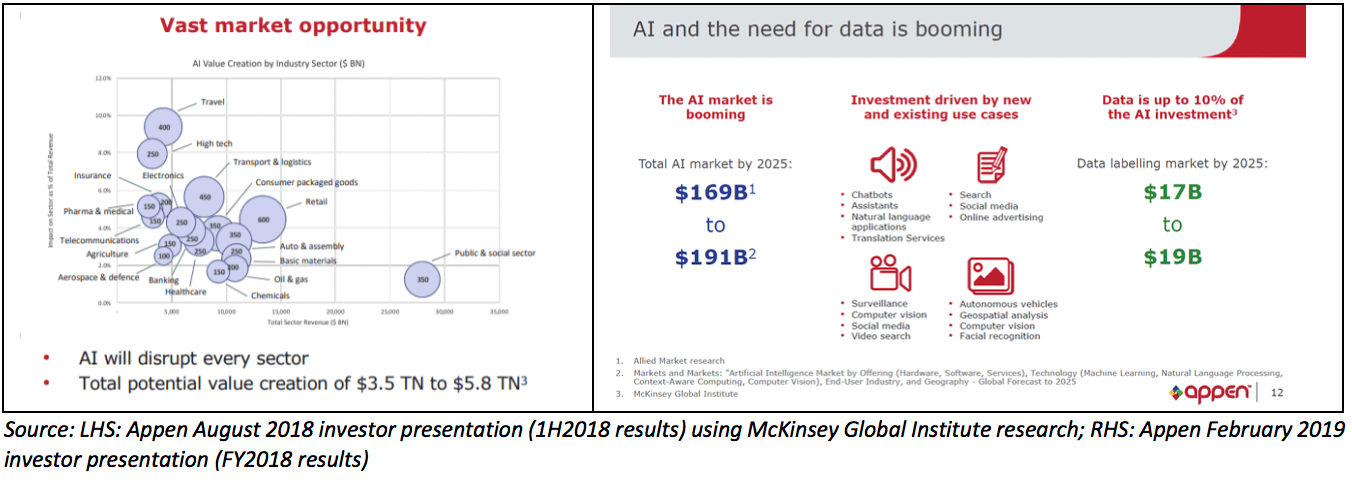

The chart below left comes from Appen’s August 2018 investor presentation and describes the large market opportunity as different industries begin to embrace AI (with AI still comparatively nascent). The slide below right from the FY18 results investor presentation frames APX’s Total Addressable Market (“TAM”) – being the $17 - $19 billion (by 2025) Data Labelling segment of the total global AI market.

AI is expected to transform the majority of industries over coming decades and significantly boost profitability – but AI is not some far off distant technology, we are already enjoying the early benefits of AI in our everyday lives:

- Smart phones – digital assistants such as Siri, adaptive camera effects, apps and games with mixed/virtual reality;

- Smart cars – such as the Tesla models (connected to the Tesla network to share learnings);

- Social media feeds – personalised news, ads and notifications (all curated by AI);

- Music and media streaming – with personalised recommendations and curated playlists;

- Navigation & travel – pretty much any activity that relies on location-based services;

- Video games – powering the non-human (bot) players in the game and adapting for human skill levels;

- Banking & finance – used to track potential fraudulent transactions etc

- Smart home devices – such as those used to set lighting, regulate temperature and manage appliances; and

- Security and surveillance – using facial and object recognition in deciphering videos and images.

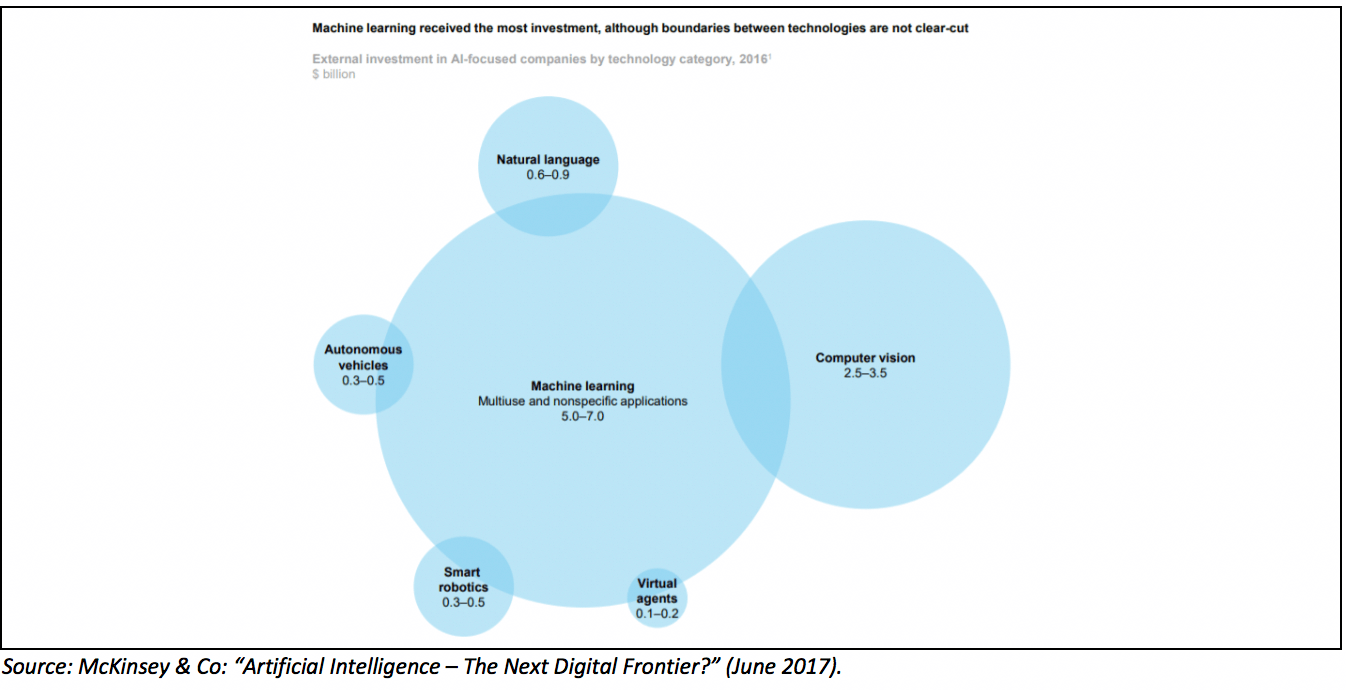

In its 2017 report “Artificial Intelligence – The Next Digital Frontier?”, renowned consulting group McKinsey estimated that global AI spend in 2016 was US$26 - $39 billion. The technology giants (likely to primarily comprise cashed-up major players Google, Amazon, Microsoft, Facebook and Apple) are estimated to comprise US$20 - $30 billion of this total.

While Appen typically does not disclose the identity of its clients, it has revealed that it works with 8 of the top 10 global technology companies, plus we know that Facebook and Google generated the vast majority of Leapforce’s revenue, and that Microsoft was APX’s largest customer prior to the acquisition of Leapforce. Based on the customer relationships graphic from earlier, these would still seem to be large APX customers.

McKinsey estimates that Machine Learning accounted for ~60% of the 2016 total AI spend – primarily due to it being an enabler for the other technologies and applications below – which includes speech recognition, autonomous vehicles and computer vision (both video and images).

A key current driver of demand for APX’s services is in the AI assistant space (i.e. Google’s Siri and Amazon’s Alexa, as noted earlier) – which combines both of Appen’s divisions:

- Language Resources: speech data collection for customer voice recognition, as well as voice synthesis (the assistant conversing with the customer); and

- Content Relevance: the need to precisely understand what the customer wants, and then have high accuracy internet search abilities to find that good/service exactly, and continue learning to incorporate new contexts and meaning in order to better deal with future customer wants.

Smart phone AI assistants have been a “thing” since Siri’s launch in 2011 and the use of Voice in searches continues to increase due to its convenience and the difficulty in using keyboards on some devices. The game-changing widespread adoption of AI assistants is likely to be in the home – especially following the advancements made in speech recognition accuracy in the past couple of years.

Professor Scott Galloway of NYU Stern believes Voice is the next battleground for the tech giants and describes Alexa and Siri as beachheads into the home – from which Amazon and Google respectively aim to have their products involved in every retail decision made – in a future where all households will have an Amazon Prime account (100 million US households as of April 2018) and all retail purchases will be delivered to the home. Sales of AI assistant speakers (including Amazon Echo and Google Home using the above examples) were predicted to reach 100 million units globally for 2018. Last month Recode reported that ~52 million units were sold in the US alone in 2018 – increasing the number of installed US speakers to 118.5 million (an increase of 78%).

Impressive history of revenue and earnings growth

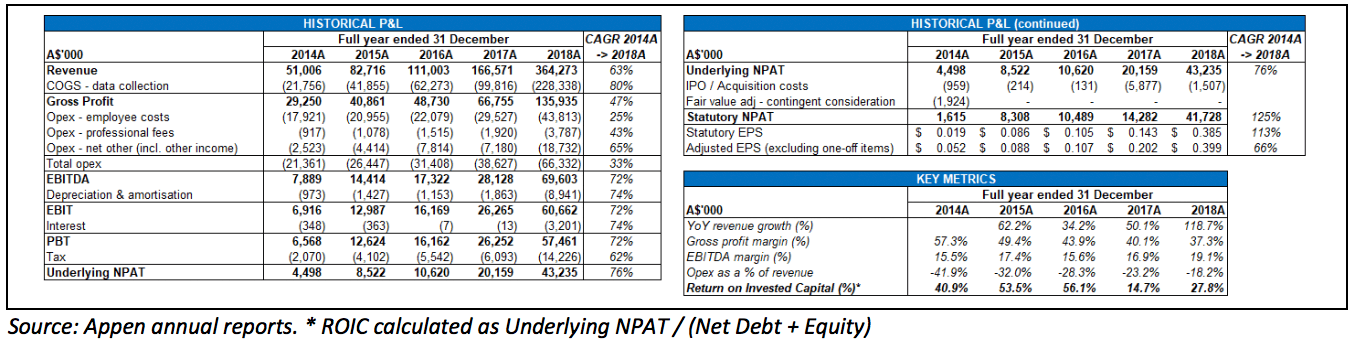

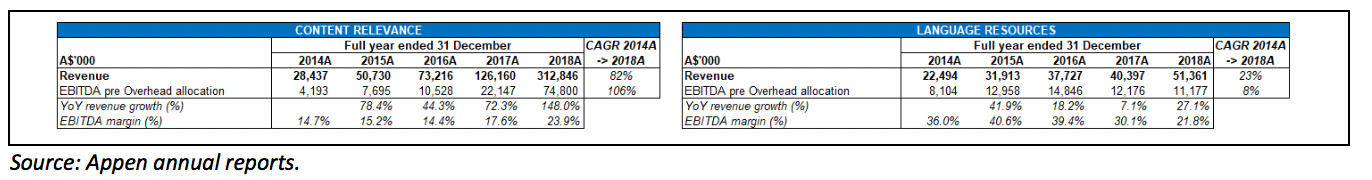

Appen reports according to the calendar year, and the 2018 numbers were eye-catching. FY18 revenue increased by 119% to $364M – reflecting the first full year contribution from the Leapforce business acquired in late 2017. Appen’s revenue grew at an impressive pace prior to this acquisition (48% CAGR between FY14 and FY17), but Leapforce has certainly supercharged the top line growth potential of the business.

EBITDA increased by 147% in FY18 – demonstrating the scalability of the business, while underlying NPAT increased by 114% (with a significant increase in depreciation following the Leapforce acquisition, and higher effective tax rate), and adjusted EPS rising by 97% (including shares issued to the Leapforce vendors). Cash conversion was strong at 92% of EBITDA.

Gross margins declined in FY18 primarily due to a less favourable project mix in Language Resources (lower volumes of complex higher margin government work). Following the acquisition of Leapforce, Language Resources comprised just 14% of full year revenue in FY18 (compared with 44% in FY14).

Margins in the Content Relevance business increased in FY18 to a high watermark of ~24% – per management reflecting the increased scale of this division following the integration of Leapforce and also increased automation. As mentioned earlier, management plan to reinvest the estimated $6M of synergies back into the business in the form of increased use of AI within the business – i.e. using ML to take the first crack at datasets with humans taking over from there. This could lead to a material improvement in internal efficiencies and margins – and could drive Return on Invested Capital back closer to the very attractive historical levels (north of 50% and growing prior to the acquisition of Leapforce and associated increases in debt and equity).

With almost all revenue derived outside Australia (mainly in USD), Appen is also likely to be the beneficiary of any further depreciation in the AUD – but earnings would naturally be impacted if the AUD moves in the other direction.

FY19 guidance

In terms of forward outlook, management guided towards FY19 EBITDA of $85M-90M assuming an AUD F/X rate of $0.74 against the USD (note currently around $0.715 – so upside for APX if exchange rates averaged at these levels throughout the year – but always wise to give a buffer when quoting F/X for forecasting purposes). This reflects EBITDA growth from FY18 of 22-29%. Factoring in similar depreciation & amortisation and effective tax rate in FY19 as just recorded in FY18, and a degree of continued debt pay-down – and FY19 EPS could be 30-40% higher than FY18. Given the 24% increase in the share price since FY18 results were released however, that still equates to a forward P/E in the vicinity of ~40x FY19 earnings.

The total value of sales generated to mid-February and the forward order book at that time was $165M – already 45% of total FY18 sales.

One analyst on the investor call – no doubt bearing in mind the string of earnings upgrades since listing (see next section) tried to get management to admit that this FY19 guidance might be conservative based on the strong second half of FY18 – which management disclosed contained some unusually large projects which are not expected to repeat this year. I’m more inclined to believe that this guidance is probably a little conservative – note APX has never delivered an earnings downgrade versus 13 upgrades if you include this week. Time will tell however and we won’t have a feel for how FY19 is tracking until the company either releases half-year results in August – or issues yet another earnings upgrade.

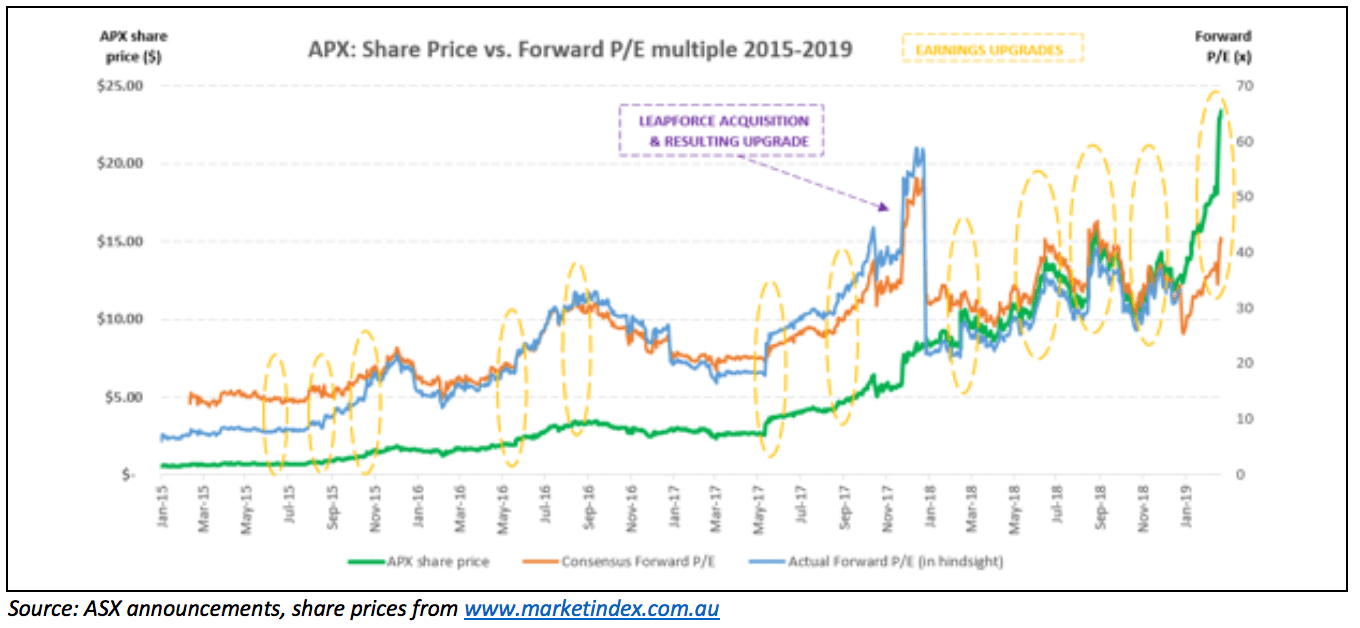

Continual earnings upgrades = enormous share price momentum

As referred to at the start of this article, APX has been a stunning performer since listing just over 4 years – as borne out by the chart below. This chart includes the company’s share price as well as its forward P/E multiple – both the consensus (research analyst) forward multiple, and also the company’s actual forward P/E multiple in hindsight. Note that (A) the forward EPS estimates are always for the financial year in progress, and (B) Appen has a December year, and so on 1st January the EPS estimate used rolls forward to the new financial year; and (C) the distortion of a falling P/E in late 2017 is due to the amount of new equity issued for the Leapforce acquisition, as well as the resulting significant EPS upgrades for FY18 including Leapforce.

Apologies for the many flavours of everything that is going on in the chart above but you can see that:

- APX has a long history of earnings upgrades – I counted 12 between June 2015 and November 2018 (or 13 including this week). This included upgraded guidance at all four of the company’s half-year result reporting dates, one upgrade on the release of full year results (12 months ago, but also again this week) and the remainder during the normal trading year (including at the time of the material Leapforce acquisition);

- For most of FY15, FY16 and FY18, actual forward P/E was below broker consensus P/E – meaning that even after brokers upgraded forecasts to account for APX’s new guidance, the company ended up outperforming broker forecasts.

- In response to the growing earnings profile combined with the string of upgrades, the company’s forward P/E has inflated considerably from ~20x in 2016 to between 30x and 40x ever since (and around ~40x currently for 2019F – though I’m writing this before seeing updated broker estimates).

Valuation considerations

Make no mistake: the current ~40x forward multiple is a premium multiple which very few ASX companies enjoy – which means a lot of earnings expectation is baked into Appen’s share price and that any material underachievement versus market expectations could trigger a savage decrease in the share price.

High growth, relatively expensive companies like APX are also likely to be sold off during the market’s “Risk Off” phases – as occurred when Appex’s share price declined by 35% between the end of August and the end of October last year; and these high growth companies are generally considerably more volatile than more stable Blue Chip companies (though try telling that to long-suffering shareholders of AMP, Telstra and the big four banks).

It must be noted, however, that not all companies are cut from the same cloth. It’s easy to compare APX’s forward P/E multiple to other (especially more mature and non-growth) stocks and conclude that Appen is very expensive. While true prima facie (in the context that APX commands a higher multiple), this exercise ignores comparative growth rates between the companies. It is useful to use a PEG Ratio (which incorporates future growth rates) to make comparisons like this more meaningful, and personally I’d rather own a company with a 40x forward P/E and a 20% EPS growth rate (PEG Ratio = 2) than a company on a 15 forward P/E and a 5% EPS growth rate (PEG Ratio = 3).

Closing thoughts

It’s worth recalling Appen’s total addressable market (the Data Labelling segment of the total global AI market) of $17 - $19 billion, by 2025, and the concept of the company being the global #1 player (though I would expect the number of competitors (in China in particular) is growing weekly). A 10% share of that market would translate into nearly $2 billion of sales. That’s a 400% increase on FY18 revenue just reported. This is a very easy and *obvious* calculation to make – and one which is not necessarily going to come true of course – but it demonstrates the size of the opportunity in front of the company.

Management’s excitement over the size of this opportunity was palpable on the investor call. The CEO expressed his confidence in the extremely high growth prospects for the Data Labelling market and made it clear that the management team are keen to execute. The CEO sees demand for data sets growing substantially over the medium term – and in order to meet this demand APX is investing in technology to make its global crowdsourcing workforce more efficient. A key question will be whether the company can continue to grow its crowd to meet forecast demand, and whether there will be margin pressure if Appen is forced to “fight for talent” against emerging rivals. As the market grows, management will need to continue to execute as it has done admirably to date. But at a ~40x forward P/E there is little margin for error.

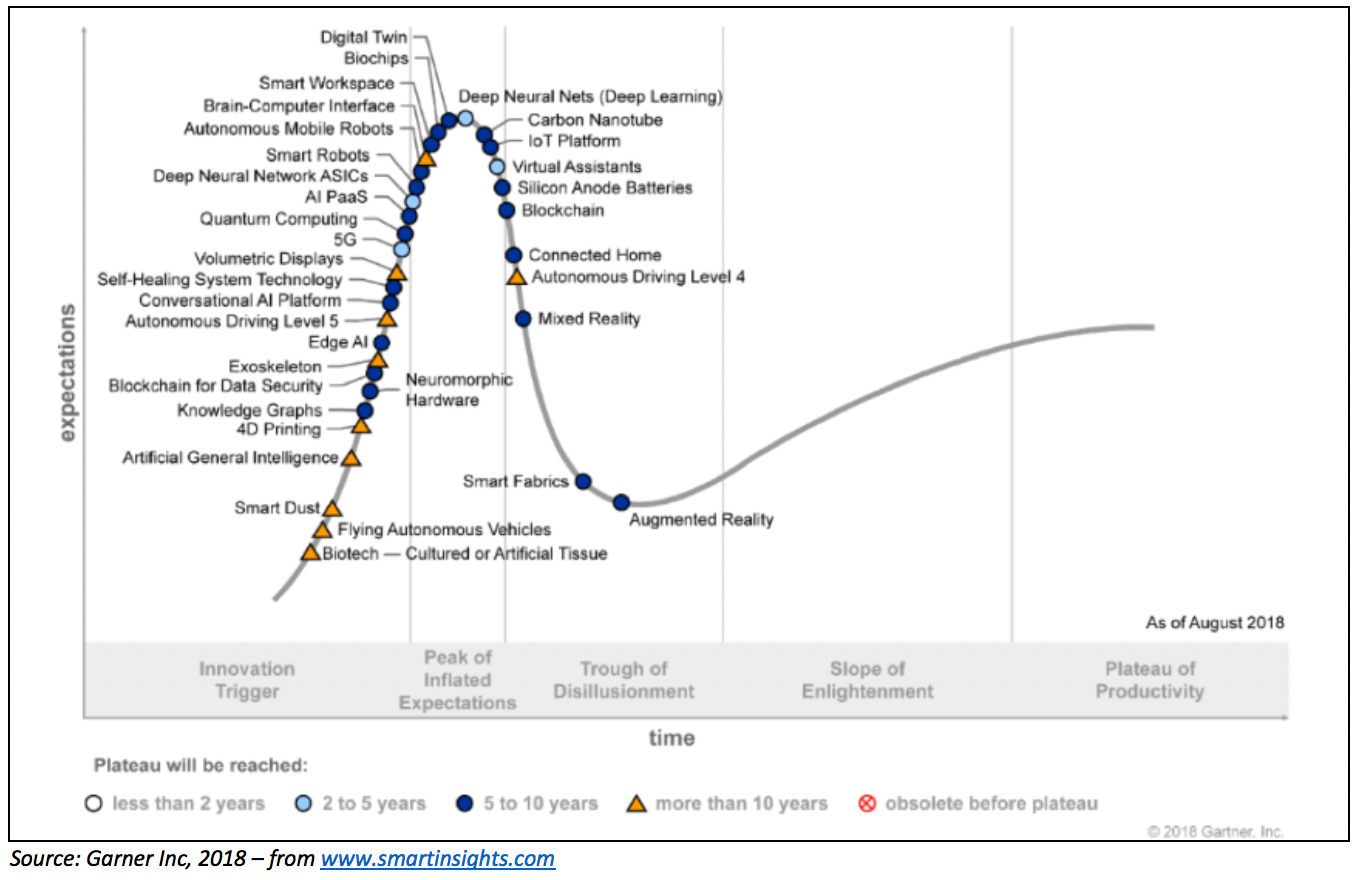

There is little question that the growth potential of the business is enormous – we haven’t really touched on Autonomous Vehicles or Augmented/Virtual Reality in this article. Both are expected to be significant opportunities in their own right over the next few years, having passed the “Peak of Inflated Expectations” and working their way through the “Trough of Disillusionment” in the Garner Hype Cycle. (The August 2018 version is below; I find it a great tool for understanding how close previously hyped technologies are to actual widespread adoption):

APX has not been “cheap” by traditional value measures since 2015 – and many readers will not be comfortable with paying such a premium multiple. We therefore suggest that Appen would only ever be suitable for investors with a higher than normal risk appetite, and are able to endure a higher degree of volatility than exhibited by more mature companies.

In addition, the share price has doubled since the depths of December – so I would expect a degree of profit taking over the next couple of weeks. I will not be one of them personally – I am happily strapped in and curious to see where this ride takes me.

_______

Disclosure: I (the author) own shares in Appen – although it took me a long while to commit and this has significantly reduced my returns from owning the company. After stalking it around $2.80 (being too “cute” in waiting for it to fall to $2.60) pre earnings upgrade, then being thwarted by my Anchoring Bias above $4.00 (pre-acquisition of Leapforce), I eventually gritted my teeth about the valuation and bought some above $7.00 in late 2017. I personally consider APX a longer-term portfolio cornerstone, and may purchase more shares (though I know I will continue to grapple with the valuation) – but not for at least 2 days after the publication of this article.

Claude Walker also owns shares in Appen (and will not trade within 2 business days of publishing this article).

Please feel free to sign up to the forums and let us know what you think!

For early access to our content, join the Ethical Equities Newsletter.

This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.