Appen Ltd (ASX:APX) FY 2019 Half Year Results Analysis

On Thursday Appen (ASX: APX) reported its results for the first half of FY19 (the company has a December reporting year-end). The stock price moved violently in response, initially soaring 10% within the first hour of trading to almost $30 (within sight of the $32 all-time high set in late July), but from that point plunged 20% to below $24 and ended the day down 11% from its previous close. On Friday the share price rebounded 7% as the market digested the key takeaways, and the APX share price managed to record a 2% gain for the week despite the nausea-inducing rollercoaster ride. In fairness, there was quite a bit to digest, but also readers should remember that over the past couple of months the markets have been particularly jittery amidst the ongoing trade/tariff wars, inversion of the yield curve and other macro concerns.

Figure Eight

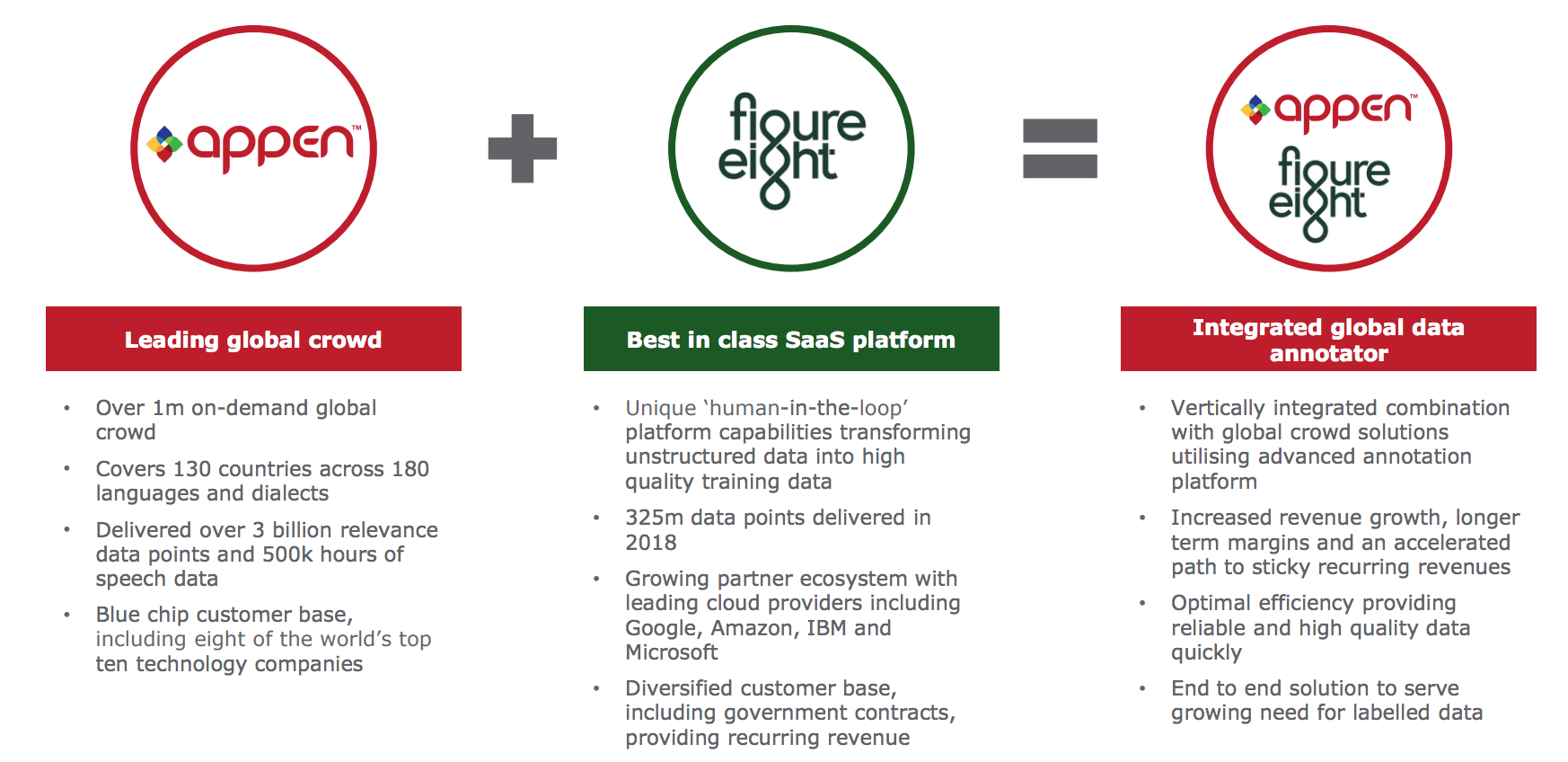

A key focus of the result and accompanying commentary was Figure Eight (“F8”) which Appen acquired in March for upfront consideration of US$175M plus an expected earn-out of US$60-80M. This acquisition was announced only a couple of weeks after our initiation report on the company (see here for background on the company and the evolving Artificial Intelligence (“AI”) landscape).

The acquisition was met with a degree of puzzlement in some quarters but made sense strategically. Appen had planned to invest significant funds in developing an annotation platform to drive efficiencies amongst its crowd-sourced human workforce. F8 had spent more than a decade developing a high quality SAAS machine learning annotation platform to transform unstructured text, image, audio and video data into customised AI datasets. F8’s datasets have been used for autonomous vehicles, consumer product identification, natural language processing, search relevance and intelligent chatbots.

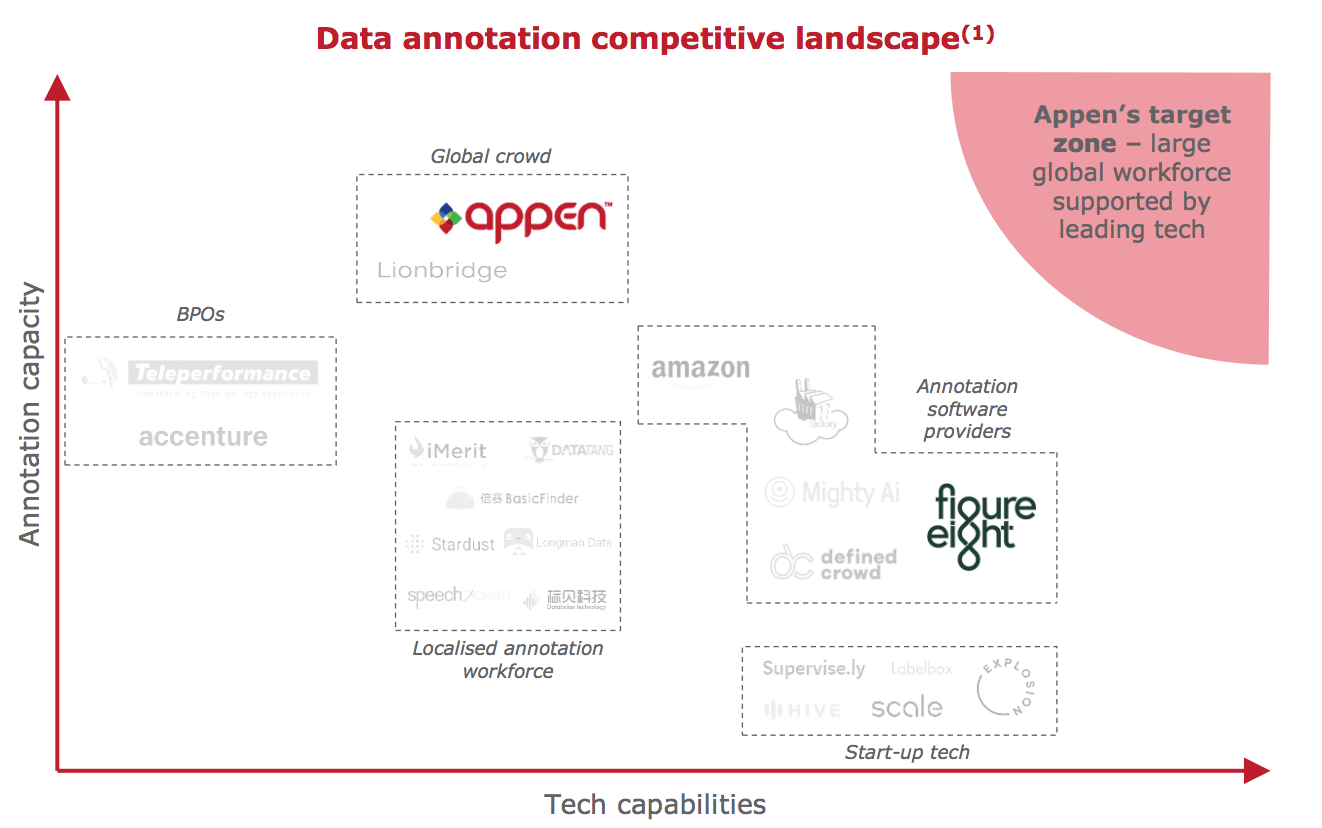

The strategic rationale for the acquisition is summarised below left, but essentially management believe that the combination of Appen and F8 will transform APX into the preeminent provider of high quality datasets for the Machine Learning (“ML”) market).

By acquiring the F8 platform – instead of investing capital into developing its own annotation tools over 2019/2020 – management argue that Appen has gotten the jump over its rivals (named in the graphic above right), and at the current super-fast pace of growth as the industry ramps, this time saving (presumably 12+ months) may prove to be a canny strategic decision indeed.

The acquisition of F8 also delivered to Appen a new high quality customer base with little overlap with the company’s existing tech giant customers, and recurring high-margin SAAS revenues:

- New technology customers including eBay, Adobe, LinkedIn, Yahoo, Twitter, and Spotify (as well as some volumes with existing Appen clients Microsoft, Facebook and Google); and

- Contracts with US government departments (representing Appen’s first meaningful foray into this market segment), including the US department of Defence.

This new Government segment appears to be an important future growth driver for the company, with growing US government interest in AI (no doubt stimulated by what it views as the AI threat from China – more on that later) and the potential for large-scale projects given the size and nature of these customers. The government sector will no doubt have high barriers to entry in the form of accreditation and extremely high security clearances – so given F8’s experience with working with the US government, I would hope that Appen is be well placed to win future lucrative contracts in this space.

Appen quoted Annualised Recurring Revenue (“ARR”) for F8 of A$27M for FY18 and management iterated its expectations for continued strong ARR growth for F8 over the medium term. Indeed, the US$60-80M (A$81-108M) Earn Out included in the transaction price was predicated upon strong growth in FY19, and the 5.1x to 5.4x incremental revenue multiple underpinning the Earn Out range (calculating to A$16-20M of incremental revenue) suggested that Appen expected FY19 ARR for F8 of A$43-47M.

F8 is currently still operating on a standalone basis and integration with Appen won’t commence until January 2020 (management have been focused on finalising the integration of late 2017 acquisition Leapforce). At the time of acquisition, Appen management forecast that F8 will generate positive EBITDA by the December 2020 half-year (prior to estimated post integration synergies of ~$10.5M).

1H19 results

Appen’s first few months of ownership of F8 don’t appear to have gone completely to script. The company provided an FY19 ARR range for F8 of A$30-35M, well below the range above, and admitted that F8 was “behind plan” due to distractions resulting from the acquisition and missing out on some key new customer contracts that it had expected to win. Appen believes it has remedied this initial disappointment with a new sales leader and stated that F8 is still expected to meet budgeted EBITDA for FY19 (based on a more profitable 1H19 than expected but a slower start to 2H19 based on contract delays and lost momentum). This speed bump with F8 is likely to result in a significantly lower Earn Out paid to the vendors of this business – now expected to be in the range of US$26-37M, less than half of the originally expected payment. This material saving is of course positive to APX shareholders in the long run (provided of course that F8 delivers expected longer term benefits and earnings).

The underperformance of F8 appears to be one of two key reasons for the (delayed, once the market had gotten through the shiny headline pages) negative share price reaction. The other driver I believe is the lack of an earnings upgrade – which we’ll get to later.

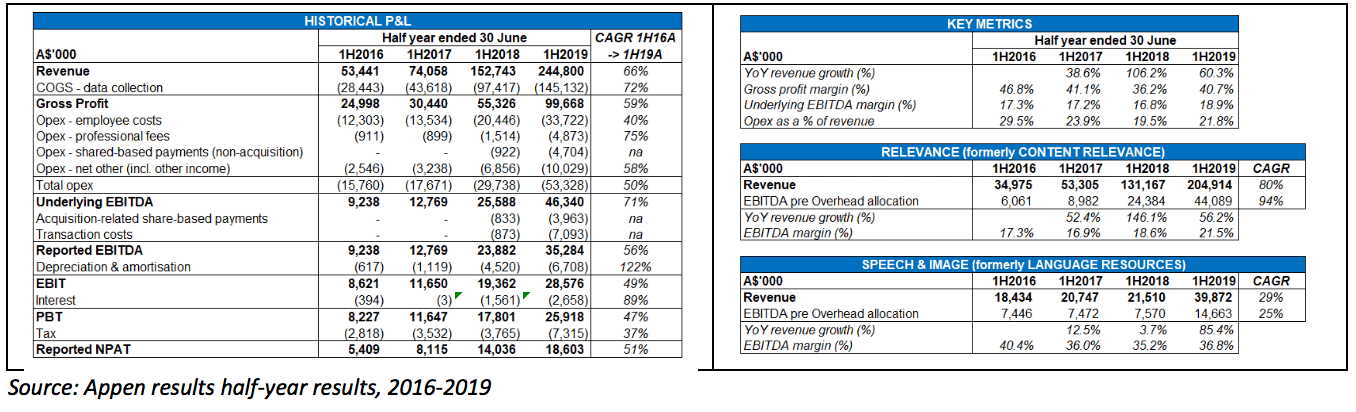

The results themselves were impressive at a headline level and demonstrated the strong revenue and earnings growth currently being generated by the company (half-year numbers ONLY below, refer to our previous Appen note for full-year historical numbers):

The company generated an 81% increase in underlying EBITDA from the comparable 1H18 period on a 60% lift in revenue – although the notes to the 1H19 results reveal that approximately $2M of the ~$21M EBITDA boost relates to the adoption of AASB 16 (Leases) which moved these costs below the line into D&A and Interest expense. The numbers are impressive nonetheless.

The Relevance division (which provides data sets for ML algorithms designed to improve content relevance (accuracy of search results) in online search grew revenue by ~$74M (+56%), $11M of which was contributed by F8. Margin increased by ~3% to 21.5% with management noting improved operational efficiencies following the integration of Leapforce, however excluding the $2.7M drag from F8 on this division, margin actually increased by 5.5% to 24%.

The Speech & Image division (which provides speech data collection and annotation services for use in voice recognition and voice synthesis – such as for AI assistants like Apple’s Siri, Amazon’s Alexa) increased revenue by ~$18M (+85%) with margins improving by 200bps to ~37%. With the Leapforce acquisition finally integrated, we would hope that margins will recover back to FY16 levels (i.e. north of 40%) for this division.

What may have been overlooked by some market observers is that the company significantly increased its investment in R&D over 1H19 , in order to “future proof” the company, according to management. R&D investment increased nearly-10-fold from $1.4M in 1H18 to $13.3M, and clearly the un-capitalized component of this additional investment will have impacted 1H19 earnings. This sacrificing of near term earnings in order to bolster the longer term revenue and earnings potential of the business is eminently sensible in my view, especially considering the vast potential of the fast-growing ML/AI market and what we should assume are increasing competitive pressures. No doubt a primary aim of this additional investment will be to improve internal efficiencies and enhance/protect margin (i.e. in the event that competition leads to future pricing pressure).

FY19 guidance vs. Appen’s earnings upgrade history

As mentioned earlier, the second reason for the negative share price response to the 1H19 results appears to have been the lack of a “hard” upgrade to FY19 guidance previously provided by the company (which was US$85-90M initially provided in February, and then reiterated at the AGM in May). This previous guidance had been pegged at an AUD F/X rate of $0.74 against the USD, and again the company reiterated this EBITDA range at the same F/X rate.

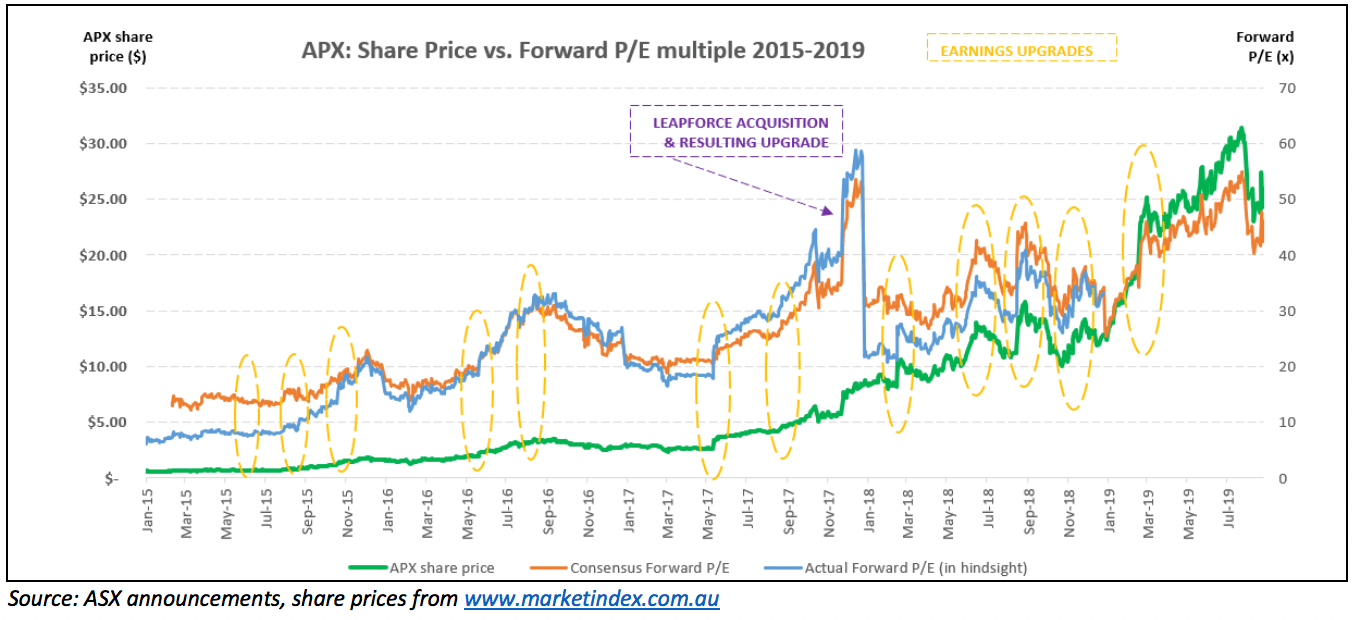

As we noted in our initiation piece on the company, Appen has a long history of earnings upgrades (versus consensus expectations) – 13 of them in fact – and this continuous cycle of upgrades has driven a material inflation in the company’s forward P/E multiple since 2015 (chart below updated from our previous APX report).

As noted previously, for most of FY15, FY16 and FY18, actual forward P/E was below broker consensus P/E – meaning that even after brokers upgraded forecasts to account for APX’s new guidance, the company still ended up outperforming broker forecasts. This resulted in an inflation of the forward P/E multiple from 20x to above 40x over the last year or so as the market began to automatically assume future earnings upgrades. The share price soared by 70% following the release of the FY18 results (and accompanying broker upgrades) in February this year – up until the late July 2019 peak, at which time the company was trading on a forward FY19E P/E multiple of over 55x (“HA, CHILD’S PLAY!” snorted Pro Medicus and Nanosonics from above the clouds).

You can see from the chart above that Appen had delivered “hard” earnings upgrades at the release of each of its 1H15, 1H16, 1H17, and 1H18 results (i.e. for 4 Augusts in a row), and so unsurprisingly the market had already presumptuously factored in yet another. When this did not eventuate, the share price uncoiled accordingly. Following the recent decrease in share price, Appen is back trading at ~45x forward P/E – a level it first breached about a year ago.

But note: the $0.74 AUD/USD F/X rate assumed by the company is ~10% less favourable than the current spot rate ($0.67) and ~5% less favourable than the average over CY2019YTD ($0.70). As such, there is likely to be a strong currency tailwind in 2H19 – as there was in 1H19 – and therefore a very real possibility that Appen outperforms this guidance range (indeed management expressed its confidence that it would hit the top end of the range – which was already a “soft upgrade” without factoring in potential F/X upside).

Readers should note that the company has in prior years upgraded guidance late in the year – October 2015, November 2017 (via the Leapforce acquisition) and November 2018. I have a feeling there may be another upgrade around November this year - at which point management will have good visibility on likely CY19 numbers including the benefits of currency tailwinds. We shall see.

China’s increasing importance in AI

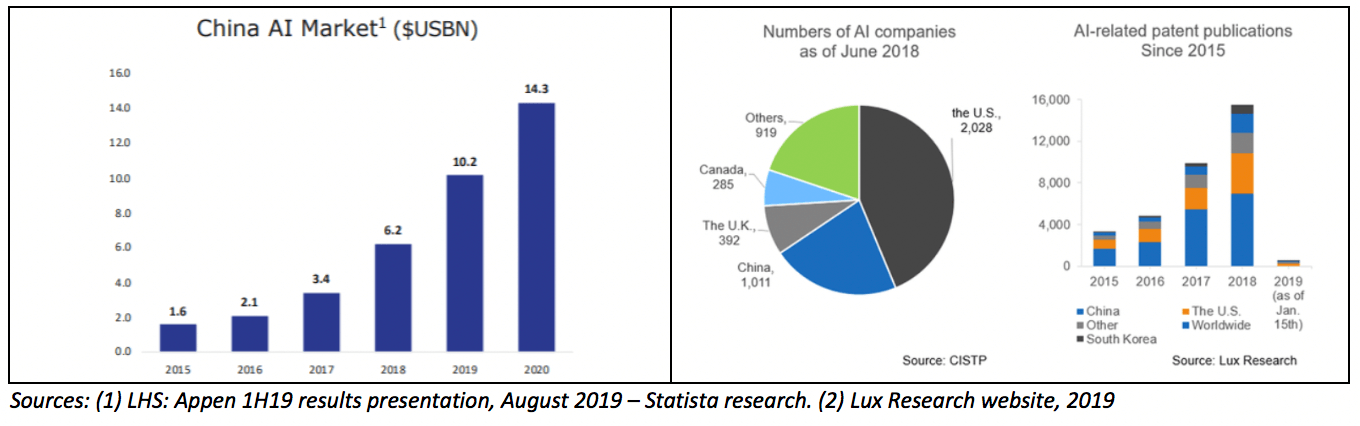

At Appen’s AGM in May, management for the first time called out China as potential new market for the company. This makes a lot of sense strategically – as China is the second largest AI market in the world (behind the US where Appen is focused heavily), and in mid-2017 China announced its ambitions to become the global leader in AI by 2030. This included a vision for the country to develop a “new generation” of AI theory and technology (both software and devices) by the end of 2020, and then a “major breakthrough” in AI technology by 2025 in order to facilitate “industrial upgrading and economic transformation” in areas such as smart cities and also its military (cue global AI arms race).

The chart below left from Appen’s investor presentation from last week includes forecasts from German online statistics portal Statista that the Chinese AI market will reach $14BN of value by 2020, representing a CAGR of 55% since 2015 (albeit off a low base).

According to the Nikkei Asian Review, China filed more than 8,000 AI patents between 2009 and 2014 – significantly closing the gap on the US – and since 2015 has been the largest filer of patents in the world (and largest publisher of AI-related publications) (see middle chart above). As at June 2018, China had the second largest number of AI start-ups in the world (behind the US) and this is expected to accelerate in response to the Chinese government’s AI policies and funding packages (which have included science parks, incubators and development zones). Cynical observers might note that China’s comparatively lax data privacy regulations may prove to be a highly valuable (and potentially unlimited) source of data for AI algorithms

Appen entered China in 2017 with the establishment of an office in Beijing, and has since expanded to other cities such as Shanghai and Wuxi. While initially the focus was on providing Chinese language data to US customers, presumably the company has its eye on securing contracts with Chinese AI leaders such as Baidu, Tencent, Didi Chuxing and Alibaba. Contracts won with any major Chinese AI players could potentially move the needle for Appen, so we will be watching that space with interest.

Ethical Equities readers should note that Alibaba has backed a couple of Chinese AI start-ups which are focused heavily on facial recognition technology and which are providers of these AI products to the Chinese government (including in suppressing the Muslim-majority Uighurs in Xinjiang province in China’s West): near-term IPO aspirant Megvii Technology, and SenseTime (also backed by Softbank and valued at US$7B during its 2018 funding round). At this stage, we don’t know if Appen will be working with these companies.

Closing thoughts

Over the past few months there had been murmurs in the market that Appen might be impacted by the ongoing privacy issues of its huge technology customers (i.e. revelations of AI assistants recording private conversations and much pearl clutching over the potential use of this information etc). Appen management did not comment on this however (particularly amidst commentary on the outlook for future demand), so this may have been overblown.

At the release of 1H19 results last week, management reiterated its “strong conviction” on the F8 acquisition and the benefits from combining the companies, in particular the acceleration of Appen’s technological capabilities resulting from F8’s best in class platform and the diversification of its customer base (including into the lucrative US government market). I am a believer, personally. If the company can land some large contracts for the US government – as it races against China in the perceived battle for global AI supremacy, I would see that as the start of a new growth engine for the company. And if the company could demonstrate serious traction in the Chinese market, that would also represent a potential step change in Appen’s revenue and earnings base.

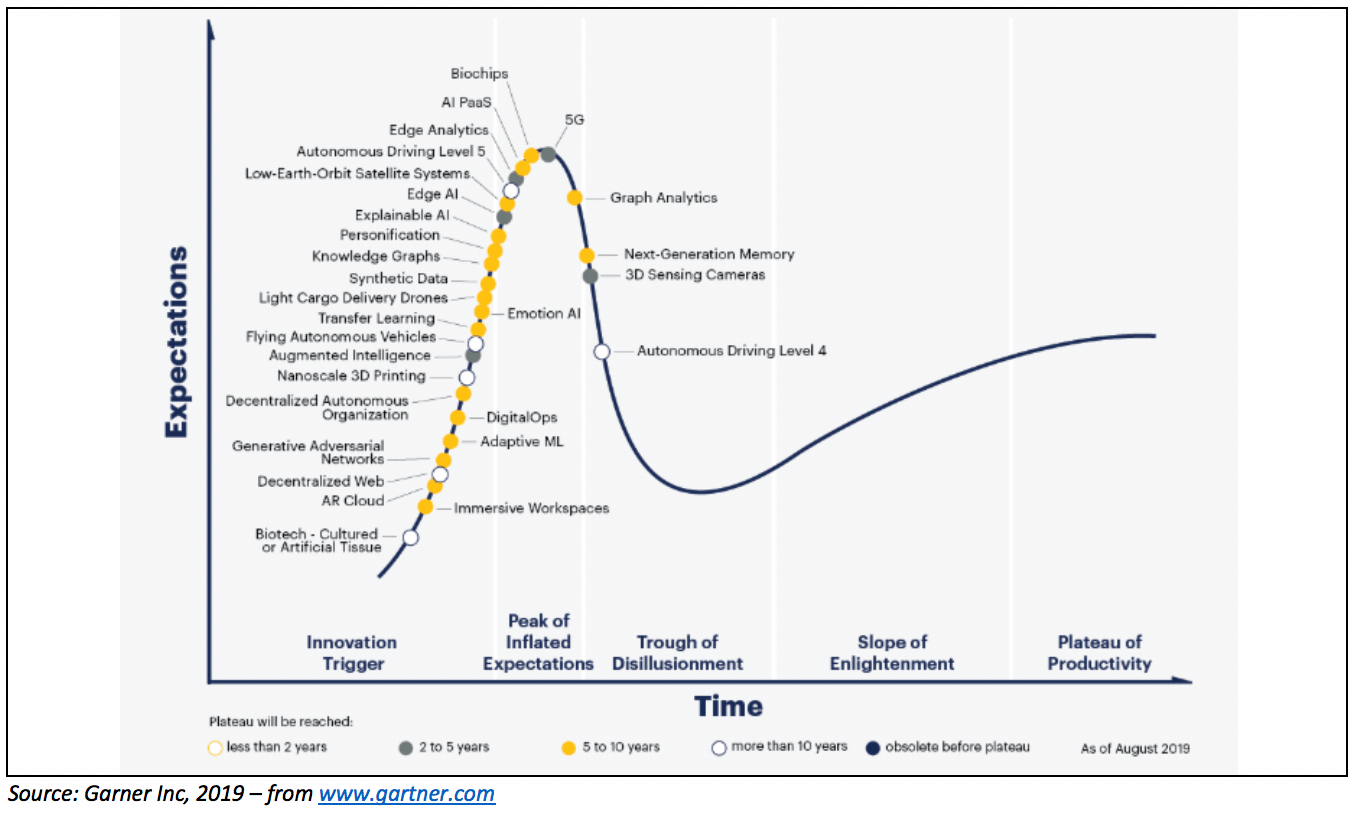

In our initiation report on the company in February we included the (then) latest (from August 2018) Gartner Hype Cycle for Emerging Technologies – a very helpful tool for understanding how close emerging technologies are to widespread adoption (following initial flurries of excitement). Fortunately for both of us, dear reader, Gartner released the updated 2019 version of its Hype Cycle last week and it is presented below.

When compared with the 2018 chart (refer to our previous APX report), we can see that AI has been split into multiple categories including AI Platform-as-a-Service and “Explainable AI” (where AI outputs can be understood by human experts), and “Augmented Intelligence” (the use of AI to improve human intelligence, not replace it). Further, we can see that Autonomous Driving Level 4 (no need for a human to monitor safety) has moved further down the curve, and that Autonomous Driving Level 5 (“steering wheel optional”) has appeared for the first time. As far as I’m concerned, investing in Appen offers direct exposure to these exciting emerging themes (alongside technologies that have already arrived within the last few years such as AI assistants and chatbots, and augmented reality – and which are becoming mainstream).

As we mentioned last time, APX has not been “cheap” by traditional value measures since 2015 and is unlikely to be any time in the near future while the broader market and Appen’s top and bottom line are growing so quickly. We continue to recommend that the company is only suitable for readers with a higher than normal risk appetite, and are prepared to weather some share price volatility along the way.

_______

Disclosure: I (the author) own shares in Appen and consider the company to be a cornerstone of my Growth portfolio. I aim to add to my position over the coming months during any bouts of share price weakness – though, as always, not for at least 2 days post publication of this article.

For occasional exclusive content, join the FREE Ethical Equities Newsletter.

This article does not take into account your individual circumstances and contains general investment advice only (under AFSL 501223). Authorised by Claude Walker.

If, somehow, you are not already using Sharesight, please consider signing up for a free trial on this link, and we will get a small contribution if you do decide to use the service (which in turn should save you money with your accountant, or time if you do your own tax.)

"The Ethical Equities website contains general financial advice and information only. That means the advice and information does not take into account your objectives, financial situation or needs. Because of that, you should consider if the information is appropriate to you and your needs, before acting on it. In addition, you should obtain and read the product disclosure statement (PDS) of the financial product before making a decision to acquire the financial product. We cannot guarantee the accuracy of the information on this website, including financial, taxation and legal information. Remember, past performance is not a reliable indicator of future performance."