Fair warning to anyone considering buying Vmoto shares - I don't consider this company of the same class as the other companies on this website.

I've long hesitated to write about Vmoto Ltd (ASX: VMT), because it's a slightly flawed investment. However, I'm going to give Vmoto a mention today because their core business, building electric scooters, is an extremely environmentally positive activity.

I have covered Vmoto stock for the Motley Fool, declaring it to be one of my top 3 speculative stocks for 2014. Regular posters on the well populated VMT forum on Hotcopper, probably know me as a stick in the mud, as I've consistently expressed my concerns (despite often owning stock), so perhaps that's something worth considering when reading this blurb.

Vmoto makes electric scooters for Power Eagle, for its own Vmoto brand, and for the (currently insignificant) European eMax brand. Its factory is in Nanjing, China. Vmoto makes scooters for Power Eagle in relatively large volumes, but the margin on this contract is quite low, at about 8%. Sales of Vmoto's own scooters through its network of 10 retail stores in China are driving profit growth. At a share price of 5c, it has a market capitalisation well over $60 million

Vmoto reported an unaudited profit of $192,000 for October, and has given guidance of $300,000 – $600,000 for the year to 31 December 2013. The Power Eagle contract increases in volume for 2014, and it's not unreasonable to suggest that retail stores would grow sales as the company builds the Vmoto brand. Here is a snapshot of the particularly important Power Eagle deal:

The main thing that worries me about Vmoto is capital management practices that don't reward long-term retail investors. Directors and sophisticated investors recently subscribed for shares at 2.2 cents, a steep discount to the prevailing market price, in order for the company to make a non-essential acquisition.

In addition, I am wary of companies with their main operations in China, because corruption is more common there. The highly intelligent hedge fund manager John Hempton said in a presentation once that fraud was more common in China and that the wild west in Australia (that is, Western Australia) has a disproportionate incidence of dodgy companies. He also warned against unnecessary dual listing. I wish I understood why a $60 million company like Vmoto has a dual listing. I wish I understood why the directors got to buy shares at 2.2 cents, when the prevailing share price was 2.7 cents, and the company was about to report its first profit. If it weren't for these factors, I would happily hold a lot of VMT shares.

In the first half of 2013, Vmoto Ltd made a loss of $554,000. The company has given guidance of $600,000 for 2013. Normalised that would imply a profit of just under $1.2 million. However, given the rapid expansion (and monthly profit figures) it wouldn't be entirely unreasonable to assume the company is chugging along at about $2.5 million a year. However, I would consider that to be an optimistic snapshot of unaudited profitability. Assuming that is the run rate at the end of 2013 (the company matches the FY with the Calendar Year), then the company is trading at a trailing PE ratio of about 24.

I sold my VMT shares in early December for 3.1c, although I still considered the company a decent prospect. I subsequently bought back in at 2.8 cents, and I've sold small parcels at 4.1 cents and 4.6 cents. I plan to keep selling down as the forward growth is increasingly priced in, although I won't sell all my shares until I see the result [Edit: Changed my mind on that one - see below]. Vmoto shares are currently trading at 4.9 cents, the highest they've been since 2011. I don't consider the company attractive at these prices, but I'm not ready to let go of my remaining shares, either.

Edit: Directors have just given notice of application for admission of 1.2 million performance shares. Will we see insider selling soon?

Further Update: I just sold another parcel at 5.4c. I don't have many left now.

Another Update: I just sold out completely. The upside is mostly priced in, I think. I'm not confident management will do the right thing by small shareholders, and I want to have cash to take advantage of opportunities that might arise during the reporting season. I'll be interested in buying at around 4c.

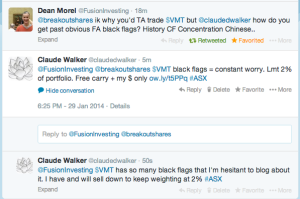

Further Update: Fair warning to anyone considering buying Vmoto shares - I don't consider this company of the same class as the other companies on this website. Witness...

The Author owns shares in Vmoto (at time of writing). Nothing on this website is advice, ever. This post is for entertainment (and for my own reference!)

Sign up to the Free Newsletter to receive hidden research into my favourite companies, before the price spikes up.

VMOTOs Nanjing factory would be worth a visit...has anyone i.e shareholders or analysts done this?

LinkHi Phil,

LinkI'm not sure, apparently some UK investors visited it a while ago.