Pro Medicus (ASX:PME) 1H FY2020 First Half Results Analysis

Over the years, Ethical Equities has written plenty about Pro Medicus (ASX:PME). We received more feedback on that one stock than any other.

read moreOver the years, Ethical Equities has written plenty about Pro Medicus (ASX:PME). We received more feedback on that one stock than any other.

read moreOne of the pleasing developments I've noticed over the last few years is the continually expanding selection of ethical funds available to Australian investors. But unfortunately, some funds could be considered to have much stronger ethical policies than others. For example, AMP Limited (ASX:AMP) has a fund called "The AMP Capital Ethical Leaders Fund".

read more

When Ecofibre Ltd (ASX:EOF) released its 4C (quarterly cashflow report) for the three months to 30th September early last week, there was no notable share price reaction. However, we do note straight out of the gates that it was rather early, and not amidst the muddy scrum of 4Cs lodged in the last couple of days before the deadline. I like this, because I think it demonstrates that the company has its sh!t together and management have a steady hand on the tiller. That's important in a fast moving industry such as hemp products.

read more

An Ethical Equities Supporter has requested I do more case studies of investments I've made in the past, which I think is good for learning, so here is the first one.

read more

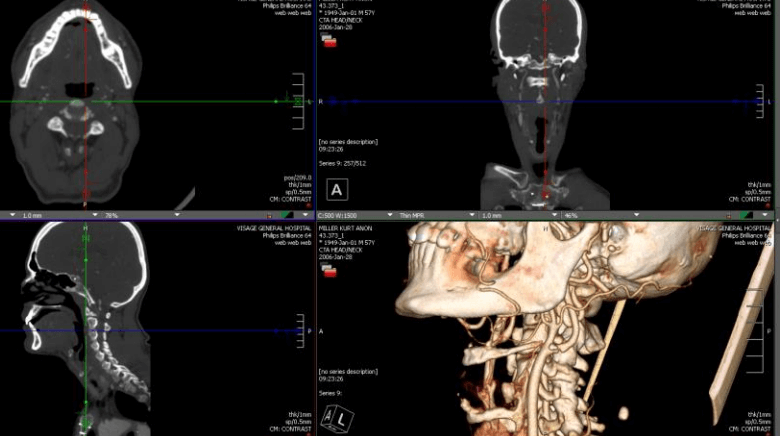

It’s high time we checked in on Elixinol Global (ASX:EXL) post the release of the company’s 1H19 results late last month and following a very busy last several months which we’ll summarise in this update. This time however we’re going to do things backwards and start with the financials – where some of the developments since we last published on Elixinol in February have begun to manifest. Then we’ll triangulate the numbers to the narrative to understand where the company is at this point in time.

read more

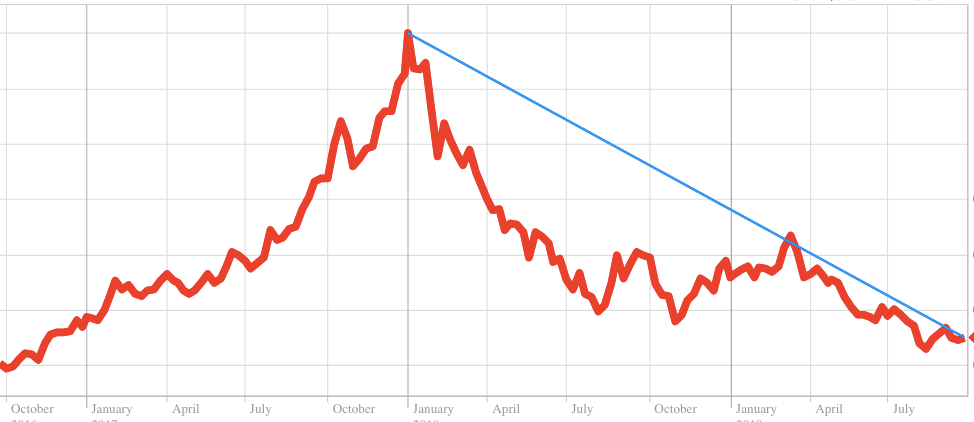

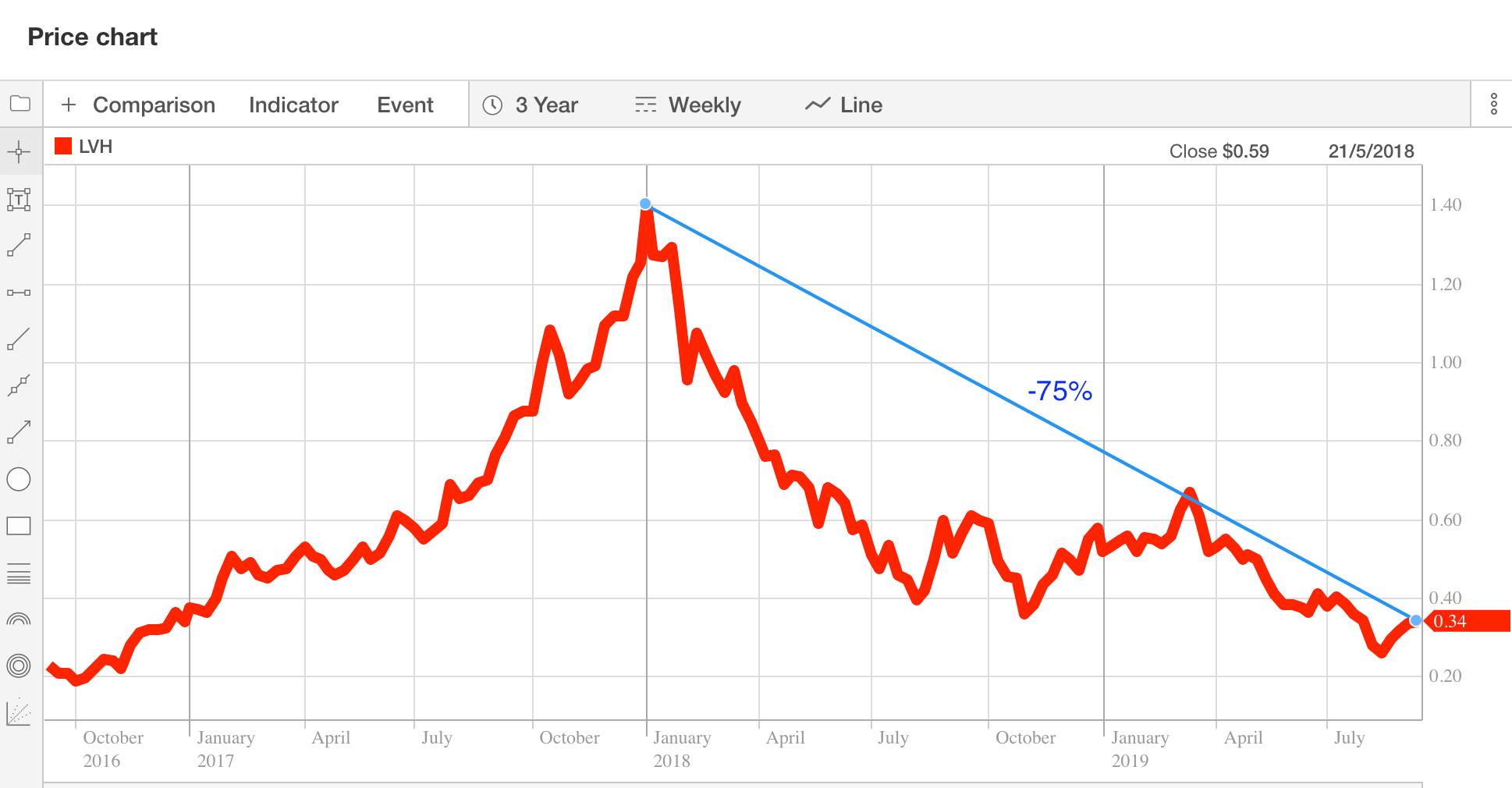

Livehire (ASX:LVH) is a “talent management technology company” with a market capitalisation of $84 million at the current share price of $0.285. The company has around $35 million in cash which we believe should be returned to shareholders since we believe the business is destined to fail and the business itself is worth nothing, at best.

read more.jpg)

I recently shared "2 Rules To Avoid The Hype Trap" with Ethical Equities Supporters. Following those rules requires that investors can establish revenue growth, free cash flow and profit from the primary documents. It is always important to take these numbers from the accounts themselves, because companies will often highlight misleading adjusted numbers in their presentations, not the statutory numbers.

read more

On Thursday Appen (ASX: APX) reported its results for the first half of FY19 (the company has a December reporting year-end). The stock price moved violently in response, initially soaring 10% within the first hour of trading to almost $30 (within sight of the $32 all-time high set in late July), but from that point plunged 20% to below $24 and ended the day down 11% from its previous close. On Friday the share price rebounded 7% as the market digested the key takeaways, and the APX share price managed to record a 2% gain for the week despite the nausea-inducing rollercoaster ride. In fairness, there was quite a bit to digest, but also readers should remember that over the past couple of months the markets have been particularly jittery amidst the ongoing trade/tariff wars, inversion of the yield curve and other macro concerns.

read more

On Friday last week, IT distributor Dicker Data (ASX:DDR) reported its results for the first half of 2019, demonstrating that it remains a great source of funding for its co-founder’s private race track and superfast racing cars.

read more