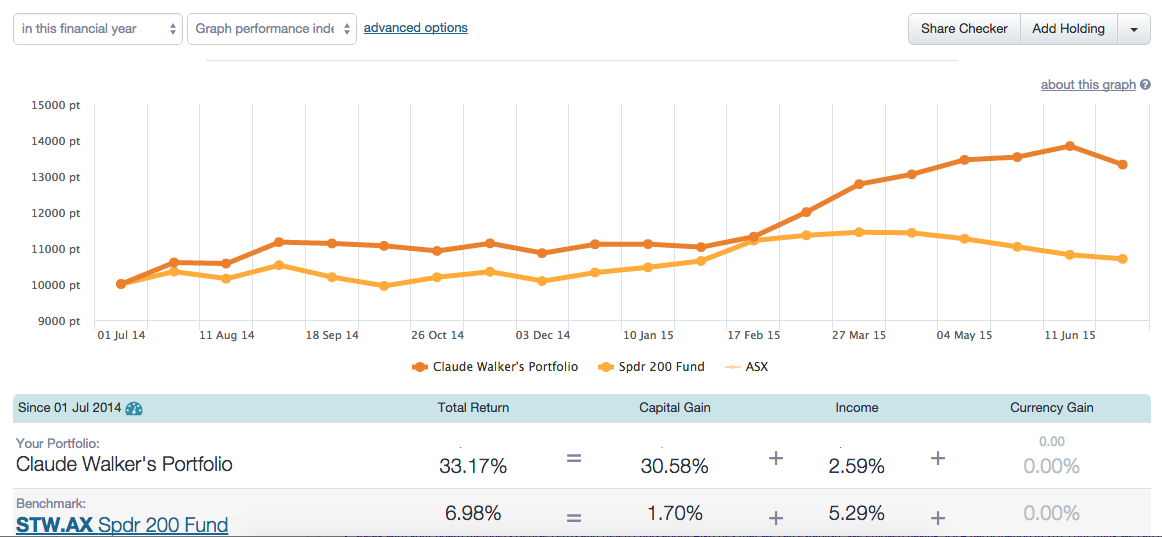

Well, in the spirit of accountability, here is my private portfolio performance for financial year 2015.

Performance has suffered due to a failure to not selling overvalued equities when the market offered a good price, but -- more significantly -- by the poor performance of a handful of investments, which, in retrospect, I paid too high a price for.

The poor performance of Azure Healthcare (ASX:AZV), Academies Australasia (ASX:AKG) and one other company which I sold recently were a major drag on returns.

Luckily, my highest conviction investments performed well, and this led to decent results despite my manifest and numerous errors.

Overall, I go into FY 2016 feeling pretty pessimistic about my portfolio, since only some holdings are solidly in "clear value" territory. I have probably let a few holdings get too expensive to justify holding on, as a result of selling too early on many occasions in the past. I'm developing a "hold on" bias, and it's faced its first test in the last few weeks.

However, on a brighter note, I think my portfolio is still of good quality, with heavy weightings towards companies that have resilient revenues and reasonable growth prospects. I've got some cash to spend should I so desire, but as is my fashion, I'm not sitting on significant chunks of dry powder.

Notably the graph below doesn't include some puts I own, which are in the money, but would nonetheless drag down returns if included.

Nothing on this website is advice, ever. The author owns shares in Azure Healthcare and Academies Australasia. This post is for entertainment (and for my own reference!)

Please do follow me on twitter @claudedwalker.

The Free Newsletter is not regularly published at present, but you can still subscribe now.