Energy Action is undergoing a transition from a business with a competitive advantage, high margins and high recurring revenue to an acquisitive machine with lower margins and less recurring revenue and a gradually reducing competitive advantage, as well as higher working capital needs. I have sold my Energy Action shares on open and (as I stated here, just before market open) I have removed them from the Hypothetical Ethical portfolio.

Energy Action Limited (ASX:EAX) was one of my oldest shareholdings. It is a company that provides a reverse auction platform for procuring gas and electricity, software as a service to monitor electricity use, and energy efficiency solutions for organisations wishing to cut down on energy use.

When I first bought shares in the company it was run largely by the founders, who oversaw several years of rapid growth. However, there has been somewhat of a changing-of-the-guard in recent years, and, worryingly, an increased focus on the contract based, lower margin energy efficiency solutions business. That used to be called Activ8+, then it was rebranded (at some expense I believe) to Sustainability Solutions, and now it is referred to as "Projects & Advisory Services" and operates a few different brands. This is a bad business to be in as it is specifically targeted by conservative governments who want to do the bidding of the fossil fuel companies that benefit from inefficient use of energy such as Origin Energy Limited (ASX: ORG). These companies are in direct conflict with Energy Action, any way you look at it.

Having worked in the solar and energy efficiency industries, and having studied them extensively, I can tell you that as a shareholder this move was somewhat concerning. The bad taste in my mouth was compounded by the fact that it literally took weeks for management to get back to me when I had some queries. I duly sold down most of my holding late last year.

Energy Action released disappointing full year results today, confirming management is not of sufficient quality

Employee expenses increased by $2.6 million, even accounting for $300,000 of the acquisition cost of Exergy that counted as "employee expense." Revenue increased by $3.7 million, so revenue growth is low margin revenue growth, even before you consider the fact that the acquired businesses have much higher working capital needs.

The huge 82% increase in cost of goods sold reflects the shift from low working capital SaaS and auction platform business to high working capital "Projects & Advisory Services" business.

What's more, these results don't even reflect a full year of contribution from Exergy, or any contribution from EnergyAdvice [sic] which was announced today, presumably as a result of pure coincidence rather than the hope that it would obscure disappointing results. Keep in mind the acquisitions, particularly Exergy, are what bring the high employee expenses and the high working capital needs. What a lemon.

Most damningly, the number of AEX sites under auction actually decreased, despite the fact that the company has obviously acquired a bunch of smaller customers. This is of key importance for two reasons:

1) It shows that in expanding the unpredictable and low margin Projects & Advisory Services, the company has neglected its most important competitive advantage - a strong auction platform, and;

2) That growth in the recurring revenue, high margin Activ8 "Contract Management" division will not benefit from a greater number of auction sites. In the past, convincing owners of auction sites to use the Activ8 services has been a key way of winning sales. That pool of potential customers hasn't grown.

As regular readers will know, I originally invested in Energy Action because the AEX reverse auction platform was a great offering that could attract customers to the high margin Activ8 monitoring service. I was always a little skeptical of the Sustainability Solutions/Activ8+/Projects & Advisory Services division because it is contract based, liable to be shut down by government regulation (or lack of incentives) and it requires much higher working capital, which eats into free cash flow generated by the other business lines.

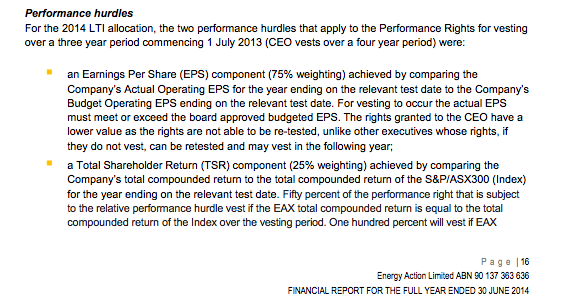

One question remaining shareholders might want to ask is why the dividend was cut if the "underlying profit" was essentially flat. My bet is that the company wants to conserve as much capital as possible so it can continue to make acquisitions that boost EPS, whether or not they represent an attractive return on invested capital. That's because management is remunerated largely on EPS. Keep in mind that's the same kind of remuneration package that lead to the demise of Forge Group. And we undoubtedly paid consultants for that. Any company with cash can boost earnings per share by simply spending the cash on a business that returns better than whatever measly interest they were receiving. As shareholders, we'd be better off if Scott bought ice-cream stores in beach towns - at least that would offer a decent ROIC and not suck up much working capital.

Worse still, the high margin monitoring segment actually saw a reduction in revenue, so there is less money from the high margin recurring business. Even worse than that, this reduction was due to a rejig of the sales team that we - once again - paid consultants to devise.

It's definitely worth noting that advertising - an expense that actually makes sense for shareholders - was basically flat. It's also worth noting that today's announcement of another acquisition (which will of course boost EPS) was gleeful about the prospect of increased employee expenses. CEO Scott Wooldridge said: "It is particularly pleasing that EnergyAdvice's existing Directors will be joining Energy Action's Executive team..." At least the EnergyAdvice acquisition will bring some new clients, but if you think the price of 9x the average EBIT of FY2012 - FY2014 is a good price, then I have some authentic persian rugs you might be interested in ;)

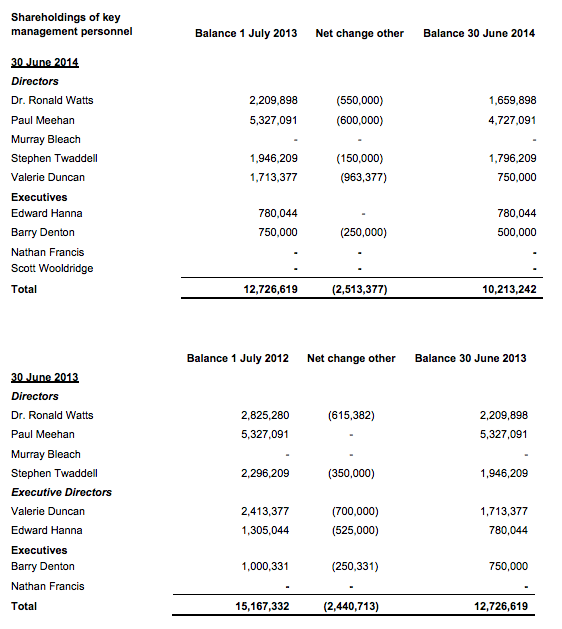

I wonder what multiple of FY 2014 EBIT Energy Action shareholders are paying so Scott can grow EPS? Also funny how shares represent less than 5% of the consideration for this new business. I guess Mr Phil Randall doesn't want to have too many shares. After all, we could have made a lot more money by following the other insiders' lead and relentlessly dumping shares on market.

Ok, well I could go on for hours about how annoyed I am, but suffice it to say that I should have followed my instinct and sold all my shares a while ago.

Newsletter Subscribers are send monthly updates with my best research as well as information about my acquisitions and disposals. Regular readers are always welcome to email me directly with questions.

The author sold his shares in Energy Action on open this morning. The author probably still has an indirect interest in Energy Action. The purpose of this blog is to document my thoughts on different companies in an easily accessible way and to make connections with likeminded investors. Subscribers to the Free Newsletter get sent research first, and have access to the Hidden Research.

Yes, recurring revenue is nice.

But, probably need some more time to see if they can find some synergies from acquisitions, and then also benefit from scale in a fragmented industry.

Whilst the EnergyAdvice revenue is not recurring, there is a fair amount contracted for 5 years.

Also with the auction value, the major fall was in the first half. We already knew this, and the reasons why. From what I can see looks to have had a strong pick-up in the second half, providing evidence that they have addressed the issues.

They have taken on 20% extra staff costs to build capacity for the FY15 contract renewal opportunty....So FY15 becomes their imprtant year. If they cant produce increased revenue from the increased sales team then you would have reason for concern.

When you talk about advertising cost, I think a 20% increase in sales staff does a fair bit to address the sales/marketing opportunity.

WIth taking on debt, remember they are in net cash! and will have continuing free cash flow that needs to be utilised. I thik a strategy that involves increasing scale in a fragmented industry is a good way to utilise this free cash flow.

Hi Simon,

You're bringing be back around to an an extent - my negativity may be overdone. However at the root of it is that my trust in the management team has been eroded. It feels like acquisitions are designed to grow earnings per share and that their hurdles are too low. I'm not as quick to forgive the overestimation of the company's prospects as you may be. Basically, for me it is a big black mark if the company overestimates profits, and insiders sell prior to a downgrade. Does that not look suspect?

At the end of the day you are reminding me of why I invested in Energy Action in the first place. However now that my trust in management has been eroded I feel like I should throw my DCF models out the window because they didn't account for shenanigans that management might undertake, and assumed management had a decent ability to forecast their own business. I agree FY 2015 is important and I had looked forward to the year in the past. Certainly, I would expect revenue from gas to play a bigger role in the future, especially as east coast gas prices soar.

Thanks as usual for your contribution. We are lucky to have you commenting here - providing some much needed balance!

Well said Claude, harsh but fair (and a lot politer than my thoughts when I read the announcements!).

LinkI am selling tomorrow morning. Disappointing, but that's the way it goes sometimes.

I am trying to tell myself that if I learn from this, it will make me a better investor. The lesson, I think, is that I should have sold late last year, but didn't want to admit that I was wrong. As a result I've lost eight months as well as taking a bigger loss on the selling price.

Here's hoping I get it right next time! All the best

Pete

Hi Peter,

LinkThanks for your comment. Some others think I may be over-reacting, but then again, they are still sellers. I think overall I know a fair few sellers yesterday, with a few of us silently dumping shares in the early minutes of trading.

As for learning from the experience, I too would have done better if I'd sold out completely some time ago. It was a pity that I kept Energy Action in the Hypothetical Ethical Portfolio, despite selling down most of my personal holding. I'm trying to "trade" less in the hypothetical portfolio, but I kept my real life holding partly because I want to have exposure to all my "hypothetical" holdings in real life. So my games on the internet may have lost me money!

I think once again the lesson here is that if management start making signs that they don't have shareholders long term interest at heart, get out and get out without delay. The warning signs were all there with the remuneration package, and excessive use of consultants. Of course your acquisition consultant will tell you to make the acquisition, and of course the remuneration consultant will come up with a poorly designed and expensive plan - these guys call their firm "Ratchet, Ratchet and Bingo" for a reason!

To be fair to us though, I don't think we could have predicted the abandon with which the CEO would piss away the company's prospects. After all, the AEX/ Activ8 combination is - on it's own - a 5 star business combo. When I first bought EAX shares I was envisaging them spreading that to new jurisdictions. Apparently not. They will pay top dollar for unreliable contract based business instead, right at a time where Abbott is taking aim at all things green. At least it looks like there is a buyer from $2.65 - $2.70, there might even be a bounce.

Hi Claude,

LinkSome quality analysis there, and management definitely deserve a clip.

However I would argue it is in the price, and looking forward to FY15, there is an opportunity for strong growth from the contract renewal opportunity.

This did again confirm the rule, of selling on the first downgrade, and waiting for at least the third before buying. My view is that we may now have all the bad news out, and $2.60 ish should be the floor.

Just my opinion.

Cheers mate

Simon

Hi Simon,

LinkThanks for commenting, your opinion is always much appreciated here. I hope you are right because I strongly support the mission of Energy Action, business-wise, and I hope that existing shareholders will be rewarded extremely handsomely. Also, that would mean that Australia would be paying less for power (lower margins to retailers) and also be using energy more efficiently.

However I do not like the way management are remunerated or the fact that they are taking on debt. Imagine if they spent less on "executive level" management and rather spend the money on advertising. Indeed, imagine how many clients could be won by using $12 million on advertising (over a few years) rather than a new acquisition. I'm talking long term recurring revenue at high margins, not once-off contract revenue that requires heaps of working capital.