Please note: this report is very old to the point where it is useless. You must not consider it to be current. Many things may have changed, and it may well be that I no longer believe this company to be an attractive option. Please consider it an archive only.

1300 Smiles Limited (ASX: ONT) provides marketing, administration, billing, collections, finance, facilities, certification of facilities, equipment, and all consumable goods to a network of dentistry practices emanating from Townsville. The company also owns a practice in Adelaide. The company employs some dentists, but also allows dentists to remain self-employed. In the last 10 years, 1300 Smiles has never achieved Return on Investment of under 20%, and has averaged ROI of above 30%. While the company is facing the most difficult time since listing, I believe it will average ROI of at least 20% over the next 10 years.

Why would a dentist join 1300 Smiles?

1300 Smiles allows dentists to focus on dentistry, without troubling themselves with the various extra responsibilities of running a practice. Dentists can choose to be employees or self-employed, in accordance with their personal preference. Employee dentists have the comfort of a secure salary. Self-employed dentists pay the company a management fee on a sliding scale, such that they are incentivised to be more productive.

Marketing and brand recognition can increase the flow of patients to a self-employed dentist’s practice, and the financing options may increase the appeal of the practice. Furthermore, the improving smiles program engenders customer loyalty (to the brand), facilitating customer retention.

The main drawback, for an individual dentist, would be that 1300 Smiles clinics have fairly standardized pricing, and I suspect this is company policy, although I haven’t confirmed this. I know for a fact there is some flexibility, because a quick ring around turned up slight differences in pricing. However, the Improving Smiles program requires a degree of standardized pricing for basic services, at least.

The truth is that dentists who are experiencing high demand don’t need the 1300 Smiles brand, but the company can manage a practice, without lending its brand.

Correction: I previously incorrectly stated that 1300 Smiles manages LifeCare Dental practices in Western Australia. This is no longer the case, as this arrangement has ceased. I apologise unreservedly for the error. Fortunately, it doesn't change the thesis.

Why would a customer visit 1300 Smiles?

In the relatively rare event that a practice is sufficiently awesome to win the approval of the acquisitions team and the MD, 1300 Smiles might acquire an existing customer base.

More generally, North Queenslanders visit 1300 Smiles because they recognise the brand. Dr Holmes claims that securing the naming rights for the 1300 Smiles Stadium, home to the North Queensland Cowboys, was one of the better decisions he has made in his life. The better that team does, the more valuable the sponsorship will be. Let’s thank our lucky stars Dr Holmes doesn’t support Cronulla!

On a more serious note, the company does offer very competitive rates for a basic check-up, as well as discounts for Improving Smiles members and interest free finance for more expensive operations.

The Improving Smiles program itself certainly encourages repeat visits. The program costs $15 a fortnight and includes 2 checkups, 2 cleans, 2 fluoride treatments and 2 X-Rays, each year. I haven’t been able to find a better deal, and I'd probably put my children on it, if I had children.

The beauty of the 1300 Smiles Limited business model

The company’s intangible brand value accrues to the practices it controls, whether as an owner or a manager. As this brand grows, so too does the value it brings to new practices. As a consequence, the company becomes more attractive to dentists, making it easier to grow the brand.

As the network of dentists supplied by 1300 Smiles grows, so too do the potential economies of scale. This allows 1300 Smiles dentists to compete on price more effectively, making the company more attractive to dentists. In turn, this makes it easier to grow the network.

As the network grows, the utility and durability of the Improving Smiles program increases, because the risk that members will move to a location that does not have a 1300 Smiles dentist decreases. Once there are multiple 1300 Smiles dentists in every city of Australia, the chances that people will leave the Improving Smiles program are much lower. The program also encourages loyalty to the 1300 Smiles brand, rather than an individual dentist.

In short, 1300 Smiles is widening its moat as it grows.

The regulatory environment for dentistry

In December 2012 the Federal Government closed the Chronic Dental Disease Scheme (CDDS) in a mean-spirited attempt to produce a budgetary surplus. The CDDS was the easiest way for people who cannot afford dental care to receive dental care, and had grown to represent 20% of the Over-the-Counter (OTC) revenue billed by dentists in Australia.

1300 Smiles has struck a partnership with the Queensland State government to help reduce public dental care waiting lists. The Child Dental Benefits Schedule (CDBS) commenced on 1 January 2014. The program is means tested and could provide basic dental services to around 3.4 million children aged 2-17 years. The entitlement is capped at $1000 per child, every two years.

I don’t think that these measures will go anywhere near making up for the closure of the CDDS. The resulting reduction of revenue to practices will result in increasing competition, quite likely via reduction in prices. This is already evident in the market, although I’m confident 1300 Smiles practices are run sufficiently well, that operating costs are likely to be lower than at most comparable independent practices.

Nevertheless, relatively high operating leverage means that lower prices have a significant impact on the bottom line. This shows in the operating cashflow. The operating cashflow for the 2nd half of 2013 was less than half the operating cashflow of the 1st half. The 1st half was a particularly good one due to the rush of patients anxious to charge the CDDS before it closed. The 2nd half as the first half without the CDDS.

Even assuming an improvement in 2014, it’s quite possible that operating cashflow could be lower than $3 million. If it is, that would imply the company is trading at a minimum of 24 times cashflow. Given depreciation was $2 million last year, the NPAT figure for FY 2014 could be as low as $4 million, putting the company on a P/E ratio of 37.5. In my opinion, this is more than the market could bear. In this scenario, the stock could fall to around $4.

Regardless of the stock price, investors should be aware that the company was able to grow cashflow from $6.2 million in 2011 to $9.6 million in 2012. Where it not for the closure of the CDDS, it would have been reasonable to expect cashflow of around $12 million in 2013. Only if cashflow has dropped to around $2.5 million (or thereabouts), should investors question whether this business will rebound. However, I don't think cashflow will come back as quickly as it was growing previously.

Discounted Cashflow Valuation of 1300 Smiles Limited

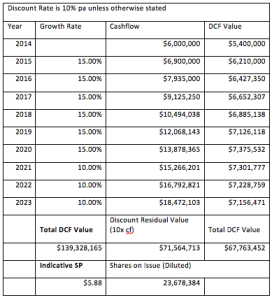

I’ve chosen to value 1300 Smiles in a way that is somewhat contentious. Generally speaking, free cash flow should be used, with allowance made for capital expenditure. However, because the company has a cash kitty that is more than adequate to cover necessary capital expenditure, I’m going to use operating cashflow, and not adjust for the cash. I believe this is appropriate as it treats the $8 million will be used for acquisitions, where appropriate, and to cover any capital expenditure that is not easily covered by cashflow at the time. The company can also be trusted to take on a couple of million worth of debt, if needed for an acquisition. 1300 Smiles pays 40%-80% of earnings as dividend, so it is reasonably safe to assume the cash kitty will in the absence of acquisitions. I will therefore use an operating cashflow of $6 million for 2014.

I’ve chosen a 15% growth rate until 2020, with a 10% growth rate thereafter. Obviously, this is necessarily an estimate of what I believe is approximately achievable. I’ve chosen a growth rate of 10% from 2021 – 2023, to reflect the fact that it will be harder for the company to grow once it get a bit larger. It's worth noting I intend to hold 1300 Smiles shares indefinitely, so the 10 year timeframe is somewhat arbitrary.

As you can see I get an indicative buy price of $5.88. This is the price at which I would consider buying (more) shares if the cashflow for 2014 is $6 million. However, as everybody knows, I added 1300 Smiles to the Hypothetical Ethical Share Portfolio at $6.50, a substantial premium to my buy price. I have done this because 1300 Smiles is an extremely ethical company, and if I have to achieve a return slightly below my target return in order to be a shareholder, that is something I am willing to do. There is also low downside risk to the company as long as Dr Daryl Holmes remains fit and healthy and in control. Thus, you can think of it as a 10% “ethics and leadership premium.”

How I’m preparing for the 1300 Smiles Half Year Results

Basically, if the cashflow is around $3.1 million, I’d probably buy shares under $5.90. However, if the cashflow is around $2.6 million, I would only pay about $5 per share. If the cashflow is closer to $4 million, I’d consider paying today’s price of $6.85, but would be more interested at around $6.50. I’m glad that the ethical portfolio bought shares at $6.50, because there is no guarantee that the share price will fall. However, I really hope that the share price does fall, as I believe there is a substantial margin of safety in the fact that this company can grow for more than 10 years. It is conservatively managed in the interests of all shareholders. What more could you want for a long term holding?

A pleasant aftertaste

At the end of the day, there's more to life than money. Equally true; you have to put your capital somewhere. If you give your money to a big bank, they will undoubtedly lend it to a mining company that will spend it on destroying the environment for future generations, or a pokies company that preys on addicts, leaving their children helpless, disadvantaged and more likely to develop their own addictions in the future.

Many dentists and staff at 1300 Smiles volunteer their time to travel to Papua New Guinea and work on board the Youth With A Mission Medical (YWAM) Ship in remote areas, performing much-needed dental work for the people of PNG. In October 2013 1300 Smiles was chosen (with YWAM) as a recipient of a Special Recognition Award from the Edward B. Shils Entrepreneurial Fund, which is a non-profit organization dedicated to innovative leadership in health care. Dr Daryl Holmes describes working with YWAM as "one of the most gratifying, worthwhile & rewarding experiences - personally, professionally & corporately - in my 26 years as a dentist & in business."

When you die, you can't take your money with you.

The Author owns shares in 1300 Smiles. Nothing on this website is advice, ever. This post is for entertainment (and for my own reference!)

If you're reading this, you're probably already signed up to the Free Newsletter, and receive all my best research before everyone else. If not why not sign up now?

Hey Claude,

I guess I wasn't being clear. What I was wondering is if new graduates are more likely to start their own practice, or sign up with a service such as 1300 Smiles. In any case, I'd like to assess the level of potential competition ONT might face in the future. Over the next ten years, I think ONT is in a good position, so definitely a long termer.

I did a bit of digging and found this on the oversupply of dentists in the future: http://www.ada.org.au/App_CmsLib/Media/Lib/1311/M709141_v1_demand_for_dental_services_australia.pdf. You might have seen this already though.

Thanks for your comments! I still have a long way to go with regards to valuation, so reading your articles always helps me on this aspect. Keep up the good work!

Nice article!

LinkWould you say that the business that the company is in is business implementation and management as opposed to healthcare/dentistry?

If so, is there scope to apply the same model over for say optometry etc..?

I would say that the company does business implementation and management <em>as well as</em> healthcare/dentistry (it has employee dentists remember).

LinkAs for optometry, I guess that the circle of competence is helping dentists, so I'm not sure I would advise Dr Holmes to take it in that Direction. Having said that, I do think that with a trustworthy and wise optometrist putting a large chunk of his or her net worth in a joint venture, it might be worth exploring. Would have to look at optometrist earnings: equipment and admin costs ratio. There's a reason Vision Eye Institute isn't in my portfolio.

Great comments, thanks for sharing your ideas!

I've heard about 1300 Smiles, but had never examined it thoroughly. I had a look at the 2013 annual and a browse of the 2012 annual. I liked the way Dr Holmes explained about his company's operations, especially with respect to revenues (the OTC and Statutory). Wish more companies would be clear and candid in their annuals!

LinkThere are quite a number of pluses for this company, which you touched on in the article, e.g. scale, great management, etc. I wonder if the dental practice industry might be going through what amounts to consolidation? If so, 1300 Smiles is in a good position. It is quite likely for this to happen, considering that it has been a recent trend in healthcare in general recently.

Things to watch out for: regulatory risk (like the recent cancellation of CDDS, though 1300 Smiles is benefiting in a way from this e.g. dentists being let off from other practices joining 1300 Smiles), valuation risk (price seems rich in my opinion now, any flat earnings is likely to cause price to stumble), retention risk i.e. holding on to existing employed dentists. Need to find out more about the trend in employment of dentists before further conclusions can be made.

Also, I think the market is currently valuing this on earnings as opposed to cash flow. Like you, I'd be interested around the $5.50 to $6 mark, but I guess I can pay a premium for the plus in management and the brand. Definitely putting this one on the watchlist, and subject to more work.

Out of curiosity, have you tried using the dividend discount model on 1300 Smiles? Seems they are committed to paying a dividend, so it may be a reasonable way to value the company.

Hi Paul,

LinkThanks for your high-value response to this piece. Very much appreciated by all readers, I'm sure.

What do you mean by "dentist employment trends?" The research I did indicated an oversupply of graduates. I also would have thought a lot of dental graduates would be keen on employment (as a start), and I think 1300 has taken on younger dentists in the past.

No, I haven't done a dividend discount model on it. I rarely do those, mostly just for infrastructure plays that have high depreciation distorting earnings and can't be trusted to reinvest cashflow for shareholder benefit. Interesting idea and worth doing to get another angle.