Not everyone I’ve talked to sees the same value I do in Energy Action (ASX:EAX) so I thought I would share this valuation with my readers; please feel free to let me know what you think.

This article assumes a fair bit of knowledge; if you want the basics, you can find them here and here.

I’ve split the businesses to make an estimate of how they will perform in FY2013. In all my projections, I aim to underestimate results (because I want a margin of safety anyway). I have assumed that sustainability (Activ8+) will actually underperform 1H2013 by 5% in both scenarios. In the low estimate I have simply doubled 1H2013 revenue for Procurement and Monitoring. In the Mid Estimate I have attributed 2nd half improvements of 2.5% and 3% respectively. I have added in the expected contribution of Ward Consulting to Procurement and Monitoring in the 2nd Half, but not attributed any growth to that business.

EAX Revenue by Segment

Fosters are using a 32% EBITDA: Revenue ratio for FY2013 and Ord Minnett are using 33%.

EBITDA Estimates For Energy Action in FY2013 (based on revenue estimates above)

The reason I have looked at EBITDA is to try to understand the growth of the company. I calculate FY 2012 EBITDA to be $5,666,67. Even in my worst case scenario, the company grows EBITDA at 1.2%. At the optimistic end of the scale, the company grows EBITDA 19.4%

The purpose of this exercise was to explore the growth rate of the company, based on a conservative set of assumptions. The conclusion, is that FY2013 will be an improvement of 1.2% - 19.4% on FY2012.

Looking beyond FY2013 here are the main reasons that I believe that the company will be able to continue on this growth trajectory.

- The AEX service costs the customer very little up front, and offers to save them money. It is thus a relatively easy service to sell.

- Many customers seem to initiate contact with Energy Action when they suspect there is an error in their energy bill. Thus, in the natural passage of time, as such “mistakes” occur, more organisations will be driven to contact Energy Action

- Once the carbon tax issue is resolved, contracts under the AEX will be simpler, and probably longer, increasing both upfront fees and ongoing revenue (NB: EAX charges upfront fees but receives a small % from the retailer on an ongoing basis – I previously did not understand this, and need to look into it further)

- Energy Efficiency is reasonably embedded in people’s minds, but this has not been the case for very long.

- There is no evidence of meaningful competition to the AEX, and this gives EAX a competitive advantage when trying to sell Activ8 and Activ8+ services.

- Energy Action has largely focused on medium scale enterprises. As their brand becomes more established, I think they stand a better chance of winning larger clients (eg Ramsay Healthcare).

- Energy Action has an opportunity to partner with firms such as First Solar. Because solar is most valuable if it is part of an integrated system, Energy Action adds real value. Because First Solar has the balance sheet to fund projects, this strategy is the best possible way to develop Activ8+

However, there are some things that could prevent the company growing

- If the way electricity is billed changes (can of worms), then the AEX could become a lot less useful, but Activ8+ would become more relevant.

- If the retailers changed the way they did business, then they could make the Activ8 service significantly less valuable. They could also compete in this space, which would be very dangerous for Energy Action. Unlikely for this reason.

- If Energy Action lacks discipline operating Activ8+ they could hurt their profits. It is important that they do not stump up the cash for much, but rather continue to focus on grants, and partnering with other firms as a middle (wo)men. Political correctness is always hilarious, as are non-sequiturs.

- The carbon pricing "debate" may continue for a long time.

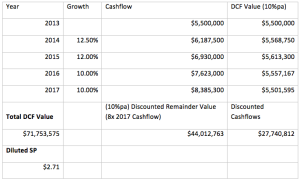

Estimated buy price for Energy Action shares based on solid growth

These valuations are more conservative than Fosters and Ord Minnett. The discount rate is 10%, and the remainder value is 8x cashflow. The critical factor is that I have simply estimated the starting cashflow. The cashflow last half was $2.4 million, and I think this company is growing.

Key assumptions: Strong Industry Tailwinds, plus improving margins through scale and cross-selling services. Remainder value in 2017 is based on 8x Cashflow, which is a bit unrealistic, because if the company does actually grow every year until then, it would probably be going for a lot more than 8x cashflow.

The real question is: will this Energy Action keep growing by at least these amounts for the next four years (and beyond)?

The Author owns shares in Energy Action both directly and indirectly.

Claude, I think you could be more generous in your terminal value and still be conservative. Assuming just 1.5% terminal growth in cash flow along with your 10% discount rate gives a multiple of 11.8x your 2017 CF rather than 8x.

LinkFair point, thanks for your thoughts.

LinkIt could grow more quickly or more slowly than that model suggests. That model is internally inconsistent as I said... unrealistic. Overall, given the generous assumption for cash-flow in 2013, I'm still cautious about the model. And also the investment thesis.