Share Price: $1.40

Market Capitalisation: Approximately $81 Million

Medical Developments International (ASX:MVP) is a company with a variety of business segments. Their main two product lines are Penthrox® an inhaled analgesic known colloquially as the “green whistle” and a range of asthma equipment, such as face masks and spacers. In addition to this, they also sell other medical equipment such as oxygen resuscitation equipment, defibrillators and veterinary anaesthetic machines. In recent times, the company has been successful at selling Penthrox and the Space Chamber Plus® range, which are a new design of the spacers that have been used in conjunction with asthma inhalers for decades. Penthrox, by the way, is methoxyflurane, and it would be very difficult to sell it in the USA, because there has been a determination by the FDA that it was withdrawn from sale for reasons of health and safety. According to that determination, approval for methoxyflurane was withdrawn in the USA after the company that sold it there advised the FDA that it “was no longer being marketed under NDA 13-056 and requested withdrawal of that application.” It seems to me that methoxyflurane is safe for its current applications, despite very rare cases of adverse effects. To share a personal anecdote, I was very grateful for methoxyflurane when I broke my collarbone!

For many years, this company was undervalued by the market, probably because it showed few signs of growth. Management, at least, had the good sense to buy back shares at that time. Since John Sharman took over as CEO of the company in 2010, it has seen a dramatic increase in market capitalisation, reflecting the fact that, since that time, revenue has grown by an average of about 9.7% per half, and gross profit has grown by an average of over 12.4% per half. In my opinion this growth could continue at this rate for some time to come, and fortunately, growth to date has been funded completely without debt. The company has simply begun to sell more products by breaking into new geographic markets, signing new distribution agreements, and expanding the uses for which Penthrox is approved. The last 5 halves have seen steady Penthrox sales in Australia plus some new sales in the Middle East. Importantly, the company has significantly increased Space Chamber sales through a partnership with Glaxo Smith Klein (GSK) to supply asthma equipment in Australia, and has begun selling Space Chambers in Germany through distribution partner Cegla. The company has also begun shipping space chambers to Canadian hospitals as part of 5 year supply agreement they won in the first half of FY2013

Net profit was down for the first half of 2013, leading to a reasonably dramatic share price drop from above $2 to current levels of around $1.40. If we look a little closer at the accounts, we can see that the likely culprit is the money spent on marketing. Marketing expenses for the last three consecutive halves were as follows: 1st Half 2012: $541,000; 2nd Half 2012: $634,000; 1st Half 2013: $971,000. That increase in marketing expenses accounts for the lion's share of the additional expenses that prevented MVP from recording increased net profit in the last half.

To quote from the most recent report, “In the first half of FY 2013, MVP made a significant investment in our Asthma business, establishing a European Head Office, appointing a European Business Development Manager, Global Asthma Co-ordinator, and additional sales staff. Time will tell if this is money well spent, but given the success the company has had growing its Asthma business to date, I think there is a good chance the increased spending will pay off.

Uncertain Upside

The company has too many irons in the fire for me to go in depth about them all. However, the main initiatives to grow profit over the medium to long term are (in no particular order):

-Sell asthma spacers into the UK

-Sell asthma spacers into European countries other than Germany and the UK

-Sell asthma spacers into the USA

- Start selling Penthrox into the UK (this would be great, given that Penthrox allows the company a higher margin than the equipment sales)

- Gain approval for use of Penthrox in colonoscopies.

- Sell Penthrox into Japan

- Distribute new and existing equipment lines more widely

- Improve the cost of making Penthrox using a new manufacturing process

There is no certainty that the company will achieve any of these goals, and some are closer to fruition than others. The worst case scenario is that MVP is unable to achieve any of these aims. In that case, the company would be able to cut back on costs a bit, but would still be extremely overvalued at current prices. On the other hand, a combination of an improved manufacturing process and opening new markets for Penthrox would multiply earnings.

Major Shareholders

Chairman David Williams owns 52.8% of the company. He recently re-invested his dividend at a price of $2 per share. According to the 2012 annual report, other top shareholders (with much smaller holdings) include Dr Russel Hancock, an anaesthetist, Mrs Erica Strong and Mr Alistair Strong, the latter two being early investors in Cryosite (ASX:CTE), which to me indicates good judgement.

Significant Valuation Risk for Investors at current price

The company has no debt, so balance sheet risk is low. Earnings are underpinned by fairly steady sales of Penthrox in Australia, and are more likely to grow than shrink, in my opinion. However, there is considerable valuation risk involved at current share prices. Unless this company grows earnings, the share price is sure to fall. Worse still, the market may currently be assuming that a dividend of 3c per half will continue to be paid. At current levels, free cash flow simply cannot support the dividend payment. Indeed, the 9c of dividends paid over the last three halves would not have been possible were it not for the Chairman (and major shareholder) re-investing his dividend. If the company does cut dividends, it’s quite likely that there will be more sellers. Given that a cut in the dividend may simply indicate that the company is reinvesting in its own businesses, this could provide an opportunity to buy a great company at a good price. As I'm writing this trading has closed at $1.40, and the buy sell spread is $1.35 - $1.49. In the last week, shares have mostly been changing hands in small volumes between $1.31 and $1.41.

Cashflow Graph

This graphs shows how the free cashflow has been eaten up by the increased cash outflows. The combined cash outflows include payments for plant and equipment, payments to supplier and employees and R&D expenditure, the latter of which is driving the growth in cash outflows. For a dividend to be sustainable in the long run, it needs to be funded by free cash flow.

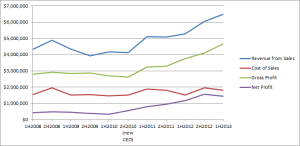

Profit Graph

This graph shows that the strong growth in revenue and gross profit hasn't translated into growth in net profit, as expenses have been increasing. A key risk facing the company is that the increased marketing expenditure fails to generate increased sales.

Disclosure: The Author has bought 2500 shares in MVP at $1.35. The author feels somewhat ambivalent about whether the share price goes up or down, given that he would really like to be able to buy shares at a more reasonable PE ratio.

Want to get my best research first? Sign up here for free.